概述

该策略基于LazyBear的压缩动量指标,结合布林带和Keltner通道,识别价格突破通道形成的压缩和扩张形态,判断股票价格的潜在趋势方向,采用趋势跟踪方式来决定开仓方向。策略优点是充分利用了动量指标识别潜在趋势的能力,并设置了多个条件过滤器来控制交易信号的质量,可以有效过滤掉不确定的交易信号,避免在震荡盘整中过于频繁交易。

策略原理

计算布林带中的中轨、上轨和下轨。中轨为n日收盘价的简单移动平均线,上下轨为中轨加减m倍的n日收盘价标准差。

计算Keltner通道中的中线、上线和下线。中线为n日收盘价的简单移动平均线,上下线为中线加减m倍的n日真实波幅的简单移动平均。

判断价格是否突破布林带和Keltner通道的上下轨构成压缩和扩张形态。当价格从上方突破下轨时为压缩形态,当价格从下方突破上轨时为扩张形态。

计算线性回归曲线的数值,作为动量指标。当动量线上穿0时为买入信号,下穿0时为卖出信号。

结合压缩扩张形态、动量指标方向、均值过滤器等多重条件判断最终交易信号。只有满足所有条件才会生成交易信号,避免错误交易。

策略优势

使用布林带和Keltner通道双重过滤,识别高质量的压缩和扩张形态。

动量指标能够及时捕捉价格趋势反转,与通道指标形成互补。

允许超前入场,提高盈利机会。

采用多重条件判断,避免在震荡行情中频繁开仓。

各技术指标参数可自定义,适应不同品种和参数组合。

可设定回测时间段,针对特定时间周期进行优化测试。

策略风险

趋势跟踪策略,当趋势发生反转时容易产生亏损。

参数设置不当可能导致交易频率过高或信号质量不佳。

依赖历史数据测试,无法保证未来返回持续稳定。

无法应对突发事件引起的市场震荡和价格剧烈波动。

回测时间窗口设置不当,可能导致过拟合。

策略优化方向

优化布林带和Keltner通道的参数,找到最佳组合。

测试加入移动止损来控制单笔交易最大亏损。

尝试在特定品种、周期参数组合下进一步优化。

探索加入机器学习模型判断趋势反转。

测试不同入场顺序和仓位管理策略。

研究如何识别趋势反转信号并及时止损。

总结

该策略融合多种技术指标判断价格趋势方向并进行趋势跟踪,具有较强的适应性。通过参数自定义和多重条件过滤,可以有效控制交易频率和提高信号质量。但反转交易和突发事件仍需警惕,可以继续探索趋势反转信号和风险控制机制进行优化,使策略更稳健。

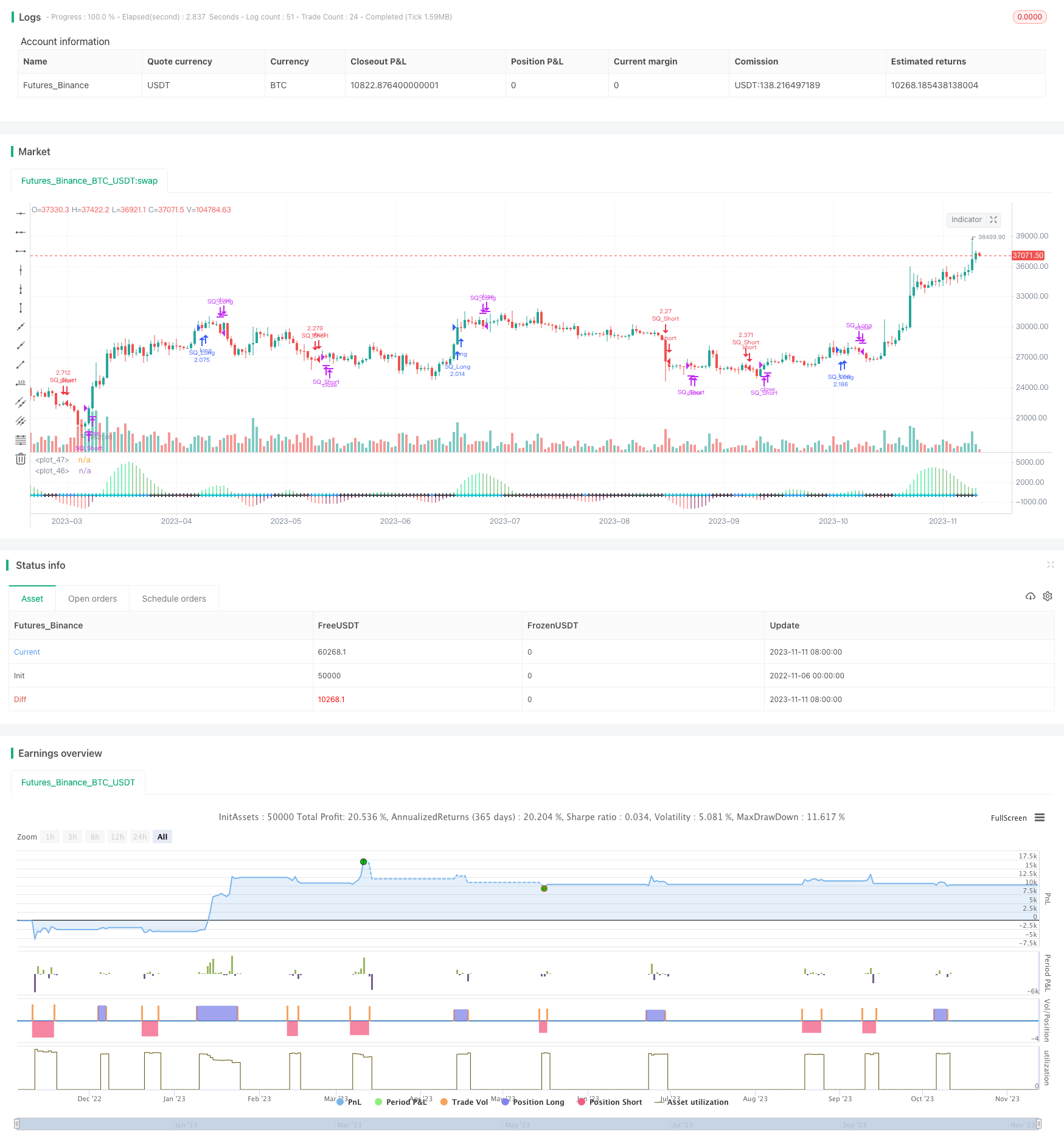

/*backtest

start: 2022-11-06 00:00:00

end: 2023-11-12 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Strategy based on LazyBear Squeeze Momentum Indicator

//I added some custom feature and filters

//

// @author LazyBear

// List of all my indicators:

// https://docs.google.com/document/d/15AGCufJZ8CIUvwFJ9W-IKns88gkWOKBCvByMEvm5MLo/edit?usp=sharing

// v2 - fixed a typo, where BB multipler was always stuck at 1.5. [Thanks @ucsgears]

//

strategy(shorttitle = "SQZMOM_LB", title="Strategy for Squeeze Momentum Indicator [LazyBear]", overlay=false, calc_on_every_tick=true, pyramiding=0,default_qty_type=strategy.percent_of_equity,default_qty_value=100,currency=currency.USD)

length = input(14, title="BB Length")

mult = input(2.0,title="BB MultFactor")

lengthKC=input(16, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = input(true, title="Use TrueRange (KC)", type=bool)

//FILTERS

useExtremeOrders = input(false, title="Early entry on momentum change", type=bool)

useMomAverage = input(false, title="Filter for Momenutum value", type=bool)

MomentumMin = input(20, title="Min for momentum")

// Calculate BB

src = close

basis = sma(src, length)

dev = mult * stdev(src, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = sma(src, lengthKC)

range = useTrueRange ? tr : (high - low)

rangema = sma(range, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

val = linreg(src - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)),sma(close,lengthKC)), lengthKC,0)

bcolor = iff( val > 0, iff( val > nz(val[1]), lime, green), iff( val < nz(val[1]), red, maroon))

scolor = noSqz ? blue : sqzOn ? black : aqua

plot(val, color=bcolor, style=histogram, linewidth=4)

plot(0, color=scolor, style=cross, linewidth=2)

//LOGIC

//momentum filter

filterMom=useMomAverage?abs(val)>(MomentumMin/100000)?true:false:true

//standard condition

longCondition = scolor[1]!=aqua and scolor==aqua and bcolor==lime and filterMom

exitLongCondition = bcolor==green and not useExtremeOrders

shortCondition = scolor[1]!=aqua and scolor==aqua and bcolor==red and filterMom

exitShortCondition = bcolor==maroon and not useExtremeOrders

//early entry

extremeLong= useExtremeOrders and scolor==aqua and bcolor==maroon and bcolor[1]!=bcolor[0] and filterMom

exitExtLong = scolor==black or bcolor==red

extremeShort = useExtremeOrders and scolor==aqua and bcolor==green and bcolor[1]!=bcolor[0] and filterMom

exitExtShort = scolor==black or bcolor==lime

//STRATEGY

strategy.entry("SQ_Long", strategy.long, when = longCondition)

strategy.close("SQ_Long",when = exitLongCondition )

strategy.entry("SQ_Long_Ext", strategy.long, when = extremeLong)

strategy.close("SQ_Long_Ext",when = exitExtLong)

//strategy.exit("exit Long", "SQ_Long", when = exitLongCondition)

strategy.entry("SQ_Short", strategy.short, when = shortCondition)

strategy.close("SQ_Short",when = exitShortCondition)

strategy.entry("SQ_Short_Ext", strategy.short, when = extremeShort)

strategy.close("SQ_Short_Ext",when = exitExtShort)

//strategy.exit("exit Short", "SQ_Short", when = exitShortCondition)

// // === Backtesting Dates === thanks to Trost

// testPeriodSwitch = input(true, "Custom Backtesting Dates")

// testStartYear = input(2018, "Backtest Start Year")

// testStartMonth = input(1, "Backtest Start Month")

// testStartDay = input(1, "Backtest Start Day")

// testStartHour = input(0, "Backtest Start Hour")

// testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,testStartHour,0)

// testStopYear = input(2018, "Backtest Stop Year")

// testStopMonth = input(12, "Backtest Stop Month")

// testStopDay = input(14, "Backtest Stop Day")

// testStopHour = input(23, "Backtest Stop Hour")

// testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,testStopHour,0)

// testPeriod() =>

// time >= testPeriodStart and time <= testPeriodStop ? true : false

// isPeriod = testPeriodSwitch == true ? testPeriod() : true

// // === /END

// if not isPeriod

// strategy.cancel_all()

// strategy.close_all()