概述

该策略运用CT TTM指标来识别价格的趋势,采用追踪止损来控制风险。策略名为“基于CT TTM指标的趋势跟踪策略”。

策略原理

该策略使用CT TTM指标来判断价格趋势。具体来说,策略中定义了以下变量:

- e1 - 中间带的中间价位

- osc - 通过计算e1周期收盘价与e1的差值并进行线性回归得到的振荡器

- diff - 布林带和肯特纳通道之间的差值

- osc_color - 指定osc的不同颜色

- mid_color - 指定diff的不同颜色

如果osc上穿0轴,则显示为绿色,表示多头;如果osc下穿0轴,显示为红色,表示空头。

当osc为正时,做多;当osc为负时,做空。

该策略使用振荡器osc判断趋势方向,并以diff来判断多空力度。当振荡器osc上穿0轴时,认为行情由下向上,做多;当osc下穿0轴时,认为行情由上向下,做空。

策略优势分析

该策略具有以下优势:

使用CT TTM指标判断趋势,准确率较高。CT TTM指标综合考虑了移动平均线、布林带和肯特纳通道,能够有效识别价格趋势。

应用振荡器来判断 specific 多空节点,可以避免在非趋势区域发出错误信号。振荡器能够有效过滤价格小幅震荡对交易信号的影响。

采用追踪止损来控制风险,可以有效限制每单损失。策略中在入场后及时设置止损,可锁定盈利并最大程度避免亏损扩大。

策略参数较少,容易优化。该策略仅依赖长度length一个参数,便于快速测试找到最佳参数组合。

绘图功能完善,可以清晰看到信号。策略采用不同颜色区分多空信号及力度,直观显示趋势判断结果。

策略风险分析

该策略也存在以下风险:

CT TTM指标在某些市场情况下可能发出错误信号,导致交易亏损。当价格出现剧烈波动时,指标可能产生错误的多空信号。

振荡器发生背离时,可能出现交易信号错误。当价格已经反转但振荡器尚未转向时,会造成错误信号。

追踪止损过于激进可能造成无谓损失。当止损点设置过近时,正常波动可能触发追踪止损而被迫离场。

该策略仅适用于趋势性较强的品种,不适合盘整市。策略以趋势交易为主,在盘整震荡市场中效果不佳。

优化过度可能导致曲线拟合。参数优化时应注意避免过度优化导致的回测曲线拟合问题。

策略优化方向

该策略可以从以下几个方面进行优化:

综合多个指标进行组合,提高信号准确率。可以加入MACD、KDJ等其他指标,优化entry信号。

加入止损方式优化模块,使止损更加智能化。可以测试参数自适应追踪止损、挂单止损等止损方式。

优化资金管理策略,测试固定份额、凯利公式等资金管理方式。优化后可以在保证单笔风险的前提下提高资金使用效率。

针对特定品种进行参数优化,提高策略适应性。根据不同交易品种的特点微调参数,能够提高策略对特定品种的拟合度。

增加机器学习算法,实现策略的自适应学习。使用RNN、LSTM等对策略进行增强,提高策略的自适应能力。

总结

本策略运用CT TTM指标判断趋势方向,以振荡器白数值作为entry信号,采取追踪止损管理风险。策略优势是准确率较高、参数优化容易,但也存在指标失灵、止损过于激进等风险。未来可通过多指标组合、止损优化、资金管理优化等方法进行提升,使策略效果更佳。

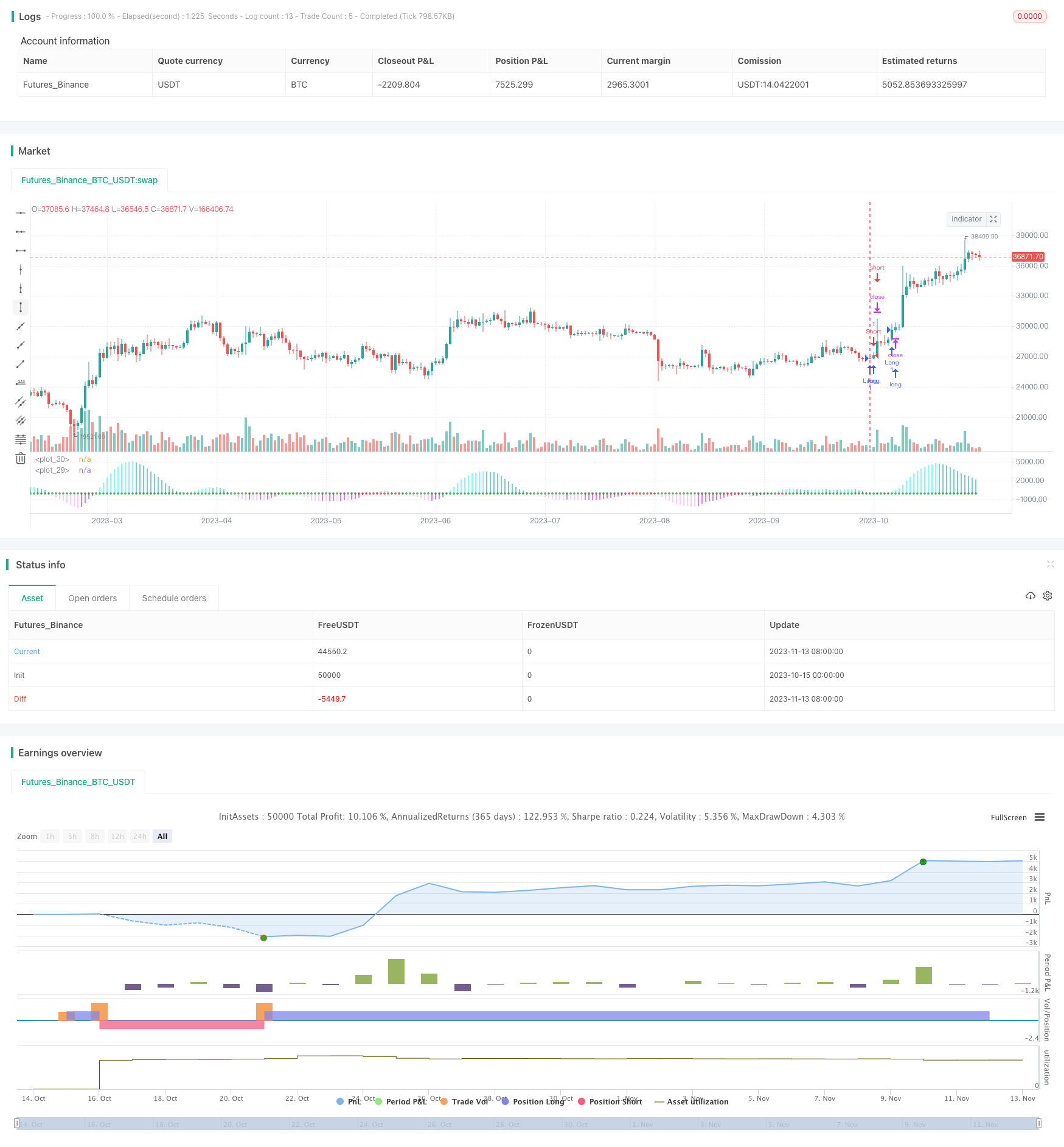

/*backtest

start: 2023-10-15 00:00:00

end: 2023-11-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("CT TTM Squeeze")

length = input(title="Length", defval=20, minval=0)

bband(length, mult) =>

sma(close, length) + mult * stdev(close, length)

keltner(length, mult) =>

ema(close, length) + mult * ema(tr, length)

// Variables

e1 = (highest(high, length) + lowest(low, length)) / 2 + sma(close, length)

osc = linreg(close - e1 / 2, length, 0)

diff = bband(length, 2) - keltner(length, 1)

osc_color = osc[1] < osc[0] ? osc[0] >= 0 ? #00ffff : #cc00cc : osc[0] >= 0 ? #009b9b : #ff9bff

mid_color = diff >= 0 ? green : red

// Strategy

long = osc > 0

short = osc < 0

if long

strategy.entry("Long", strategy.long)

if short

strategy.entry("Short", strategy.short)

plot(osc, color=osc_color, style=histogram, linewidth=2)

plot(0, color=mid_color, style=circles, linewidth=3)