概述

Heikin Ashi HighLow通道动态均线交易策略是一种根据Heikin Ashi蜡烛线收盘价与动态均线比较,产生交易信号的策略。该策略运用双均线形成通道,根据蜡烛线收盘价突破通道上下轨进行买入和卖出操作。

策略原理

该策略基于Heikin Ashi蜡烛线技术指标。Heikin Ashi蜡烛线能过滤市场噪音,识别趋势。该策略使用高点形成的lenh周期均线作为通道上轨,低点形成的lenl周期均线作为通道下轨。当Heikin Ashi蜡烛线收盘价上穿上轨时,产生买入信号;当Heikin Ashi蜡烛线收盘价下穿下轨时,产生卖出信号。

具体来说,策略首先计算高低点各自的简单移动平均线,以构建通道。高点移动平均线mah为通道上轨,低点移动平均线mal为通道下轨。然后比较Heikin Ashi蜡烛线的收盘价与通道上下轨,以产生交易信号。如果蜡烛线收盘价高于上轨mah,则产生买入信号longCondition;如果蜡烛线收盘价低于下轨mal,则产生卖出信号shortCondition。

策略优势

- 使用Heikin Ashi蜡烛线技术指标能识别趋势,滤除噪音

- 双均线形成通道,能清晰判断支撑阻力

- 动态均线适应市场变化

- 策略逻辑简单清晰

策略风险

- 双均线容易产生错误信号

- 未考虑突破失败的情况

- 移动平均线滞后性可能错过价格反转点

- 未设置止损,可能造成较大亏损

针对风险,可以设置止损机制,或者结合其他指标确认突破信号,避免错误信号导致不必要的亏损。

优化方向

- 评估不同参数对策略表现的影响,优化参数

- 增加指标或模型进行信号过滤和确认

- 增加风险控制机制,如止损、跟踪止损

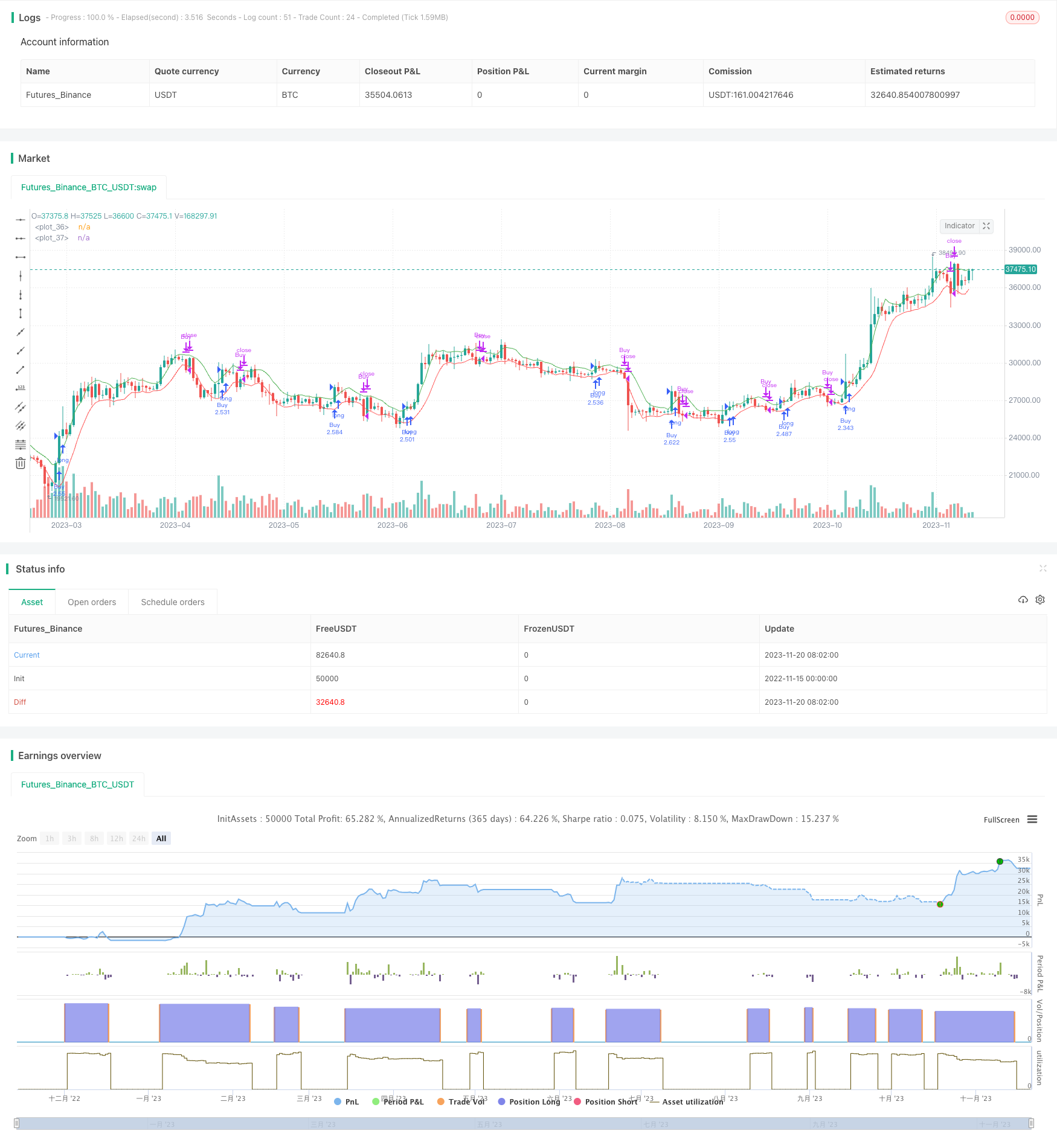

- 进行回测评估策略表现,衡量收益和风险指标

- 考虑交易成本的影响,适当调整仓位规模

总结

Heikin Ashi HighLow通道动态均线交易策略整体来说逻辑清晰、简单可操作。该策略充分利用Heikin Ashi蜡烛线技术的优势识别趋势,并设置双均线动态通道判断支撑阻力。通过优化参数,增加信号过滤机制,设置止损策略等方法可以进一步完善该策略,减小交易风险。

策略源码

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shiner_trading

// [email protected]

//@version=4

strategy("Hi-Lo Channel Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, initial_capital=500, default_qty_value=100, currency="USD")

lenh = input(5, "High-Based MA")

lenl = input (5, "Low-Based MA")

ha = input(true, "Use Heikin Ashi OHCL values (on real chart)?")

ha_h = security(heikinashi(syminfo.tickerid), timeframe.period, high)

ha_l = security(heikinashi(syminfo.tickerid), timeframe.period, low)

ha_c = security(heikinashi(syminfo.tickerid), timeframe.period, close)

float mah = na

float mal = na

longCondition = false

shortCondition = false

/// HA is the check mark box in the configuration.

/// IF "Use Heikin Ashi OHCL values?" is true, then the strategy will use the Heikin Ashi close values

// and therefore give the same buy/sell signals regardless of what chart you are viewing.

/// That being said, if "Use Heikin Ashi OHCL values?" is FALSE, yet you are viewing Heikin Ashi candles on your chart,

// then logically you will also get the same buy/sell signals

if ha == true

mah := sma(ha_h, lenh)

mal := sma(ha_l, lenl)

longCondition := ha_c > mah

shortCondition := ha_c < mal

if ha == false

mah := sma(high, lenh)

mal := sma(low, lenl)

longCondition := close > mah

shortCondition := close < mal

plot(mah, color=color.green)

plot(mal, color=color.red)

if (longCondition)

strategy.entry("Buy", 100)

if (shortCondition)

strategy.close("Buy")