这里是我尝试根据您的要求写的文章:

这里是我尝试根据您的要求写的文章:

概述

本策略综合应用了123形态反转策略和熊力指标策略,当二者同向做多或做空信号出现时,产生交易信号,属于突破反转型交易策略。

策略原理

该策略由两部分组成:

123形态反转策略

当收盘价连续2日下跌后第3日收盘价突破向上,并且低位stoch指标从低位反弹时产生买入信号;当收盘价连续2日上涨后第3日收盘价突破向下,并且高位stoch指标从高位回落时产生卖出信号。

熊力指标策略

熊力指标反映多空力量对比,当指标大于设定的卖出界线时产生卖出信号,当指标小于设定的买入界线时产生买入信号。

综合信号时,若二者给出同向信号,产生实际交易信号。

策略优势

结合反转信号和指标过滤,避免假突破,提高信号质量。

多种时间周期适用,灵活应对不同市场环境。

可单独使用组成部分策略,也可组合使用,策略模块化设计。

策略风险

反转信号可能出现回调深度较大情况。

熊力指标参数设置需要反复测试优化。

多因子综合策略参数调优复杂,需要大量历史数据测试。

策略优化

join量化模块连接更多数据源,获取更长时间段更丰富数据。

应用机器学习方法自动搜索和评估参数组合。

增加止损机制以控制单笔损失。

总结

本策略综合运用反转技术分析和量化指标,通过双重确认提高信号质量,模块化程度高,可扩展性强,属于实用型策略。后续可通过引入更多先进技术手段进行优化,从而适应更加复杂的市场环境。

策略源码

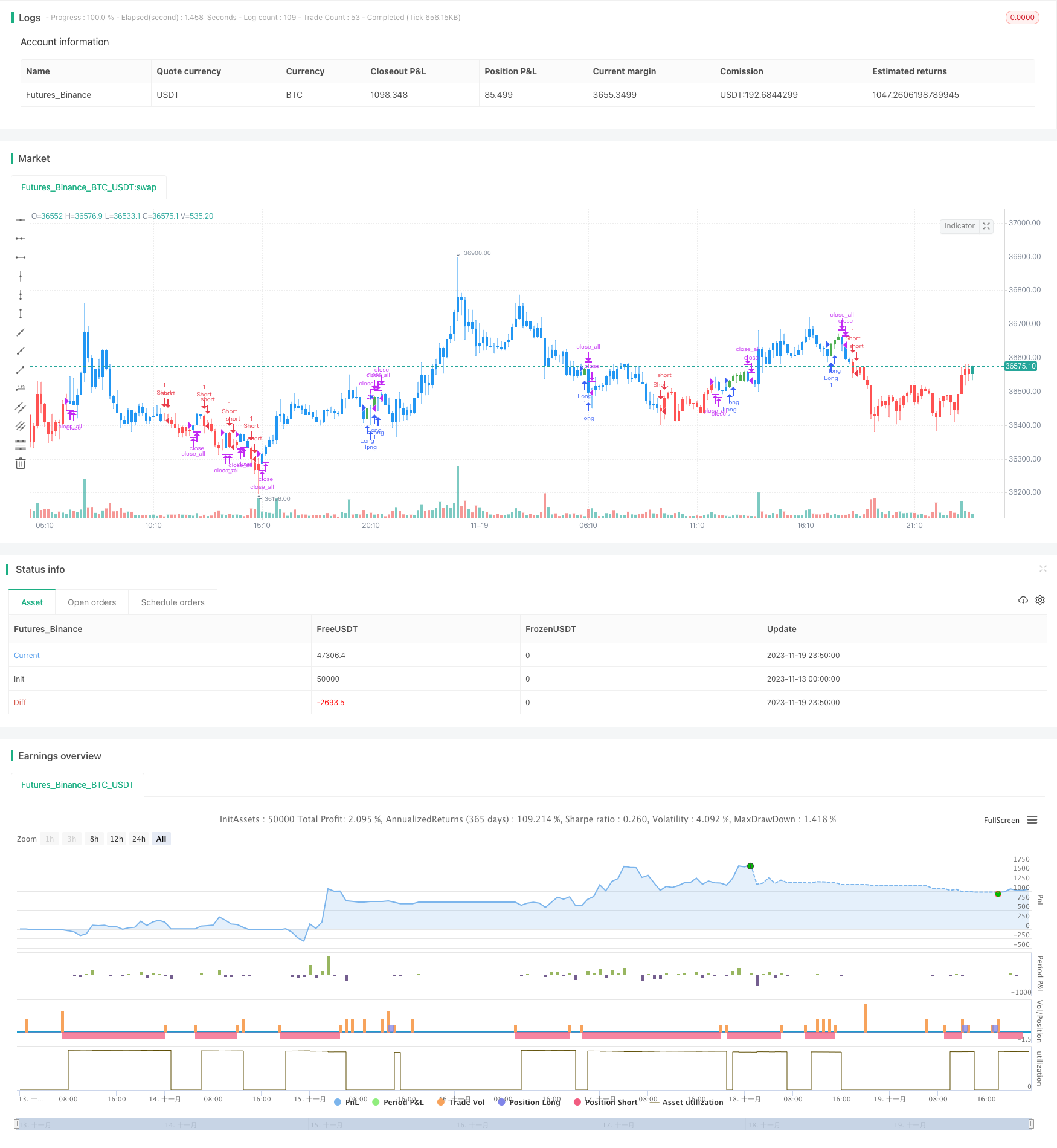

/*backtest

start: 2023-11-13 00:00:00

end: 2023-11-20 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 29/05/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Bear Power Indicator

// To get more information please see "Bull And Bear Balance Indicator"

// by Vadim Gimelfarb.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

BearPower(SellLevel, BuyLevel) =>

value = iff (close < open ,

iff (close[1] > open , max(close - open, high - low), high - low),

iff (close > open,

iff(close[1] > open, max(close[1] - low, high - close), max(open - low, high - close)),

iff(high - close > close - low,

iff (close[1] > open, max(close[1] - open, high - low), high - low),

iff (high - close < close - low,

iff(close > open, max(close - low, high - close),open - low),

iff (close > open, max(close[1] - open, high - close),

iff(close[1] < open, max(open - low, high - close), high - low))))))

pos = 0.0

pos := iff(value > SellLevel, -1,

iff(value <= BuyLevel, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Bear Power", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

SellLevel = input(30)

BuyLevel = input(3)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posBearPower = BearPower(SellLevel, BuyLevel)

pos = iff(posReversal123 == 1 and posBearPower == 1 , 1,

iff(posReversal123 == -1 and posBearPower == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )