概述

该策略通过计算快速移动平均线和慢速移动平均线的金叉死叉,来判断入场和出场时机。当快速线从下方上穿慢速线时,做多;当快速线从上方下穿慢速线时,做空。

策略原理

该策略主要基于移动平均线的金叉死叉原理。计算一条长度为3的快速移动平均线,以及一条长度为266的慢速移动平均线。当快速线从下方上穿慢速线时产生买入信号;当快速线从上方下穿慢速线时产生卖出信号。收到信号后第三根K线发出入场委托。

这个策略判断趋势的基础在于,价格上涨时,短期移动平均线更快速地上移;价格下跌时,短期移动平均线更快速地下移。因此,短期快线和长期慢线之间会产生穿越。

优势分析

该策略最大的优势在于,通过计算不同长度周期的移动平均线,并利用它们之间的金叉死叉关系来判断趋势转折点。相比单一的移动平均线等指标,能更准确地捕捉价格转折。

首先,快速移动平均线能更敏感地捕捉价格变化,慢速移动平均线则起到滤波噪音的作用,能有效识别趋势方向。两条均线配合使用,避免产生错误信号。

其次,该策略采用了滞后入场方式,即信号产生后第三根K线入场。这可以进一步避免由于均线震荡而产生的错误交易。

再者,参数选取合理简单,仅仅依靠两条移动平均线即可完成判断,无需计算繁复的指标,降低了过度优化的可能性。

风险分析

尽管该策略无明显缺陷和风险,但实盘使用时仍需要注意几点:

首先,仅仅依靠移均这一趋势判断指标,可能错过其他指标判断出的入场机会。可以考虑适当增加备选指标,综合判断。

其次,在强势趋势中,价格可能会长期运行在快线之上或之下。这时就会出现长期不产生信号的情况。需要调整参数,让快线更贴近价格。

再次,指标参数并非百分之百可靠,不同品种和周期下最优参数也会有所不同。需要根据实盘反馈不断测试和优化。

最后,对交易手数、止损点和止盈点也需要做好精确评估,避免亏损过大或未及时止盈。

优化方向

该策略还有几个主要的优化方向:

第一,可以考虑在金叉死叉的同时,增加其他辅助指标的判断逻辑。例如RSI指标显示超买超卖时,进一步确认交易信号。

第二,参数优化至关重要。可以综合考虑周期、交易品种等因素,通过历史回测和模拟实盘的方法,不断测试和调整参数,使策略更加适应市场环境。

第三,优化入场方式。除了简单的第三K线入场,可以研究滞后’N’根K线入场、价差进场、突破新高新低进场等方式,具体情况根据品种和周期微调。

最后,完善止损止盈方式同样重要。可以结合波动率ATR指标,实时调整止盈止损幅度。另外,移动止损、分批止盈等方式也值得考虑。这些都将大幅提高策略盈利率。

总结

该策略运用移动平均线金叉死叉判断价格未来方向的经典原理,通过合理参数设定产生交易信号,并采用滞后入场以及止损止盈方法控制风险,是一个简单实用的量化交易策略。在优化指标参数、完善指标体系、调整入场出场逻辑等多个方面都具有进一步改进的潜力。

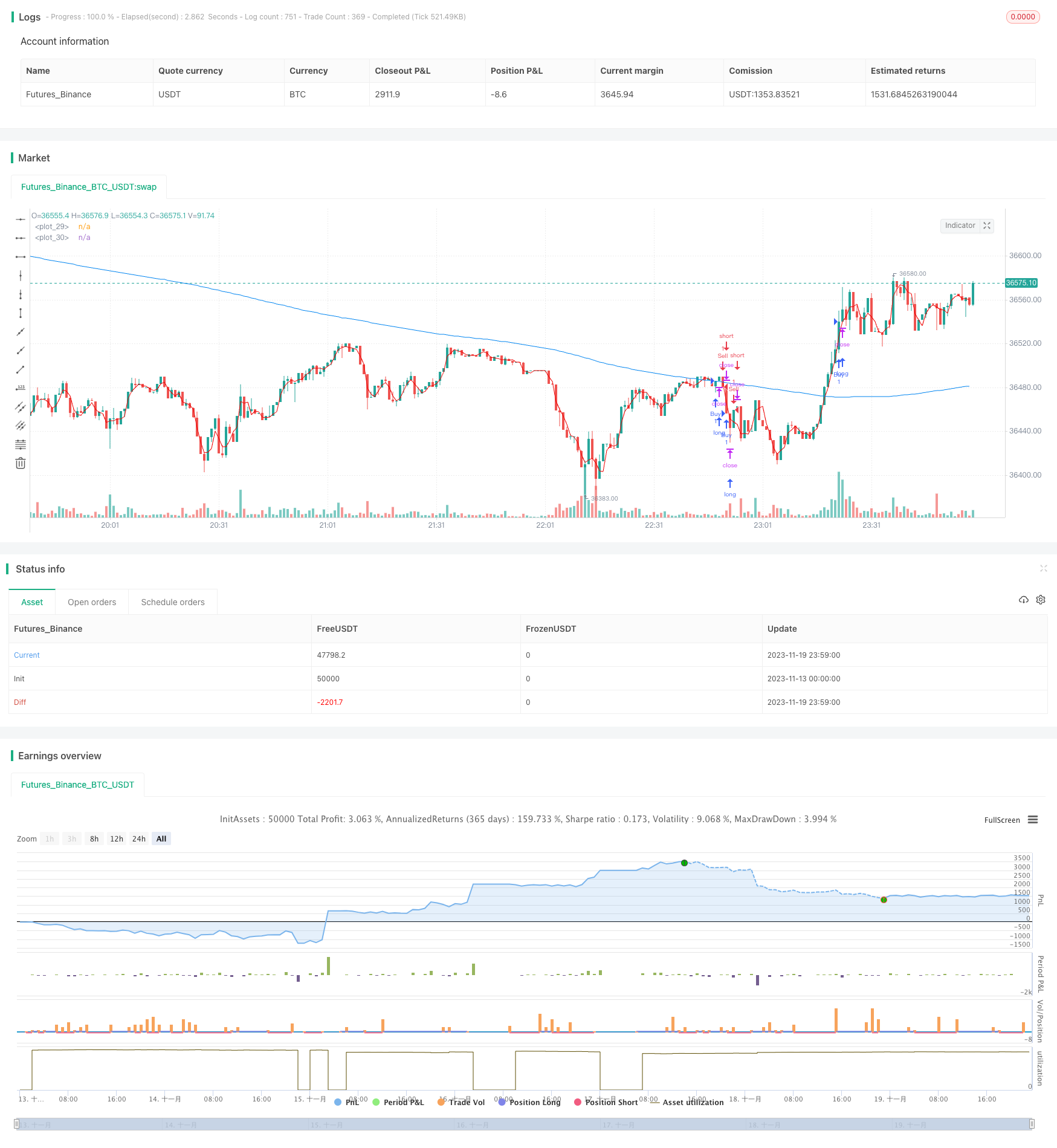

/*backtest

start: 2023-11-13 00:00:00

end: 2023-11-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Cruzamento de Médias Móveis", overlay=true)

// Definir os parâmetros da estratégia

length_fast = 3

length_slow = 266

price = close

take_profit = 10000.0

stop_loss = 2000.0

// Calcular as médias móveis

fast_ma = vwma(price, length_fast)

slow_ma = sma(price, length_slow)

// Definir as condições de entrada

buy_signal = crossover(fast_ma, slow_ma)

sell_signal = crossunder(fast_ma, slow_ma)

// Enviar ordens de negociação com base nas condições de entrada

if (buy_signal[3]) // Verifica se o sinal de compra ocorreu 3 velas atrás

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", "Buy", profit=take_profit, loss=stop_loss)

if (sell_signal[3]) // Verifica se o sinal de venda ocorreu 3 velas atrás

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", profit=take_profit, loss=stop_loss)

// Plotar as médias móveis no gráfico

plot(fast_ma, color=color.rgb(238, 0, 0))

plot(slow_ma, color=color.rgb(0, 132, 240))