概述

动态均线趋势交叉策略是一种基于MACD(移动平均收敛发散指标)的交易系统。该策略依据短期与长期移动平均线的差异来判断市场趋势,从而作出买入或卖出的决策。其主要思想是通过监测短期和长期趋势之间的关系,来预测市场的潜在变化。

策略原理

该策略使用了两个不同周期的指数移动平均线(EMA):快速EMA(8日)和慢速EMA(16日)。MACD值由这两条EMA的差值构成。此外,策略还引入了一个信号线,即MACD的简单移动平均线(11日)。当MACD线上穿信号线时,代表多头趋势,策略执行买入操作;当MACD线下穿信号线时,代表空头趋势,执行卖出操作。

在代码层面,策略首先计算快速和慢速EMA,然后得出MACD值。随后,计算MACD的SMA,作为信号线。通过比较MACD和信号线的位置,策略确定当前的持仓状态。此外,策略还提供了反向交易的选项,允许用户在相反的信号出现时进入市场。

策略优势

动态均线趋势交叉策略的主要优势在于其简洁性和对市场趋势变化的敏感性。通过使用不同周期的EMA,该策略能够有效捕捉到短期和长期趋势之间的偏差,从而及时响应市场变化。此外,信号线的加入进一步提高了策略的准确性,使投资者能够更快地识别趋势转变。

风险分析

尽管动态均线趋势交叉策略在多数情况下表现良好,但它也存在一些风险。最主要的风险是在市场波动性较大或趋势不明显时,该策略可能产生误导性信号。此外,策略对历史数据的依赖也可能导致延迟反应。为减轻这些风险,投资者可以结合其他技术指标或市场分析来辅助决策。

优化方向

该策略的优化方向主要包括调整EMA周期长度、引入其他技术指标以及考虑市场波动性因素。调整周期长度可以使策略更适应不同市场条件。引入如RSI、布林带等其他指标可以提供更全面的市场视角。考虑市场波动性因素,如通过ATR调整交易策略,可以增强策略的适应性和稳健性。

总结

动态均线趋势交叉策略是一种以MACD为核心的量化交易策略。它通过分析短期与长期趋势的关系,来把握市场动向。虽然这种策略简洁有效,但也需要注意其局限性和潜在风险。通过不断优化和结合其他分析工具,投资者可以更好地利用这一策略,实现有效的市场操作。

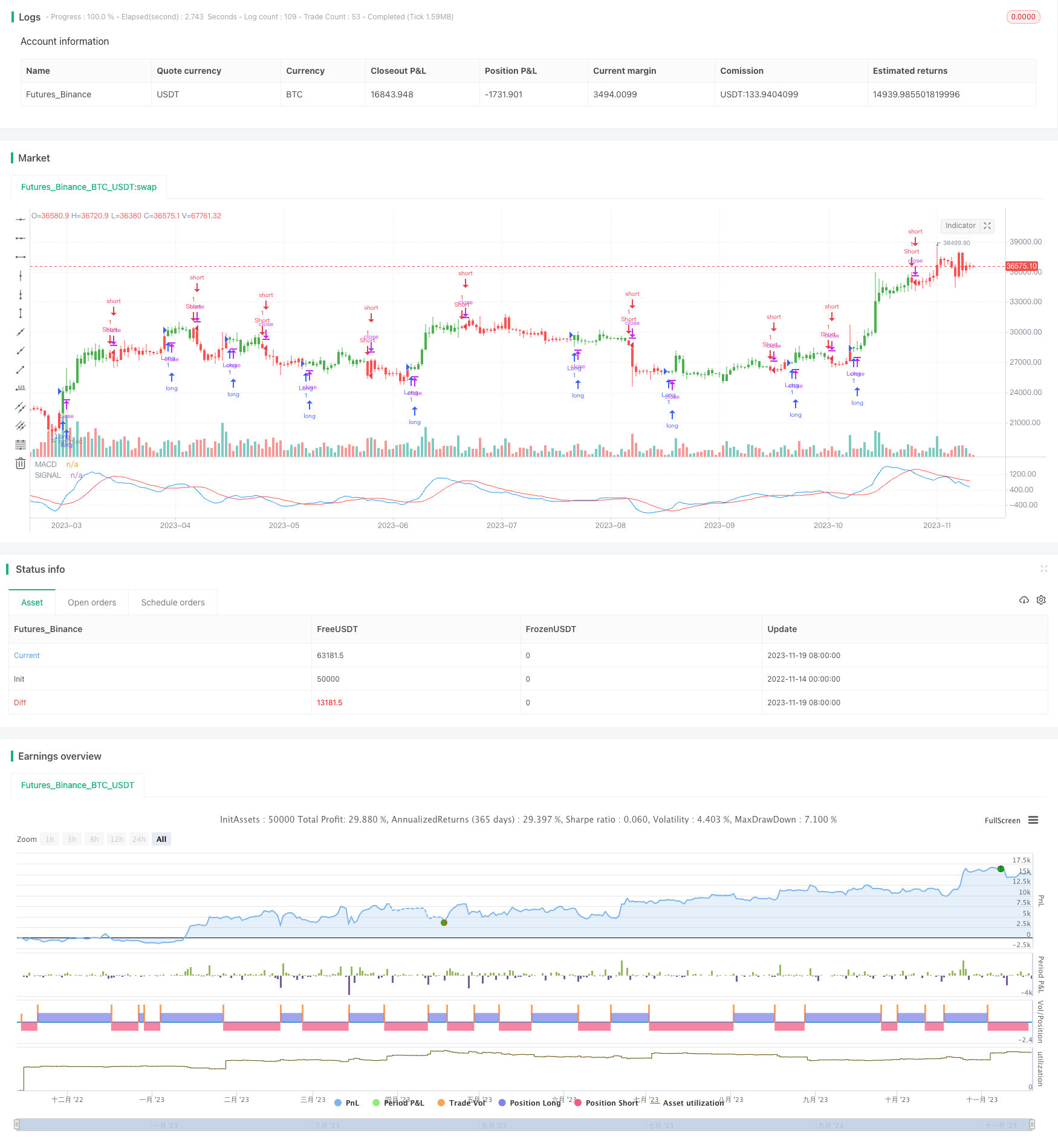

/*backtest

start: 2022-11-14 00:00:00

end: 2023-11-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 06/09/2017

// MACD – Moving Average Convergence Divergence. The MACD is calculated

// by subtracting a 26-day moving average of a security's price from a

// 12-day moving average of its price. The result is an indicator that

// oscillates above and below zero. When the MACD is above zero, it means

// the 12-day moving average is higher than the 26-day moving average.

// This is bullish as it shows that current expectations (i.e., the 12-day

// moving average) are more bullish than previous expectations (i.e., the

// 26-day average). This implies a bullish, or upward, shift in the supply/demand

// lines. When the MACD falls below zero, it means that the 12-day moving average

// is less than the 26-day moving average, implying a bearish shift in the

// supply/demand lines.

// A 9-day moving average of the MACD (not of the security's price) is usually

// plotted on top of the MACD indicator. This line is referred to as the "signal"

// line. The signal line anticipates the convergence of the two moving averages

// (i.e., the movement of the MACD toward the zero line).

// Let's consider the rational behind this technique. The MACD is the difference

// between two moving averages of price. When the shorter-term moving average rises

// above the longer-term moving average (i.e., the MACD rises above zero), it means

// that investor expectations are becoming more bullish (i.e., there has been an

// upward shift in the supply/demand lines). By plotting a 9-day moving average of

// the MACD, we can see the changing of expectations (i.e., the shifting of the

// supply/demand lines) as they occur.

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="MACD Crossover", shorttitle="MACD Crossover")

fastLength = input(8, minval=1)

slowLength = input(16,minval=1)

signalLength=input(11,minval=1)

reverse = input(false, title="Trade reverse")

// hline(0, color=purple, linestyle=dashed)

fastMA = ema(close, fastLength)

slowMA = ema(close, slowLength)

macd = fastMA - slowMA

signal = sma(macd, signalLength)

pos = iff(signal < macd , 1,

iff(signal > macd, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(signal, color=red, title="SIGNAL")

plot(macd, color=blue, title="MACD")