概述

双轨跟踪震荡分型策略是一种基于布林带和EMA指标的量化交易策略。该策略 attempts to capture short-term price fluctuations through identifying oscillator patterns based on Bollinger Bands and EMA.

策略原理

该策略同时使用布林带和EMA作为技术指标。布林带包含上轨、中轨和下轨,能够判断价格是否处于震荡区间。EMA是一种趋势跟踪指标,能够判断价格趋势。

该策略首先计算布林带的中轨,也就是价格的n日简单移动均线,其中n值默认为20天。布林带上轨和下轨分别为中轨加/减两个标准差。然后计算9日EMA。

当价格上穿EMA时,视为买入信号;当价格下穿EMA时,视为卖出信号。这样,EMA作为快速均线,能够捕捉价格短期趋势;而布林带中轨作为慢速均线,能过滤掉部分假信号。

所以,该策略通过EMA和布林带的双轨跟踪,尽可能捕捉价格的短期震荡。当EMA上穿中轨时买入,EMA下穿中轨时卖出。

策略优势分析

这种双轨跟踪策略有以下几个优势:

使用EMA和布林带中轨双轨跟踪,能够同时判断趋势和震荡,更准确地捕捉短期价格波动。

EMA作为快速均线,布林带中轨作为慢速均线,二者配合使用,可以有效过滤假信号,提高信号质量。

指标参数可调整,n值和布林带标准差可根据市场调整,适应性强。

策略思路简单清晰易于实现,非常适合短期震荡行情。

可适当优化参数,结合其他指标过滤,进一步提高策略稳定性。

风险分析

该策略也存在一些潜在风险:

布林带上下轨容易形成支撑和压力,可能会提前触发止损。

EMA和布林带中轨交叉时,价格可能出现背离,发出错误信号。

大幅趋势行情时,EMA容易形成san杯底买点或三山顶卖点,可能错过趋势。

震荡行情减弱时,交易信号将明显减少,无法持续盈利。

参数设置不当可能导致过度交易或漏失交易机会。

交易费用会降低实际盈利,需要控制好仓位规模。

策略优化方向

该策略可以从以下几个方面进行优化:

增加成交量等指标,过滤信号质量不佳的交叉信号。

结合RSI等超买超卖指标,避免买卖点出现在极端区域。

根据ATR值来设置止损和止盈,使止损更合理。

增加对趋势的判断,避免趋势行情下产生错误信号。

优化参数,如EMA周期、布林带参数等,使之更符合不同市场环境。

采用机器学习方法动态优化参数,使策略更具鲁棒性。

采用算法交易,设置更严格的入场和出场条件,减少人为干预。

总结

双轨跟踪震荡分型策略同时利用EMA和布林带双轨跟踪价格,通过EMA上穿中轨买入,EMA下穿中轨卖出,捕捉短期价格震荡,是一个较为简单实用的短线策略。该策略具有趋势判断和滤除假信号的优势,但也存在一定的风险。通过不断优化参数设置、入场出场条件等,该策略可以变得更稳定可靠,适用于更多市场环境,是一个值得学习和应用的策略思路。

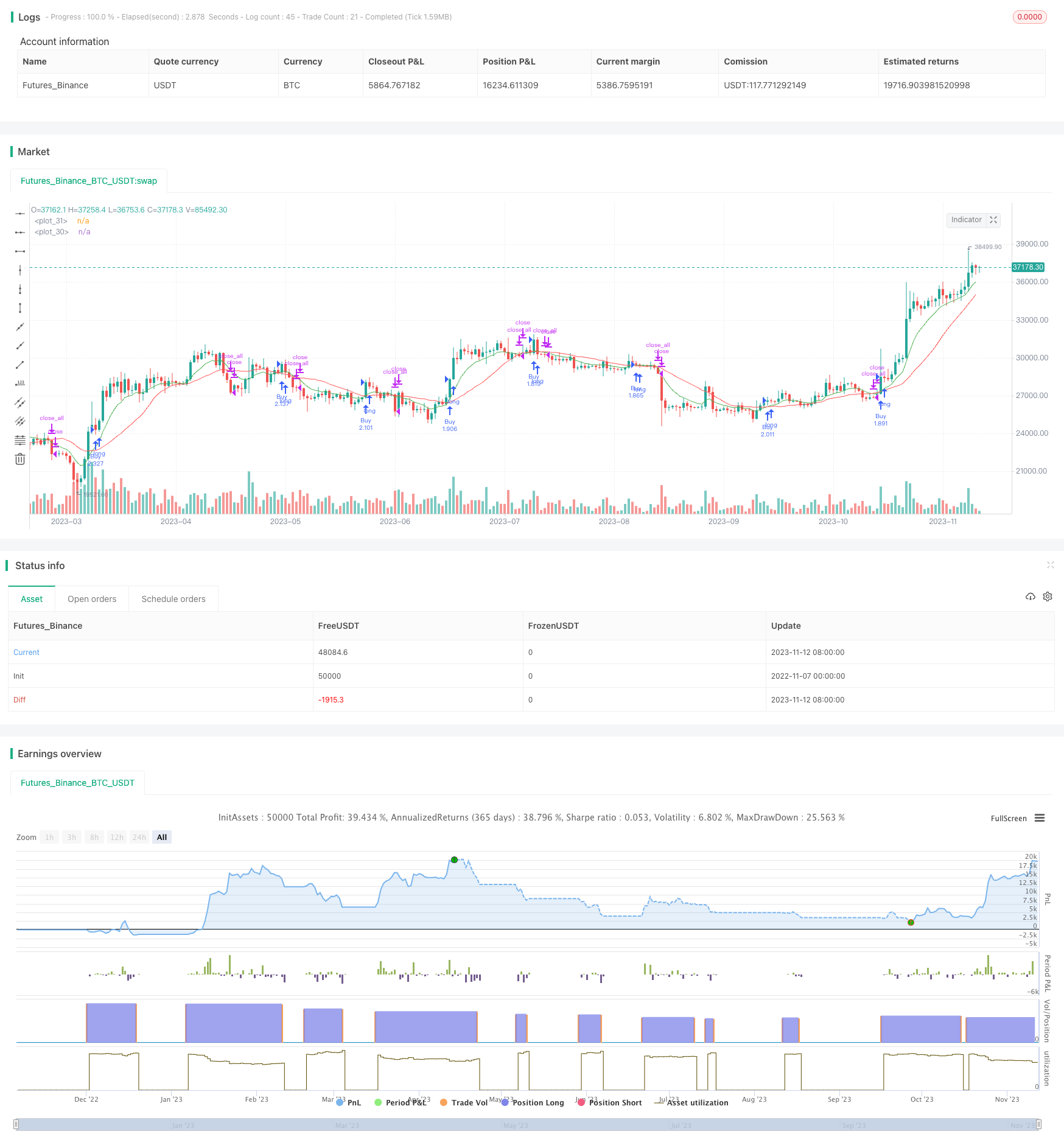

/*backtest

start: 2022-11-07 00:00:00

end: 2023-11-13 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(shorttitle="BBXEMA", title="Bollinger Bands Cross EMA", default_qty_type=strategy.percent_of_equity, default_qty_value=100, overlay=true)

length = input(20, minval=1)

lengthEMA = input(9)

src = input(close, title="Source")

srcEMA = input(close, title="Source EMA")

//mult = input(2.0, minval=0.001, maxval=50)

// === INPUT BACKTEST RANGE ===

FromYear = input(defval = 2019, title = "From Year", minval = 2009)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2009)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true

basis = sma(src, length)

EMA = ema(srcEMA,lengthEMA)

//dev = mult * stdev(src, length)

//upper = basis + dev

//lower = basis - dev

Buy = crossover(EMA,basis)

Sell = crossunder(EMA,basis)

bb = plot(basis, color=color.red)

signal = plot(EMA, color=color.green)

//p1 = plot(upper, color=color.blue)

//p2 = plot(lower, color=color.blue)

//fill(p1, p2)

strategy.entry("Buy",true,when=window() and Buy)

strategy.close_all(when=window() and Sell)