概述

该策略名称为“高级布林带均线网格趋势追踪策略”。它是一个利用布林带、均线进行趋势判断,在趋势方向建立网格持仓追踪的策略。

策略原理

该策略的主要思路是:

利用布林带判断目前市场波动范围。布林带中轨为n日简单移动平均线,带宽为n日ATR均幅。

布林带外侧的四条均为异数平均真实波动幅度线。策略在突破不同级别线时建立持仓。

EMA快慢均线判断大周期趋势方向。在大周期多头时只做多头,空头反之。

在趋势方向追踪建仓,出现针形K线时平仓止盈。

具体来说,该策略主要分为以下几个部分:

确定布林带参数,布林中轨为n日SMA均线,布林带宽度为n日ATR。策略中布林长度n为20。

设置四条布林外扩线,线上下离中轨距离分别为1.236倍、2.382倍、3.618倍和4.236倍平均真实波动幅度。

设置快慢EMA均线判断大周期趋势,快线长度为25日,慢线长度为200日。

在大周期多头时,价格突破下方四条均线时逐步建立多头持仓。空头同理。

当出现针形K线或价格重新跨越大周期均线时,视为针形结束信号,平仓止盈。

以上是该策略的主要技术原理。通过布林带判断目前波动范围,在大周期趋势下追踪建仓,最终达到高概率持仓的效果。

策略优势分析

该策略主要有以下几个优势:

充分利用趋势特征,大周期判断趋势方向,在趋势方向建仓,可以减少不必要的反向操作。

采用多级布林线,可以更加清晰的判断目前波动区域,有利于把握大部分行情。

网格持仓方式可以使每一个单位资金均匀分配风险,从而得到稳定收益。

利用针形K线这一高效信号平仓,可以快速止盈。

策略整体实现了趋势判断、网格持仓、特定信号平仓三位一体,是一种相对成熟完整的量化策略。

策略风险分析

该策略也存在以下一些风险:

大周期趋势判断错误的概率。快慢均线存在一定误差概率,可能导致不必要的反向操作。

布林线突破失败概率。布林线并不能百分百预判价格路径。

针形K线信号发出较晚,无法及时止盈。

大周期震荡调整中容易形成过多重叠持仓。

对应解决方法如下:

调整快慢均线参数,降低误差概率。

调整布林线参数,使布林线尽量贴近大部分波动。

测试更加灵敏的特定形态止盈信号。

加大间距距离,控制持仓规模。

策略优化方向

该策略可以从以下几个方向进行优化:

测试不同均线参数优化大周期趋势判断。例如测试EMA、RSI等其他指标。

测试不同倍数ATR参数优化布林通道宽度设置。使布林带更贴近真实波动。

测试其他高效止盈信号。例如 SAR、卡尔曼均线等。

优化网格间距。使得波动区间更加均匀切分,减少重复建仓。

增加止损机制。避免极端行情下的大亏损。

总结

该策略综合运用布林带通道、均线指标、特定K线形态等技术手段。在判断大周期趋势的前提下,构建了一个趋势跟踪型的均线布林网格策略。相比传统布林带突破,该策略加入了趋势特征判断,可以减少不必要的反向建仓,同时网格持仓方式使每一个单位资金风险分散,从而获得了稳定收益。该策略可以从趋势判断、布林宽度、止盈信号、止损方式等多个角度进行优化调整,以获得更加稳定的策略效果。

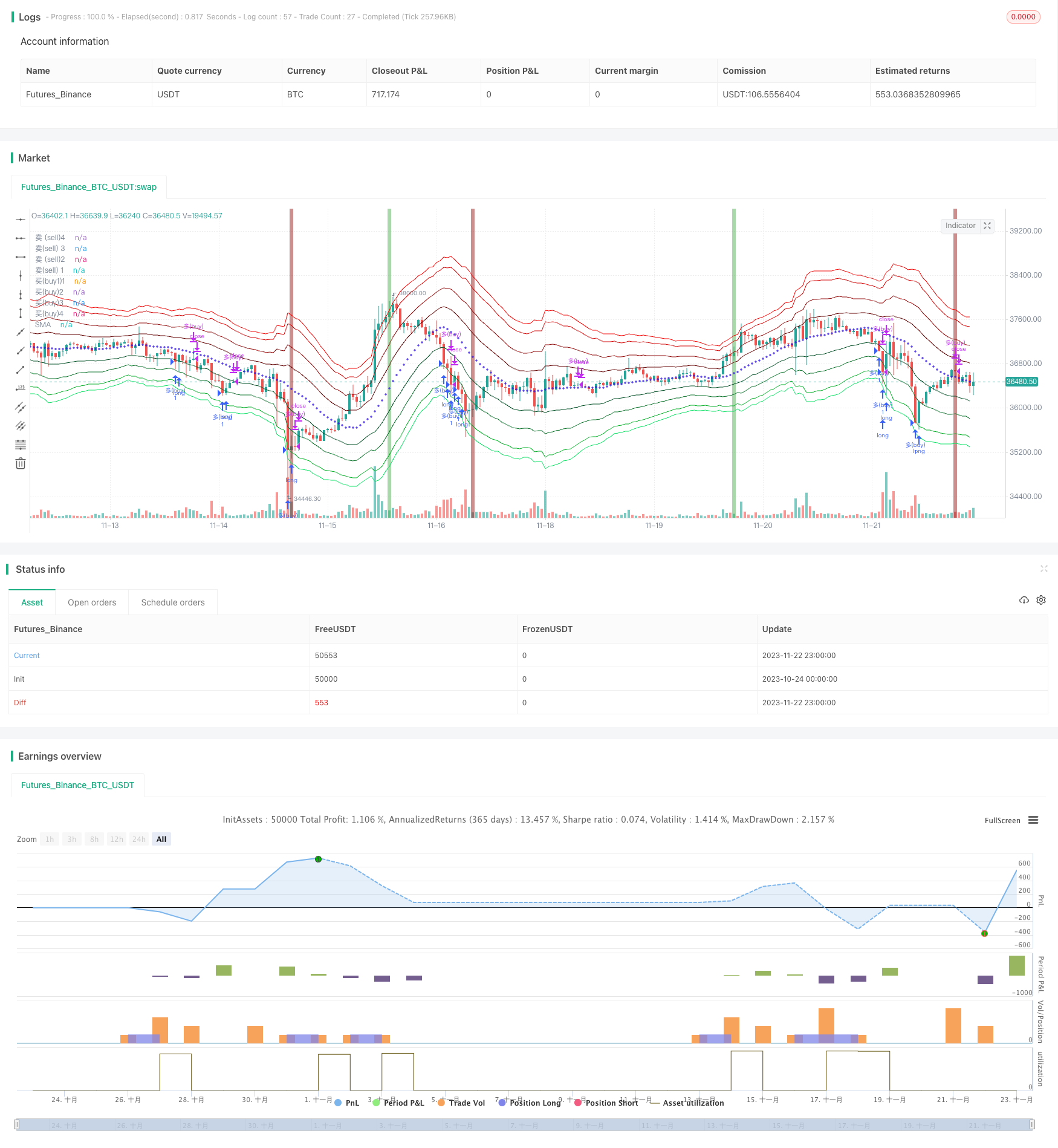

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Aayonga

//@version=5

strategy("fib trend grid@Aa", overlay=true)

//回测时间

useDateFilter=input.bool(true,title = "启用回测时间范围限定(backtest)", group = "回测范围(backtest)")

backtesStarDate=input(timestamp("1 Jan 2015"),title = "开始时间(Start)", group = "回测范围(backtest)")

backtestEndDate=input(timestamp("1 Jan 2040"),title = "结束时间(finish)",group = "回测范围(backtest)")

inTradeWindow=true

//入场位 entry

bolllen=input.int(defval=20,minval=1,title="布林长度,(boll length)",group = "入场位(entry)")

sma=ta.sma(close,bolllen)

avg=ta.atr(bolllen)

fib1=input(defval=1.236,title="Fib 1",group = "入场位(entry)")

fib2=input(defval=2.382,title="Fib 2",group = "入场位(entry)")

fib3=input(defval=3.618,title="fib 3",group = "入场位(entry)")

fib4=input(defval=4.236,title="Fib 4",group = "入场位(entry)")

r1=avg*fib1

r2=avg*fib2

r3=avg*fib3

r4=avg*fib4

top4=sma+r4

top3=sma+r3

top2=sma+r2

top1=sma+r1

bott1=sma-r1

bott2=sma-r2

bott3=sma-r3

bott4=sma-r4

//趋势 plot

t4=plot(top4,title="卖 (sell)4",color=color.rgb(244, 9, 9))

t3=plot(top3,title = "卖(sell) 3",color=color.rgb(211, 8, 8))

t2=plot(top2,title="卖 (sell)2",color=color.rgb(146, 13, 13))

t1=plot(top1,title="卖(sell) 1",color=color.rgb(100, 3, 3))

b1=plot(bott1,title="买(buy1)1",color=color.rgb(4, 81, 40))

b2=plot(bott2,title="买(buy)2",color=color.rgb(15, 117, 46))

b3=plot(bott3,title = "买(buy)3",color =color.rgb(8, 176, 42) )

b4=plot(bott4,title="买(buy)4",color=color.rgb(15, 226, 103))

plot(sma,style=plot.style_cross,title="SMA",color=color.rgb(47, 16, 225))

//趋势

LengthF=input(defval = 25,title = "快线长度(fastlength)")

LengthS=input(defval=200,title = "慢线长度(slowlength)")

emaF=ta.ema(close,LengthF)

smaS=ta.sma(close,LengthS)

longTrend=emaF>smaS

longb=ta.crossover(emaF,smaS)

bgcolor(longb ? color.new(color.green,40):na,title = "多头强势(bull trend)")

shortTrend=smaS>emaF

shortb=ta.crossunder(emaF,smaS)

bgcolor(shortb ? color.new(#951313, 40):na,title = "空头强势(bear trend)")

//pinbar

bullPinBar = ((close > open) and ((open - low) > 0.6* (high - low))) or ((close < open) and ((close - low) > 0.9 * (high - low)))

//plotshape(bullPinBar , text ="pinbar", textcolor=color.rgb(9, 168, 144),location=location.belowbar, color=color.rgb(29, 103, 67), size=size.tiny)

bearPinBar = ((close > open) and ((high - close) > 0.7 * (high - low))) or ((close < open) and ((high - open) > 0.7 * (high - low)))

//plotshape(bearPinBar , text ="pinbar", textcolor=color.rgb(219, 12, 12),location=location.abovebar, color=color.rgb(146, 7, 7), size=size.tiny)

buy1=ta.crossunder(close,bott1) and longTrend and close>ta.ema(close,100)

buy2=ta.crossunder(close,bott2) and longTrend

buy3=ta.crossunder(close,bott3) and longTrend

buy4=ta.crossunder(close,bott4) and longTrend

buyclose=bearPinBar or ta.crossunder(close,smaS)

if buy2 or buy3 or buy4 or buy1 and inTradeWindow

strategy.order("多(buy)",strategy.long)

if buyclose and inTradeWindow

strategy.close("多(buy)")

sell1=ta.crossover(close,top1) and shortTrend and close<ta.ema(close,200)

sell2=ta.crossover(close,top2) and shortTrend and close<ta.ema(close,200)

sell3=ta.crossover(close,top3) and shortTrend and close<ta.ema(close,200)

sell4=ta.crossover(close,top4) and shortTrend and close<ta.ema(close,200)

sellclose=bullPinBar or ta.crossover(close,ta.sma(close,220))

if sell1 or sell2 or sell3 or sell4 and inTradeWindow

strategy.order("空(sell)",strategy.short)

if sellclose and inTradeWindow

strategy.close("空(sell)")