概述

本策略通过组合使用3条不同周期的简单移动平均线(SMA)与Kaufman自适应移动平均线,形成长线入场信号。当短周期SMA上穿较长周期的SMA时产生买入信号。此外,策略还结合K线实体颜色判断主趋势,只在多头趋势中产生买入信号,避免假突破。

策略原理

本策略使用3条不同周期的SMA,包括SMA 4、SMA 9和SMA 18。这3条SMA的交叉组合是经典的判断趋势方向的技术指标。当SMA 4上穿SMA 9,并且SMA 9上穿SMA 18时,产生长线的买入信号。

为了过滤假突破,本策略还引入了Kaufman自适应移动平均线。只有当收盘价高于自适应移动平均线,即处于多头趋势时,SMA的金叉信号才生效启动长线。

此外,本策略还使用100周期的SMA判断主趋势。当价格上穿100周期SMA时,确认进入多头趋势。策略只在主多头趋势中产生买入信号。

综上,本策略的买入信号来自以下几部分的组合: 1. SMA 4上穿SMA 9,并且SMA 9上穿SMA 18,形成短周期SMA的金叉 2. 收盘价高于Kaufman自适应移动平均线,处于多头趋势 3. 价格上穿100周期SMA,确认主多头

当上述3个条件同时满足时,产生长线买入信号。

优势分析

本策略具有以下几点优势:

- 使用3重SMA交叉判断趋势,可以有效过滤噪音,提高信号的可靠性

- 引入自适应移动平均线,避免在无明确趋势时假突破

- 结合主趋势判断,加大获利概率,避免在震荡行情中反复打开头寸

- 长短周期SMA交叉,形成长线信号,利于抓取较大的趋势行情

- 适用于高周期择时,如4小时或日线级别,信号更加可靠

风险分析

本策略也存在一些风险:

- 长线策略,无法在短期内及时止损,存在一定回撤风险

- 入场信号相对稀少,可能错过部分涨幅

- 当短期、中期和长期趋势不一致时,会产生信号错误

可以通过以下方式优化: 1. 适当缩短中长期SMA的周期,增加入场机会 2. 加入其它辅助指标,如成交量指标,确认趋势的可靠性 3. 采取科学止损,合理控制回撤

优化方向

本策略还有进一步优化的空间:

- 可以测试更多组合的SMA周期,寻找最优参数

- 可以加入成交量的确认,避免虚假突破

- 可以添加波动率指标,在震荡加大的场景过滤入场

- 可以引入机器学习算法,自适应寻找最优参数

- 可以引入情绪指标,在市场恐慌或亢奋时避免建仓

总结

本策略通过多重SMA交叉形成长线信号,同时结合自适应移动平均线和主趋势判断,可在趋势行情中获取较大收益,具有稳定的逻辑和较强的实战效果。但也存在一定的风险,需要继续优化以降低回撤和提高胜率。本策略为长线持仓策略,适合有耐心和风险控制能力的投资者。

策略源码

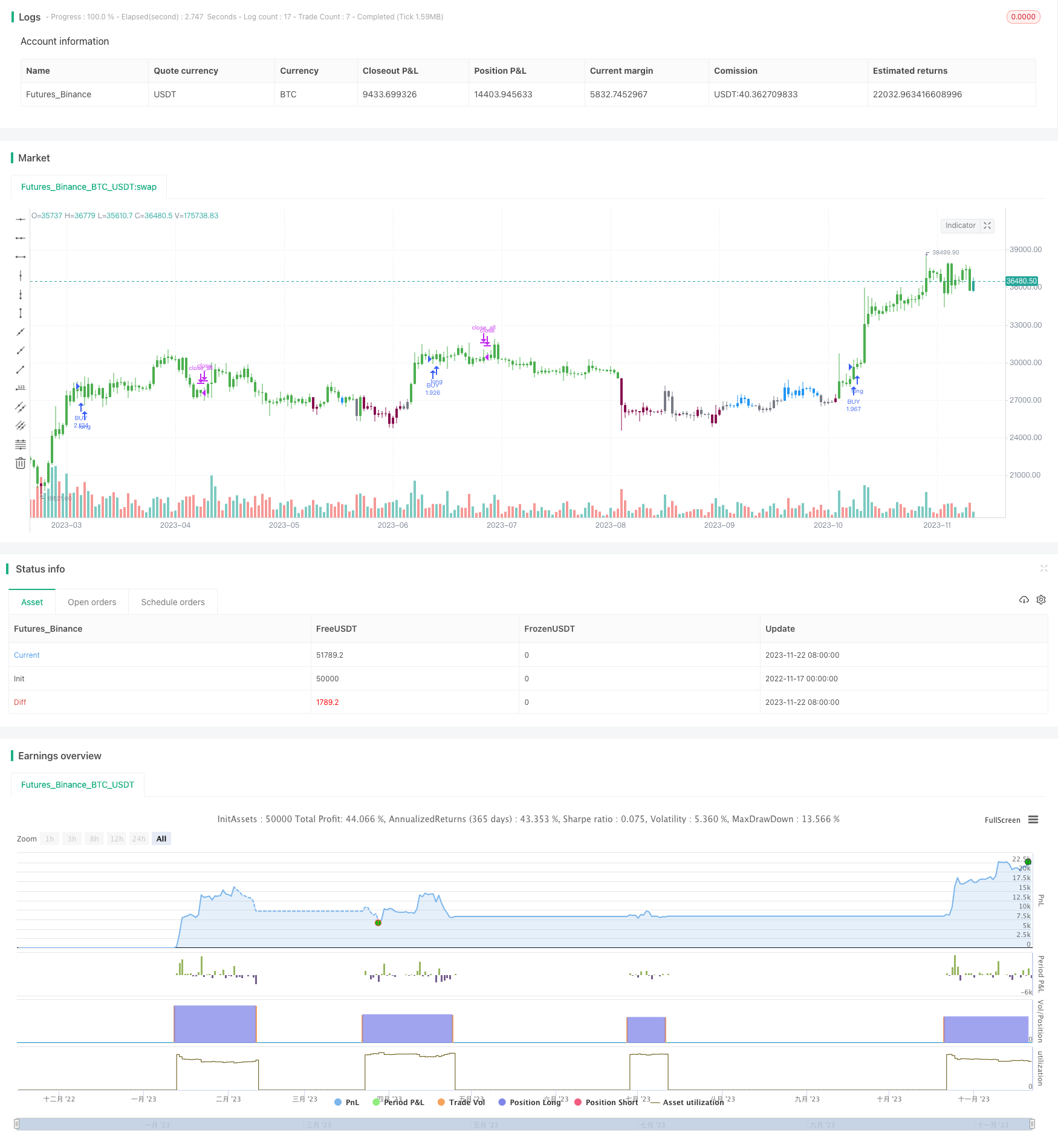

/*backtest

start: 2022-11-17 00:00:00

end: 2023-11-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Wielkieef

//@version=5

strategy(title='twisted SMA strategy [4h] ', overlay=true, pyramiding=1, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, calc_on_order_fills=false, slippage=0, commission_type=strategy.commission.percent, commission_value=0.03)

src = close

Length1 = input.int(4, title=' 1-SMA Lenght', minval=1, group='SMA')

Length2 = input.int(9, title=' 2-SMA Lenght', minval=1, group='SMA')

Length3 = input.int(18, title=' 3-SMA Lenght', minval=1, group='SMA')

SMA1 = ta.sma(close, Length1)

SMA2 = ta.sma(close, Length2)

SMA3 = ta.sma(close, Length3)

Long_ma = SMA1 > SMA2 and SMA2 > SMA3

Short_ma = SMA1 < SMA2 and SMA2 < SMA3

LengthMainSMA = input.int(100, title=' SMA Lenght', minval=1)

SMAas = ta.sma(src, LengthMainSMA)

// Powered Kaufman Adaptive Moving Average by alexgrover (modificated by Wielkieef)

lengthas = input.int(25, title=' Lenght')

sp = input.bool(true, title=' Self Powered')

er = math.abs(ta.change(close, lengthas)) / math.sum(math.abs(ta.change(close)), lengthas)

pow = sp ? 1 / er : 2

per = math.pow(math.abs(ta.change(close, lengthas)) / math.sum(math.abs(ta.change(close)), lengthas), pow)

a = 0.

a := per * src + (1 - per) * nz(a[1], src)

mad4h = 0.

a_f = a / a[1] > .999 and a / a[1] < 1.001

///.

Bar_color = close > SMAas ? color.green : Long_ma ? color.blue : Short_ma ? color.maroon : color.gray

barcolor(color=Bar_color)

long_cond = Long_ma and SMAas < close and not a_f

long_stop = Short_ma

if long_cond

strategy.entry('BUY', strategy.long)

strategy.close_all(when=long_stop)

//by wielkieef