概述

该策略利用RSI和EMA指标来决定入场和退出。它在熊市中表现良好,可以捕捉底部反弹机会。

策略原理

该策略基于以下买入和卖出条件:

买入条件: 1. RSI < 40 2. RSI 比昨日下降3点 3. 50日EMA下穿100日EMA

卖出条件:

1. RSI > 65

2. 9日EMA上穿50日EMA

这样可以在跌势中买入,在反弹中高位卖出,捕捉底部反弹机会。

优势分析

该策略具有以下优势:

- 利用RSI捕捉超跌机会

- EMA形态判断趋势变化点

- 回测结果良好,特别在熊市中表现抗跌

- 可配置参数调整策略

风险分析

该策略也存在以下风险:

- 参数设置不当可能导致过早买入或迟滞卖出

- 反弹不一定能及时出现或无法持续

- 交易费用和滑点也会影响实际盈利

可通过调整参数优化策略,或结合其他指标判断多空格局。

优化方向

该策略可以从以下方向进行优化:

- 根据不同币种分别测试参数组合

- 结合交易量变化判断买卖信号效力

- 增加止损点,降低单笔亏损风险

- 考虑动态调整仓位规模

总结

该捕捉底部策略整体来说逻辑清晰,在熊市中能较好发挥作用。通过参数调整和优化空间还大,可望获得更好回测指标。但实盘过程中也需要关注风险,无法完全规避亏损情况。

策略源码

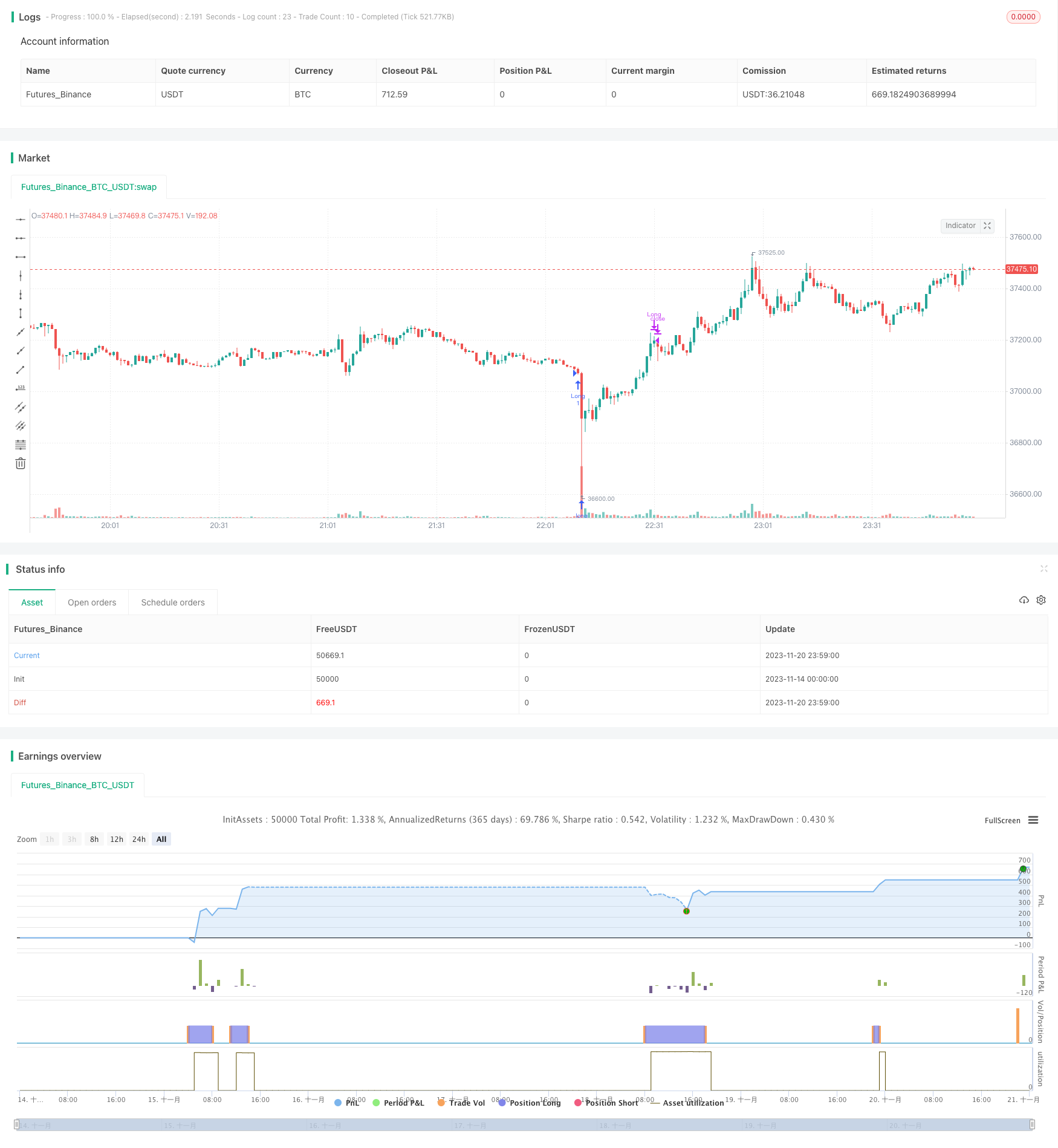

/*backtest

start: 2023-11-14 00:00:00

end: 2023-11-21 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=5

strategy("V3 - Catching the Bottom",

overlay=true)

showDate = input(defval=true, title='Show Date Range')

timePeriod = time >= timestamp(syminfo.timezone, 2022, 4, 1, 0, 0)

notInTrade = strategy.position_size <= 0

//==================================Buy Conditions============================================

//RSI

length = input(14)

vrsi = ta.rsi(close, length)

buyCondition1 = vrsi < 40

//RSI decrease

decrease = 3

buyCondition2 = (vrsi < vrsi[1] - decrease)

//sellCondition1 = request.security(syminfo.tickerid, "15", buyCondition2)

//EMAs

fastEMA = ta.sma(close, 50)

slowEMA = ta.sma(close, 100)

buyCondition3 = ta.crossunder(fastEMA, slowEMA)

//buyCondition2 = request.security(syminfo.tickerid, "15", buyCondition3)

if(buyCondition1 and buyCondition2 and buyCondition3 and timePeriod)

strategy.entry(id='Long', direction = strategy.long)

//==================================Sell Conditions============================================

sellCondition1 = vrsi > 65

EMA9 = ta.sma(close, 9)

EMA50 = ta.sma(close, 50)

sellCondition2 = ta.crossover(EMA9, EMA50)

if(sellCondition1 and sellCondition2 and timePeriod)

strategy.close(id='Long')

//Best on: ETH 5mins (7.59%), BNB 5mins (5.42%), MATIC 30mins (15.61%), XRP 45mins (10.14%) ---> EMA

//Best on: MATIC 2h (16.09%), XRP 15m (5.25%), SOL 15m (4.28%), AVAX 5m (3.19%)