概述

本策略通过计算交易量变化情况,判断市场趋势方向,采用趋势跟踪方式,在趋势开始阶段建立仓位,在趋势结束时平仓止损。

策略原理

- 计算典型价格typical,对数收益率inter,收益率方差vinter

- 计算交易量平均值vave,最大交易量阈值vmax

- 计算价格变化量mf,与方差阈值cutoff比较,计算出价格驱动量vcp

- 汇总vcp得到量价指标vfi,分别计算vfi和其均线vfima

- 比较vfi和vfima大小,得到量价指标差值dVFI,以判定趋势方向

- 当dVFI上穿0时为看涨信号,下穿0时为看跌信号

- 根据dVFI形态,建立做多做空策略

策略优势分析

- 该策略充分考虑了交易量变化对趋势判断的影响,通过动量指标衡量趋势强弱,可以更准确地捕捉趋势转折点。

- 策略加入交易量阈值计算,可以过滤正常波动,只捕捉大资金的集体行为,避免被市场噪音误导。

- 量价联动判断,综合考量价格与成交量,可以有效避免假突破。

- 采用均线过滤和逻辑判断,可以过滤掉大部分假信号。

- 跟踪趋势而非预测反转,非常适合中长线趋势交易,有利于把握市场主要方向。

策略风险分析

- 该策略主要依赖交易量变化来判断趋势,在交易量不活跃的品种中效果会打折扣。

- 交易量数据容易被操纵,可能产生误导性信号,需要防范量价背离的情况。

- 量价关系经常有滞后,可能错过趋势开始的最佳入场时机。

- 粗放的止损方式可能会过早止损,无法持续捕捉趋势。

- 无法有效响应短期调整,对突发事件也可能反应不敏感。

可以考虑加入均线系统、波动率指标等来优化入场和止损;结合更多数据源分析量价关系,防范误导信号;加入适当技术指标提升对短期调整的响应。

策略优化方向

优化入场条件,可以考虑加入均线、자세오극점等判断,在趋势开始后确定入场。

优化止损方式,可以设定移动止损、级别止损等,让止损更贴近价格,跟踪趋势停止。

加入趋势判断环节,如ADX,可以避免横盘和震荡市场的错误交易。

优化参数设置,可以通过更长的数据回测寻找最优参数组合。

将策略扩展到更多品种,寻找质量更好、交易量更活跃的品种。

考虑加入机器学习模型,利用更多数据进行量价关系判断,提升信号质量。

总结

本策略整体思路清晰,核心指标直观易懂,可靠地识别趋势方向。策略优势在于强调交易量变化,适合追踪中长线趋势,但需防范误导信号。通过参数优化、止损方式改进、指标优化组合等方面进行改进,可以进一步增强策略的实盘表现。

策略源码

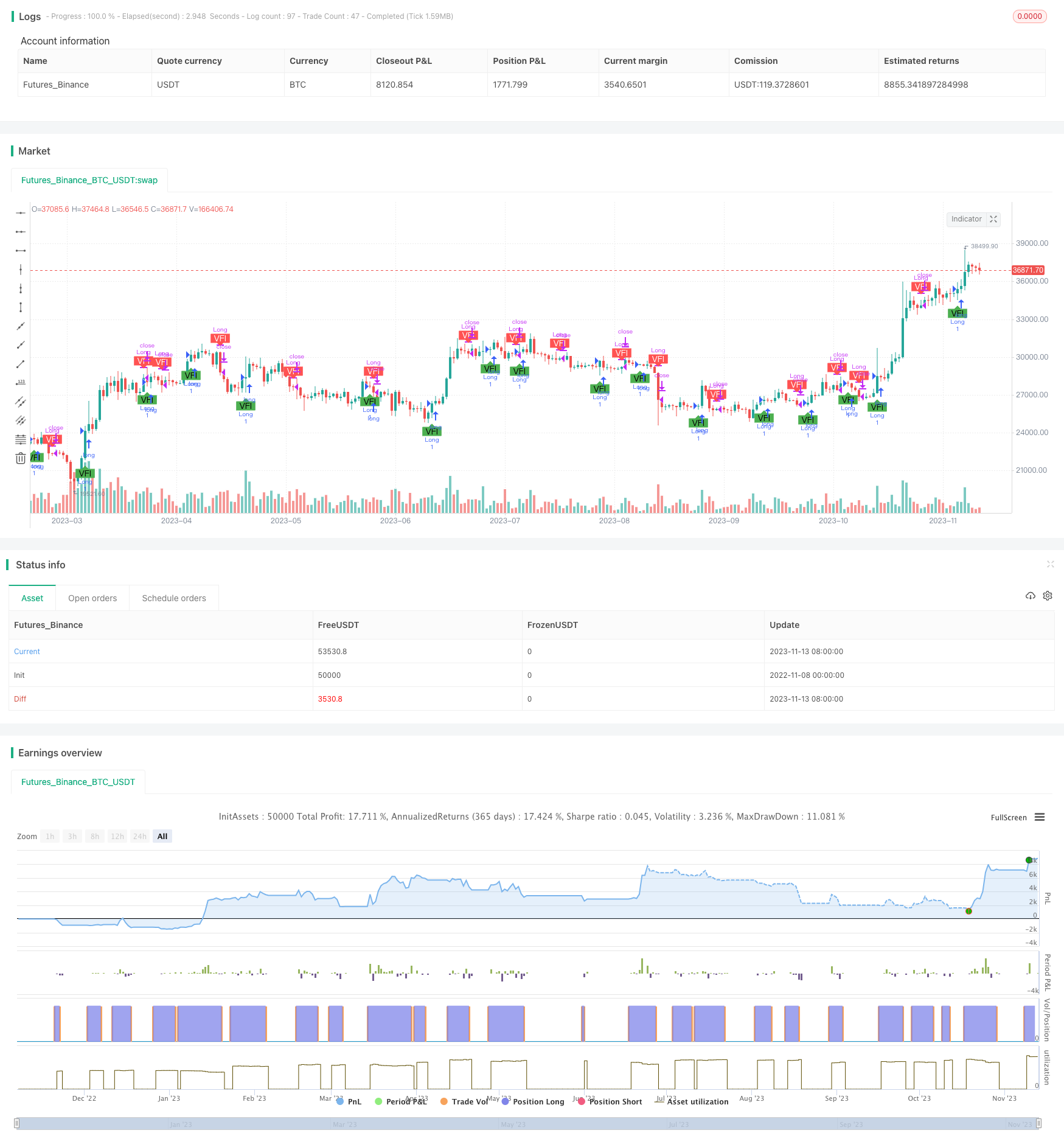

/*backtest

start: 2022-11-08 00:00:00

end: 2023-11-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Strategy for Volume Flow Indicator with alerts and markers on the chart", overlay=true)

// This indicator has been copied form Lazy Bear's code

lengthVFI = 130

coefVFI = 0.2

vcoefVFI = 2.5

signalLength= 5

smoothVFI=true

ma(x,y) => smoothVFI ? sma(x,y) : x

typical=hlc3

inter = log( typical ) - log( typical[1] )

vinter = stdev(inter, 30 )

cutoff = coefVFI * vinter * close

vave = sma( volume, lengthVFI )[1]

vmax = vave * vcoefVFI

vc = iff(volume < vmax, volume, vmax)

mf = typical - typical[1]

vcp = iff( mf > cutoff, vc, iff ( mf < -cutoff, -vc, 0 ) )

vfi = ma(sum( vcp , lengthVFI )/vave, 3)

vfima=ema( vfi, signalLength )

dVFI=vfi-vfima

bullishVFI = dVFI > 0 and dVFI[1] <=0

bearishVFI = dVFI < 0 and dVFI[1] >=0

longCondition = dVFI > 0 and dVFI[1] <=0

shortCondition = dVFI < 0 and dVFI[1] >=0

plotshape(bullishVFI, color=color.green, style=shape.labelup, textcolor=#000000, text="VFI", location=location.belowbar, transp=0)

plotshape(bearishVFI, color=color.red, style=shape.labeldown, textcolor=#ffffff, text="VFI", location=location.abovebar, transp=0)

alertcondition(bullishVFI, title='Bullish - Volume Flow Indicator', message='Bullish - Volume Flow Indicator')

alertcondition(bearishVFI, title='Bearish - Volume Flow Indicator', message='Bearish - Volume Flow Indicator')

if(year > 2018)

strategy.entry("Long", strategy.long, when=dVFI > 0 and dVFI[1] <=0)

if(shortCondition)

strategy.close(id="Long")