概述

本策略通过结合双均线交叉和RSI指标来识别趋势方向和超买超卖情况,在符合买入条件时做多,在符合卖出条件时平仓。该策略旨在利用均线交叉来确定趋势方向,同时利用RSI指标来避免在市场顶部做多和市场底部做空,从而获得更好的收益。

策略原理

当快速9周期均线上穿慢速50周期均线时,表示短期趋势上升叠加长期趋势上升,属于典型的多头信号。同时,如果RSI指标大于上一周期5个点且小于70时,则表明处于超买前的区域,这时做多则是比较合适的时机。

当快速9周期均线下穿慢速50周期均线时,表示处于空头市场,需要平仓。

优势分析

- 利用双均线交叉判断大趋势,避免被假突破误导

- RSI指标避免市场转折点做出错误决策

- 可以灵活调整均线周期,适应不同品种和时间维度

- 可控的止损策略

风险分析

- 均线交叉做出决策有时效性不高,可能出现亏损

- RSI参数设置不当可能导致错过最佳入场时机

- 需要关注交易量能否支撑价格行情

- 突发事件带来的非理性行情需要手工干预

优化方向

- 优化RSI的参数以取得最佳结果

- 结合交易量指标避免虚假信号

- 根据不同品种和时间维度测试最佳均线参数

- 适当放宽止损幅度,避免被套

总结

本策略通过双均线交叉判断方向和RSI避免追高追低,能够有效利用中长线趋势获得稳定收益。但也需要警惕均线交叉信号的滞后性和RSI参数的调整,同时关注价格与成交量的关系。通过持续测试和优化,本策略有望取得更好的效果。

策略源码

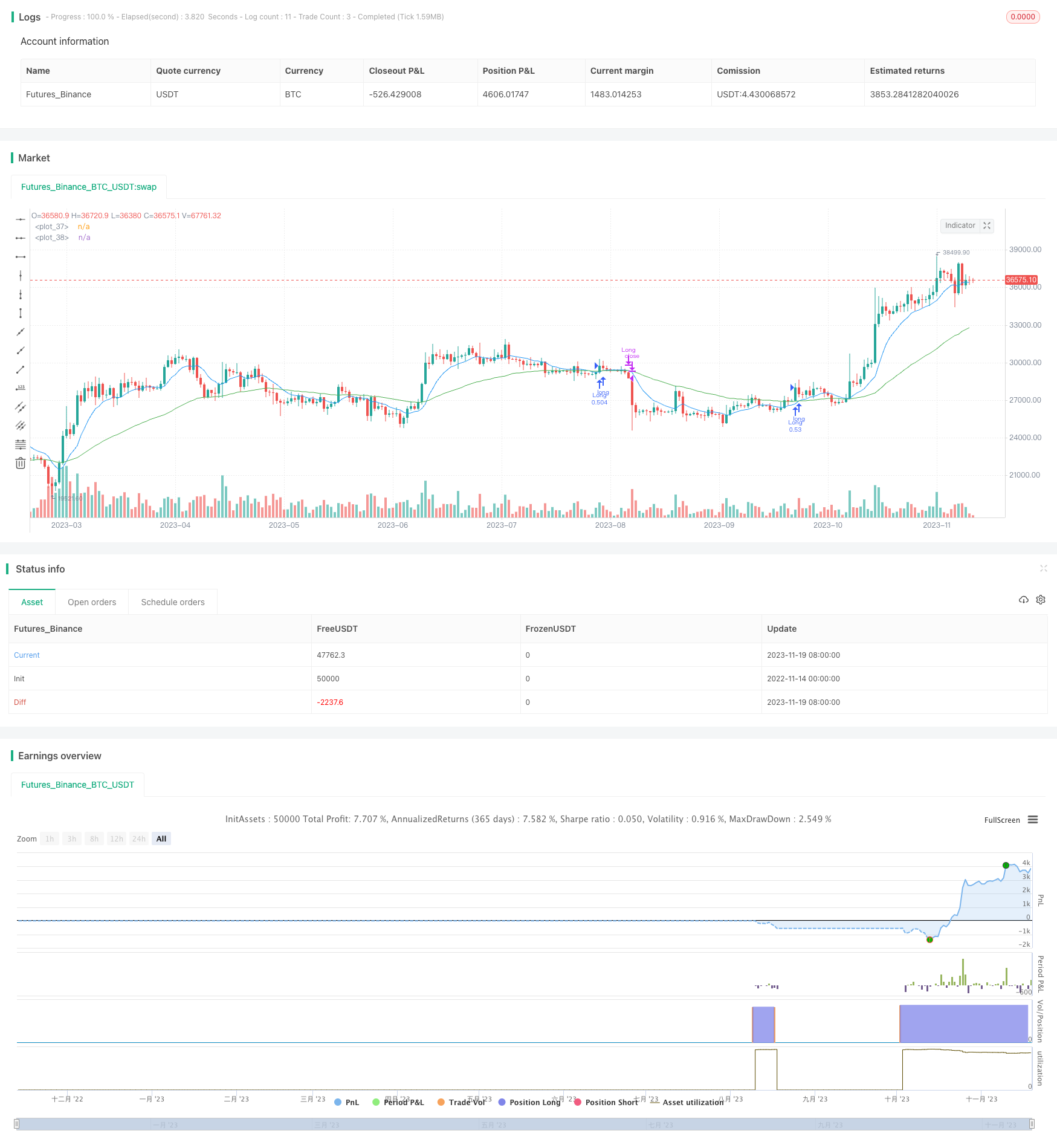

/*backtest

start: 2022-11-14 00:00:00

end: 2023-11-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © joshuajcoop01

//@version=5

strategy("Bitpanda Coinrule Template",

overlay=true,

initial_capital=1000,

process_orders_on_close=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=30,

commission_type=strategy.commission.percent,

commission_value=0.1)

showDate = input(defval=true, title='Show Date Range')

timePeriod = time >= timestamp(syminfo.timezone, 2020, 1, 1, 0, 0)

notInTrade = strategy.position_size <= 0

// RSI

length = input(14)

vrsi = ta.rsi(close, length)

// Moving Averages for Buy Condition

buyFastEMA = ta.ema(close, 9)

buySlowEMA = ta.ema(close, 50)

buyCondition1 = ta.crossover(buyFastEMA, buySlowEMA)

increase = 5

if ((vrsi > vrsi[1]+increase) and buyCondition1 and vrsi < 70 and timePeriod)

strategy.entry("Long", strategy.long)

// Moving Averages for Sell Condition

sellFastEMA = ta.ema(close, 9)

sellSlowEMA = ta.ema(close, 50)

plot(request.security(syminfo.tickerid, "60", sellFastEMA), color = color.blue)

plot(request.security(syminfo.tickerid, "60", sellSlowEMA), color = color.green)

condition = ta.crossover(sellSlowEMA, sellFastEMA)

//sellCondition1 = request.security(syminfo.tickerid, "60", condition)

strategy.close('Long', when = condition and timePeriod)