概述

这是一个利用移动平均线和MACD指标进行双向突破操作的量化交易策略。它具有跨时间轴操作的特点,即在较长时间周期判断趋势方向,在较短时间周期寻找入场机会的优势。

策略原理

该策略使用3条不同长度期的SMMA均线以及一条EMA均线判断趋势方向。同时,它结合MACD指标判断短期趋势和入场时机。具体来说,它的买入条件是:价格上穿所有均线,且短均线在长均线之上时触发;而卖出条件则是相反,价格下穿所有均线,短均线在长均线之下时触发。

可以看出,该策略同时利用了移动平均线判断中长期趋势方向,以及MACD判断短期反转来捕捉较优的入场时机。这种多时间轴联合操作是该策略的重要特点。

优势分析

这种跨时间轴操作的优势在于,可以在高概率的趋势方向中,选择合适的短期反转点入场,从而获得较优的风险回报比。具体来说,主要有以下3点优势:

3条SMMA均线加1条EMA均线多级滤波,可以有效判断中长期趋势方向,避免逆势操作。

MACD指标判断短期反转点入场,可以获得较优的入场价位。

严格的移动平均线顺序关系作为过滤条件,可以减少误操作的概率。

风险分析

该策略的主要风险在于:

移动平均线本身滞后性较强,可能错过短期趋势反转机会。

MACD指标容易产生假Signals,需要结合价位过滤。

多时间轴判断增加了策略复杂度,容易产生失效的情况。

针对风险1和风险2,可以通过适当缩短均线周期和Signal周期来优化,快速响应短期趋势反转。针对风险3,则需要针对不同品种和周期进行优化测试,使策略参数严格适配该品种的特点。

优化方向

该策略主要可以从以下几个方面进行优化:

优化移动平均线和MACD的参数,使其最佳匹配不同周期和品种特点。例如缩短均线长度,加大Signal 参数等。

增加止损策略,利用ATR 或其它指标设置合理的移动止损。这可以显著改善策略的风险控制。

寻找替代MACD信号的更好指标或过滤方式。例如引入波动率指标,对 Signals 进行过滤等。

测试不同的止盈止损比例关系,以获取风险回报比更优的参数组合。

总结

总体来说,这是一个具有独特跨时间轴思路的突破系统。它同时利用移动平均线和 MACD 的优势,实现了多时间段联合判断操作策略。通过对参数和过滤条件进行优化调整,该策略可以成为一个非常实用的量化交易方案。

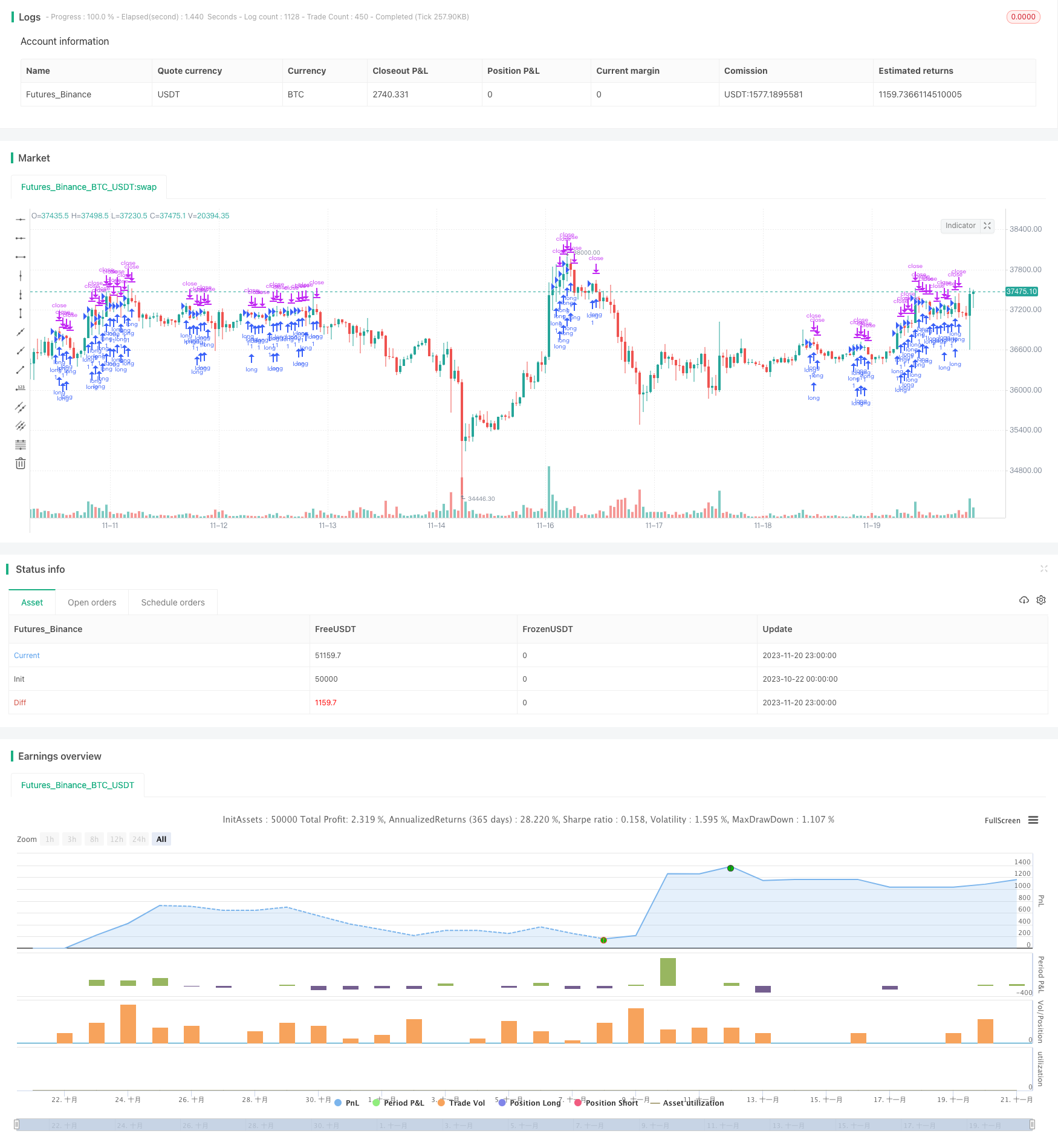

/*backtest

start: 2023-10-22 00:00:00

end: 2023-11-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("Koala Script",initial_capital=1000,

commission_type=strategy.commission.cash_per_contract,

commission_value=0.000065,

slippage=3)

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2000, title = "From Year", minval = 1970)

// To Date Inputs

toDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 8, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2031, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

len = input(3, minval=1, title="Length")

src = input(hl2, title="Source")

smma = 0.0

sma1 = sma(src, len)

smma := na(smma[1]) ? sma1 : (smma[1] * (len - 1) + src) / len

len2 = input(6, minval=1, title="Length")

src2 = input(hl2, title="Source")

smma2 = 0.0

sma2 = sma(src2, len2)

smma2 := na(smma2[1]) ? sma2 : (smma2[1] * (len2 - 1) + src2) / len2

len3 = input(9, minval=1, title="Length")

src3 = input(hl2, title="Source")

smma3 = 0.0

sma3 = sma(src3, len3)

smma3 := na(smma3[1]) ? sma3 : (smma3[1] * (len3 - 1) + src3) / len3

len4 = input(50, minval=1, title="Length")

src4 = input(close, title="Source")

smma4 = 0.0

sma4 = sma(src4, len4)

smma4 := na(smma4[1]) ? sma4 : (smma4[1] * (len4 - 1) + src4) / len4

len5 = input(200, minval=1, title="Length")

src5 = input(close, title="Source")

out5 = ema(src5, len5)

timeinrange(res, sess) => time(res, sess) != 0

london=timeinrange(timeframe.period, "0300-1045")

londonEntry=timeinrange(timeframe.period, "0300-0845")

time_cond = time >= startDate and time <= finishDate and londonEntry

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

srcc = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

// Calculating

fast_ma = sma_source ? sma(srcc, fast_length) : ema(srcc, fast_length)

slow_ma = sma_source ? sma(srcc, slow_length) : ema(srcc, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

longCond = close > out5 and close > smma4 and close > smma3 and close > smma2 and close > smma and londonEntry and smma > smma2 and smma2>smma3 and smma3>smma4 and smma4>out5

shortCond = close < out5 and close < smma4 and close < smma3 and close < smma2 and close < smma and londonEntry and smma < smma2 and smma2<smma3 and smma3<smma4 and smma4<out5

//longCond2 = crossover(close,out5) and crossover(close,smma4) and crossover(close,smma3) and crossover(close,smma2) and crossover(close,smma) and time_cond

//shortCond2 = crossunder(close,out5) and crossunder(close,smma4) and crossunder(close,smma3) and crossunder(close,smma2) and crossunder(close,smma) and time_cond

length=input(14, title="ATR Length")

mult=input(1.0, title="Percentage Multiplier (for ex., 0.7 = 70%)", step=0.1, minval=0.1, maxval=5.0)

oa=input(false, title="Show actual ATR")

ii=syminfo.pointvalue==0

s=ii?na:oa?atr(length):(syminfo.pointvalue * mult * atr(length))

tp=input(300,title="tp")

sl=input(300,title="sl")

//tp = s*10000

//sl= s*10000

//if(tp>300)

// tp:=300

//if(sl>300)

// sl:=300

//if(sl<150)

// sl:=150

//if(tp<150)

// tp:=150

strategy.initial_capital = 50000

//MONEY MANAGEMENT--------------------------------------------------------------''

balance = strategy.netprofit + strategy.initial_capital //current balance

floating = strategy.openprofit //floating profit/loss

risk = input(3,type=input.float,title="Risk %")/100 //risk % per trade

//Calculate the size of the next trade

temp01 = balance * risk //Risk in USD

temp02 = temp01/sl //Risk in lots

temp03 = temp02*100000 //Convert to contracts

size = temp03 - temp03%1000 //Normalize to 1000s (Trade size)

if(size < 10000)

size := 10000 //Set min. lot size

strategy.entry("long",1,when=longCond )

strategy.exit("closelong","long", profit=tp,loss=sl)

//strategy.close("long",when= crossunder(close[4],smma4) and close[4] > close[3] and close[3]>close[2] and close[2] > close[1] and close[1] > close)

strategy.entry("short",0,when=shortCond )

strategy.exit("closeshort","short", profit=tp,loss=sl)

//strategy.close("short",when= crossover(close[4],smma4) and close[4] < close[3] and close[3]< close[2] and close[2] < close[1] and close[1] < close)

strategy.close_all(when = not london)

maxEntry=input(2,title="max entries")

// strategy.risk.max_intraday_filled_orders(maxEntry)