概述

该策略是一个利用K线实体大小和趋势动量指标EMA来判断市场趋势,实现低买高卖的自动交易策略。其基本思路是在上升行情中追涨杀跌,在下降行情中回补做多。

策略原理

- 根据K线实体大小将蜡烛分为渣渣蜡烛、小蜡烛、大蜡烛三种类型。

- 在EMA上升的情况下,如果出现大红蜡烛,说明市场在调整,此时抛出多单。

- 在EMA下降的情况下,如果出现大绿蜡烛,说明市场企稳,此时加仓建仓。

- 通过实时监控K线实体变化和EMA趋势,动态调整仓位。

优势分析

- 策略思路清晰,通过简单指标判断市场结构,容易理解。

- 策略参数较少,不易过拟合,稳定性较高。

- 实现了低吸高抛的交易逻辑,在行情大幅波动时获利明显。

- 兼顾趋势和反转,在行情转换时也能及时反应。

风险及优化

- 未考虑股价的绝对幅度,可能导致止损风险。可以结合ATR指标进行止损。

- 没有考虑加密货币的基差问题,可以测试更多的交易对。

- 可以引入机器学习算法辅助判断K线形态。

- 可以结合交易量指标筛选品种。

- 可以测试不同周期的参数调整。

总结

本策略整体思路清晰易懂,主要突出“动量”和“追踪”两个特点。通过简单的EMABOLL指标判断市场主线方向,K线实体判断局部调整,实现低吸高抛的高效交易。策略稳定性较高,在加密货币中表现尤为出色,值得进一步测试优化。

策略源码

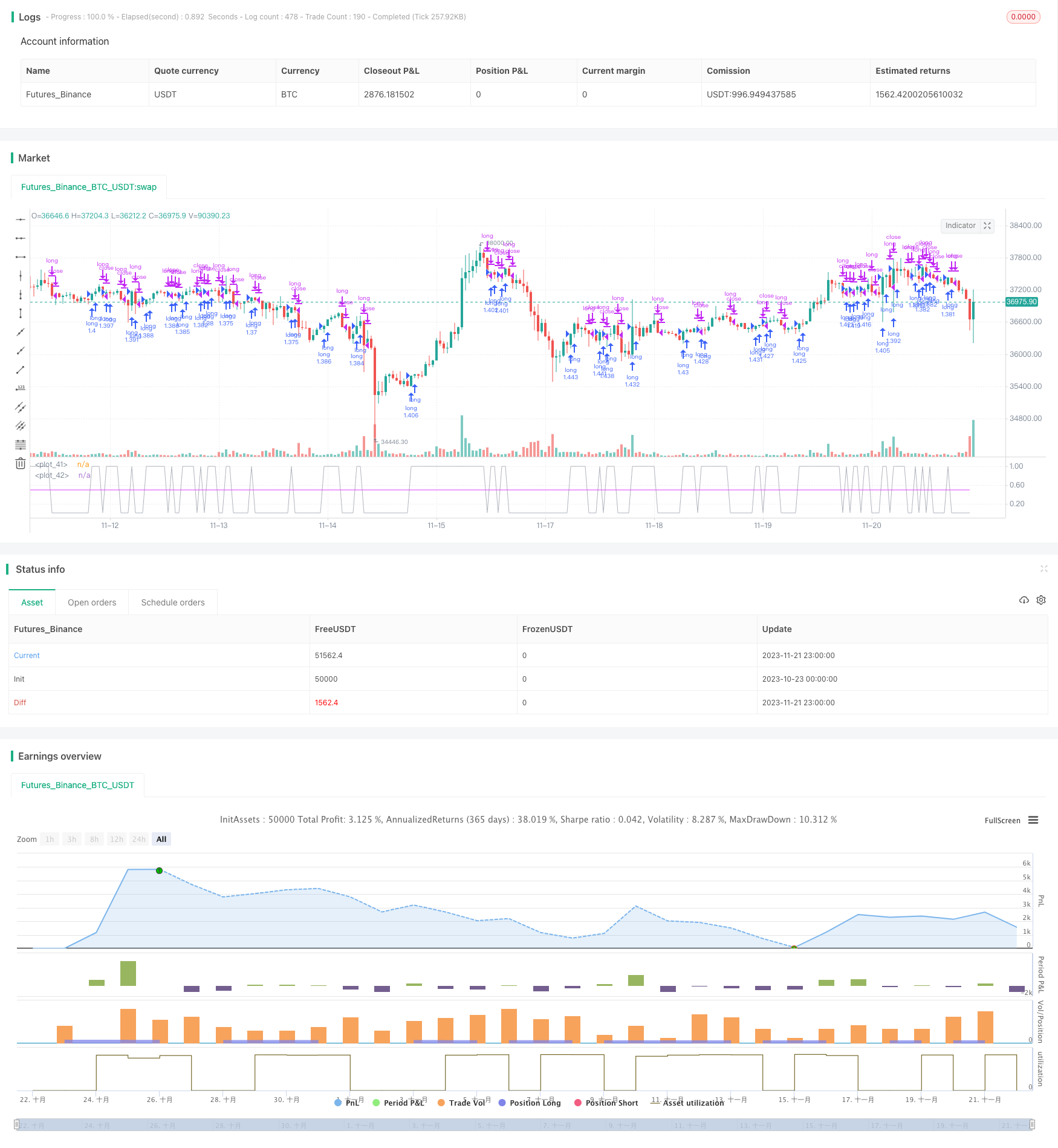

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Author @divonn1994

strategy(title='Trend Follower Strategy v2 [divonn1994]', shorttitle='TrendFollowStrategyV2', overlay=false, pyramiding=0, default_qty_value=100, default_qty_type=strategy.percent_of_equity, precision=7, currency=currency.USD, commission_value=0.1, commission_type=strategy.commission.percent, initial_capital=100)

//Important Constants for Classifying Candle Size----------------------------------------------------------------------------------------------------------------------------------------------

timesBigger = 2

crumbSize = 1400

crumbSize2 = 2100

bigCandleSize = 3800

//Key Alerts and Classifications of Candle Size and EMAs---------------------------------------------------------------------------------------------------------------------------------------

emaAlert = ta.ema(close, 8) > ta.ema(open, 8) ? 1 : 0

CandleSize = close * 1 - open * 1

previousCandleSize = close[1] * 1 - open[1] * 1

greenCandle = close > open ? 1 : 0

previousGreenCandle = close[1] > open[1] ? 1 : 0

crumb = (greenCandle==1 and CandleSize<=crumbSize) or (greenCandle==0 and -CandleSize<=crumbSize) ? 1 : 0

bigCrumb = (greenCandle==1 and CandleSize<=crumbSize2 and CandleSize>crumbSize) or (greenCandle==0 and -CandleSize<=crumbSize2 and -CandleSize>crumbSize) ? 1 : 0

previousCandleIsSmallCrumb = (previousGreenCandle==1 and previousCandleSize<=crumbSize) or (previousGreenCandle==0 and -previousCandleSize<=crumbSize) ? 1 : 0

previousCandleIsBigCrumb = (previousGreenCandle==1 and previousCandleSize<=crumbSize2 and previousCandleSize>crumbSize) or (previousGreenCandle==0 and -previousCandleSize<=crumbSize2 and -previousCandleSize>crumbSize) ? 1 : 0

bigCandle = (greenCandle==1 and previousCandleIsBigCrumb==1 and CandleSize>=math.abs(timesBigger*previousCandleSize)) or (greenCandle==1 and previousCandleIsSmallCrumb==1 and CandleSize>=bigCandleSize) or (greenCandle==1 and previousCandleIsSmallCrumb==0 and previousCandleIsBigCrumb==0 and CandleSize>=math.abs(timesBigger*previousCandleSize)) ? 1 : 0

//Engine (Secret Sauce)------------------------------------------------------------------------------------------------------------------------------------------------------------------------

buy = (crumb==0 and bigCrumb==0 and greenCandle==0) or (greenCandle==1 and bigCandle==1) or (emaAlert==0) ? 0 : 1

//Strategy-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

if ta.crossover(buy, 0.5)

strategy.entry('long', strategy.long, comment='long')

if ta.crossunder(buy, 0.5)

strategy.close('long')

//Plot Strategy Behavior-----------------------------------------------------------------------------------------------------------------------------------------------------------------------

plot(buy, color=color.new(color.silver, 0))

plot(0.5, color=color.new(color.fuchsia, 0))