基于T3指标和CCI指标的趋势追踪策略

概述

这是一个利用T3平滑移动平均线和CCI指标实现趋势追踪的量化策略。该策略通过计算T3-CCI指标来识别趋势,并在获得双重确认信号时入市,以追踪趋势。

策略原理

该策略首先计算出T3平滑移动平均线和CCI指标。然后将CCI指标通过一系列滤波计算成T3-CCI指标。当T3-CCI指标上穿0轴线时产生买入信号,下穿0轴线时产生卖出信号。为了过滤假信号,该策略要求T3-CCI指标连续两个周期保持同一信号才会下单。

具体来说,该策略采用以下步骤:

- 计算CCI指标和T3指标

- 将CCI指标通过一系列数字滤波器转换为T3-CCI指标

- 判断T3-CCI指标的多空状态

- 等待两个bar的持续信号作为入市信号

策略优势分析

该策略具有以下优势:

- 利用T3指标有效平滑CCI指标,过滤市场噪音

- 采用双重确认机制,避免产生假信号

- 追踪中长线趋势,避开短期回调

风险分析

该策略也存在一定的风险:

- 在震荡行情中容易产生假信号

- 双重确认机制可能错过短线机会

- 大幅趋势反转时止损风险较大

对策:

- 调整CCI和T3参数,优化指标效果

- 可以适当缩短确认周期,或同时运行快慢参数组合

- 采用移动止损或及时止损,控制单笔损失

优化方向

该策略可以从以下几个方向进行优化:

- 调整CCI和T3参数,适应不同周期和市场

- 增加趋势判断指标,提高信号质量

- 基于波动率自动调整止损位置

- 利用机器学习方法动态优化参数

总结

该策略整体来说是一个可靠的中长线趋势追踪策略。它利用双重确认和趋势跟踪特点控制了风险,可以作为趋势交易的基础策略。通过参数和规则优化,可以进一步提高策略表现。

策略源码

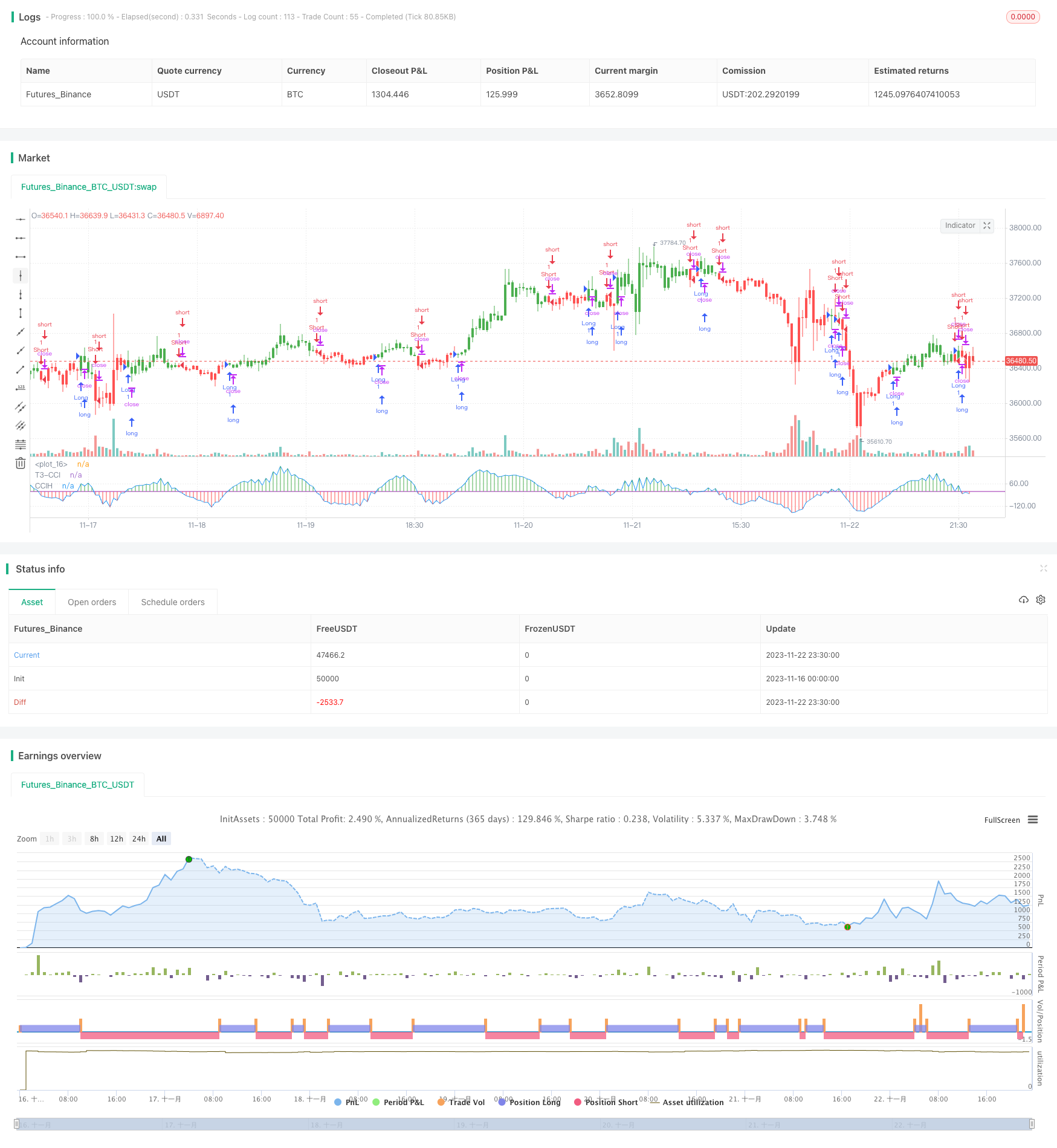

/*backtest

start: 2023-11-16 00:00:00

end: 2023-11-23 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 19/12/2016

// This simple indicator gives you a lot of useful information - when to enter, when to exit

// and how to reduce risks by entering a trade on a double confirmed signal.

//

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="FX Sniper: T3-CCI Strategy", shorttitle="T3-CCI")

CCI_Period = input(14, minval=1)

T3_Period = input(5, minval=1)

b = input(0.618)

reverse = input(false, title="Trade reverse")

hline(0, color=purple, linestyle=line)

xPrice = close

b2 = b*b

b3 = b2*b

c1 = -b3

c2 = (3*(b2 + b3))

c3 = -3*(2*b2 + b + b3)

c4 = (1 + 3*b + b3 + 3*b2)

nn = iff(T3_Period < 1, 1, T3_Period)

nr = 1 + 0.5*(nn - 1)

w1 = 2 / (nr + 1)

w2 = 1 - w1

xcci = cci(xPrice, CCI_Period)

e1 = w1*xcci + w2*nz(e1[1])

e2 = w1*e1 + w2*nz(e2[1])

e3 = w1*e2 + w2*nz(e3[1])

e4 = w1*e3 + w2*nz(e4[1])

e5 = w1*e4 + w2*nz(e5[1])

e6 = w1*e5 + w2*nz(e6[1])

xccir = c1*e6 + c2*e5 + c3*e4 + c4*e3

cciHcolor = iff(xccir >= 0 , green,

iff(xccir < 0, red, black))

pos = iff(xccir > 0, 1,

iff(xccir < 0, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xccir, color=blue, title="T3-CCI")

plot(xccir, color=cciHcolor, title="CCIH", style = histogram)