概述

该策略基于移动止损的思想,利用Distance Close Bars(DCB)指标判断价格走势,结合快速RSI指标进行过滤,实现移动止损和跟踪止损。策略同时还使用了马丁格尔增仓原理,适合中长线趋势交易。

原理

计算lastg和lastr分别代表最后一个涨幅K线的收盘价和最后一个跌幅K线的收盘价。

计算dist为lastg和lastr的价差。

计算adist为dist的30周期简单移动平均。

当dist大于adist的两倍时生成交易信号。

结合快速RSI指标过滤 signal,避免假突破。

若有信号且无持仓,按固定百分比入场开仓。

使用马丁格尔原理,亏损后加仓。

价格触发止损或止盈后平仓。

优势

采用DCB指标判断趋势方向,能够有效捕捉中长线趋势。

快速RSI指标过滤可避免假突破带来亏损。

移动止损止盈机制可锁定盈利,有效控制风险。

马丁格尔原理可在亏损后加大仓位,追求更高收益。

策略参数设置合理,适合不同市场环境。

风险

DCB指标可能发出错误信号,需要结合其他指标过滤。

马丁格尔加仓会加剧亏损,需要严格的资金管理。

止损点设置不合理可能造成超过预期的损失。

需要严格控制仓位数量,避免超出资金负担能力。

交易合约设置不当可能导致极端行情下巨额亏损。

优化思路

优化DCB参数,寻找最佳参数组合。

尝试其他指标替代快速RSI进行过滤。

优化止损止盈参数,提高策略胜率。

优化马丁格尔参数,降低加仓风险。

测试不同交易品种,选择最佳品种套利。

结合机器学习等技术动态优化策略参数。

总结

该策略 Overall是一个较为成熟的趋势跟踪策略。采用DCB判定趋势方向,快速RSI过滤信号可避免错误开仓。同时止损止盈机制可有效控制单笔亏损。但策略也存在一定风险,需要进一步优化参数以降低风险,提升稳定性。总体来说,该策略思路清晰易懂,适合中长线趋势交易者。

策略源码

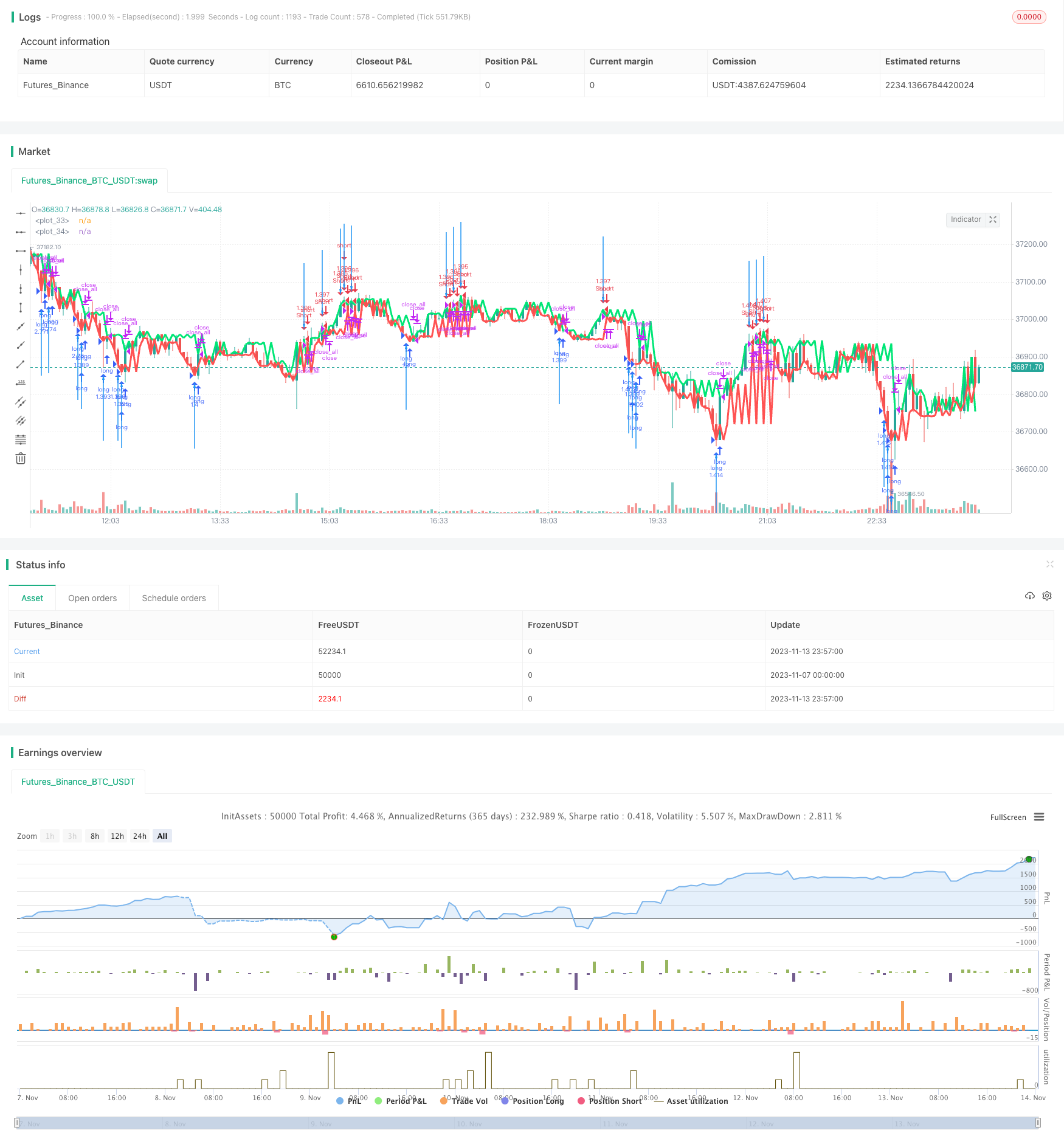

/*backtest

start: 2023-11-07 00:00:00

end: 2023-11-14 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Distance Strategy v1.0", shorttitle = "Distance str 1.0", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 10)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usemar = input(true, defval = true, title = "Use Martingale")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

usersi = input(true, defval = true, title = "Use RSI-Filter")

periodrsi = input(7, defval = 7, minval = 2, maxval = 50, title = "RSI Period")

limitrsi = input(30, defval = 30, minval = 1, maxval = 50, title = "RSI Limit")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(close), 0), periodrsi)

fastdown = rma(-min(change(close), 0), periodrsi)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Distance

bar = close > open ? 1 : close < open ? -1 : 0

lastg = bar == 1 ? close : lastg[1]

lastr = bar == -1 ? close : lastr[1]

dist = lastg - lastr

adist = sma(dist, 30)

plot(lastg, linewidth = 3, color = lime)

plot(lastr, linewidth = 3, color = red)

up = bar == -1 and dist > adist * 2

dn = bar == 1 and dist > adist * 2

//RSI Filter

rsidn = fastrsi < limitrsi or usersi == false

rsiup = fastrsi > 100 - limitrsi or usersi == false

//Signals

up1 = up and rsidn

dn1 = dn and rsiup

exit = ((strategy.position_size > 0 and close > open) or (strategy.position_size < 0 and close < open))

//Arrows

plotarrow(up1 ? 1 : na, colorup = blue, colordown = blue)

plotarrow(dn1 ? -1 : na, colorup = blue, colordown = blue)

//Trading

profit = exit ? ((strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price)) ? 1 : -1 : profit[1]

mult = usemar ? exit ? profit == -1 ? mult[1] * 2 : 1 : mult[1] : 1

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 * mult : lot[1]

signalup = up1

if signalup

if strategy.position_size < 0

strategy.close_all()

strategy.entry("long", strategy.long, needlong == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

signaldn = dn1

if signaldn

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if time > timestamp(toyear, tomonth, today, 23, 59) or exit

strategy.close_all()