概述

本策略综合运用多种指标识别趋势方向,采用趋势追踪方式,在中短线上捕捉趋势机会。策略专门为追踪趋势而设计,旨在增加胜率,降低回撤。

策略原理

使用WVAP指标判断价格比例;

RSI指标判断多空动量;

QQE指标识别价格突破;

ADX指标判断趋势力度;

Coral Trend Indicator判断基本面走势;

LSMA指标辅助判断趋势;

结合多种指标信号发出交易信号。

该策略主要依靠RSI,QQE,ADX等多个指标判断趋势方向和力度,并以Coral Trend Indicator的曲线作为基本面趋势判断标准。当RSI等指标发出买入信号时,若Coral Trend Indicator也显示上升曲线,则高概率符合趋势向上,则策略会选择买入。WVAP等指标主要用来判断价位是否合理,避免买入高点。

策略优势

多指标组合,提高判断准确性;

强调趋势追踪,增加盈利概率;

采用突破思路,筛选 Trading Range 市场;

结合基本面指标,避免逆势交易;

交易时间和手数设置合理,降低风险;

策略思路清晰,容易理解与优化。

该策略最大优势是多指标组合判断,能在一定程度上减少单一指标误判的概率,提高判断准确性。同时强调趋势追踪与突破思路,对于筛选靠谱中短线机会具有帮助。此外,策略加入基本面指标,能避免逆势操作。这些设计都提高了策略的稳定性和盈利概率。

策略风险

多空判断存在时滞,可能错过最佳入场时机;

回撤控制并不完善,存在较大回撤风险;

当基本面发生转折时,策略可能错过信号;

未考虑交易成本,实际应用时收益存在下滑风险。

该策略最大的风险在于多指标组合判断可能存在时滞,导致错过最佳入场时机,从而影响获利空间。此外,策略的回撤控制并不理想,存在较大回撤风险。当市场基本面发生转折而指标还未反映时,也容易形成损失。实际应用时,交易成本也会对收益造成一定影响。

策略优化方向

加入止损策略,优化回撤控制;

优化参数设置,缩短指标延迟;

增加基本面指标应用,提高准确性;

结合机器学习算法,实现动态参数优化。

该策略的优化重点应考虑回撤控制,可以加入移动止损策略来锁定利润,降低回撤。同时可以优化参数设定,缩短指标延迟,增强策略对市场变化的敏感性。此外,可以进一步增加基本面判断指标,提高准确性。如果能运用机器学习方法实现参数动态优化,也将大幅提升策略稳定性。

总结

本策略综合多种指标判断趋势方向,采用趋势追踪思路设计,旨在提高判断准确性,增加盈利概率。策略具有指标组合判断、强调趋势追踪、结合基本面等优势,但也存在误判时滞、回撤控制不足等问题。未来可通过优化参数设定、完善止损策略、增加基本面指标等方式进行改进,使策略在实际应用中达到更好效果。

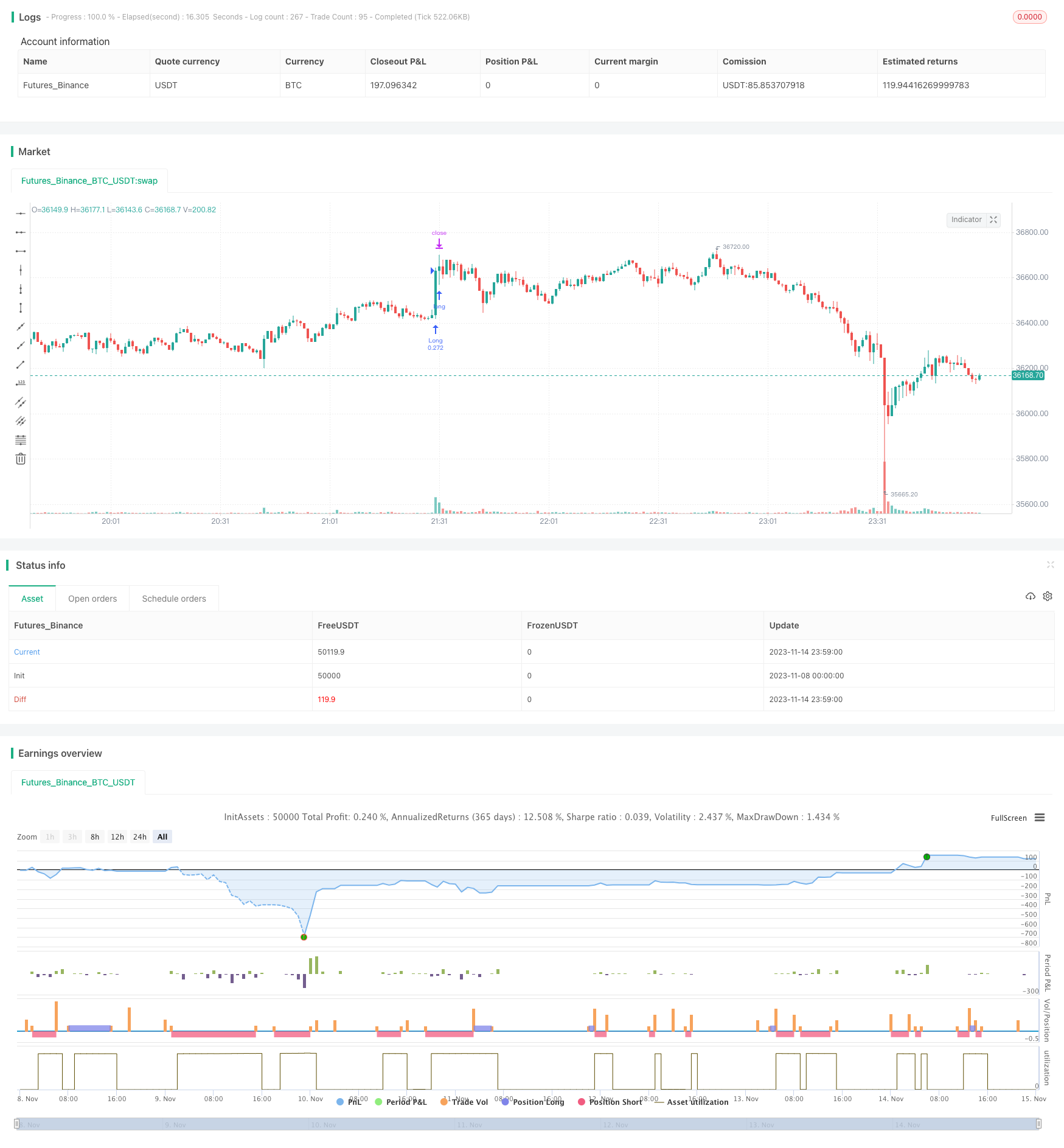

/*backtest

start: 2023-11-08 00:00:00

end: 2023-11-15 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © RolandoSantos

//@version=4

strategy(title = "VWAP Candles Strategy", overlay=true, shorttitle = "VWAP Cndl", default_qty_type=strategy.cash, default_qty_value=10000, initial_capital=10000)

//Make inputs that set the take profit %

longProfitPerc = input(title="Take Long Profit % ", minval=0.0, step=0.1, defval=0.3) / 100

shortProfitPerc = input(title="Take Short Profit % ", minval=0.0, step=0.1, defval=0.95) / 100

tp = input(100, "Take Profit % QTY (How much profit you want to take after take profit target is triggered)")

// Figure out take profit price

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortExitPrice = strategy.position_avg_price * (1 - shortProfitPerc)

//Use NYSE for Copp Curve entries and exits//

security = input("", title="Change this if you want to see Copp Curve calculated for current ticker. All Copp Curve calculations are base on NYSE Composite")

ticker = security(security,"", close)

///Copp Curve////

period_ = input(21, title="Length", minval=1)

isCentered = input(false, title="Centered")

barsback = period_/2 + 1

ma = sma(close, period_)

dpo = isCentered ? close[barsback] - ma : close - ma[barsback]

instructions =input(title="Standard Copp settings are (10, 14, 11) however, DOUBLE these lengths as alternate settings to (20,28,22) and you will find it may produce better results, but less trades", defval="-")

wmaLength = input(title="WMA Length (Experiment changing this to longer lengths for less trades, but higher win %)", type=input.integer, defval=20)

longRoCLength = input(title="Long RoC Length", type=input.integer, defval=28)

shortRoCLength = input(title="Short RoC Length", type=input.integer, defval=22)

source = ticker

curve = wma(roc(source, longRoCLength) + roc(source, shortRoCLength), wmaLength)

//////////// QQE////////////QQE///////////////////QQE////////////////////////

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//@version=4

src=input(close)

length = input(25,"RSI Length", minval=1)

SSF=input(9, "SF RSI SMoothing Factor", minval=1)

showsignals = input(title="Show Crossing Signals?", type=input.bool, defval=true)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

RSII=ema(rsi(src,length),SSF)

TR=abs(RSII-RSII[1])

wwalpha = 1/ length

WWMA = 0.0

WWMA := wwalpha*TR + (1-wwalpha)*nz(WWMA[1])

ATRRSI=0.0

ATRRSI := wwalpha*WWMA + (1-wwalpha)*nz(ATRRSI[1])

QQEF=ema(rsi(src,length),SSF)

QUP=QQEF+ATRRSI*4.236

QDN=QQEF-ATRRSI*4.236

QQES=0.0

QQES:=QUP<nz(QQES[1]) ? QUP : QQEF>nz(QQES[1]) and QQEF[1]<nz(QQES[1]) ? QDN : QDN>nz(QQES[1]) ? QDN : QQEF<nz(QQES[1]) and QQEF[1]>nz(QQES[1]) ? QUP : nz(QQES[1])

//QQF=plot(QQEF,"FAST",color.maroon,2)

//QQS=plot(QQES,"SLOW",color=color.blue, linewidth=1)

buySignalr = crossover(QQEF, QQES)

sellSignalr = crossunder(QQEF, QQES)

buyr = QQEF > QQES

////QQE////////////////QQE/////////////////QQE/////////////////

//////////////LSMA//////////////////////////

// LSMA 1 Settings & Plot

lsma1Length = input(100, minval=1, title="LSMA 1")

lsma1Offset = input(title="LSMA 1 Offset", type=input.integer, defval=0)

lsma1Source = input(close, title="LSMA 1 Source")

lsma1 = linreg(lsma1Source, lsma1Length, lsma1Offset)

lsma1_std_dev = stdev(abs(lsma1[1] - lsma1), lsma1Length)

//plot(lsma1, color=(lsma1 > lsma1[1] ? color.yellow : color.blue), title="LSMA 1", linewidth=2, transp=0)

////////////LSMA///////////////////

//////////////////ADX////////////////////

len = input(14)

th = input(20)

TrueRange = max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

DirectionalMovementPlus = high-nz(high[1]) > nz(low[1])-low ? max(high-nz(high[1]), 0): 0

DirectionalMovementMinus = nz(low[1])-low > high-nz(high[1]) ? max(nz(low[1])-low, 0): 0

SmoothedTrueRange = 0.0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1])/len) + TrueRange

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1])/len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = 0.0

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1])/len) + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIPlus-DIMinus) / (DIPlus+DIMinus)*100

ADX = sma(DX, len)

///////////////////ADX/////////////////////

/////////////sqz momentum/////////////////////////

//

// @author LazyBear & ChrisMoody complied by GIS_ABC

//

lengthBB = input(20, title="BB Length")

mult = input(2.0,title="BB MultFactor")

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = input(true, title="Use TrueRange (KC)")

// Calculate BB

sourceBB = close

basis = sma(sourceBB, lengthBB)

dev = multKC * stdev(source, lengthBB)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

maKC = sma(sourceBB, lengthKC)

rangeKC = useTrueRange ? tr : (high - low)

rangema = sma(rangeKC, lengthKC)

upperKC = maKC + rangema * multKC

lowerKC = maKC - rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

val = linreg(source - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)),sma(close,lengthKC)),lengthKC,0)

////////////////////////////

/////// RSI on EMA/////////////////

lenrsi = input(13, minval=1, title="Length")

srcrsi = linreg(hlc3,100,0)

up = rma(max(change(srcrsi), 0), lenrsi)

down = rma(-min(change(srcrsi), 0), lenrsi)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsicolor = rsi > rsi[1] ? color.green : color.red

//plot(rsi,color = rsicolor)

//hline(20,color=color.green)

//hline(80,color=color.red)

vwaprsi = rsi(vwap(hlc3),13)

vwaprsicolor = vwaprsi > vwaprsi[1] ? color.blue : color.yellow

emarsi = ema(rsi,13)

emarsicolor = emarsi > emarsi[1] ? color.green : color.red

//plot(emarsi,color=emarsicolor)

//plot(vwaprsi,color=vwaprsicolor)

/////// RSI on VWMA/////////////////

lenrsiv = input(23, minval=1, title="Length RSI VWMA")

srcrsiv = vwma(linreg(close,23,0),23)

upv = rma(max(change(srcrsiv), 0), lenrsiv)

downv = rma(-min(change(srcrsiv), 0), lenrsiv)

rsiv = downv == 0 ? 100 : upv == 0 ? 0 : 100 - (100 / (1 + upv / downv))

rsicolorv = rsiv > rsiv[1] ? color.green : color.red

/////////////////////////////////////

/////////////////////////////////////

////////////////coral trend////////////////////

//

// @author LazyBear

// List of all my indicators:

// https://docs.google.com/document/d/15AGCufJZ8CIUvwFJ9W-IKns88gkWOKBCvByMEvm5MLo/edit?usp=sharing

//

//study(title="Coral Trend Indicator [LazyBear]", shorttitle="CTI_LB", overlay=true)

srcCT=close

i1 = 1.0

i2 = 1.0

i3 = 1.0

i4 = 1.0

i5 = 1.0

i6 = 1.0

sm =input(21, title="Smoothing Period")

cd = input(0.4, title="Constant D")

ebc=input(false, title="Color Bars")

ribm=input(false, title="Ribbon Mode")

di = (sm - 1.0) / 2.0 + 1.0

c1 = 2 / (di + 1.0)

c2 = 1 - c1

c3 = 3.0 * (cd * cd + cd * cd * cd)

c4 = -3.0 * (2.0 * cd * cd + cd + cd * cd * cd)

c5 = 3.0 * cd + 1.0 + cd * cd * cd + 3.0 * cd * cd

i1 := c1*srcCT + c2*nz(i1[1])

i2 := c1*i1 + c2*nz(i2[1])

i3 := c1*i2 + c2*nz(i3[1])

i4 := c1*i3 + c2*nz(i4[1])

i5 := c1*i4 + c2*nz(i5[1])

i6 := c1*i5 + c2*nz(i6[1])

bfr = -cd*cd*cd*i6 + c3*(i5) + c4*(i4) + c5*(i3)

// --------------------------------------------------------------------------

// For the Pinescript coders: Determining trend based on the mintick step.

// --------------------------------------------------------------------------

//bfrC = bfr - nz(bfr[1]) > syminfo.mintick ? green : bfr - nz(bfr[1]) < syminfo.mintick ? red : blue

//bfrC = bfr > nz(bfr[1]) ? green : bfr < nz(bfr[1]) ? red : blue

//tc=ebc?gray:bfrC

//plot(ribm?na:bfr, title="Trend", linewidth=3)

//bgcolor(ribm?bfrC:na, transp=50)

//barcolor(ebc?bfrC:na)

////////////////////////////////////////////////////////////////

///////////////////VWAP///////////////////

//------------------------------------------------

//------------------------------------------------

NormalVwap=vwap(hlc3)

H = vwap(high)

L = vwap(low)

O = vwap(open)

C = vwap(close)

left = 30

left_low = lowest(left)

left_high = highest(left)

newlow = low <= left_low

newhigh = high >= left_high

q = barssince(newlow)

w = barssince(newhigh)

col2 = q < w ? #8B3A3A : #9CBA7F

col2b=O > C?color.red:color.lime

AVGHL=avg(H,L)

AVGOC=avg(O,C)

col=AVGHL>AVGOC?color.lime:color.red

col3=open > AVGOC?color.lime:color.red

//plotcandle(O,H,L,C,color=col2b)

//plot(H, title="VWAP", color=red)

//plot(L, title="VWAP", color=lime)

//plot(O, title="VWAP", color=blue)

//plot(C, title="VWAP", color=black)

//plot(NormalVwap, color=col2b)

/////////////////////////////////////////////////////////////////////////////

///Trade Conditions///

t = time(timeframe.period, "0930-1500")

long = vwaprsi > vwaprsi[1] and rsi>rsi[1] and vwaprsi < 20 //vwaprsi > 98 and rsi > 50 and rsi[1] < rsi and rsi[1] < rsi[2] //crossover(rsi,20)//O<C and O > linreg(hlc3,100,0) and linreg(hlc3,100,0) > linreg(hlc3,100,0)[1] and AVGHL>AVGOC and t //O < C and close > vwap(hlc3) and ADX > ADX[1] //and val > nz(val[1]) and close > vwap(hlc3) and open > sma(close,23) and close > vwap(hlc3) and t //and rsi > rsi[1] and open > ema(close,13) and open > bfr and bfr > bfr[1]

close_long = crossover(vwaprsi,99.8) //C < O // linreg(hlc3,100,0) and linreg(hlc3,100,0) < linreg(hlc3,100,0)[1] //O > C and val < nz(val[1]) // and close < vwap(hlc3)

close_short = rsiv > rsiv[1] and rsiv[2] > rsiv[1]//vwaprsi > vwaprsi[1] or rsi > rsi[1] // vwaprsi > 99 and rsi > 99 and rsi > rsi[1] and vwaprsi > vwaprsi[1]//vwaprsi > vwaprsi[1] and rsi>rsi[1] and vwaprsi < 20 //vwaprsi > 98 and rsi > 50 and rsi[1] < rsi and rsi[1] < rsi[2] //crossover(rsi,20)//O<C and O > linreg(hlc3,100,0) and linreg(hlc3,100,0) > linreg(hlc3,100,0)[1] and AVGHL>AVGOC and t //O < C and close > vwap(hlc3) and ADX > ADX[1] //and val > nz(val[1]) and close > vwap(hlc3) and open > sma(close,23) and close > vwap(hlc3) and t //and rsi > rsi[1] and open > ema(close,13) and open > bfr and bfr > bfr[1]

short = rsiv > 95 and rsiv < rsiv[1] and rsiv[2] < rsiv[1] //vwaprsi < 1 and rsi < 1 and rsi < rsi[1] and vwaprsi < vwaprsi[1] and t //crossover(vwaprsi,99.8) //C < O // linreg(hlc3,100,0) and linreg(hlc3,100,0) < linreg(hlc3,100,0)[1] //O > C and val < nz(val[1]) // and close < vwap(hlc3)

//long = vwaprsi > vwaprsi[1] and emarsi > emarsi[1] and emarsi[2] > emarsi[1] and ADX > 25//O<C and O > linreg(hlc3,100,0) and linreg(hlc3,100,0) > linreg(hlc3,100,0)[1] and AVGHL>AVGOC and t //O < C and close > vwap(hlc3) and ADX > ADX[1] //and val > nz(val[1]) and close > vwap(hlc3) and open > sma(close,23) and close > vwap(hlc3) and t //and rsi > rsi[1] and open > ema(close,13) and open > bfr and bfr > bfr[1]

//close_long = vwaprsi < vwaprsi[1] or emarsi < emarsi[1]//C < O // linreg(hlc3,100,0) and linreg(hlc3,100,0) < linreg(hlc3,100,0)[1] //O > C and val < nz(val[1]) // and close < vwap(hlc3)

//close_long = O>C or lsma1 < H // or O > linreg(hlc3,100,0) //and linreg(hlc3,100,0) > linreg(hlc3,100,0)[1] and AVGHL>AVGOC and t //O < C and close > vwap(hlc3) and ADX > ADX[1] //and val > nz(val[1]) and close > vwap(hlc3) and open > sma(close,23) and close > vwap(hlc3) and t //and rsi > rsi[1] and open > ema(close,13) and open > bfr and bfr > bfr[1]

//long = rsi > rsi[1] and rsi[1] >rsi[2] and lsma1 > lsma1[1] and bfr > bfr[1] and O<C and lsma1 > L and close > close[1] and ADX > ADX[1] and ADX[1] > ADX[2] and ADX > 20 and rsi > rsi[1] and t // linreg(hlc3,100,0) and linreg(hlc3,100,0) < linreg(hlc3,100,0)[1] //O > C and val < nz(val[1]) // and close < vwap(hlc3)

//close_short = O<C or lsma1 > H // or O > linreg(hlc3,100,0) //and linreg(hlc3,100,0) > linreg(hlc3,100,0)[1] and AVGHL>AVGOC and t //O < C and close > vwap(hlc3) and ADX > ADX[1] //and val > nz(val[1]) and close > vwap(hlc3) and open > sma(close,23) and close > vwap(hlc3) and t //and rsi > rsi[1] and open > ema(close,13) and open > bfr and bfr > bfr[1]

//short = rsi < rsi[1] and rsi[1] <rsi[2] and lsma1 < lsma1[1] and bfr < bfr[1] and O>C and lsma1 < L and close < close[1] and ADX > ADX[1] and ADX[1] > ADX[2] and ADX > 20 and rsi < rsi[1] and t // linreg(hlc3,100,0) and linreg(hlc3,100,0) < linreg(hlc3,100,0)[1] //O > C and val < nz(val[1]) // and close < vwap(hlc3)

/// Start date

startDate = input(title="Start Date", defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", defval=2021, minval=1800, maxval=2100)

// See if this bar's time happened on/after start date

afterStartDate = true

///Entries and Exits//

if (long and afterStartDate)

strategy.entry("Long", strategy.long, comment = "Open Long")

// strategy.close("Short", strategy.short,qty_percent=100, comment = "close Short")

if (short and afterStartDate)

strategy.entry("Short", strategy.short, comment = "Open Short")

if (close_long and afterStartDate )

strategy.close("Long", strategy.long, qty_percent=100, comment="close Long")

// strategy.entry("Short", strategy.short, comment="Open Short")

if (close_short and afterStartDate )

strategy.close("Short", strategy.short, qty_percent=100, comment="close Long")

if ( hour(time) == 15 and minute(time) > 15 )

strategy.close_all()

//Submit exit orders based on take profit price

if (strategy.position_size > 0 and afterStartDate)

strategy.exit(id="Long", qty_percent=tp, limit=longExitPrice)

if (strategy.position_size < 0 and afterStartDate)

strategy.exit(id="Short", qty_percent=tp, limit=shortExitPrice)