概述

双VWAP均线震荡突破策略通过双VWAP均线分析市场趋势性,在震荡市场中寻找突破的机会。它结合ADX指标判断市场是否震荡,并利用两条不同标准差的VWAP均线寻找突破口下单入场。

策略原理

该策略主要由以下几部分组成:

VWAP设置:计算VWAP均线及其带宽。内部VWAP带宽通过

stDevMultiplier控制,默认为1;外部VWAP带宽通过stDevMultiplier控制,默认为2。ADX设置:计算ADX值判断市场是否震荡。当ADX低于阈值时判断为震荡市场。ADX参数可配置。

入场设置:在震荡市场中,价格突破外部VWAP带宽时入场。可配置止损价位和止盈价格。

限制入场:可选EMA均线或时间段过滤,避免非理想时段入场。

获利方式:跟踪止损或止盈价格断裂时平仓。可选择价格突破外VWAP exiting。

该策略通过ADX指标判断震荡行情,在价格突破VWAP带宽时寻找入场机会。双VWAP带提供更多过滤,确保入场强力。跟踪止损使获利更稳定。

优势分析

双VWAP带提供额外入场过滤,确保入场时机强势。

ADX指标判断震荡市场,避免趋势行情下错入。

跟踪止损锁住盈利,避免套牢。

可配置化参数丰富,适应性强。

思路清晰易理解,容易复制和修改。

风险及解决

参数设置不当可能导致过于激进入场或平仓。优化参数组合确保策略稳定。

跟踪止损容易过于激进或保守。结合波动率指标动态调整止损位置。

表现敏感于交易时段。可通过时间过滤器优化,确保高效入场。

VWAP指标对异常价格敏感。结合其他指标确认价格合理性。

优化方向

动态调整止损幅度。可以根据波动率等指标实时调整止损位置。

多 timeframe 确认入场时机。添加更高 timeframe 的趋势及机构指标,避免逆势入场。

考虑仓位管理。根据波动率和账户资金动态调整仓位百分比。

测试不同 VWAP 周期表现。VWAP 周期设定决定了策略的持仓周期,可作优化。

总结

双 VWAP 均线震荡突破策略通过 ADX 判断市场震荡利用双 VWAP 带提供额外的入场过滤。策略思路清晰,较容易实施。通过参数调整、止损优化、仓位管理等手段可显著提高策略稳定性。

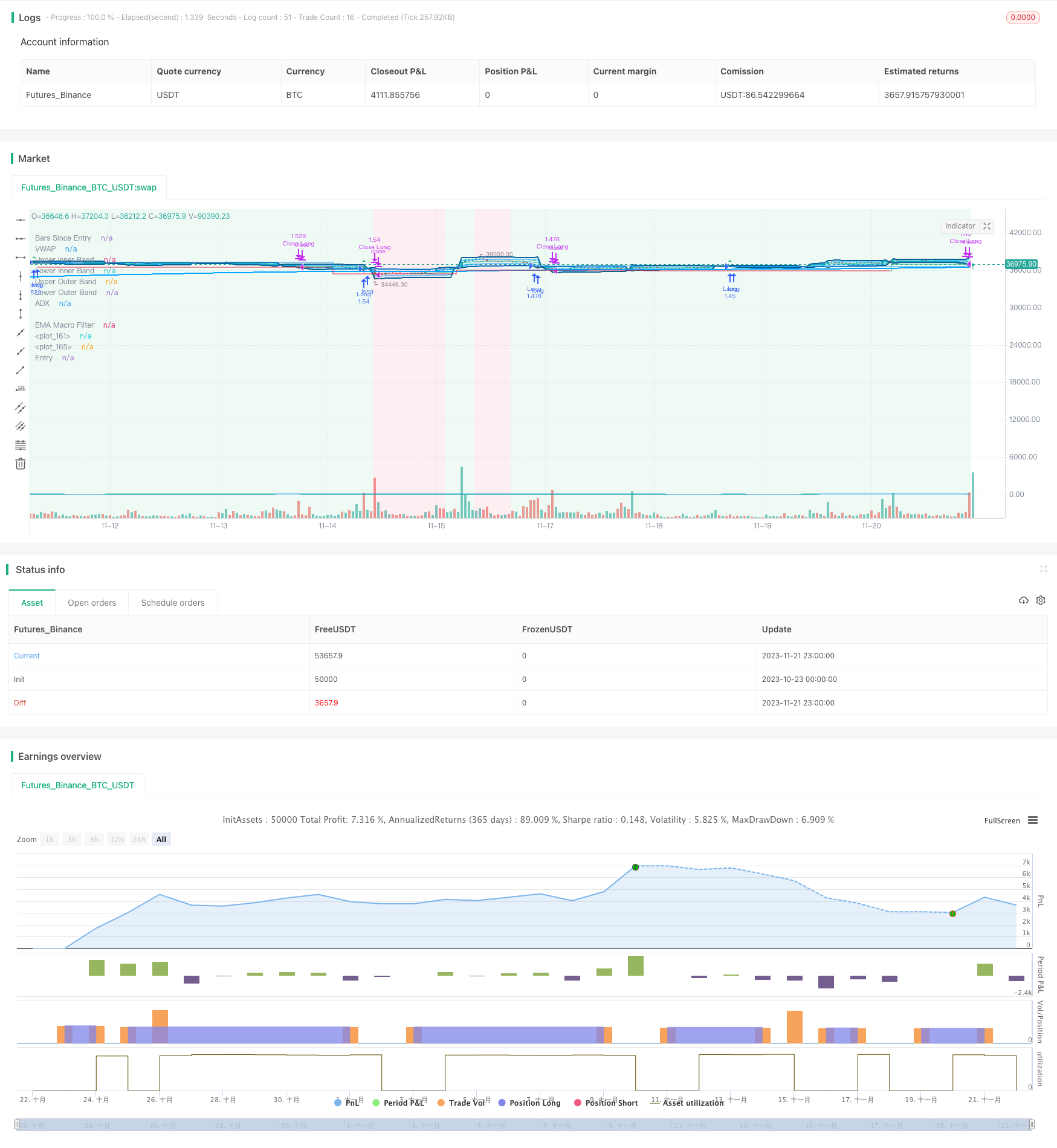

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © jordanfray

//@version=5

strategy(title="Double VWAP Strategy", overlay=true, scale=scale.none, max_bars_back=500, default_qty_type=strategy.percent_of_equity, default_qty_value=100,initial_capital=100000, commission_type=strategy.commission.percent, commission_value=0.05, backtest_fill_limits_assumption=2)

// Indenting Classs

indent_1 = " "

indent_2 = " "

indent_3 = " "

indent_4 = " "

// Group Titles

group_one_title = "VWAP Settings"

group_two_title = "ADX Settings"

group_three_title = "Entry Settings"

group_four_title = "Limit Entries"

// Input Tips

adx_thresholdToolTip = "The minumn ADX value to allow opening a postion"

adxCancelToolTip= "You can optionally set a different lower value for ADX that will allow entries even if below the trigger threshold."

ocean_blue = color.new(#0C6090,0)

sky_blue = color.new(#00A5FF,0)

green = color.new(#2DBD85,0)

red = color.new(#E02A4A,0)

light_blue = color.new(#00A5FF,90)

light_green = color.new(#2DBD85,90)

light_red = color.new(#E02A4A,90)

light_yellow = color.new(#FFF900,90)

white = color.new(#ffffff,0)

transparent = color.new(#000000,100)

// Strategy Settings - VWAP

var cumVol = 0.

cumVol += nz(volume)

if barstate.islast and cumVol == 0

runtime.error("No volume is provided by the data vendor.")

computeVWAP(src, isNewPeriod, stDevMultiplier) =>

var float sum_src_vol = na

var float sum_vol = na

var float sum_src_src_vol = na

sum_src_vol := isNewPeriod ? src * volume : src * volume + sum_src_vol[1]

sum_vol := isNewPeriod ? volume : volume + sum_vol[1]

sum_src_src_vol := isNewPeriod ? volume * math.pow(src, 2) : volume * math.pow(src, 2) + sum_src_src_vol[1]

_vwap = sum_src_vol / sum_vol

variance = sum_src_src_vol / sum_vol - math.pow(_vwap, 2)

variance := variance < 0 ? 0 : variance

standard_deviation = math.sqrt(variance)

lower_band_value = _vwap - standard_deviation * stDevMultiplier

upper_band_value = _vwap + standard_deviation * stDevMultiplier

[_vwap, lower_band_value, upper_band_value]

var anchor = input.string(defval="Session", title="Anchor Period", options=["Session", "Week", "Month", "Quarter", "Year"], group=group_one_title)

src = input(defval = close, title = "Inner VWAP Source", group=group_one_title)

multiplier_inner = input(defval=1.0, title="Inner Bands Multiplier", group=group_one_title)

multiplier_outer = input(defval=2.0, title="Outer Bands Multiplier", group=group_one_title)

show_bands = true

timeChange(period) =>

ta.change(time(period))

isNewPeriod = switch anchor

"Session" => timeChange("D")

"Week" => timeChange("W")

"Month" => timeChange("M")

"Quarter" => timeChange("3M")

"Year" => timeChange("12M")

=> false

float vwap_val = na

float upper_inner_band_value = na

float lower_inner_band_value = na

float upper_outer_band_value = na

float lower_outer_band_value = na

[inner_vwap, inner_bottom, inner_top] = computeVWAP(src, isNewPeriod, multiplier_inner)

[outer_vwap, outer_bottom, outer_top] = computeVWAP(src, isNewPeriod, multiplier_outer)

vwap_val := inner_vwap

upper_inner_band_value := show_bands ? inner_top : na

lower_inner_band_value := show_bands ? inner_bottom : na

upper_outer_band_value := show_bands ? outer_top : na

lower_outer_band_value := show_bands ? outer_bottom : na

plot(vwap_val, title="VWAP", color=green)

upper_inner_band = plot(upper_inner_band_value, title="Upper Inner Band", color=sky_blue)

lower_inner_band = plot(lower_inner_band_value, title="Lower Inner Band", color=sky_blue)

upper_outer_band = plot(upper_outer_band_value, title="Upper Outer Band", linewidth=2, color=ocean_blue)

lower_outer_band = plot(lower_outer_band_value, title="Lower Outer Band", linewidth=2, color=ocean_blue)

fill(upper_outer_band, lower_outer_band, title="VWAP Bands Fill", color= show_bands ? light_blue : na)

// ADX Settings

adx_len = input.int(defval=14, title="ADX Smoothing", group=group_two_title)

di_len = input.int(defval=14, title="DI Length", group=group_two_title)

adx_threshold = input.int(defval=40, title="ADX Threshold", group=group_two_title, tooltip=adx_thresholdToolTip)

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plus_dm = na(up) ? na : (up > down and up > 0 ? up : 0)

minus_dm = na(down) ? na : (down > up and down > 0 ? down : 0)

true_range = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plus_dm, len) / true_range)

minus = fixnan(100 * ta.rma(minus_dm, len) / true_range)

[plus, minus]

adx(di_len, adx_len) =>

[plus, minus] = dirmov(di_len)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adx_len)

adx_val = adx(di_len, adx_len)

plot(adx_val, title="ADX")

// Entry Settings

stop_loss_val = input.float(defval=2.0, title="Stop Loss (%)", step=0.1, group=group_three_title)/100

take_profit_val = input.float(defval=6.0, title="Take Profit (%)", step=0.1, group=group_three_title)/100

long_entry_limit_lookback = input.int(defval=1, title="Long Entry Limit Lookback", minval=1, step=1, group=group_three_title)

short_entry_limit_lookback = input.int(defval=1, title="Short Entry Limit Lookback", minval=1, step=1, group=group_three_title)

limit_order_long_price = ta.lowest(close, long_entry_limit_lookback)

limit_order_short_price = ta.highest(close, short_entry_limit_lookback)

start_trailing_after = input.float(defval=3, title="Start Trailing After (%)", step=0.1, group=group_three_title)/100

trail_behind = input.float(defval=2, title="Trail Behind (%)", step=0.1, group=group_three_title)/100

close_early_if_crosses_outter_band = input.bool(defval=false, title="Close early if price crosses outer VWAP band")

// Limit Entries

enableEmaFilter = input.bool(defval=true, title="Use EMA Filter", group=group_four_title)

emaFilterTimeframe = input.timeframe(defval="", title=indent_4+"Timeframe", group=group_four_title)

emaFilterLength = input.int(defval=300, minval=1, step=10, title=indent_4+"Length", group=group_four_title)

emaFilterSource = input.source(defval=hl2, title=indent_4+"Source", group=group_four_title)

ema_filter = ta.ema(emaFilterSource, emaFilterLength)

ema_filter_smoothed = request.security(syminfo.tickerid, emaFilterTimeframe, ema_filter[barstate.isrealtime ? 1 : 0], gaps=barmerge.gaps_on)

plot(enableEmaFilter ? ema_filter_smoothed: na, title="EMA Macro Filter", linewidth=2, color=sky_blue, editable=true)

useTimeFilter = input.bool(defval=false, title="Use Time Session Filter", group=group_four_title)

withinTime = true

long_start_trailing_val = strategy.position_avg_price + (strategy.position_avg_price * start_trailing_after)

short_start_trailing_val = strategy.position_avg_price - (strategy.position_avg_price * start_trailing_after)

long_trail_behind_val = close - (strategy.position_avg_price * (trail_behind/100))

short_trail_behind_val = close + (strategy.position_avg_price * (trail_behind/100))

currently_in_a_long_postion = strategy.position_size > 0

currently_in_a_short_postion = strategy.position_size < 0

long_profit_target = strategy.position_avg_price * (1 + take_profit_val)

long_stop_loss = strategy.position_avg_price * (1.0 - stop_loss_val)

short_profit_target = strategy.position_avg_price * (1 - take_profit_val)

short_stop_loss = strategy.position_avg_price * (1 + stop_loss_val)

bars_since_entry = currently_in_a_long_postion or currently_in_a_short_postion ? bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) + 1 : 5

plot(bars_since_entry, editable=false, title="Bars Since Entry", color=green)

long_run_up = ta.highest(high, bars_since_entry)

long_trailing_stop = currently_in_a_long_postion and bars_since_entry > 0 and long_run_up > long_start_trailing_val ? long_run_up - (long_run_up * trail_behind) : long_stop_loss

//long_run_up_line = plot(long_run_up, style=plot.style_stepline, editable=false, color=currently_in_a_long_postion ? green : transparent)

long_trailing_stop_line = plot(long_trailing_stop, style=plot.style_stepline, editable=false, color=currently_in_a_long_postion ? long_trailing_stop > strategy.position_avg_price ? green : red : transparent)

short_run_up = ta.lowest(low, bars_since_entry)

short_trailing_stop = currently_in_a_short_postion and bars_since_entry > 0 and short_run_up < short_start_trailing_val ? short_run_up + (short_run_up * trail_behind) : short_stop_loss

//short_run_up_line = plot(short_run_up, style=plot.style_stepline, editable=false, color=currently_in_a_short_postion ? green : transparent)

short_trailing_stop_line = plot(short_trailing_stop, style=plot.style_stepline, editable=false, color=currently_in_a_short_postion ? short_trailing_stop < strategy.position_avg_price ? green : red : transparent)

// Conditions

adx_is_below_threshold = adx_val < adx_threshold

price_crossed_down_VWAP_lower_outer_band = ta.crossunder(low, lower_outer_band_value)

price_closed_above_VWAP_lower_outer_band = close > lower_outer_band_value

price_crossed_up_VWAP_upper_outer_band = ta.crossover(high,upper_outer_band_value)

price_closed_below_VWAP_upper_outer_band = close < upper_outer_band_value

price_above_ema_filter = close > ema_filter_smoothed

price_below_ema_filter = close < ema_filter_smoothed

//Trade Restirctions

no_trades_allowed = not withinTime or not adx_is_below_threshold

// Enter trades when...

long_conditions_met = enableEmaFilter ? price_above_ema_filter and not currently_in_a_long_postion and withinTime and adx_is_below_threshold and price_crossed_down_VWAP_lower_outer_band and price_closed_above_VWAP_lower_outer_band : not currently_in_a_long_postion and withinTime and adx_is_below_threshold and price_crossed_down_VWAP_lower_outer_band and price_closed_above_VWAP_lower_outer_band

short_conditions_met = enableEmaFilter ? price_below_ema_filter and not currently_in_a_short_postion and withinTime and adx_is_below_threshold and price_crossed_up_VWAP_upper_outer_band and price_closed_below_VWAP_upper_outer_band : not currently_in_a_short_postion and withinTime and adx_is_below_threshold and price_crossed_up_VWAP_upper_outer_band and price_closed_below_VWAP_upper_outer_band

plotshape(long_conditions_met ? close : na, title="Long Entry Symbol", color=green, style=shape.triangleup, location=location.abovebar)

plotshape(short_conditions_met ? close : na, title="Short Entry Symbol", color=red, style=shape.triangledown, location=location.belowbar)

// Take Profit When...

price_closed_below_short_trailing_stop = ta.cross(close, short_trailing_stop)

price_hit_short_entry_profit_target = low > short_profit_target

price_closed_above_long_entry_trailing_stop = ta.cross(close, long_trailing_stop)

price_hit_long_entry_profit_target = high > long_profit_target

long_position_take_profit = close_early_if_crosses_outter_band ? price_crossed_up_VWAP_upper_outer_band or price_closed_above_long_entry_trailing_stop or price_hit_long_entry_profit_target : price_closed_above_long_entry_trailing_stop or price_hit_long_entry_profit_target

short_position_take_profit = close_early_if_crosses_outter_band ? price_crossed_down_VWAP_lower_outer_band or price_closed_below_short_trailing_stop or price_hit_short_entry_profit_target : price_closed_below_short_trailing_stop or price_hit_short_entry_profit_target

// Cancel limir order if...

cancel_long_condition = false

cancel_short_condition = false

// Long Entry

strategy.entry(id="Long", direction=strategy.long, limit=limit_order_long_price, when=long_conditions_met)

strategy.cancel(id="Cancel Long", when=cancel_long_condition)

strategy.exit(id="Close Long", from_entry="Long", stop=long_trailing_stop, limit=long_profit_target, when=long_position_take_profit)

// Short Entry

strategy.entry(id="Short", direction=strategy.short, limit=limit_order_short_price, when=short_conditions_met)

strategy.cancel(id="Cancel Short", when=cancel_short_condition)

strategy.exit(id="Close Short", from_entry="Short", stop=short_trailing_stop, limit=short_profit_target, when=short_position_take_profit)

entry = plot(strategy.position_avg_price, editable=false, title="Entry", style=plot.style_stepline, color=currently_in_a_long_postion or currently_in_a_short_postion ? color.blue : transparent, linewidth=1)

fill(entry,long_trailing_stop_line, editable=false, color=currently_in_a_long_postion ? long_trailing_stop > strategy.position_avg_price ? light_green : light_red : transparent)

fill(entry,short_trailing_stop_line, editable=false, color=currently_in_a_short_postion ? short_trailing_stop < strategy.position_avg_price ? light_green : light_red : transparent)

bgcolor(title="No Trades Allowed", color=no_trades_allowed ? light_red : light_green)