概述

该策略结合布林带和移动平均线,设计了一个跟踪趋势的交易系统。当价格突破布林带上轨且低轨高于SMA200时做多,当价格跌破布林带下轨时部分平仓,当价格跌破SMA200时全部平仓。该策略追踪趋势,在趋势变化时及时止损。

策略原理

- 计算SMA200Exponential Moving Average作为判断大趋势的指标

- 计算布林带,包含上轨,中轨,下轨,并填充颜色作为获利区域

- 当布林带上下轨都高于SMA200,说明处于上升趋势

- 当价格向上突破布林带中轨时,做多入场

- 当价格向下跌破布林带下轨时,部分平仓

- 当价格跌破SMA200时,说明大趋势发生反转,全部平仓

- 设定止损点,防止亏损过大

- 根据账户资金和可承受风险计算交易数量

该策略判断趋势存在的前提是布林带需要完全位于SMA200之上,只有在明确的上升趋势中才会选择多头方向入场。当下跌趋势来临时,通过关键点份额止损和全仓止损来控制风险。

优势分析

- 使用布林带判断明确的趋势存在,而不是基于单一指标判断

- SMA200判断大趋势方向,避免在震荡行情无谓交易

- 部分止损让利,追踪趋势运行

- 关键点止损及时止损,最大程度避免亏损扩大

- 计算交易数量引入风险管理概念,防止单笔损失过大

风险分析

- 布林带上下突破产生的交易信号可能出现较高的假信号率

- 部分止损点设置需要优化,防止过早止损

- 止损点过小,可能出现止损过于频繁

- SMA周期参数需要测试优化,以平衡延迟和敏感度

- 交易数量计算方法可能需要优化,防止单笔过大

可以通过仔细测试布林带参数,优化部分止损策略,调整SMA周期参数,并引入更科学的风险管理方法来降低这些风险。

优化方向

- 测试优化布林带参数,降低信号误判率

- 研究如何设定更合适的部分止损点

- 测试SMA周期参数的最优值 4.考虑引入自适应止损来替代固定止损点

- 研究引入波动率定额来更科学的计算交易规模

- 回测加入交易成本进行模拟

- 考虑与其他指标组合使用来提高策略稳定性

总结

该策略整合布林带通道、SMA均线指标设计了一个较完整的趋势跟踪策略。它在判断趋势存在时比较可靠,具有较强的趋势跟踪能力。通过持续优化止损策略、降低信号误判率、引入科学的风险管理手段,该策略可以成为一个值得长期实盘跟踪的趋势策略。它为量化交易策略设计提供了一个整合多个指标的思路。

策略源码

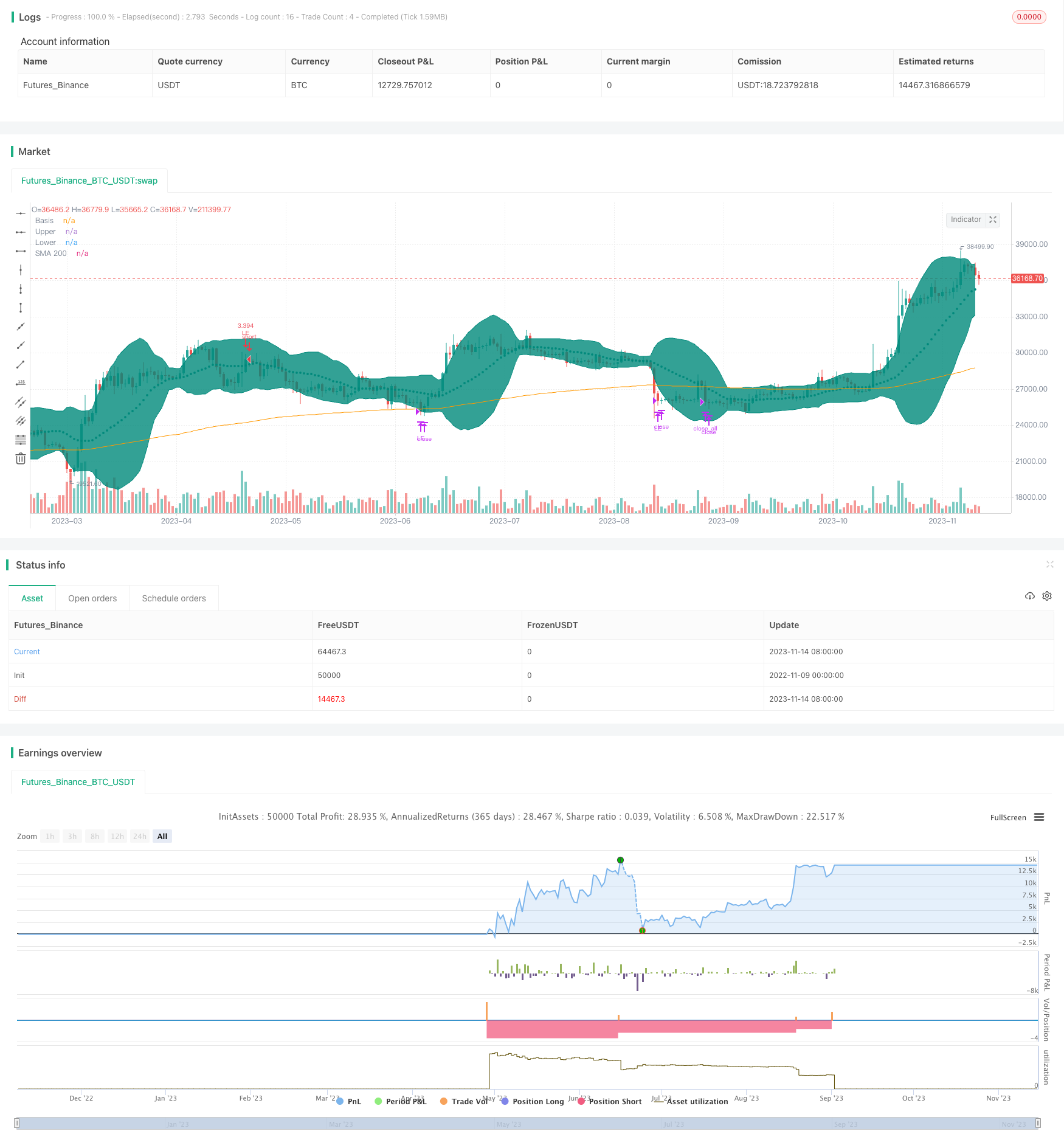

/*backtest

start: 2022-11-09 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

strategy(title="BB9_MA200_Strategy", overlay=true, pyramiding=1, default_qty_type=strategy.cash, initial_capital=10000, currency=currency.USD) //default_qty_value=10, default_qty_type=strategy.fixed,

var stopLossVal=0.00

//variables BEGIN

smaLength=input(200,title="MA Length")

bbLength=input(21,title="BB Length")

bbsrc = input(close, title="BB Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

stopLoss = input(title="Stop Loss%", defval=5, minval=1)

riskCapital = input(title="Risk % of capital == Based on this trade size is claculated numberOfShares = (AvailableCapital*risk/100) / stopLossPoints", defval=10, minval=1)

sma200=ema(close,smaLength)

plot(sma200, title="SMA 200", color=color.orange)

//bollinger calculation

basis = sma(bbsrc, bbLength)

dev = mult * stdev(bbsrc, bbLength)

upperBand = basis + dev

lowerBand = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

//plot bb

plot(basis, "Basis", color=color.teal, style=plot.style_circles , offset = offset)

p1 = plot(upperBand, "Upper", color=color.teal, offset = offset)

p2 = plot(lowerBand, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=color.teal, transp=95)

strategy.initial_capital = 50000

//Entry---

strategy.entry(id="LE", comment="LE capital="+tostring(strategy.initial_capital + strategy.netprofit ,"######.##"), qty=( (strategy.initial_capital + strategy.netprofit ) * riskCapital / 100)/(close*stopLoss/100) , long=true, when=strategy.position_size<1 and upperBand>sma200 and lowerBand > sma200 and crossover(close, basis) ) // // aroonOsc<0 //(strategy.initial_capital * 0.10)/close

barcolor(color=strategy.position_size>=1? color.blue: na)

//partial Exit

tpVal=strategy.position_size>1 ? strategy.position_avg_price * (1+(stopLoss/100) ) : 0.00

strategy.close(id="LE", comment="Partial points="+tostring(close - strategy.position_avg_price, "####.##"), qty_percent=30 , when=abs(strategy.position_size)>=1 and close>tpVal and crossunder(lowerBand, sma200) ) //close<ema55 and rsi5Val<20 //ema34<ema55

//close All on stop loss

//stoploss

stopLossVal:= strategy.position_size>1 ? strategy.position_avg_price * (1-(stopLoss/100) ) : 0.00

strategy.close_all( comment="SL Exit points="+tostring(close - strategy.position_avg_price, "####.##"), when=abs(strategy.position_size)>=1 and close < stopLossVal ) //close<ema55 and rsi5Val<20 //ema34<ema55 //close<ema89//

strategy.close_all( comment="BB9 X SMA200 points="+tostring(close - strategy.position_avg_price, "####.##"), when=abs(strategy.position_size)>=1 and crossunder(basis, sma200) ) //close<ema55 and rsi5Val<20 //ema34<ema55 //close<ema89