概述

熊市反转哈拉米回测策略通过识别蜡烛图中的熊市反转哈拉米形态,实现自动交易。当识别到熊市反转哈拉米形态时,该策略会进入做空头寸;当止损或止盈后,平仓头寸。

策略原理

该策略的核心识别指标是:前一根K线为长阳线,第二根K线收盘价包含在前一根K线实体内,并且为阴线,则可能形成熊市反转哈拉米形态。符合该形态时,策略会进入做空头寸。

具体判断逻辑是: 1. 计算前一根K线体大小ABS(Close1 - Open1)是否大于设置的最小实体大小 2. 判断前一根K线是否为阳线 Close1 > Open1 3. 判断当前K线是否为阴线 Open > Close 4. 判断当前K线开盘价是否小于等于前一根K线收盘价 Open <= Close1 5. 判断前一根K线开盘价是否小于等于当前K线收盘价 Open1 <= Close 6. 判断当前K线实体是否小于前一根K线 Open - Close < Close1 - Open1 7. 满足以上条件则形成熊市反转哈拉米,进入做空头寸

优势分析

该策略具有以下优势:

- 利用熊市反转哈拉米强势反转信号,增大获利概率

- 回测数据充足,模拟交易结果优良

- 策略逻辑简单清晰,容易理解与优化

- 可自定义止盈止损点,控制风险

风险分析

该策略也存在一些风险:

- 市场可能出现假突破,造成头寸被套。可适当放宽止损点,或增加过滤条件。

- 标的证券价格波动可能过大,无法止损。应选择波动率较低的交易品种。

- 回测数据不足,可能无法反映真实市场情况。应增加回测数据量,并做实盘验证。

优化方向

该策略还可从以下方面进行优化:

- 增加Volume,MACD等指标过滤,提高信号质量

- 优化止盈止损策略,动态调整点位

- 提高持仓效率,结合趋势等因素,减少无效交易

- 尝试不同交易品种,选择波动率更合适的品种

总结

熊市反转哈拉米回测策略整体逻辑清晰,易于理解和优化,回测结果较好。风险可控,具有实盘调整空间。整体而言,该策略形成的交易信号较为可靠,值得进一步实盘验证与优化。

策略源码

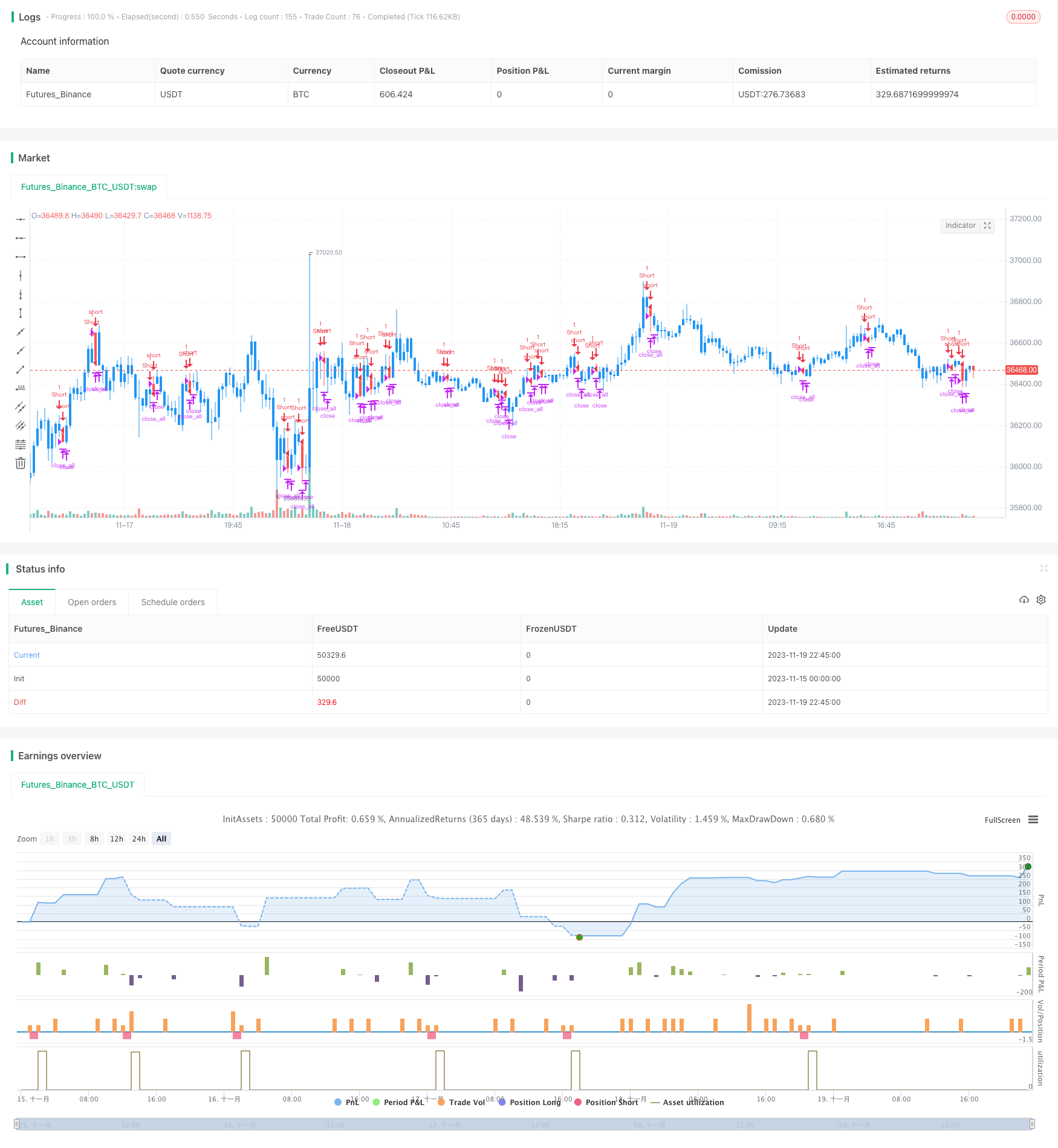

/*backtest

start: 2023-11-15 00:00:00

end: 2023-11-19 23:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 16/01/2019

// This is a bearish reversal pattern formed by two candlesticks in which a short

// real body is contained within the prior session's long real body. Usually the

// second real body is the opposite color of the first real body. The Harami pattern

// is the reverse of the Engulfing pattern.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title = "Bearish Harami Backtest", overlay = true)

input_takeprofit = input(20, title="Take Profit pip")

input_stoploss = input(10, title="Stop Loss pip")

input_minsizebody = input(3, title="Min. Size Body pip")

barcolor(abs(close- open) >= input_minsizebody ? close[1] > open[1] ? open > close ? open <= close[1] ? open[1] <= close ? open - close < close[1] - open[1] ? yellow :na :na : na : na : na : na)

pos = 0.0

barcolor(nz(pos[1], 0) == -1 ? red: nz(pos[1], 0) == 1 ? green : blue )

posprice = 0.0

posprice := abs( close - open) >= input_minsizebody? close[1] > open[1] ? open > close ? open <= close[1] ? open[1] <= close ? open - close < close[1] - open[1] ? close :nz(posprice[1], 0) :nz(posprice[1], 0) : nz(posprice[1], 0) : nz(posprice[1], 0) : nz(posprice[1], 0): nz(posprice[1], 0)

pos := iff(posprice > 0, -1, 0)

if (pos == 0)

strategy.close_all()

if (pos == -1)

strategy.entry("Short", strategy.short)

posprice := iff(low <= posprice - input_takeprofit and posprice > 0, 0 , nz(posprice, 0))

posprice := iff(high >= posprice + input_stoploss and posprice > 0, 0 , nz(posprice, 0))