概述

该策略结合了123形态反转和易于移动两种策略,目的是通过捕捉价格的转折点来进行交易。123形态反转策略在股票价格连续三日形成特定模型时产生信号。易于移动(EOM)策略则利用价格和交易量变化判断市场动量。这两种策略相结合,既考虑了价格的技术形态,也考虑了市场动量,从而提高交易信号的准确性。

策略原理

该策略由两部分组成:

123形态反转策略

- 使用Stoch指标判断超买超卖

- 当收盘价连续两日下跌,且Stoch快线高于慢线时做空

- 当收盘价连续两日上涨,且Stoch快线低于慢线时做多

易于移动策略

- 计算前一日的区间中点

- 计算区间中点相对于前一日的移动(变化)

- 计算区间中点移动和成交量的比值

- 比值大于阈值时看涨,小于阈值时看跌

综合两个信号,当Easy of Movement和123形态同时做多信号时,开多仓;当Easy of Movement和123形态同时做空信号时,开空仓。

优势分析

该策略具有以下优势:

结合价格技术形态和市场动量,提高信号准确性

123形态反转捕捉转折点,易于移动判断趋势动量,二者互补

Stoch指标避免在盘整中反复开平仓

交易逻辑简单清晰,容易实施

可自定义参数,适应不同市场环境

风险分析

该策略也存在一些风险:

过于依赖参数设置,参数不当可能导致交易频繁或漏单

多种过滤条件联合使用,信号产生频率可能过低

易于移动指标对市场波动敏感,可引发假信号

实盘略逊回测,需要控制仓位规模

仅适用趋势性股票,不适合盘整市

优化方向

可以从以下几方面优化该策略:

优化参数,调整过滤条件严格程度,平衡交易频率和信号质量

加入止损策略,严格控制单笔损失

结合趋势过滤,避免逆势交易

增加资金管理模块,根据波动率动态调整仓位

采用机器学习方法优化参数,使之动态适应市场

总结

该策略整合价格技术指标和市场动量指标,在捕捉转折点的同时确认趋势质量,具有较高的实战价值。但也需要注意控制交易频率、单笔损失和逆势操作的风险。通过参数优化、止损策略、趋势过滤等手段可以进一步提升策略的稳定性和盈利能力。该策略思路清晰易于实施,值得量化交易者继续研究和改进。

策略源码

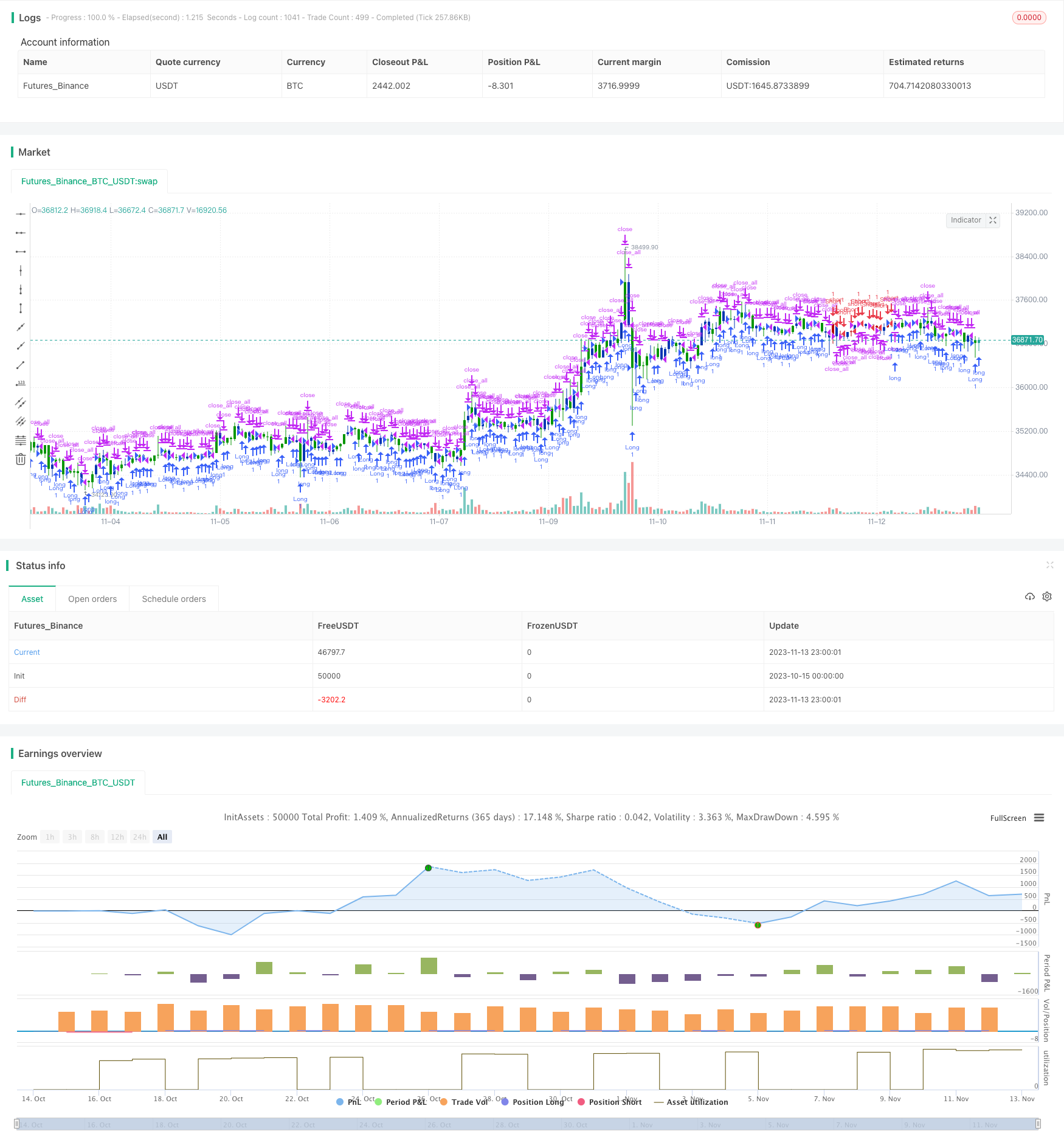

/*backtest

start: 2023-10-15 00:00:00

end: 2023-11-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 14/04/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This indicator gauges the magnitude of price and volume movement.

// The indicator returns both positive and negative values where a

// positive value means the market has moved up from yesterday's value

// and a negative value means the market has moved down. A large positive

// or large negative value indicates a large move in price and/or lighter

// volume. A small positive or small negative value indicates a small move

// in price and/or heavier volume.

// A positive or negative numeric value. A positive value means the market

// has moved up from yesterday's value, whereas, a negative value means the

// market has moved down.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

EOM(BuyZone, SellZone) =>

pos = 0

xHigh = high

xLow = low

xVolume = volume

xHalfRange = (xHigh - xLow) * 0.5

xMidpointMove = mom(xHalfRange, 1)

xBoxRatio = iff((xHigh - xLow) != 0, xVolume / (xHigh - xLow), 0)

nRes = iff(xBoxRatio != 0, 1000000 * ((xMidpointMove - xMidpointMove[1]) / xBoxRatio), 0)

pos := iff(nRes > BuyZone, 1,

iff(nRes < SellZone, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Ease of Movement (EOM)", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

BuyZone = input(4000, minval=1)

SellZone = input(-4000)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posEOM = EOM(BuyZone, SellZone)

pos = iff(posReversal123 == 1 and posEOM == 1 , 1,

iff(posReversal123 == -1 and posEOM == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )