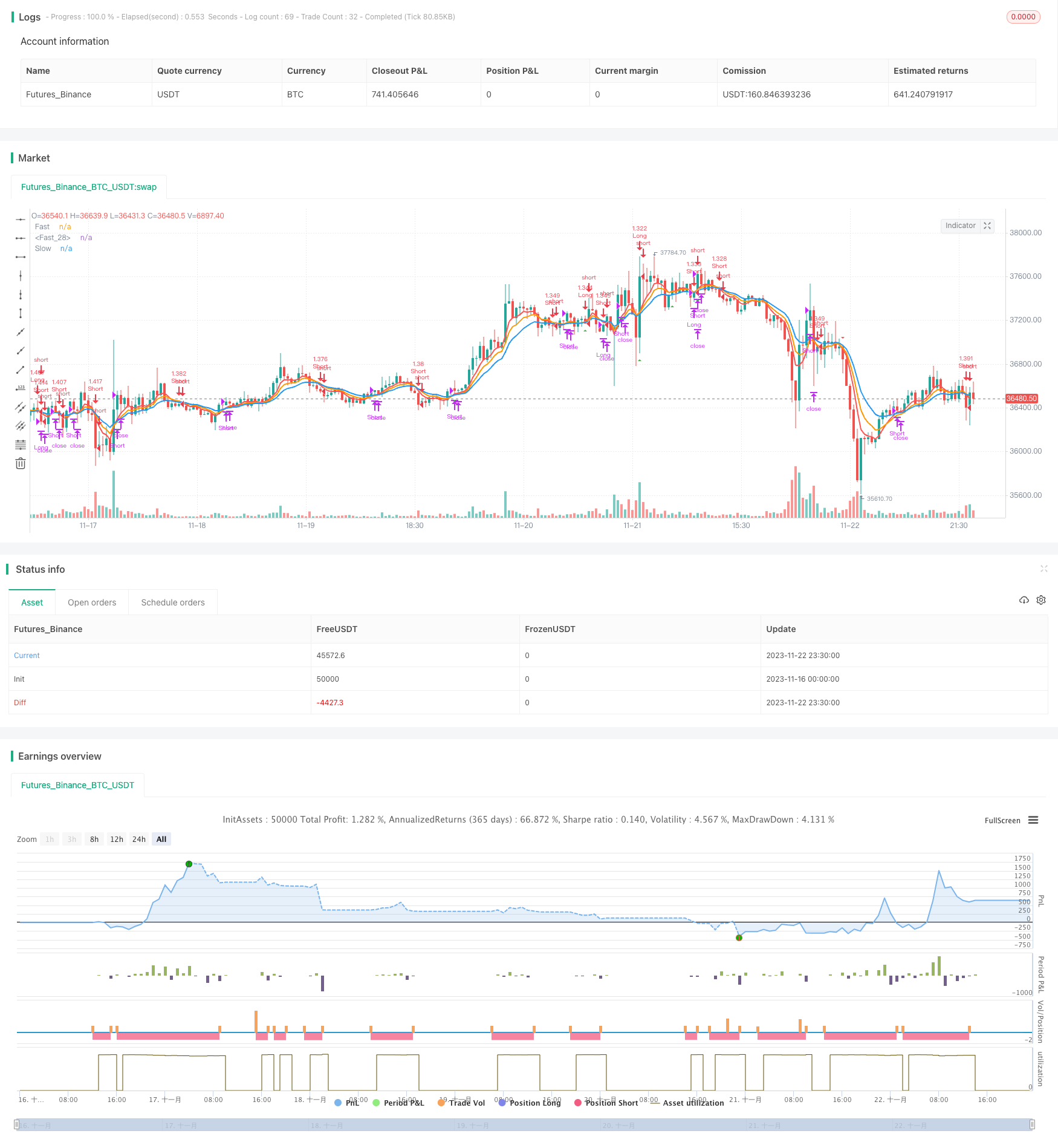

本策略基于短期、中期和长期三条不同周期的指数移动平均线(EMA)进行交易信号生成。其中,短期EMA周期为5天,中期EMA周期为8天,长期EMA周期为13天。当短期EMA上穿中期和长期EMA时,做多;当短期EMA下穿中期和长期EMA时,做空。

策略原理

该策略通过计算不同周期的EMA来判断市场趋势。短期EMA反映最近几天的平均价格,中长期EMA反映较长时间内的平均价格。短期EMA上穿中长期EMA代表价格开始向上突破,因此做多;短期EMA下穿中长期EMA代表价格开始向下突破,因此做空。

具体来说,该策略同时计算5天、8天和13天三条EMA。当5天EMA上穿8天和13天EMA时生成做多信号;当5天EMA下穿8天和13天EMA时生成做空信号。做多后,如果5天EMA重新下穿13天EMA,则平仓。做空后,如果5天EMA重新上穿13天EMA,则平仓。

策略优势

- 使用多周期EMA判断趋势,避免因单一EMA周期过短或过长而漏掉关键的趋势转折点

- 结合中短长三个周期EMA,交易信号更加可靠准确

- 通过EMA平滑价格,可过滤掉部分市场噪音,防止无谓开仓

策略风险

- 三条EMA均为延后的趋势指标,在实际价格突破前一定有时间差,可能会导致交易信号滞后

- EMA无法区分真正趋势和短期调整,可能会产生错误信号

- 固定的EMA周期无法适应市场在不同周期下的变化特征

可以通过以下方法优化:

- 结合其他指标如MACD等判断真正趋势,避免产生错误信号

- 根据不同品种、市场环境可灵活调整EMA周期参数

- 增设移动止损,以锁定利润,控制风险

总结

本策略通过计算短中长三个周期EMA并比较其交叉情况来判断市场趋势转折,属于典型的突破系统。其优点是交易信号简单清晰,容易操作;缺点是EMA指标本身滞后,无法区分真正趋势和短期调整。未来可以考虑辅以其他技术指标判断,或结合自适应参数调整优化该策略。

策略源码

/*backtest

start: 2023-11-16 00:00:00

end: 2023-11-23 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gregoirejohnb

// @It is modified by ttsaadet.

// Moving average crossover systems measure drift in the market. They are great strategies for time-limited people.

// So, why don't more people use them?

//

//

strategy(title="EMA Crossover Strategy", shorttitle="EMA-5-8-13 COS by TTS", overlay=true, pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, currency=currency.TRY,commission_type=strategy.commission.percent,commission_value=0.04, process_orders_on_close = true, initial_capital = 100000)

// === GENERAL INPUTS ===

//strategy start date

start_year = input(defval=2020, title="Backtest Start Year")

// === LOGIC ===

short_period = input(type=input.integer,defval=5,minval=1,title="Length")

mid_period = input(type=input.integer,defval=8,minval=1,title="Length")

long_period = input(type=input.integer,defval=13,minval=1,title="Length")

longOnly = input(type=input.bool,defval=false,title="Long Only")

shortEma = ema(hl2,short_period)

midEma = ema(hl2,mid_period)

longEma = ema(hl2,long_period)

plot(shortEma,linewidth=2,color=color.red,title="Fast")

plot(midEma,linewidth=2,color=color.orange,title="Fast")

plot(longEma,linewidth=2,color=color.blue,title="Slow")

longEntry = ((shortEma > midEma) and crossover(shortEma,longEma)) or ((shortEma > longEma) and crossover(shortEma,midEma))

shortEntry =((shortEma < midEma) and crossunder(shortEma,longEma)) or ((shortEma < longEma) and crossunder(shortEma,midEma))

plotshape(longEntry ? close : na,style=shape.triangleup,color=color.green,location=location.belowbar,size=size.small,title="Long Triangle")

plotshape(shortEntry and not longOnly ? close : na,style=shape.triangledown,color=color.red,location=location.abovebar,size=size.small,title="Short Triangle")

plotshape(shortEntry and longOnly ? close : na,style=shape.xcross,color=color.black,location=location.abovebar,size=size.small,title="Exit Sign")

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() =>

longEntry

exitLong() =>

crossunder(shortEma,longEma)

strategy.entry(id="Long", long=strategy.long, when=enterLong())

strategy.close(id="Long", when=exitLong())

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() =>

not longOnly and shortEntry

exitShort() =>

crossover(shortEma,longEma)

strategy.entry(id="Short", long=strategy.short, when=enterShort())

strategy.close(id="Short", when=exitShort())