概述

该策略运用动态交易者指数(TDI)作为主要技术指标,结合不同周期的移动平均线进行交易信号生成。其目的是发掘超买超卖情况下的反转机会。

策略原理

该策略首先计算close的RSI值,长度为13周期。然后计算RSI的34周期简单移动平均线,再以1.6185乘以RSI的34周期标准差作为上下轨。其中上轨为移动平均线加上偏移量,下轨为移动平均线减去偏移量。移动平均线即为中轨。

之后计算RSI的快速MA,长度为2周期;和慢速MA,长度为7周期。再从更高周期取得这些指标的历史值。当快速MA从上方向下穿越慢速MA时,产生买入信号;当快速MA从下方向上穿越慢速MA时,产生卖出信号。

优势分析

该策略利用RSI指标的 mean reversion 特性,结合动量指标 implement 反转交易。RSI上下轨反映超买超卖区域,中轨反映平均价位。快慢MA的交叉反映动量变化和反转机会。整体而言,该策略捕捉反转点精准,回撤控制理想。

具体来说,RSI上下轨设定了合理的超买超卖阈值,有助于及时发现异常情况。中轨把握了均衡价位。快速MA过滤了短期噪音,慢速MA判断了中期趋势。二者配合使用,可有效识别反转机会。此外,不同周期指标的组合运用,使策略在多个时间尺度上进行确证,降低了误判风险。

风险分析

该策略主要基于反转交易,存在一定的时效性风险。如果行情出现长期的非理性扩张,如踏空行情,该策略会产生连续亏损。此外,如果快慢MA设置不当,可能错过部分反转机会或产生误判。一定程度的参数优化是必要的。

为控制上述风险,建议适当调整MA周期,或增加止损机制等。当市场进入非理性阶段时,应降低仓位甚至停止交易。总体而言,针对特定市场环境进行策略调整是关键。

优化方向

该策略可从以下几个方面进行优化:

测试不同长度的RSI周期参数,找到对当前市场更合适的设置

优化快速MA和慢速MA的长度,平衡捕捉反转和过滤噪音

增加基于波动率的止损方式,以控制最大回撤

尝试在下单逻辑中加入其他因子,如交易量变化等,提高成功率

测试在多时间框架下REUSE同一套交易信号的效果

开发参数自适应优化机制,使策略参数动态调整

总结

该RSI反转策略整体构架合理,交易逻辑清晰可解释。具有可定制空间和优化潜力。在参数调整和风险控制到位的情况下,其捕捉反转机会的能力值得期待。下一步将通过更多回测和参数调整来优化策略,提高策略抗风险能力和收益水平。

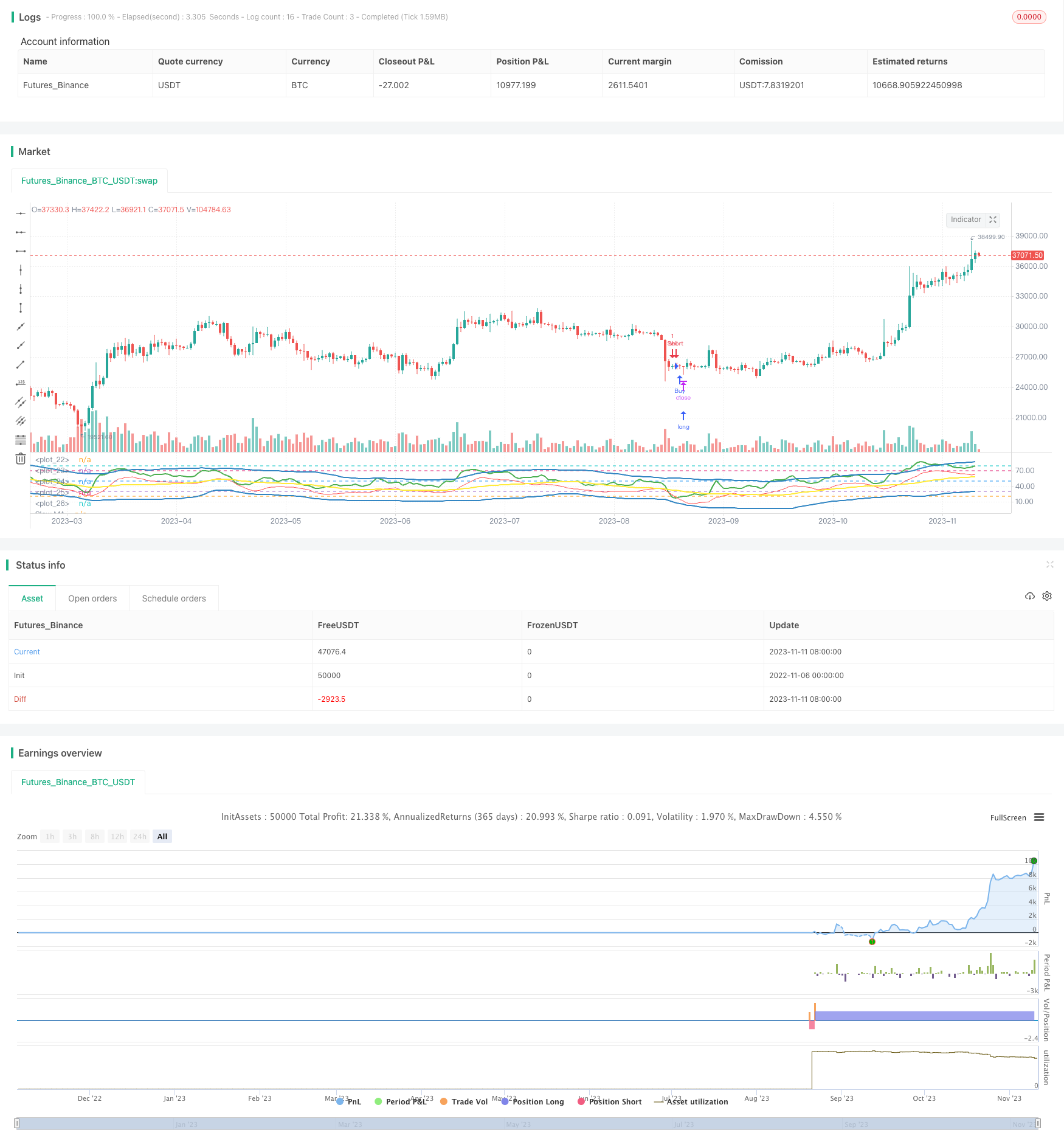

/*backtest

start: 2022-11-06 00:00:00

end: 2023-11-12 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("TDI - Traders Dynamic Index [Mehdi]", shorttitle="TDIMEHDI")

rsiPeriod = input(13, minval = 1, title = "RSI Period")

bandLength = input(34, minval = 1, title = "Band Length")

lengthrsipl = input(7, minval = 0, title = "Fast MA on RSI")

lengthtradesl = input(2, minval = 1, title = "Slow MA on RSI")

p1 = input("15", title = "Signal Timeframe")

src = close // Source of Calculations (Close of Bar)

r = rsi(src, rsiPeriod) // RSI of Close

ma = sma(r, bandLength) // Moving Average of RSI [current]

offs = (1.6185 * stdev(r, bandLength)) // Offset

up = ma + offs // Upper Bands

dn = ma - offs // Lower Bands

mid = (up + dn) / 2 // Average of Upper and Lower Bands

fastMA = sma(r, lengthrsipl) // Moving Average of RSI 2 bars back

slowMA = sma(r, lengthtradesl) // Moving Average of RSI 7 bars back

hline(20) // ExtremelyOversold

hline(30) // Oversold

hline(50) // Midline

hline(70) // Overbought

hline(80) // ExtremelyOverbought

up1 = request.security(syminfo.tickerid, p1, up)

dn1 = request.security(syminfo.tickerid, p1, dn)

mid1 = request.security(syminfo.tickerid, p1, mid)

slowMA1 = request.security(syminfo.tickerid, p1, slowMA)

fastMA1 = request.security(syminfo.tickerid, p1, fastMA)

plot(up1, "Upper Band", color = #3286c3, linewidth = 2) // Upper Band

plot(dn1, "Lower Band", color = #3286c3, linewidth = 2) // Lower Band

plot(mid1, "Middle of Bands", color = yellow, linewidth = 2) // Middle of Bands

plot(slowMA1, "Slow MA", color=green, linewidth=2) // Plot Slow MA

plot(fastMA1, "Fast MA", color=red, linewidth=1) // Plot Fast MA

if (crossover(slowMA1, fastMA1))

strategy.entry("Buy", strategy.long, comment="Buy")

if (crossunder(slowMA1, fastMA1))

strategy.entry("Sell", strategy.short, comment="Sell")