概述

这个策略的主要思想是使用不同周期的 Ratio OCHL Averager 指标构建多条均线,根据均线的交叉形态产生买卖信号。它能够动态捕捉价格趋势,适合中短期交易。

策略原理

该策略使用了两个不同周期的 Ratio OCHL Averager 指标,分别作为快线和慢线。Ratio OCHL Averager 指标的计算公式如下:

b = abs(close-open)/(high - low)

c = min(max(b, 0), 1)

Ratio OCHL Averager = c*close + (1-c)*前一日Ratio OCHL Averager

其中 b 是代表当日价格波动情况的比率,c 是对 b 做标准化处理后的值。Ratio OCHL Averager 指标综合了开盘价、收盘价、最高价和最低价四个价格构建均线。

该策略设置快线周期短,慢线周期长。当快线上穿慢线时产生买入信号,反之当快线下穿慢线时产生卖出信号。利用均线交叉原理捕捉趋势。

策略优势

Ratio OCHL Averager 指标能够平滑价格数据,有效过滤市场噪音,使交易信号更可靠。

双均线交叉结合不同周期判断趋势方向,可以较好地判定新的趋势开始。

通过调整快线和慢线的周期参数,可以适应不同市场环境。

策略思路简单直观,容易理解实现。

可以灵活设置止损止盈标准,控制风险。

策略风险

均线交叉策略可能产生较多的虚假信号,需要组合其他技术指标进行过滤。

需要合理选择快线和慢线的周期参数,参数选择不当可能影响策略效果。

双均线交叉策略属于趋势跟踪策略,不适合震荡行情,应于趋势行情使用。

需要适当调整止损点以降低亏损风险,止盈点也要合理设置。

优化方向

可以考虑结合动量指标等进行信号过滤,提高信号质量。例如 MACD,KDJ等。

可以测试不同的快线和慢线周期参数组合,寻找最优参数。

可以基于回测结果优化止损止盈点,找到最佳设置。

可以考虑在特定市场环境下动态调整参数,例如大盘震荡时增大周期参数。

总结

该策略整体思路清晰易懂,通过快慢均线交叉判断趋势方向,是一种适合中短期交易的动态跟踪策略。优化空间还很大,通过参数调整、信号过滤等方式可进一步改进策略效果。总体来说,它是一个灵活实用的趋势交易策略。

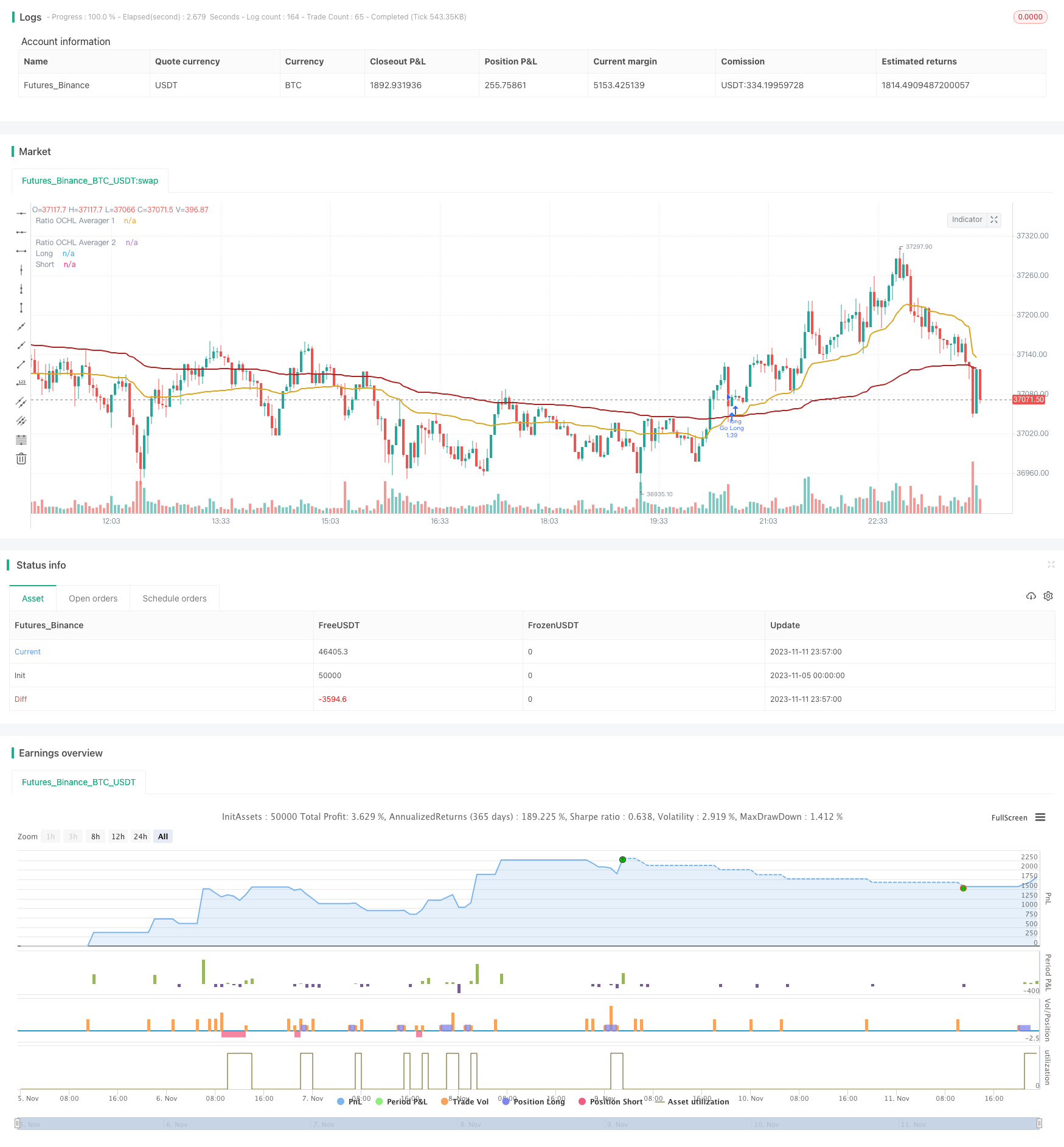

/*backtest

start: 2023-11-05 00:00:00

end: 2023-11-12 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="[XC] Adaptive Strategy V3 - Ratio OCHL Averager no repaint",shorttitle="R_OHCL", overlay=true, currency=currency.EUR,initial_capital=10000,

default_qty_value=100, default_qty_type=strategy.percent_of_equity , calc_on_every_tick=false, calc_on_order_fills=true)

// ╔═ SETTINGS ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

strategy_1 = input ( defval=true , type=input.bool , title="STRATEGY 1? —>" )

Recursive = input(false)

RES201 = "Min",RES202= "D",RES203 = "W",RES204 = "M"

//++ Resolution 1 ++

inp_resolution1 = input(600, minval=1, title="Resolution Line 1")

restype1 = input ( defval="Min" , type=input.string , title= "Resolution Line 1" , options=[ "Min","D","W","M"])

multiplier1 = restype1 == "Min" ? "" : restype1 == "D" ? "D" : restype1 == "W" ? "W" : "M"

resolution1 = tostring(inp_resolution1)+ multiplier1

//++ Resolution 2 ++

inp_resolution2 = input(1440, minval=1, title="Resolution Line 2")

restype2 = input ( defval="Min" , type=input.string , title= "Resolution Line 2" , options=["Min","D","W","M"])

multiplier2 = restype2 == "Min" ? "" : restype2 == "D" ? "D" : restype2 == "W" ? "W" : "M"

resolution2 = tostring(inp_resolution2)+ multiplier2

StopLoss = input(defval = 500 , title = "Stop Loss", minval = 0)

TakeProfit = input(defval = 2500 , title = "Take Profit", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = TakeProfit >= 1 ? TakeProfit : na

useStopLoss = StopLoss >= 1 ? StopLoss : na

// ╔═ BACKTEST RANGE ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

line_breakBTR = input ( defval = true , type=input.bool , title="BACKTEST RANGE —" )

FromYear = input ( defval = 2019, title = "From Year", minval = 2017)

FromMonth = input ( defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input ( defval = 2, title = "From Day", minval = 1, maxval = 31)

//FromHour = input ( defval = 1, title = "From Hour", minval = 1, maxval = 24)

ToYear = input ( defval = 9999, title = "To Year", minval = 2017)

//ToHour = input ( defval = 0, title = "From Hour", minval = 0, maxval = 24)

ToMonth = input ( defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input ( defval = 1, title = "To Day", minval = 1, maxval = 31)

// === FUNCTION EXAMPLE ===

start = timestamp(syminfo.timezone, FromYear, FromMonth, FromDay, 0, 00) // backtest start window

finish = timestamp(syminfo.timezone, ToYear , ToMonth , ToDay , 0, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

// ╔═ INDICATOR ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

// "Ratio OCHL Averager" -> alexgrover / tradingview.com/script/RGAtOI6h-Ratio-OCHL-Averager-An-Alternative-to-VWAP/

rochla( res,Recursive)=>

//Recursive = false

H = security(syminfo.tickerid,res,high[1],gaps = barmerge.gaps_off, lookahead = barmerge.lookahead_on)

L = security(syminfo.tickerid,res,low[1] ,gaps = barmerge.gaps_off, lookahead = barmerge.lookahead_on)

d = 0.

//----

a = Recursive ? nz(d[1],open) : open

b = abs(close-a)/(H - L)

c = b > 1 ? 1 : b

d := c*close+(1-c)*nz(d[1],close)

strat1_line1=rochla(resolution1,Recursive)

strat1_line2=rochla(resolution2,Recursive)

plot(strat1_line1, title="Ratio OCHL Averager 1", color=#DAA520,linewidth=2,transp=0)

plot(strat1_line2, title="Ratio OCHL Averager 2", color=#B22222,linewidth=2,transp=0)

// ╔═ STRATEGY 1 ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

trading_strat1_line1 = strategy_1 == 1 ? strat1_line1 : na

trading_strat1_line2 = strategy_1 == 1 ? strat1_line2 : na

longCross = crossunder (trading_strat1_line2, trading_strat1_line1) ? true : false

shortCross = crossover (trading_strat1_line2, trading_strat1_line1) ? true : false

plot( longCross ? trading_strat1_line1 : na , title = "Long" , color=color.aqua, style=plot.style_circles, linewidth=5, offset= 0)

plot( shortCross ? trading_strat1_line2 : na , title = "Short" , color=color.red , style=plot.style_circles, linewidth=5, offset= 0)

// ╔═ Backtest 1 ╗

//░░░░░░░░░░░░░░░░░ ╚════════════════════════════╝ ░░░░░░░░░░░░░░░░░░░░░░░░

strategy.exit("close",loss = useStopLoss, profit = useTakeProfit)

if longCross and window() and strategy_1 == 1

strategy.entry("Go Long", strategy.long)

if shortCross and window() and strategy_1 == 1

strategy.entry("Go Short", strategy.short)

//end