概述

本策略通过结合3个开源指标实现多时间轴的趋势判断,并设置止损止盈以锁定利润。具体来说,策略使用AK MACD BB指标判断短期趋势方向,SSL指标过滤掉部分假信号,最后结合成交量指标VSF判断真实买卖盘力度,从而判断入场时机。同时,策略预设止损止盈点以锁定利润,可大幅降低单笔交易的亏损风险。

策略原理

AK MACD BB指标

该指标将布林带应用于MACD指标,MACD指标线突破布林带上轨时产生买入讯号,下轨时产生卖出讯号。

SSL指标

SSL指标判断价格是否突破均线,并检测回试信号。价格上穿均线且SSL指标为蓝色时为上升趋势,价格下穿均线且SSL指标为红色时为下降趋势,发出交易信号。

VSF指标

VSF指标判断买卖双方力量。策略只在买方力量或卖方力量大于50%时发出信号,避免无效突破。

止损止盈

策略含有4档 progressive take profit,从1.5倍到3倍利润间隔设置。同时设置2%固定止损,有效控制单笔交易最大亏损。

优势分析

多指标组合,判断准确

通过不同指标判断多时间轴趋势,可过滤假信号,判断更准确。

自动止盈止损,风险可控

策略内置止盈止损设置,可将单笔交易亏损控制在2%左右,避免出现巨亏。

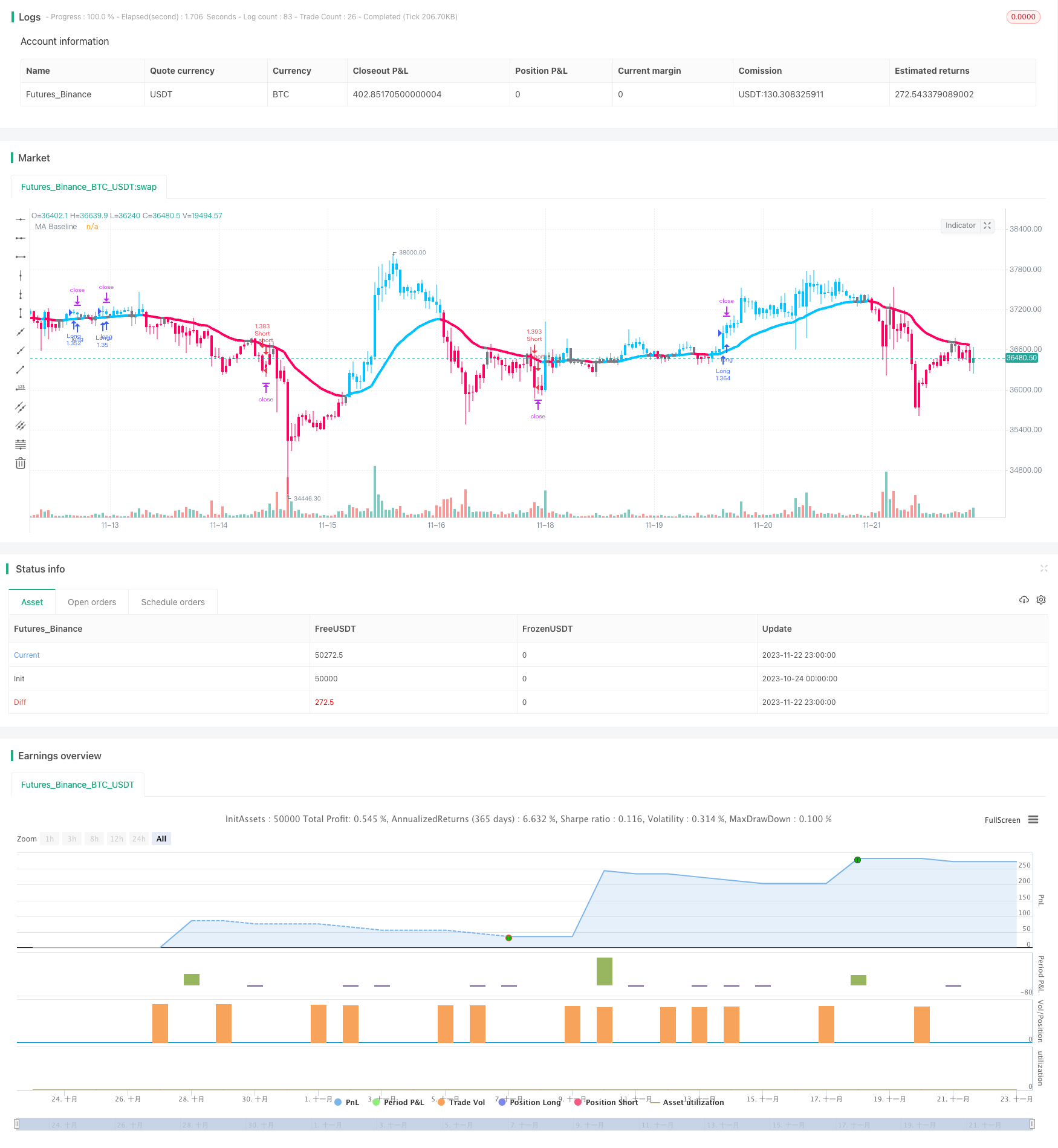

回测数据优异

根据发布者回测,100笔交易中,获利交易达到74%,427%总盈利。

风险及对策分析

市场剧烈波动风险

在大级别区间震荡时,可能出现多次小幅亏损。此时可调整固定止损幅度,或暂停交易。

多头空头受限风险

目前策略可做多可做空。若限制只做多或只做空,则无法获利的机会将减少一半。

交易时段风险

策略使用5分钟数据进行判断,如果在一个交易日中只有几个小时数据,则样本量不足,信号可能不可靠。

策略优化方向

优化止损止盈参数

可以测试不同的止损止盈水平,找到最优参数。止损过小无法有效控制风险,止损过大则可能错失更大利润。

增加自动位置调整

可设置追踪止损或移动止损来锁定利润。或根据特定条件加仓以获利更多。

结合其他指标

可测试不同指标的组合,判断哪些指标组合效果最好。也可以加入更多指标进行交叉验证。

参数优化

可通过不同参数进行回测,找到参数优化方向。本策略中,改变布林带参数或均线参数可能会产生更好结果。

总结

本策略整合多个指标判断趋势方向,设置自动止盈止损,能够在强势趋势中获利且将单笔交易亏损控制在很小的范围。从发布者的回测数据来看,其获利率和盈利率都非常理想。通过一定的优化,有望进一步提高策略的稳定性和盈利能力。

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © myn

//@version=5

strategy('Strategy Myth-Busting #7 - MACDBB+SSL+VSF - [MYN]', max_bars_back=5000, overlay=true, pyramiding=0, initial_capital=1000, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=1.0, commission_value=0.075, use_bar_magnifier = false)

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

//nwVqTuPe6yo

//5 min

//ak MACD BB by AlgoKid

//Disable bar colors in style

//SSL hybrid by mihkel00

// Style disable all but bar colors and ma baseline

// Change SSL1 baseline length from 60 to 30

// Change SSL1 baseline type from HMA to EMA

//volume strength Finder by Saravanan

// Get rid of bar colors on style

// Trading Rules

// SSL Hybrid.

// Buy only when price action is closed above the EMA and the line is blue color.

// Sell priace action must be closed below the EMA and the line is red color

// Volume Indicator

// Buy when Buyers strength / volume is higher than sellers volume

// Opposite

// General trading rules

// Short

// Price action must be moving below the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from red to gray or from red to blue.

// If the price action is touching the EMA but the line does not change the color, the pullback is not confirmed.

// Once we have this pullback we're going to be waiting for the MACD to issue a new continuation short signal. A red circle must appear on the indicator and these circles should not be touching accross the zero level while they are being greeen

// Sellers strength above 50% at the time the MACD indiactor issues a new short signal.

// Stop Loss at EMA line 1:1.5 risk ratio.

// Functions universal to strategy

f_priorBarsSatisfied(_objectToEval, _numOfBarsToLookBack) =>

returnVal = false

for i = 0 to _numOfBarsToLookBack

if (_objectToEval[i] == true)

returnVal = true

// AK MACD BB v 1.00 by Algokid

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//indicator('AK MACD BB v 1.00')

length = input.int(10, minval=1, title='BB Periods',group="AK MACD BB")

dev = input.float(1, minval=0.0001, title='Deviations')

//MACD

fastLength = input.int(12, minval=1)

slowLength = input.int(26, minval=1)

signalLength = input.int(9, minval=1)

fastMA = ta.ema(close, fastLength)

slowMA = ta.ema(close, slowLength)

macd = fastMA - slowMA

//BollingerBands

Std = ta.stdev(macd, length)

Upper = Std * dev + ta.sma(macd, length)

Lower = ta.sma(macd, length) - Std * dev

//Band1 = plot(Upper, color=color.new(color.gray, 0), style=plot.style_line, linewidth=2, title='Upper Band')

//Band2 = plot(Lower, color=color.new(color.gray, 0), style=plot.style_line, linewidth=2, title='lower Band')

//fill(Band1, Band2, color=color.new(color.blue, 75), title='Fill')

mc = macd >= Upper ? color.lime : color.red

// Indicator

//plot(macd, color=mc, style=plot.style_circles, linewidth=3)

zeroline = 0

//plot(zeroline, color=color.new(color.orange, 0), linewidth=2, title='Zeroline')

//buy

//barcolor(macd > Upper ? color.yellow : na)

//short

//barcolor(macd < Lower ? color.aqua : na)

//needs improvments

MACDBBNumBarsBackToLookForMACDToBelowZero = input(1, title="Number Of bars to look back to ensure MACD isn't above/below Zero Line?")

// Sell when MACD to issue a new continuation short signal. A new red circle must appear on the indicator and these circles should not be touching accross the zero level while they were previously green

MACDBBENtryShort = mc == color.red and macd < zeroline and f_priorBarsSatisfied(macd < zeroline and mc == color.lime, MACDBBNumBarsBackToLookForMACDToBelowZero)

// Buy when MACD to issue a new continuation long signal. A new green circle must appear on the indicator and these circles should not be touching accross the zero level while they were previously red

MACDBBENtryLong = mc == color.lime and macd > zeroline and f_priorBarsSatisfied(macd > zeroline and mc == color.red, MACDBBNumBarsBackToLookForMACDToBelowZero)

// SSL Hybrid by Mihkel00

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//@version=5

//AK MACD BB

//created by Algokid , February 24,2015

//@version=5

//By Mihkel00

// This script is designed for the NNFX Method, so it is recommended for Daily charts only.

// Tried to implement a few VP NNFX Rules

// This script has a SSL / Baseline (you can choose between the SSL or MA), a secondary SSL for continiuation trades and a third SSL for exit trades.

// Alerts added for Baseline entries, SSL2 continuations, Exits.

// Baseline has a Keltner Channel setting for "in zone" Gray Candles

// Added "Candle Size > 1 ATR" Diamonds from my old script with the criteria of being within Baseline ATR range.

// Credits

// Strategy causecelebre https://www.tradingview.com/u/causecelebre/

// SSL Channel ErwinBeckers https://www.tradingview.com/u/ErwinBeckers/

// Moving Averages jiehonglim https://www.tradingview.com/u/jiehonglim/

// Moving Averages everget https://www.tradingview.com/u/everget/

// "Many Moving Averages" script Fractured https://www.tradingview.com/u/Fractured/

//indicator('SSL Hybrid', overlay=true)

show_Baseline = input(title='Show Baseline', defval=true, group="SSL Hybrid")

show_SSL1 = input(title='Show SSL1', defval=false)

show_atr = input(title='Show ATR bands', defval=true)

//ATR

atrlen = input(14, 'ATR Period')

mult = input.float(1, 'ATR Multi', step=0.1)

smoothing = input.string(title='ATR Smoothing', defval='WMA', options=['RMA', 'SMA', 'EMA', 'WMA'])

ma_function(source, atrlen) =>

if smoothing == 'RMA'

ta.rma(source, atrlen)

else

if smoothing == 'SMA'

ta.sma(source, atrlen)

else

if smoothing == 'EMA'

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input.string(title='SSL1 / Baseline Type', defval='EMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'])

len = input(title='SSL1 / Baseline Length', defval=30)

SSL2Type = input.string(title='SSL2 / Continuation Type', defval='JMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'McGinley'])

len2 = input(title='SSL 2 Length', defval=5)

//

SSL3Type = input.string(title='EXIT Type', defval='HMA', options=['DEMA', 'TEMA', 'LSMA', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'McGinley', 'MF'])

len3 = input(title='EXIT Length', defval=15)

src = input(title='Source', defval=close)

//

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

kidiv = input.int(defval=1, maxval=4, title='Kijun MOD Divider')

jurik_phase = input(title='* Jurik (JMA) Only - Phase', defval=3)

jurik_power = input(title='* Jurik (JMA) Only - Power', defval=1)

volatility_lookback = input(10, title='* Volatility Adjusted (VAMA) Only - Volatility lookback length')

//MF

beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Modular Filter, General Filter Only - Beta')

feedback = input(false, title='Modular Filter Only - Feedback')

z = input.float(0.5, title='Modular Filter Only - Feedback Weighting', step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20)

ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3])

//----

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down = ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input.float(0.2, step=0.05, title='Base Channel Multiplier')

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open * 1

close_pos = close * 1

difference = math.abs(close_pos - open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

candlesize_violation = atr_violation and InRange

//plotshape(candlesize_violation, color=color.new(color.white, 0), size=size.tiny, style=shape.diamond, location=location.top, title='Candle Size > 1xATR')

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//SSL2 VALUES

Hlv2 = int(na)

Hlv2 := close > maHigh ? 1 : close < maLow ? -1 : Hlv2[1]

sslDown2 = Hlv2 < 0 ? maHigh : maLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = ta.crossover(close, sslExit)

base_cross_Short = ta.crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title='Color Bars', defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

//plotarrow(codiff, colorup=color.new(#00c3ff, 20), colordown=color.new(#ff0062, 20), title='Exit Arrows', maxheight=20, offset=0)

p1 = plot(show_Baseline ? BBMC : na, color=color_bar, linewidth=4, title='MA Baseline', transp=0)

//DownPlot = plot(show_SSL1 ? sslDown : na, title='SSL1', linewidth=3, color=color_ssl1, transp=10)

barcolor(show_color_bar ? color_bar : na)

//up_channel = plot(show_Baseline ? upperk : na, color=color_bar, title='Baseline Upper Channel')

//low_channel = plot(show_Baseline ? lowerk : na, color=color_bar, title='Basiline Lower Channel')

//fill(up_channel, low_channel, color=color_bar, transp=90)

////SSL2 Continiuation from ATR

atr_crit = input.float(0.9, step=0.1, title='Continuation ATR Criteria')

upper_half = atr_slen * atr_crit + close

lower_half = close - atr_slen * atr_crit

buy_inatr = lower_half < sslDown2

sell_inatr = upper_half > sslDown2

sell_cont = close < BBMC and close < sslDown2

buy_cont = close > BBMC and close > sslDown2

sell_atr = sell_inatr and sell_cont

buy_atr = buy_inatr and buy_cont

atr_fill = buy_atr ? color.green : sell_atr ? color.purple : color.white

//LongPlot = plot(sslDown2, title='SSL2', linewidth=2, color=atr_fill, style=plot.style_circles, transp=0)

//u = plot(show_atr ? upper_band : na, '+ATR', color=color.new(color.white, 80))

//l = plot(show_atr ? lower_band : na, '-ATR', color=color.new(color.white, 80))

//ALERTS

alertcondition(ta.crossover(close, sslDown), title='SSL Cross Alert', message='SSL1 has crossed.')

alertcondition(ta.crossover(close, sslDown2), title='SSL2 Cross Alert', message='SSL2 has crossed.')

alertcondition(sell_atr, title='Sell Continuation', message='Sell Continuation.')

alertcondition(buy_atr, title='Buy Continuation', message='Buy Continuation.')

alertcondition(ta.crossover(close, sslExit), title='Exit Sell', message='Exit Sell Alert.')

alertcondition(ta.crossover(sslExit, close), title='Exit Buy', message='Exit Buy Alert.')

alertcondition(ta.crossover(close, upperk), title='Baseline Buy Entry', message='Base Buy Alert.')

alertcondition(ta.crossover(lowerk, close), title='Baseline Sell Entry', message='Base Sell Alert.')

// Buy only when price action is closed above the EMA and the line is blue color.

SSLHybridEntryLong1 = src > BBMC and color_bar == #00c3ff

// Sell only when action must be closed below the EMA and the line is red color

SSLHybridEntryShort1 = src < BBMC and color_bar == #ff0062

sslHybridNumBarsBackToLookForPullBack = input(4, title="Number Of bars back to look for SSL pullback")

// Buy when Price action must be moving above the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from blue to gray or from blue to red.

SSLHybridEntryLong2 = color_bar == #00c3ff and (f_priorBarsSatisfied(color_bar == #ff0062,sslHybridNumBarsBackToLookForPullBack) or f_priorBarsSatisfied(color_bar == color.gray, sslHybridNumBarsBackToLookForPullBack))

// Sell when Price action must be moving below the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from red to gray or from red to blue.

SSLHybridEntryShort2 = color_bar == #ff0062 and (f_priorBarsSatisfied(color_bar == #00c3ff,sslHybridNumBarsBackToLookForPullBack) or f_priorBarsSatisfied(color_bar == color.gray, sslHybridNumBarsBackToLookForPullBack))

SSLHybridEntryLong = SSLHybridEntryLong1 and SSLHybridEntryLong2

SSLHybridEntryShort = SSLHybridEntryShort1 and SSLHybridEntryShort2

// Price action must be moving below the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from red to gray or from red to blue.

// If the price action is touching the EMA but the line does not change the color, the pullback is not confirmed.

// Volume Strength Finder by Saravanan_Ragavan

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Saravanan_Ragavan

//@version=5

//indicator('Volume Strength Finder', 'VSF', overlay=true)

T1 = time(timeframe.period, '0915-0916:23456')

T2 = time(timeframe.period, '0915-1530:23456')

Y = bar_index

Z1 = ta.valuewhen(T1, bar_index, 0)

L = Y - Z1 + 1

SSPV = 0.00

SSNV = 0.00

pdw = 0.00

ndw = 0.00

total_w = 0.00

for i = 1 to L - 1 by 1

total_w := high[i] - low[i]

positive = close[i] - low[i]

negative = high[i] - close[i]

pdw := positive / total_w * 100

ndw := negative / total_w * 100

SSPV := volume[i] * pdw / 100 + SSPV

SSNV := volume[i] * ndw / 100 + SSNV

SSNV

total_v = SSPV + SSNV

Pos = SSPV / total_v * 100

Neg = SSNV / total_v * 100

bgc = SSPV > SSNV ? color.green : SSPV < SSNV ? color.red : color.white

//barcolor(bgc)

var table sDisplay = table.new(position.top_right, 1, 5, bgcolor=color.aqua, frame_width=2, frame_color=color.black)

if barstate.islast

table.cell(sDisplay, 0, 0, 'Today\'s Volume : ' + str.tostring(total_v), text_color=color.white, text_size=size.large, bgcolor=color.aqua)

table.cell(sDisplay, 0, 1, 'Buyers Volume: ' + str.tostring(math.round(SSPV)), text_color=color.white, text_size=size.large, bgcolor=color.green)

table.cell(sDisplay, 0, 2, 'Sellers Volume: ' + str.tostring(math.round(SSNV)), text_color=color.white, text_size=size.large, bgcolor=color.red)

table.cell(sDisplay, 0, 3, 'Buyers Strength: ' + str.tostring(math.round(Pos)) + '%', text_color=color.white, text_size=size.large, bgcolor=color.green)

table.cell(sDisplay, 0, 4, 'Sellers Strength: ' + str.tostring(math.round(Neg)) + '%', text_color=color.white, text_size=size.large, bgcolor=color.red)

// Sellers strength above 50% at the time the MACD indiactor issues a new short signal.

VSFShortEntry = math.round(Neg) > 50

// Buyers strength above 50% at the time the MACD indiactor issues a new long signal.

VSFLongEntry = math.round(Pos) > 50

//////////////////////////////////////

//* Put your strategy rules below *//

/////////////////////////////////////

longCondition = SSLHybridEntryLong and VSFLongEntry and MACDBBENtryLong

shortCondition =SSLHybridEntryShort and VSFShortEntry and MACDBBENtryShort

//define as 0 if do not want to use

closeLongCondition = 0

closeShortCondition = 0

// ADX

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

adxEnabled = input.bool(defval = false , title = "Average Directional Index (ADX)", tooltip = "", group ="ADX" )

adxlen = input(14, title="ADX Smoothing", group="ADX")

adxdilen = input(14, title="DI Length", group="ADX")

adxabove = input(25, title="ADX Threshold", group="ADX")

adxdirmov(len) =>

adxup = ta.change(high)

adxdown = -ta.change(low)

adxplusDM = na(adxup) ? na : (adxup > adxdown and adxup > 0 ? adxup : 0)

adxminusDM = na(adxdown) ? na : (adxdown > adxup and adxdown > 0 ? adxdown : 0)

adxtruerange = ta.rma(ta.tr, len)

adxplus = fixnan(100 * ta.rma(adxplusDM, len) / adxtruerange)

adxminus = fixnan(100 * ta.rma(adxminusDM, len) / adxtruerange)

[adxplus, adxminus]

adx(adxdilen, adxlen) =>

[adxplus, adxminus] = adxdirmov(adxdilen)

adxsum = adxplus + adxminus

adx = 100 * ta.rma(math.abs(adxplus - adxminus) / (adxsum == 0 ? 1 : adxsum), adxlen)

adxsig = adxEnabled ? adx(adxdilen, adxlen) : na

isADXEnabledAndAboveThreshold = adxEnabled ? (adxsig > adxabove) : true

//Backtesting Time Period (Input.time not working as expected as of 03/30/2021. Giving odd start/end dates

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

useStartPeriodTime = input.bool(true, 'Start', group='Date Range', inline='Start Period')

startPeriodTime = input(timestamp('1 Jan 2019'), '', group='Date Range', inline='Start Period')

useEndPeriodTime = input.bool(true, 'End', group='Date Range', inline='End Period')

endPeriodTime = input(timestamp('31 Dec 2030'), '', group='Date Range', inline='End Period')

start = useStartPeriodTime ? startPeriodTime >= time : false

end = useEndPeriodTime ? endPeriodTime <= time : false

calcPeriod = true

// Trade Direction

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tradeDirection = input.string('Long and Short', title='Trade Direction', options=['Long and Short', 'Long Only', 'Short Only'], group='Trade Direction')

// Percent as Points

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

// Take profit 1

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp1 = input.float(title='Take Profit 1 - Target %', defval=1, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 1')

q1 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 1')

// Take profit 2

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp2 = input.float(title='Take Profit 2 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 2')

q2 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 2')

// Take profit 3

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp3 = input.float(title='Take Profit 3 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 3')

q3 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 3')

// Take profit 4

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp4 = input.float(title='Take Profit 4 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit')

/// Stop Loss

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

stoplossPercent = input.float(title='Stop Loss (%)', defval=2, minval=0.01, group='Stop Loss') * 0.01

slLongClose = close < strategy.position_avg_price * (1 - stoplossPercent)

slShortClose = close > strategy.position_avg_price * (1 + stoplossPercent)

/// Leverage

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

leverage = input.float(1, 'Leverage', step=.5, group='Leverage')

contracts = math.min(math.max(.000001, strategy.equity / close * leverage), 1000000000)

/// Trade State Management

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

isInLongPosition = strategy.position_size > 0

isInShortPosition = strategy.position_size < 0

/// ProfitView Alert Syntax String Generation

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

alertSyntaxPrefix = input.string(defval='CRYPTANEX_99FTX_Strategy-Name-Here', title='Alert Syntax Prefix', group='ProfitView Alert Syntax')

alertSyntaxBase = alertSyntaxPrefix + '\n#' + str.tostring(open) + ',' + str.tostring(high) + ',' + str.tostring(low) + ',' + str.tostring(close) + ',' + str.tostring(volume) + ','

/// Trade Execution

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

longConditionCalc = (longCondition and isADXEnabledAndAboveThreshold)

shortConditionCalc = (shortCondition and isADXEnabledAndAboveThreshold)

if calcPeriod

if longConditionCalc and tradeDirection != 'Short Only' and isInLongPosition == false

strategy.entry('Long', strategy.long, qty=contracts)

alert(message=alertSyntaxBase + 'side:long', freq=alert.freq_once_per_bar_close)

if shortConditionCalc and tradeDirection != 'Long Only' and isInShortPosition == false

strategy.entry('Short', strategy.short, qty=contracts)

alert(message=alertSyntaxBase + 'side:short', freq=alert.freq_once_per_bar_close)

//Inspired from Multiple %% profit exits example by adolgo https://www.tradingview.com/script/kHhCik9f-Multiple-profit-exits-example/

strategy.exit('TP1', qty_percent=q1, profit=per(tp1))

strategy.exit('TP2', qty_percent=q2, profit=per(tp2))

strategy.exit('TP3', qty_percent=q3, profit=per(tp3))

strategy.exit('TP4', profit=per(tp4))

strategy.close('Long', qty_percent=100, comment='SL Long', when=slLongClose)

strategy.close('Short', qty_percent=100, comment='SL Short', when=slShortClose)

strategy.close_all(when=closeLongCondition or closeShortCondition, comment='Close Postion')

/// Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Inspired by https://www.tradingview.com/script/uWqKX6A2/ - Thanks VertMT

// showDashboard = input.bool(group="Dashboard", title="Show Dashboard", defval=true)

// f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

// _cellText = _title + "\n" + _value

// table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// // Draw dashboard table

// if showDashboard

// var bgcolor = color.new(color.black,0)

// // Keep track of Wins/Losses streaks

// newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// varip int winRow = 0

// varip int lossRow = 0

// varip int maxWinRow = 0

// varip int maxLossRow = 0

// if newWin

// lossRow := 0

// winRow := winRow + 1

// if winRow > maxWinRow

// maxWinRow := winRow

// if newLoss

// winRow := 0

// lossRow := lossRow + 1

// if lossRow > maxLossRow

// maxLossRow := lossRow

// // Prepare stats table

// var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

// if barstate.islastconfirmedhistory

// // Update table

// dollarReturn = strategy.netprofit

// f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

// f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

// _profit = (strategy.netprofit / strategy.initial_capital) * 100

// f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

// _numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

// f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

// _winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

// f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

// f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

// f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

// f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

// f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)