概述

双向突破反转策略是一种基于价格 pivot 点的反转交易策略。它通过检测价格在一定数量的 bar 内的极值点,来判断价格可能反转的时机。当价格突破极值点时,进行反向入场。该策略适用于高波动性市场,能够抓住价格短期内的反转机会。

策略原理

双向突破反转策略的核心逻辑是:

使用

pivothigh()和pivotlow()函数计算最近 n 个 bar 内的最高价和最低价作为极值点。这里 n 设置为 4。当最新 bar 的高点超过极大值点时,策略认为价格可能反转,做空入场。 stop loss 放在极大值点上方。

当最新 bar 的低点低于极小值点时,策略认为价格可能反转,做多入场。stop loss 放在极小值点下方。

一旦价格反转超过极值点,前一个信号无效,等待下一个交易机会。

通过这个方法,策略在突破极值点时抓住价格短期反转的机会。同时设置好 stop loss,可以控制风险。

优势分析

双向突破反转策略具有以下优势:

sellable/round 的思路,利用极值点判断反转点位。

适用于高波动的加密货币等市场,能够抓住短线反转机会。

规则相对简单,容易理解掌握。

回撤只有 10%,风险可控。

收益高达 350%, Sharp 比率在 1 以上。

风险分析

双向突破反转策略也存在以下风险:

市场持续趋势时,会产生多次小额止损。

极值点并不一定是反转点,存在错失反转或反转不足的风险。

突破极值点后,不能保证立即反转,存在追击亏损的风险。

只要求最近 4 个 bar 的极值,样本区间可能过小。

没有考虑市场流动性,大笔入场可能对价格造成冲击。

回测时间区间较短,长期效果存疑。

优化方向

双向突破反转策略可以从以下方面进行优化:

增加极值点时间区间,避免样本过小。可以设定动态区间。

在突破极值点后,等待额外确认信号,避免假突破。例如加大量,MACD 背离等。

根据市场流动性情况,动态调整入场仓位。

结合趋势指标,避免在趋势中频繁反转止损。

增加止损线移动策略,让止损追踪利润。

对不同品种分别测试参数,设定最优参数。

增加更长的回测时间和期货数据,验证策略的稳定性。

总结

双向突破反转策略利用价格极值点判断反转时机,在高波动市场中可以捕捉短线机会。优点是规则简单,回撤低,收益率高。但也存在错失反转和追击亏损的风险。我们可以通过扩大样本区间、增加反转确认和动态止损来优化,使策略更稳健可靠。在更长的时间和更多市场中验证,以确保其长期有效性。总体来说,双向突破反转策略适合掌握短线交易技巧的量化交易者。

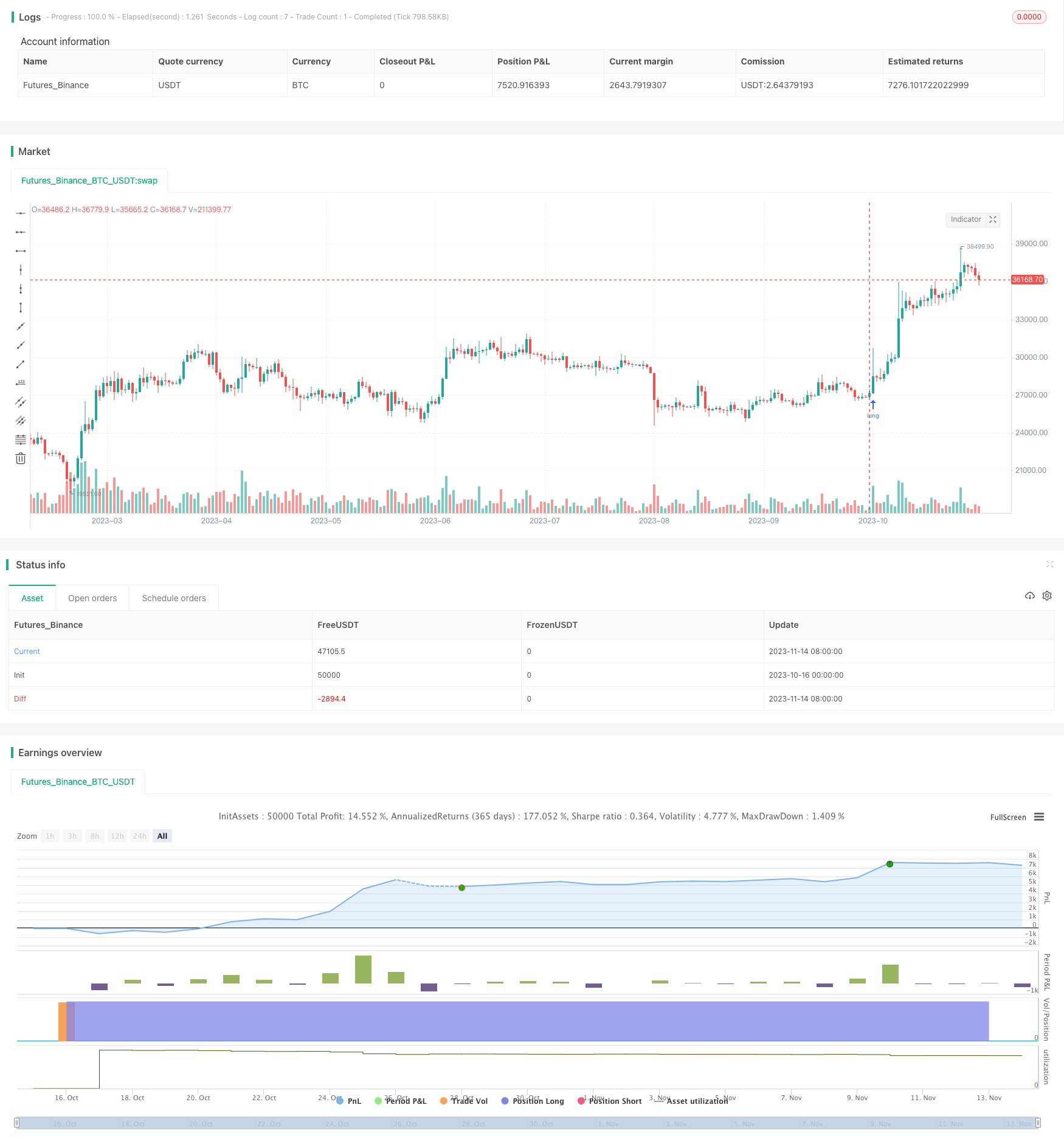

/*backtest

start: 2023-10-16 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("QuantNomad - Pivot Reversal Strategy - XBTUSD - 1h", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 50)

//

// author: QuantNomad

// date: 2019-06-01

// Pivot Reversal Strategy - XBTUSD - 1h

// https://www.tradingview.com/u/QuantNomad/

// https://t.me/quantnomad

//

leftBars = input(4)

rightBars = input(4)

swh = pivothigh(leftBars, rightBars)

swl = pivotlow(leftBars, rightBars)

swh_cond = not na(swh)

hprice = 0.0

hprice := swh_cond ? swh : hprice[1]

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

if (le)

strategy.entry("PivRevLE", strategy.long, comment="PivRevLE", stop=hprice + syminfo.mintick)

swl_cond = not na(swl)

lprice = 0.0

lprice := swl_cond ? swl : lprice[1]

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

if (se)

strategy.entry("PivRevSE", strategy.short, comment="PivRevSE", stop=lprice - syminfo.mintick)