概述

该策略是基于CCI指标的趋势跟踪策略。它使用两个不同周期的CCI指标进行交易信号生成。具体来说,它会监测一个较短周期的CCI指标是否突破一个较长周期的CCI指标,根据突破的方向来决定做多或做空。

策略原理

该策略的核心逻辑是:

- 定义两个CCI指标,ci1为14周期,ci2为56周期

- 当ci1向上突破ci2时,做多

- 当ci1向下突破ci2时,做空

- 交易信号发出后,通过ci1和ci2的数值来决定持仓的平仓

做多的具体规则是:

- ci1上穿ci2,即短周期CCI上穿长周期CCI

- 止损条件:ci1<-50且变化率或ci1跌破-100

做空的具体规则是:

- ci1下穿ci2,即短周期CCI下穿长周期CCI

- 止损条件:ci1>100且变化率>0或ci2上穿100

可以看出,该策略利用较短周期CCI的敏感性以及较长周期CCI的稳定性,实现了趋势的识别和跟踪。

策略优势

该策略具有以下优势:

- 利用CCI指标的优势,能够有效识别趋势

- 双CCI设计可以过滤掉部分噪音交易

- 通过长短周期CCI指标的组合,可以在跟踪趋势的同时控制风险

- 策略规则简单清晰,容易理解和实现

- 可配置性较强,CCI周期和止损条件都可以自定义

策略风险

该策略也存在一些风险:

- CCI指标对于横盘和震荡行情识别能力较弱

- 长短周期CCI可能发生背离,导致交易信号错误

- 止损条件设置不当可能造成较大亏损

- 参数设置不当也会对策略收益产生较大影响

对应风险的解决方法:

- 可以结合其他指标来判断行情,避免在震荡行情中交易

- 增加过滤条件,避免长短周期CCI背离带来的错误信号

- 优化和测试不同的止损条件

- 通过回测和参数优化选择合适的参数组合

策略优化方向

该策略还可以进一步优化的地方包括:

- 增加其他指标判断,形成更 SYSTEM 的交易系统

- 测试不同weekday和session的收益差异

- 结合 machine learning 方法寻找更优的参数

- 根据不同品种特性调整参数

- 优化开仓和平仓条件

总结

本策略整体来说是一个基于长短周期CCI指标突破的简单趋势跟踪策略。它能够有效识别趋势方向并跟踪趋势。同时通过止损等手段控制风险。本策略简单实用,参数调整灵活,可作为量化交易的入门策略。通过进一步优化和组合,可以形成更强大的交易系统。

策略源码

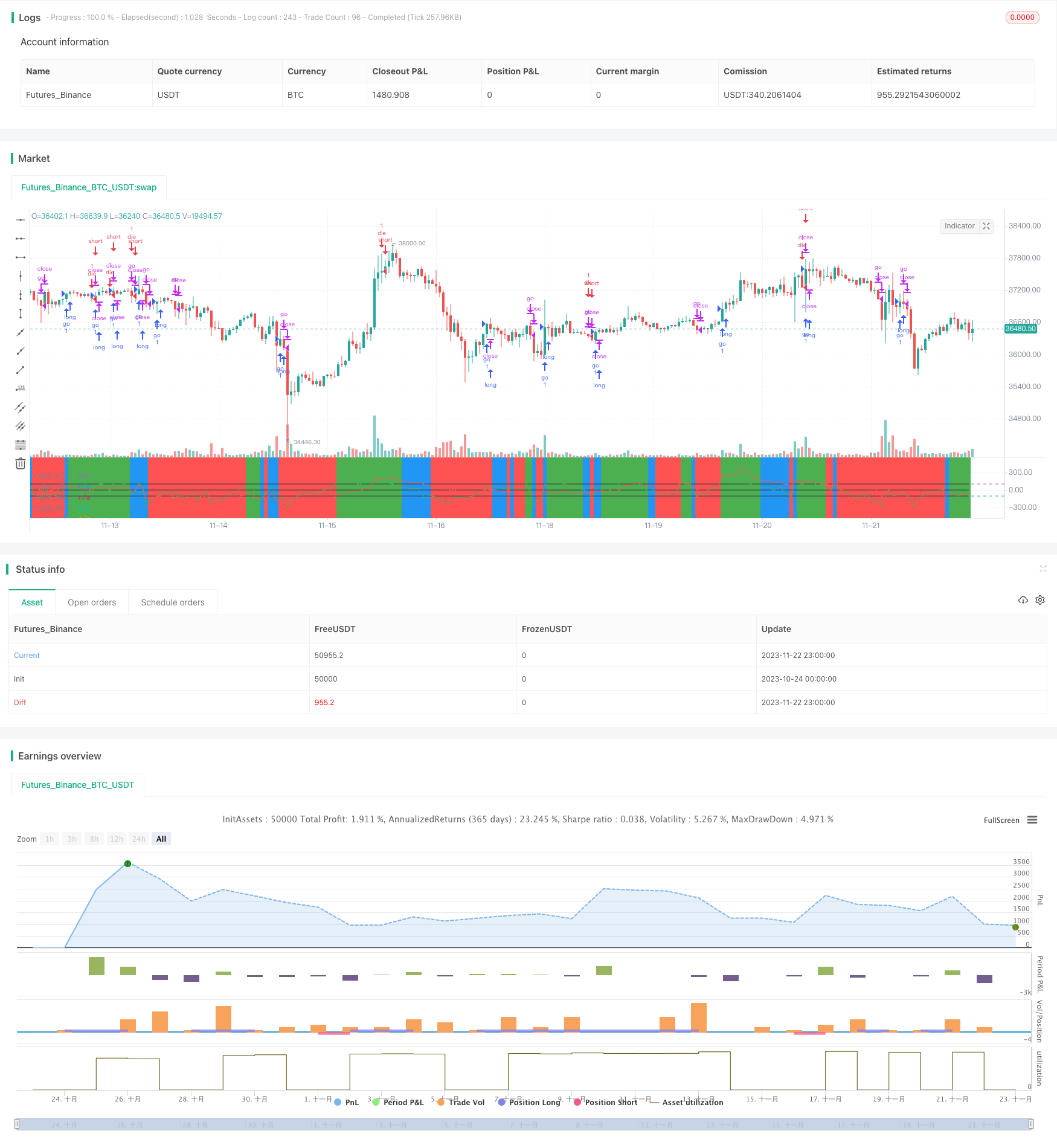

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="my work",calc_on_order_fills=true,currency=currency.USD, default_qty_type=strategy.percent_of_equity,commission_type=strategy.commission.percent)

source = close

shortlength=input(14)

longlength=input(56)

aa=input(2)

Ss=input(75)

//Cci part

ci1=cci(source,shortlength) //4시간봉의 기본 cci

ci2=cci(source,longlength) //4시간봉에서 12시봉의 cci 무빙측정

//오린간 선생님의 WT + ichimoku

len = input(10)

lenTurn = input(9)

lenStd = input(26)

wtm_e(so, l) =>

esa = ema(so, l)

d = ema(abs(so - esa), l)

ci = (so - esa) / (0.015 * d)

ema(ci, l*2+1)

alh(len) => avg(lowest(len), highest(len))

alh_src(src, len) => avg(lowest(src, len), highest(src, len))

wt = wtm_e(close,len)

turn = alh_src(wt, lenTurn)

std = alh_src(wt, lenStd)

cnt = 0

if wt > turn

cnt:=cnt+1

if wt > std

cnt:=cnt+1

//100,-100선

h0 = hline(100)

h1 = hline(-100)

//plot(ci,color=green)

// plot(k,color=green)

// plot(d,color=red)

plot(ci1,color=green)

plot(ci2,color=red)

plot(0,color=black)

plot(100,color=black)

plot(-100,color=black)

fill(h0,h1,color=purple,transp=95)

bgcolor(cnt==0 ? red : cnt==1 ? blue : cnt == 2 ? green : na, transp = Ss)

//기간조정

Fromday = input(defval=1, title="from day", minval=1, maxval=31)

FromMonth = input(defval=1, title="from month", minval=1, maxval=12)

FromYr = input(defval=2019, title="from yr", minval=1970)

Today = input(defval=13, title="to day", minval=1, maxval=31)

ToMonth = input(defval=12, title="to month", minval=1, maxval=12)

ToYr = input(defval=2019, title="to yr", minval=1970)

startDate = timestamp(FromYr, FromMonth, Fromday, 00, 00)

finishDate = timestamp(ToYr, ToMonth, Today, 00, 00)

Time_cond = true

/////롱

if crossover(ci1,ci2) and change(ci2)>0 and Time_cond

strategy.entry("go", strategy.long, comment="go")

strategy.close("go", (ci2<0 and ci1 <-50 and change(ci1)<0) or (crossunder(ci1,-100) and strategy.openprofit<0) and change(cnt)<0)

/////숏

if (crossunder(ci1,ci2) and change(ci2)<0 and falling(ci1,aa)) and Time_cond

strategy.entry("die", strategy.short, comment="die")

strategy.close("die", (ci2>0 and ci1 > 100 and change(ci1)>0) or (crossover(ci2,100) and strategy.openprofit<0) and change(cnt)>0)