概述

本策略基于SMA指标构建了一个简单的多空策略。当价格上穿20周期高点SMA时做多,当价格下破20周期低点SMA时做空。同时设置了止损退出机制。

策略原理

本策略使用20周期的highest高价和lowest低价的SMA作为判断多空的指标。当价格上穿highest SMA时,认为目前处于上涨趋势,这时做多;当价格下破lowest SMA时,认为目前处于下跌趋势,这时做空。

具体来说,策略首先计算20周期highest高价和lowest低价的SMA,并画出指标线。然后设置如下交易逻辑:

多头入场:收盘价上穿highest SMA时 多头出场:收盘价下破0.99倍highest SMA时

空头入场:收盘价下破lowest SMA时

空头出场:收盘价上穿1.01倍lowest SMA时

这样,就构建了一个跟随趋势运行的多空策略。

优势分析

这种策略具有以下几个优势:

- 使用SMA指标判断趋势方向简单实用

2.HIGHEST SMA和LOWEST SMA作为支撑阻力线,发挥指标的重要作用

3.止损设计合理,最大程度避免巨额损失 4.适用性强,多种时间周期和品种都可使用

风险分析

该策略也存在一定的风险:

- SMA指标存在滞后,可能错过趋势转折点

- 无关市场突发事件的防范措施

- 没有考虑交易成本的影响

可以通过结合其他指标、设置止损、优化参数等方式来控制和降低这些风险。

优化方向

本策略还可以从以下几个方面进行优化:

- 结合其他指标判断趋势,例如MACD、KDJ等

- 添加对突发事件的防范机制,例如停牌、限价等异常情况的处理

- 优化SMA周期参数,寻找最佳参数组合

- 考虑不同品种、不同时间周期的最佳参数

- 评估交易成本的影响,设定最佳的止损位和止盈位

总结

本策略整体思路清晰、易于实现,通过SMA指标判断多空趋势,设置合理的入场退出机制,可以获得不错的效果。有进一步优化的空间,若配合其他指标和技巧,可以成为一个值得长期跟踪的having良好潜力的策略。

策略源码

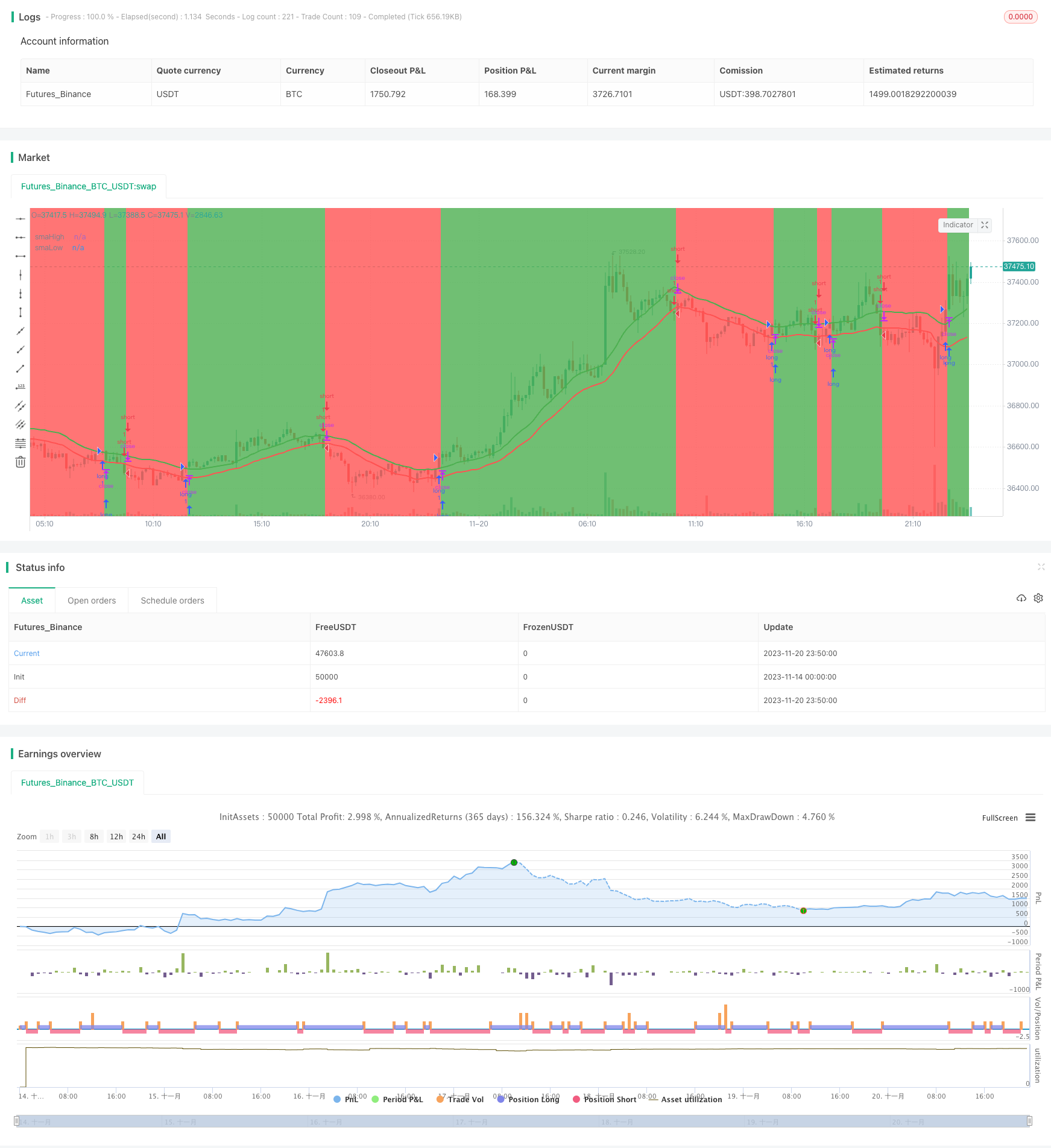

/*backtest

start: 2023-11-14 00:00:00

end: 2023-11-21 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AlanAntony

//@version=4

strategy("ma 20 high-low",overlay=true)

//compute the indicators

smaH = sma(high, 20)

smaL = sma(low, 20)

//plot the indicators

plot(smaH,title="smaHigh", color=color.green, linewidth=2)

plot(smaL,title="smaLow", color=color.red, linewidth=2)

//trading logic

enterlong = crossover(close,smaH) //positive ema crossover

exitlong = crossunder(close,0.99*smaH) //exiting long

entershort = crossunder(close,smaL) //negative EMA Crossover

exitshort = crossover(close,1.01*smaH) //exiting shorts

notintrade = strategy.position_size<=0

bgcolor(notintrade ? color.red:color.green)

//execution logic

start = timestamp(2015,6,1,0,0)

//end = timestamp(2022,6,1,0,0)

if time >= start

strategy.entry( "long", strategy.long,1, when = enterlong)

strategy.entry( "short", strategy.short,1, when = entershort)

strategy.close("long", when = exitlong)

strategy.close("short", when = exitshort)

//if time >= end

// strategy.close_all()