概述

该策略运用著名的一目均衡图技术指标,识别股价的趋势和动量,实现自动化日内交易。当价格突破云层,并且转换线上穿基准线时买入;当出现下穿转化或价格跌破云层支持线时平仓。

原理

核心指标为一目均衡图的转换线、基准线、A云层线和B云层线。买入信号为价格大于云层,且转换线上穿基准线;卖出信号为转换线下穿基准线或价格低于云层。

该策略同时融合趋势跟踪和动量特征。转换线和基准线分别通过不同周期最高价和最低价的均值来描绘短期和中期的动量;而云层标识长期的支撑和压力区域。当短线动量指标转换线上穿中线指标基准线时,表示多头力量增强,价位上攻;当价格完全突破云层上方时,显示长线趋势转为上升,因此策略在此时产生买入信号。

相反,当转换线下穿基准线,动量转换为空方导向;或价格跌破云层,长线转为空头时,平仓信号被激活。此消彼长的交替转换避免追高杀跌,锁定了长短线态势统一的最佳买点和卖点。

优势分析

云飞翔高收益策略最大的优势在于,整合趋势和动量特征,平衡了操作频率和盈利水平,既保证了足够的交易次数,也规避了追涨杀跌的过度交易问题。一目均衡图作为常青指标,长盛不衰,应用广泛,可靠性得以保证。

特别需要强调的是,该策略买卖点选择的先进性。转换线和基准线构成自适应参数设定,避免人为参数调优的主观性和局限性;云层承担过滤器角色,为策略精确定位长短线一致之最优时点。此外,交叉与突破的组合运用,同时结合趋势和动量,也使策略的实战效能大为增强。总体而言,云飞翔策略在更高的胜率与更精准的进出场调控上,均非同一般。

风险分析

需要注意的是,云层在特定时期可能异常扩张或收缩,这会影响买卖信号的产生频率。如果遇到低波动和无明确趋势的区间市,策略买卖点可能较少。此外,一目均衡图指标组合较为复杂,个别组件失效时,会降低本策略的适用性。

针对这些情况,可通过动态调整一目均衡图参数来进行优化。譬如在低波动时缩小云层区间,提高交易频次;也可以引入附加判断指标,譬如成交量,避免误 operation。总体来说,云飞翔策略在大部分市况下都具有可靠的实盘效果。

优化方向

该策略还可扩展引入更多辅助技术指标,譬如布林带,进一步优化买卖点。也可以建立动态一目均衡图参数调整机制,基于不同的波动率和趋势状态切换参数组合,进一步提升策略的适应性。

总体而言,一目均衡图滤波器与动能指标交叉的框架不易改变,但可引入机器学习等方法,实现更加智能化、动态化的参数设定、范围调整,以及止盈止损标准的优化。这无疑能进一步锁定长短线朝同的精准买卖点。

总结

云飞翔高收益一目均衡图交易策略,成功结合趋势波段识别与动量指标,实现自动进出场。其买卖点选择算法的科学性与超前性,为追求长短线转换与高胜率交易的参与者提供了有力工具。面向未来,智能化动态参数调优空间广阔,必将使该策略交出更优异答卷。

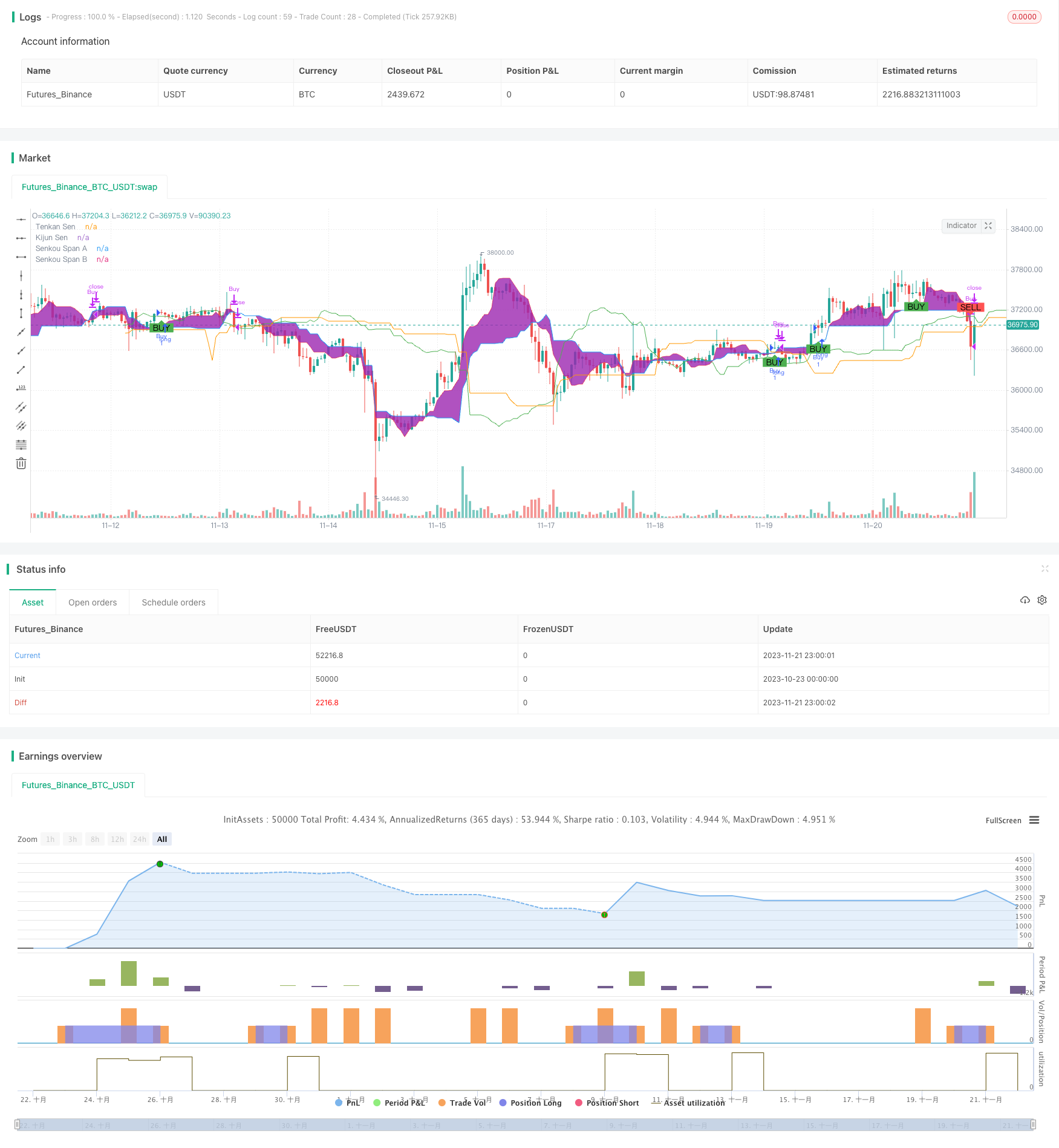

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("High Yield Ichimoku Cloud Strategy", shorttitle="HY Ichimoku", overlay=true)

// Ichimoku Cloud settings

tenkanPeriods = input(9, title="Tenkan Sen Periods")

kijunPeriods = input(26, title="Kijun Sen Periods")

senkouSpanBPeriods = input(52, title="Senkou Span B Periods")

displacement = input(26, title="Displacement")

// Calculating the Ichimoku lines

tenkanSen = (highest(high, tenkanPeriods) + lowest(low, tenkanPeriods)) / 2

kijunSen = (highest(high, kijunPeriods) + lowest(low, kijunPeriods)) / 2

senkouSpanA = (tenkanSen + kijunSen) / 2

senkouSpanB = (highest(high, senkouSpanBPeriods) + lowest(low, senkouSpanBPeriods)) / 2

chikouSpan = close[displacement]

// Plotting the Ichimoku Cloud

p1 = plot(tenkanSen, color=color.red, title="Tenkan Sen")

p2 = plot(kijunSen, color=color.blue, title="Kijun Sen")

p3 = plot(senkouSpanA, color=color.green, title="Senkou Span A", offset=displacement)

p4 = plot(senkouSpanB, color=color.orange, title="Senkou Span B", offset=displacement)

fill(p1, p2, color=color.purple, transp=80, title="Cloud")

// Buy and Sell conditions

buyCondition = crossover(tenkanSen, kijunSen) and close > max(senkouSpanA, senkouSpanB)[displacement]

sellCondition = crossunder(tenkanSen, kijunSen) and close < min(senkouSpanA, senkouSpanB)[displacement]

// Execute trade if conditions are met

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.close("Buy")

// Strategy exit conditions

strategy.close("Buy", when = crossunder(tenkanSen, kijunSen) or close < min(senkouSpanA, senkouSpanB)[displacement])

// Plot buy/sell signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")