概述

本策略首先利用123形态判断反转信号,再结合克林格量化震荡器作为过滤,实现高效捕捉反转机会的量化双击利策略。

策略原理

策略由两部分组成:

123形态判断反转信号部分:当收盘价连续2日下跌后第3日收阳,且stoch指标低位时 for 多头;当收盘价连续2日上涨后第3日收阴,且stoch指标高位时 for 空头。

克林格量化震荡器部分:克林格量化震荡器结合价格波动范围和交易量变化判断资金流入流出。当量化震荡器上穿其平均值时为多头信号;下穿其平均值时为空头信号。

最后,策略综合上述两部分信号,双击利确定最终入场。

优势分析

该策略最大优势是结合反转形态和量能指标,能高效捕捉反转机会。另外借助stoch指标避免假突破,和克林格量化震荡器判断真实资金流向,可确保入场时机准确。

风险分析

该策略主要风险在于反转形态判断和参数设置问题。由于反转信号存在一定滞后,需要确保参数设置合理,避免错过最佳反转时机。此外,反转形态本身也可能存在失效情况。

为降低风险,可以适当优化参数,使反转信号更加灵敏和及时。也可以增加其他过滤条件,确保反转次数够多和幅度足够,避免回撤扩大。

优化方向

该策略主要可优化空间在参数调整和增加其他辅助判断。具体来说,可以适当缩短stoch指标参数,优化123形态判断的灵敏度。也可以加入目前主流指标和形态进行组合,如加上 MACD 金叉死叉,或double top / bottom 多重底部等判断。

此外,可考虑动态调整止损和止盈条件,让策略更加适应市场变化。也可以结合机器学习对参数进行实时优化。

总结

本策略综合运用经典反转理论与量能技术指标,实现高效捕捉反转机会。优化空间较大,具有进一步提升效果的潜力,值得实盘验证与持续优化。

策略源码

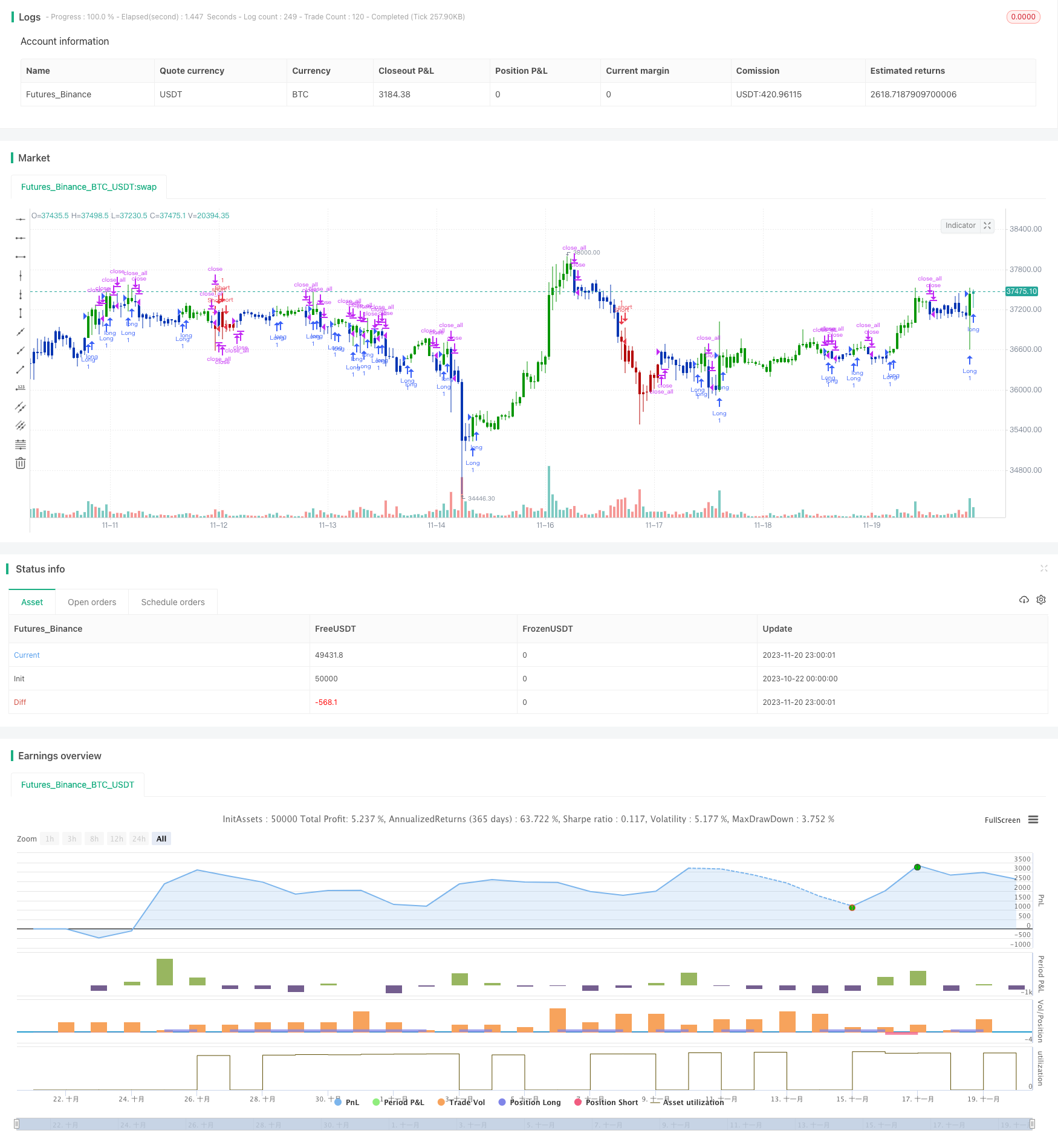

/*backtest

start: 2023-10-22 00:00:00

end: 2023-11-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 23/12/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Klinger Oscillator (KO) was developed by Stephen J. Klinger. Learning

// from prior research on volume by such well-known technicians as Joseph Granville,

// Larry Williams, and Marc Chaikin, Mr. Klinger set out to develop a volume-based

// indicator to help in both short- and long-term analysis.

// The KO was developed with two seemingly opposite goals in mind: to be sensitive

// enough to signal short-term tops and bottoms, yet accurate enough to reflect the

// long-term flow of money into and out of a security.

// The KO is based on the following tenets:

// Price range (i.e. High - Low) is a measure of movement and volume is the force behind

// the movement. The sum of High + Low + Close defines a trend. Accumulation occurs when

// today's sum is greater than the previous day's. Conversely, distribution occurs when

// today's sum is less than the previous day's. When the sums are equal, the existing trend

// is maintained.

// Volume produces continuous intra-day changes in price reflecting buying and selling pressure.

// The KO quantifies the difference between the number of shares being accumulated and distributed

// each day as "volume force". A strong, rising volume force should accompany an uptrend and then

// gradually contract over time during the latter stages of the uptrend and the early stages of

// the following downtrend. This should be followed by a rising volume force reflecting some

// accumulation before a bottom develops.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

KVO(TrigLen,FastX,SlowX) =>

pos = 0.0

xTrend = iff(hlc3 > hlc3[1], volume * 100, -volume * 100)

xFast = ema(xTrend, FastX)

xSlow = ema(xTrend, SlowX)

xKVO = xFast - xSlow

xTrigger = ema(xKVO, TrigLen)

pos := iff(xKVO > xTrigger, 1,

iff(xKVO < xTrigger, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Klinger Volume Oscillator", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

TrigLen = input(13, minval=1)

FastX = input(34, minval=1)

SlowX = input(55, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posKVO = KVO(TrigLen,FastX,SlowX)

pos = iff(posReversal123 == 1 and posKVO == 1 , 1,

iff(posReversal123 == -1 and posKVO == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )