本策略通过计算K线的阳阴影长度比率,判断目前趋势方向,配合平均真实波幅ATR进行趋势识别,在突破点进行反向开仓,设置止损止盈,捕捉短期趋势。

策略原理

该策略主要通过计算K线的阳阴影长度比率,判断目前的趋势方向,当阴线长度过长时判断为向下趋势,当阳线长度过长时判断为向上趋势。

策略具体逻辑是:

- 计算K线的下阴影长度:close-low(收盘价-最低价)

- 计算K线的上阴影长度:high-open(最高价-开盘价)

- 取下阴影和上阴影的最大值作为阴影长度

- 计算K线实体长度:high-low(最高价-最低价)

- 计算阴影长度与实体长度之比

- 当比率大于0.5并且下阴影大于上阴影时,判断为向下趋势,设置多单进场

- 当比率大于0.5并且上阴影大于下阴影时,判断为向上趋势,设置空单进场

- 进场时要同时判断K线实体长度是否大于0.75倍的ATR平均真实波幅,避免无效突破

- 进场后设置止损止盈,止损为入场价乘以系数,止盈为入场价乘以2倍系数,实现盈亏比为2:1

以上就是策略的基本交易逻辑,通过识别趋势突破点进行反向开仓,设置止损止盈后进行盈利优化。

策略优势

- 使用阳阴影比率判断趋势方向,区分度高

- 结合ATR指标进行有效突破判断,避免头假信号

- 设置止损止盈,有利于风险控制

- 实现2:1盈亏比,符合量化交易标准

- 适用于高波动股票的短线交易

- 策略逻辑简单清晰,容易理解实现

策略风险

- 股价剧烈波动时,止损可能被突破,造成损失扩大

- 效果与参数设定密切相关,需要优化参数

- 趋势产生转折时,可能形成损失

- 同步扩大止损和止盈范围会增加亏损概率

- 突破失败时会损失较大资金

可通过合理止损,优化参数,及时止损来控制风险。

策略优化

策略可从以下几个方面进行优化:

- 优化阳阴影比率参数,找出最佳数值

- 优化ATR参数,找出最好的K线长度判定

- 优化止损止盈系数,实现最佳风险收益比

- 增加仓位管理,例如逐步加仓

- 增加跟踪止损,实现盈利保护

- 结合其他指标过滤入场信号

- 优化回测时间段,测试不同市场阶段的效果

通过多方位测试与优化,可将策略效果最大化。

总体来说,该策略通过趋势识别与风险控制的方式,利用短期价格波动获利,是一个效果稳定的短线突破策略。优化后可成为量化交易的关键部分。

策略源码

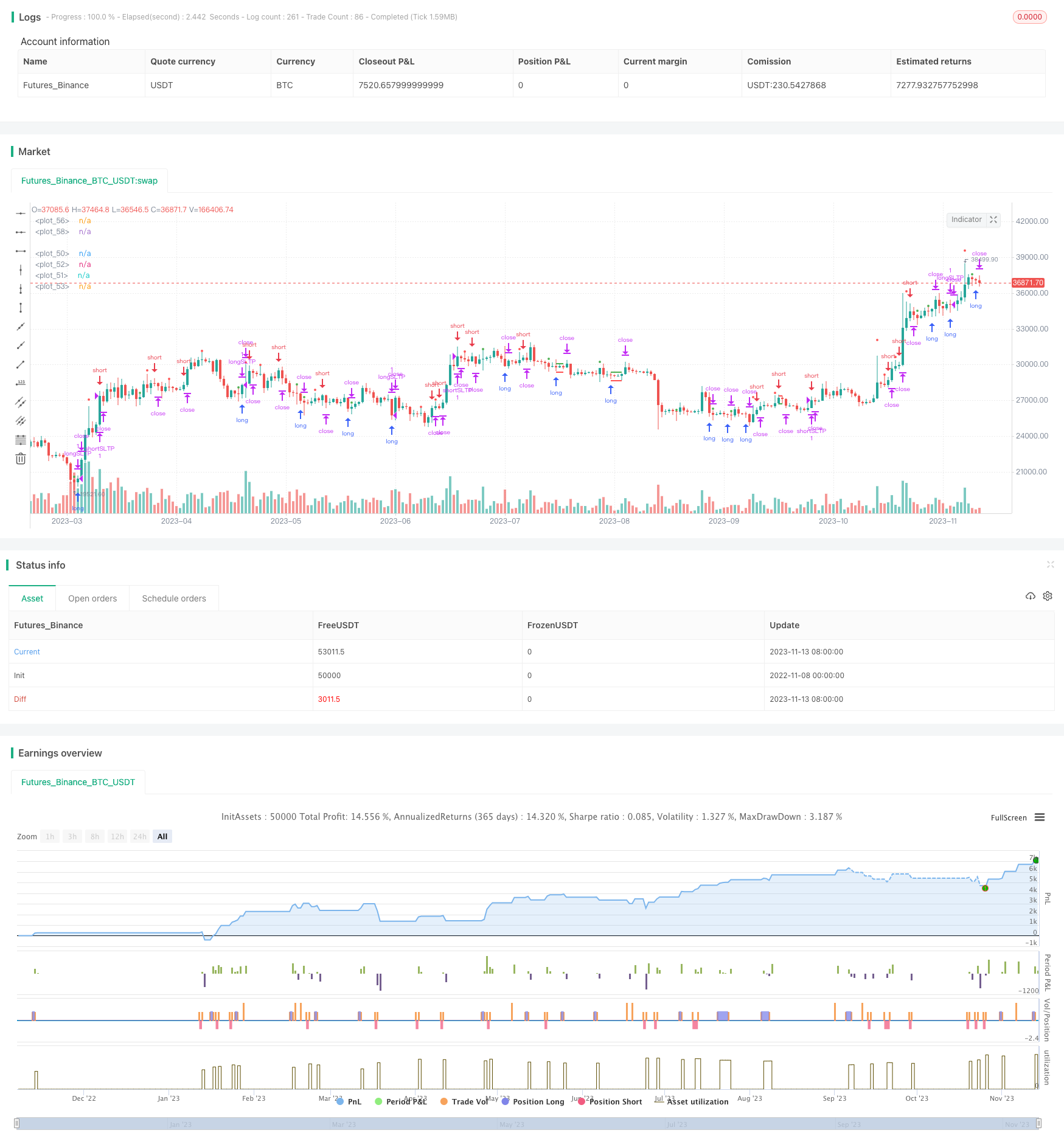

/*backtest

start: 2022-11-08 00:00:00

end: 2023-11-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ondrej17

//@version=4

strategy("longWickstrategy", overlay=true )

// Inputs

st_yr_inp = input(defval=2020, title='Backtest Start Year')

st_mn_inp = input(defval=01, title='Backtest Start Month')

st_dy_inp = input(defval=01, title='Backtest Start Day')

en_yr_inp = input(defval=2025, title='Backtest End Year')

en_mn_inp = input(defval=01, title='Backtest End Month')

en_dy_inp = input(defval=01, title='Backtest End Day')

sltp_inp = input(defval=0.8, title='N - % offset for N*SL and (2N)*TP')/100

// Dates

start = timestamp(st_yr_inp, st_mn_inp, st_dy_inp,00,00)

end = timestamp(en_yr_inp, en_mn_inp, en_dy_inp,00,00)

canTrade = time >= start and time <= end

// Indicators Setup

// Strategy Calcuations

lowerWick = (open > close) ? close-low : open - low

upperWick = (open > close) ? high-open : high-close

wickLength = max(lowerWick,upperWick)

candleLength = high-low

wickToCandleRatio = wickLength / candleLength

entryFilterCandleLength = candleLength > 0.75*atr(48)

// Entries and Exits

longCondition = entryFilterCandleLength and wickToCandleRatio > 0.5 and lowerWick > upperWick and canTrade and strategy.position_size == 0

shortCondition = entryFilterCandleLength and wickToCandleRatio > 0.5 and lowerWick < upperWick and canTrade and strategy.position_size == 0

strategy.entry("pendingLong", strategy.long, limit=low+wickLength/2, when = longCondition)

strategy.entry("pendingShort", strategy.short, limit=high-wickLength/2, when = shortCondition)

longStop = strategy.position_size > 0 ? strategy.position_avg_price*(1-sltp_inp) : na

longTP = strategy.position_size > 0 ? strategy.position_avg_price*(1+2*sltp_inp) : na

shortStop = strategy.position_size < 0 ? strategy.position_avg_price*(1+sltp_inp) : na

shortTP = strategy.position_size < 0 ? strategy.position_avg_price*(1-2*sltp_inp) : na

strategy.exit("longSLTP","pendingLong", stop=longStop, limit = longTP)

strategy.exit("shortSLTP","pendingShort", stop=shortStop, limit = shortTP)

plot(longStop, color=color.red, style=plot.style_linebr, linewidth=2)

plot(shortStop, color=color.red, style=plot.style_linebr, linewidth=2)

plot(longTP, color=color.green, style=plot.style_linebr, linewidth=2)

plot(shortTP, color=color.green, style=plot.style_linebr, linewidth=2)

plotLongCondition = longCondition ? high+abs(open-close) : na

plot(plotLongCondition, style=plot.style_circles, linewidth=4, color=color.green)

plotShortCondition = shortCondition ? high+abs(open-close) : na

plot(plotShortCondition, style=plot.style_circles, linewidth=4, color=color.red)