概述

本策略是基于SSL通道指标的回测策略,同时结合了ATR止损、ATR止盈和资金管理等功能,可以更全面地测试SSL通道策略的效果。

策略原理

SSL通道指标

SSL通道指标由通道中线和通道带组成。通道中线是简单移动平均线,分为上轨和下轨,通常取高点期间的简单移动平均线作为上轨,低点期间的简单移动平均线作为下轨。通道带则由上轨和下轨之间的区域构成。

当价格接近通道上轨时视为超买,当价格接近通道下轨时视为超卖。价格突破通道带的时候,表示趋势发生转变的信号。

本策略中的SSL通道指标参数设置为:ssl_period=16。

ATR止损止盈

ATR指平均真实波幅。它可以用来评估市场的波动性和确定止损止盈位置。

本策略使用了参数atr_period=14的ATR指标,并结合atr_stop_factor=1.5和atr_target_factor=1.0作为止损和止盈的动态倍数,实现了基于市场波动率的止损止盈。

此外,为了适应不同品种,本策略还加入了two_digit参数判断合约为2位精度的品种(如黄金、日元),从而可灵活调整止损止盈位。

资金管理

资金管理主要通过参数position_size(固定仓位)和risk(百分比风险敞口)实现。当use_mm=true时会启用资金管理模块。

资金管理的主要目标是控制每次开仓的头寸大小。当采用固定百分比风险模式时,会根据账户权益计算出风险敞口后转化为合约数,从而实现抑制单笔损失的效果。

优势分析

- 使用SSL通道判断趋势方向,对于捕捉趋势转换具有一定效果

- 应用ATR动态计算止损止盈位置,可以自适应市场波动率

- 利用资金管理原则,有助于从长期角度控制风险

风险分析

- SSL通道虽可判断趋势转折,但并不是百分之百可靠,可能出现错误信号

- ATR跟随市场波动率设置止损止盈,可能会过于宽松或过于僵硬

- 资金管理参数设置不当也会导致仓位过大或效率过低

这些风险可以通过以下方法加以改善:

- 结合其他指标进行确认,避免出现错误信号

- 适当调整ATR周期参数,使止损止盈水平达到最佳平衡

- 测试不同资金管理参数,找到最优仓位

优化方向

本策略可以从以下几个方面进行优化:

- 优化SSL通道参数,寻找最佳参数组合

- 优化或替换ATR止损止盈机制,使其更加完善

- 增加其他过滤指标,避免不必要的交易

- 增加仓位控制模块,实现损益最大化

- 针对不同品种进行参数微调,提高策略适应性

- 加入量化工具,实现更全面的回测和优化

通过系统的测试和优化,本策略可以成为一个可靠和稳定的量化交易系统。

总结

本策略整合了SSL通道指标判断趋势、ATR设定止损止盈和资金管理控制风险三种机制。通过全面的回测可以检验该策略的效果,并且可以作为量化交易策略优化的基础框架。与此同时,本策略也有可以改进的空间,如加入其他过滤指标、优化参数以及扩充功能等。总的来说,本策略为搭建自动化交易系统奠定了坚实的基石。

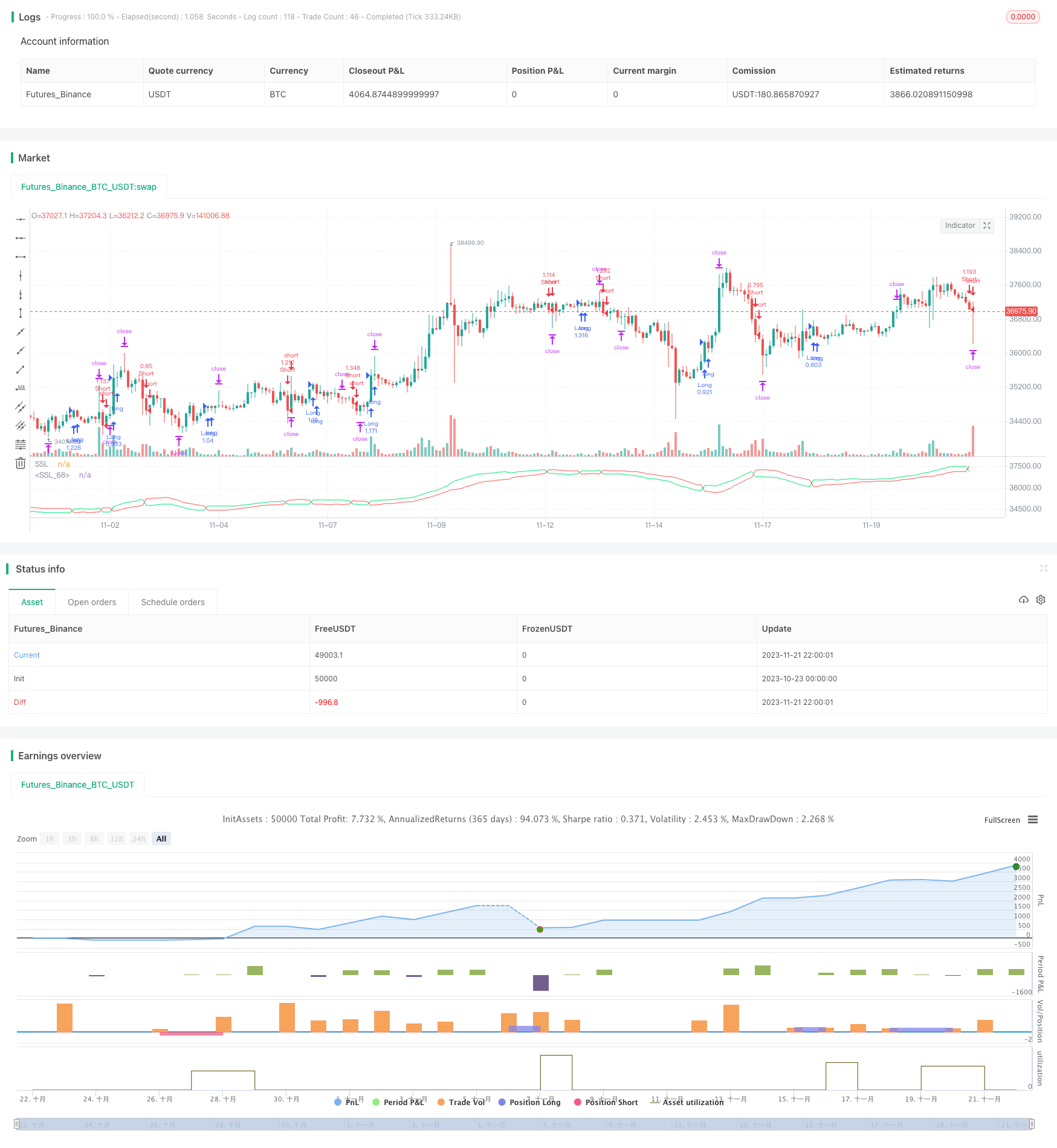

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © comiclysm

//@version=4

strategy("SSL Backtester", overlay=false)

//--This strategy will simply test the effectiveness of the SSL using

//--money management and an ATR-derived stop loss

//--USER INPUTS

two_digit = input(false, "Check this for 2-digit pairs (JPY, Gold, Etc)")

ssl_period = input(16, "SSL Period")

atr_period = input(14, "ATR Period")

atr_stop_factor = input(1.5, "ATR Stop Loss Factor")

atr_target_factor = input(1.0, "ATR Target Factor")

use_mm = input(true, "Check this to use Money Management")

position_size = input(1000, "Position size (for Fixed Risk)")

risk = input(0.01, "Risk % in Decimal Form")

//--INDICATORS------------------------------------------------------------

//--SSL

sma_high = sma(high, ssl_period)

sma_low = sma(low, ssl_period)

ssl_value = 0

ssl_value := close > sma_high ? 1 : close < sma_low ? -1 : ssl_value[1]

ssl_low = ssl_value < 0 ? sma_high : sma_low

ssl_high = ssl_value < 0 ? sma_low : sma_high

//--Average True Range

atr = atr(atr_period)

//--TRADE LOGIC----------------------------------------------------------

signal_long = ssl_value > 0 and ssl_value[1] < 0

signal_short = ssl_value < 0 and ssl_value[1] > 0

//--RISK MANAGMENT-------------------------------------------------------

strategy.initial_capital = 50000

balance = strategy.netprofit + strategy.initial_capital

risk_pips = atr*10000*atr_stop_factor

if(two_digit)

risk_pips := risk_pips / 100

risk_in_value = balance * risk

point_value = syminfo.pointvalue

risk_lots = risk_in_value / point_value / risk_pips

final_risk = use_mm ? risk_lots * 10000 : position_size

//--TRADE EXECUTION-----------------------------------------------------

if (signal_long)

stop_loss = close - atr * atr_stop_factor

target = close + atr * atr_target_factor

strategy.entry("Long", strategy.long, final_risk)

strategy.exit("X", "Long", stop=stop_loss, limit=target)

if (signal_short)

stop_loss = close + atr * atr_stop_factor

target = close - atr * atr_target_factor

strategy.entry("Short", strategy.short, final_risk)

strategy.exit("X", "Short", stop=stop_loss, limit=target)

//--PLOTTING-----------------------------------------------------------

plot(ssl_low, "SSL", color.red, linewidth=1)

plot(ssl_high, "SSL", color.lime, linewidth=1)