概述

本策略结合了移动平均线指标、布林带指标和成交量加权平均价指标,在金叉形成、短均线上穿长均线的条件下判断进入。策略还利用布林带通道,仅在价格触及布林带下轨时才考虑入场,从而避免在行情震荡中频繁进出。

策略原理

该策略主要通过均线指标判断趋势方向,利用布林带来定位波动区间选择买点。具体来说,策略包含以下几个关键规则:

使用50日EMA和200日EMA构建金叉判断系统,当快速移动平均线上穿慢速移动平均线时认为处于多头上升趋势;

价格大于VWAP时,认为处于价格上升阶段,有利于建仓做多;

价格刚刚触及或突破布林带下轨时,表明股价可能处于反弹点附近,机会较好;

进入多头持仓后,价格超过布林带上轨时及时止盈退出。

通过这几个规则的组合,使得本策略在牛市行情中,能够选择合适的买点买入,并设置止损止盈确保收益。

策略优势

利用金叉判断系统确定大趋势方向,避免在震荡行情中小胜小负;

VWAP指标可判断价格波动方向,使买点选择更精准;

布林带指标判断买点使策略更有韧性,同时设置止损止盈以锁定收益;

多种指标相互验证,使策略判断更加准确可靠。

策略风险及解决方法

金叉判断系统可能发出假信号,应适当缩短均线周期长度,并配合其他指标验证;

布林带参数设置不当也会使策略失去效用,应调节布林带周期及标准差参数;

停损点设置过于宽松,无法有效控制亏损。应适当收紧止损范围,确保风险可控。

策略优化方向

优化金叉均线组合,测试不同均线参数,找到最佳参数;

测试不同周期布林带参数,找到幅度及离散性最好的参数组合;

测试并优化止损范围,使之既能有效控制风险,又不至于过于容易被触发。

总结

本策略综合运用均线系统、布林带以及VWAP指标判断入场时机,在兼顾发现机会与控制风险上做出了平衡。通过后续参数优化及规则修正,有望锁定行业及市场中的持续良机。

策略源码

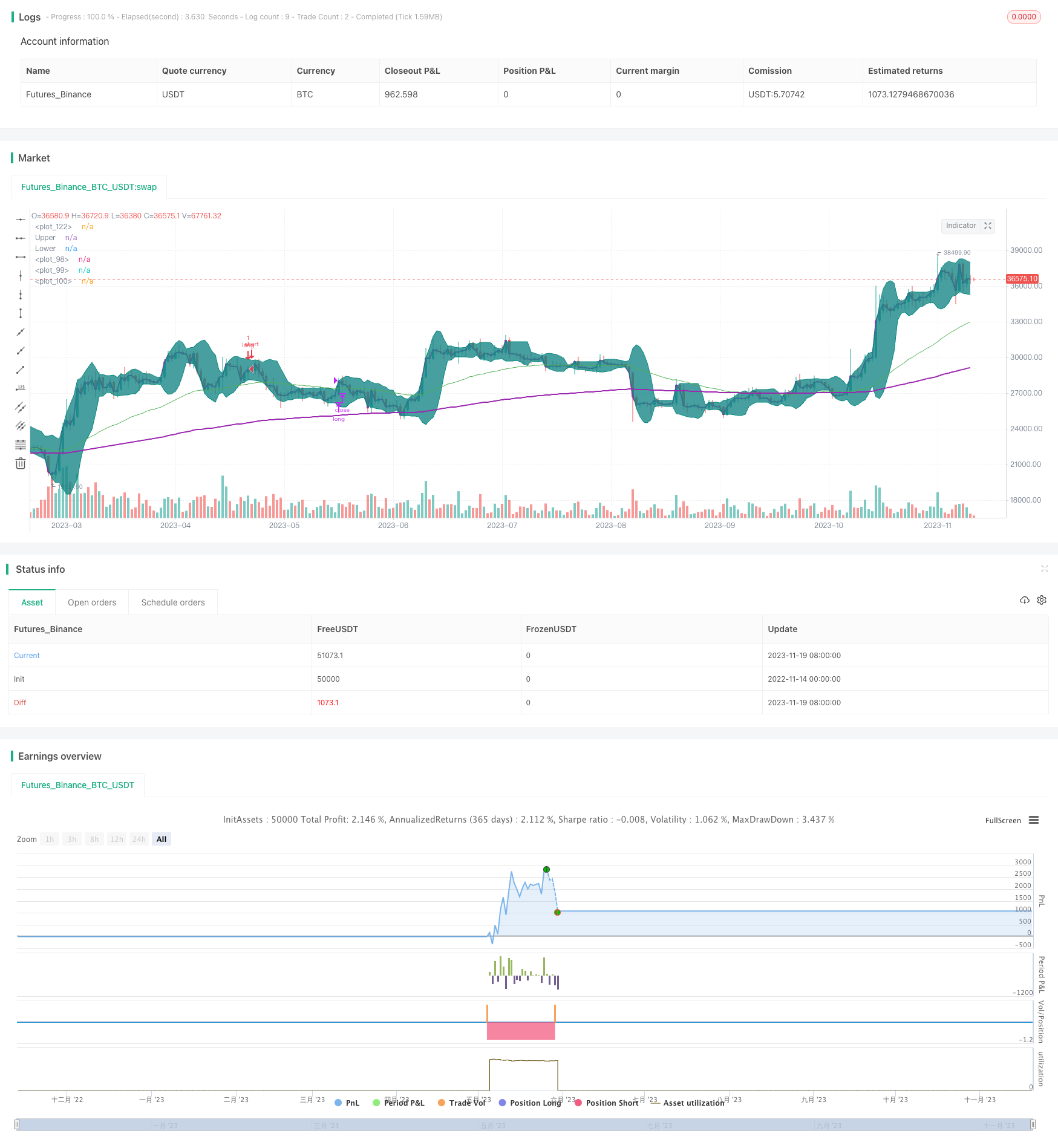

/*backtest

start: 2022-11-14 00:00:00

end: 2023-11-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

strategy(title="VWAP and BB strategy [$$]", overlay=true,pyramiding=2, default_qty_value=1, default_qty_type=strategy.fixed, initial_capital=10000, currency=currency.USD)

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 6, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2020, title = "From Year", minval = 1970)

// To Date Inputs

toDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 8, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2020, title = "To Year", minval = 1970)

// Calculate start/end date and time condition

DST = 1 //day light saving for usa

//--- Europe

London = iff(DST==0,"0000-0900","0100-1000")

//--- America

NewYork = iff(DST==0,"0400-1300","0500-1400")

//--- Pacific

Sydney = iff(DST==0,"1300-2200","1400-2300")

//--- Asia

Tokyo = iff(DST==0,"1500-2400","1600-0100")

//-- Time In Range

timeinrange(res, sess) => time(res, sess) != 0

london = timeinrange(timeframe.period, London)

newyork = timeinrange(timeframe.period, NewYork)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = time >= startDate and time <= finishDate

is_price_dipped_bb(pds,source1) =>

t_bbDipped=false

for i=1 to pds

t_bbDipped:= (t_bbDipped or close[i]<source1) ? true : false

if t_bbDipped==true

break

else

continue

t_bbDipped

is_bb_per_dipped(pds,bbrSrc) =>

t_bbDipped=false

for i=1 to pds

t_bbDipped:= (t_bbDipped or bbrSrc[i]<=0) ? true : false

if t_bbDipped==true

break

else

continue

t_bbDipped

// variables BEGIN

shortEMA = input(50, title="fast EMA", minval=1)

longEMA = input(200, title="slow EMA", minval=1)

//BB

smaLength = input(7, title="BB SMA Length", minval=1)

bbsrc = input(close, title="BB Source")

strategyCalcOption = input(title="strategy to use", type=input.string, options=["BB", "BB_percentageB"], defval="BB")

//addOnDivergence = input(true,title="Add to existing on Divergence")

//exitOption = input(title="exit on RSI or BB", type=input.string, options=["RSI", "BB"], defval="BB")

//bbSource = input(title="BB source", type=input.string, options=["close", "vwap"], defval="close")

//vwap_res = input(title="VWAP Resolution", type=input.resolution, defval="session")

stopLoss = input(title="Stop Loss%", defval=1, minval=1)

//variables END

longEMAval= ema(close, longEMA)

shortEMAval= ema(close, shortEMA)

ema200val = ema(close, 200)

vwapVal=vwap(close)

// Drawings

//plot emas

plot(shortEMAval, color = color.green, linewidth = 1, transp=0)

plot(longEMAval, color = color.orange, linewidth = 1, transp=0)

plot(ema200val, color = color.purple, linewidth = 2, style=plot.style_line ,transp=0)

//bollinger calculation

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(bbsrc, smaLength)

dev = mult * stdev(bbsrc, smaLength)

upperBand = basis + dev

lowerBand = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

bbr = (bbsrc - lowerBand)/(upperBand - lowerBand)

//bollinger calculation

//plot bb

//plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upperBand, "Upper", color=color.teal, offset = offset)

p2 = plot(lowerBand, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

plot(vwapVal, color = color.purple, linewidth = 2, transp=0)

// Colour background

//barcolor(shortEMAval>longEMAval and close<=lowerBand ? color.yellow: na)

//longCondition= shortEMAval > longEMAval and close>open and close>vwapVal

longCondition= ( shortEMAval > longEMAval and close>open and close>vwapVal and close<upperBand ) //and time_cond // and close>=vwapVal

//Entry

strategy.entry(id="long", comment="VB LE" , long=true, when= longCondition and ( strategyCalcOption=="BB"? is_price_dipped_bb(10,lowerBand) : is_bb_per_dipped(10,bbr) ) and strategy.position_size<1 ) //is_price_dipped_bb(10,lowerBand)) //and strategy.position_size<1 is_bb_per_dipped(15,bbr)

//add to the existing position

strategy.entry(id="long", comment="Add" , long=true, when=strategy.position_size>=1 and close<strategy.position_avg_price and close>vwapVal) //and time_cond)

barcolor(strategy.position_size>=1 ? color.blue: na)

strategy.close(id="long", comment="TP Exit", when=crossover(close,upperBand) )

//stoploss

stopLossVal = strategy.position_avg_price * (1-(stopLoss*0.01) )

//strategy.close(id="long", comment="SL Exit", when= close < stopLossVal)

//strategy.risk.max_intraday_loss(stopLoss, strategy.percent_of_equity)