概述

该策略通过计算快线EMA和慢线EMA,并比较两条EMA的大小关系来判断行情趋势方向,属于简单的趋势追踪策略。当快线EMA上穿慢线EMA时做多,当快线EMA下穿慢线EMA时做空,属于典型的双EMA黄金交叉策略。

策略原理

该策略的核心指标是快线EMA和慢线EMA。快线EMA长度设置为21周期,慢线EMA长度设置为55周期。快线EMA能更快速地响应价格变动,反映最近短期趋势;慢线EMA对价格变动响应更缓慢,能过滤掉部分噪音,反映中长期趋势。

当快线EMA上穿慢线EMA时,表示短期趋势转为上涨,中长期趋势可能出现转折,这是做多的信号。当快线EMA下穿慢线EMA时,表示短期趋势转为下跌,中长期趋势可能出现转折,这是做空的信号。

通过快慢EMA的比较,可以捕捉短期和中长期两个时间尺度上的趋势转折点,属于典型的趋势追踪策略。

策略优势

- 思路简单清晰,容易理解和实现

- 参数调节灵活,快线和慢线EMA周期可自定义

- 可配置ATR止损止盈,可控的风险

策略风险

- 双EMA交叉时点选择可能不当,存在错过最佳入场点的风险

- 行情震荡时,可能出现多次无效信号,带来亏损风险

- ATR参数设置不当,可能造成止损止盈过于宽松或过于激进

风险应对措施: 1. 优化EMA快慢线参数,寻找最优参数组合 2. 增加过滤机制,避免行情震荡带来的无效信号 3. 测试并优化ATR参数,确保止损止盈设置合理

策略优化方向

- 基于统计方法测试不同EMA周期参数的稳定性

- 增加过滤条件,结合其他指标避免无效信号

- 优化ATR参数以获取最佳止损止盈比率

总结

本策略通过快线EMA和慢线EMA的交叉来判断行情趋势,简单清晰,容易实现。同时结合ATR来设置止损止盈,可控风险。通过参数优化和增加过滤条件,可以进一步增强策略稳定性和盈利能力。

策略源码

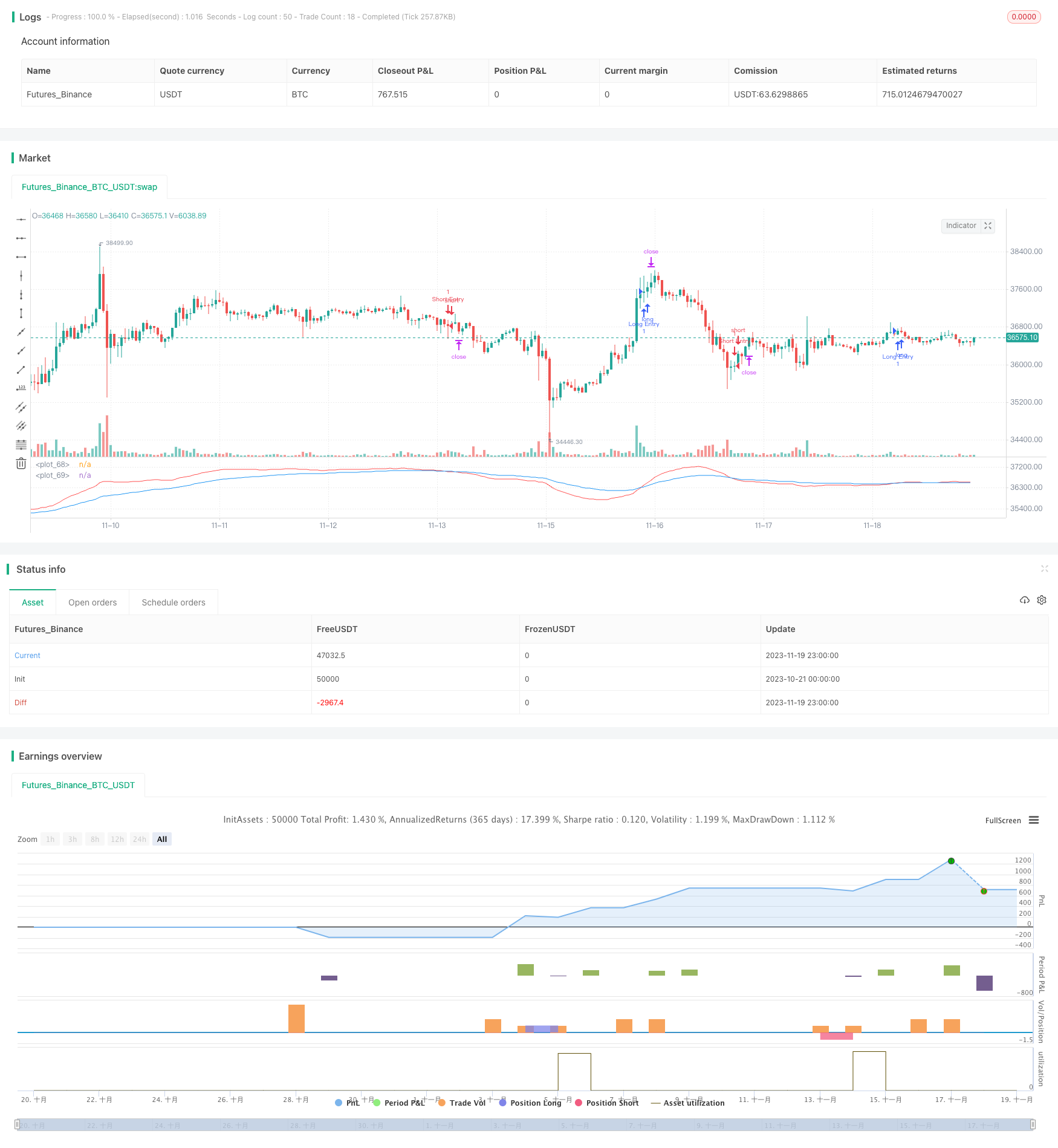

/*backtest

start: 2023-10-21 00:00:00

end: 2023-11-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = "VP Backtester", overlay=false)

// Create General Strategy Inputs

st_yr_inp = input(defval=2017, title='Backtest Start Year')

st_mn_inp = input(defval=01, title='Backtest Start Month')

st_dy_inp = input(defval=01, title='Backtest Start Day')

en_yr_inp = input(defval=2025, title='Backtest End Year')

en_mn_inp = input(defval=01, title='Backtest End Month')

en_dy_inp = input(defval=01, title='Backtest End Day')

// Default Stop Types

fstp = input(defval=false, title="Fixed Perc stop")

fper = input(defval=0.1, title='Percentage for fixed stop', type=float)

atsp = input(defval=true, title="ATR Based stop")

atrl = input(defval=14, title='ATR Length for stop')

atrmsl = input(defval=1.5, title='ATR Multiplier for stoploss')

atrtpm = input(defval=1, title='ATR Multiplier for profit')

// Sessions

asa_inp = input(defval=true, title="Trade the Asian Session")

eur_inp = input(defval=true, title="Trade the European Session")

usa_inp = input(defval=true, title="Trade the US session")

ses_cls = input(defval=true, title="End of Session Close Out?")

// Session Start / End times (In exchange TZ = UTC-5)

asa_ses = "1700-0300"

eur_ses = "0200-1200"

usa_ses = "0800-1700"

in_asa = time(timeframe.period, asa_ses)

in_eur = time(timeframe.period, eur_ses)

in_usa = time(timeframe.period, usa_ses)

strategy.risk.allow_entry_in(strategy.direction.all)

// Set start and end dates for backtest

start = timestamp(st_yr_inp, st_mn_inp, st_dy_inp,00,00)

end = timestamp(en_yr_inp, en_mn_inp, en_dy_inp,00,00)

window() => time >= start and time <= end ? true : false // create function "within window of time"

// Check if we are in a sessions we want to trade

can_trade = asa_inp and not na(in_asa) ? true :

eur_inp and not na(in_eur) ? true :

usa_inp and not na(in_usa) ? true :

false

// atr calc for stop and profit

atr = atr(atrl)

atr_stp_dst_sl = atr * atrmsl

atr_stp_dst_tp = atr * atrtpm

//*************************************************************************************

// Put your strategy/indicator code below

// and make sure to set long_condition=1 for opening a buy trade

// and short_condition for opening a sell trade

//*************************************************************************************

fastInput = input(21)

slowInput = input(55)

fast = ema(close, fastInput)

slow = ema(close, slowInput)

plot(fast, color = red)

plot(slow, color = blue)

long_condition = crossover(fast, slow)

short_condition = crossunder(fast, slow)

//*************************************************************************************

// Trade management with ATR based stop & profit

//*************************************************************************************

if (long_condition and window() )

strategy.entry("Long Entry", strategy.long)

if strategy.position_size <= 0 // Less than as in both direction strat - Could be long before switching

if atsp

atr_stop = open - atr_stp_dst_sl

atr_profit = open + atr_stp_dst_tp

strategy.exit('ATR Long Exit', "Long Entry", stop=atr_stop, limit = atr_profit)

if fstp

stop = open - (open * fper)

strategy.exit('Perc Fixed Long Stop Exit', "Long Entry", stop=stop)

if (short_condition and window() )

strategy.entry("Short Entry",strategy.short)

if strategy.position_size >= 0 // Greater than as in both direction strat - Could be long before switching

if atsp

atr_stop = open + atr_stp_dst_sl

atr_profit = open - atr_stp_dst_tp

strategy.exit('ATR Short Exit', "Short Entry", stop=atr_stop, limit = atr_profit)

if fstp

stop = open + (open * fper)

strategy.exit('Perc Fixed Short Stop Exit', "Short Entry", stop=stop)

strategy.close_all(when=not can_trade and ses_cls)