概述

该策略主要使用EMA均线指标以及标准差指标,通过EMA均线的交叉信号判断趋势方向,并利用标准差指标寻找突破信号,进而产生买入和卖出信号。当价格突破上轨时产生买入信号,突破下轨时产生卖出信号,属于趋势跟踪类型的策略。

策略原理

该策略主要由三个部分组成:

EMA均线差值(s2):计算快速EMA均线(ema_range)减去慢速EMA均线(ema_watch)的差值,该差值用于判断价格趋势方向。

标准差上下轨(s3):在EMA均线差值的基础上,加入标准差的倍数,构建上下轨道带。其中标准差倍数采用黄金分割数5.618。

旗形和信号:当价格从下向上突破上轨时,产生买入信号;当价格从上向下突破下轨时,产生卖出信号。同时在产生信号时,用旗形标记。

通过该组合指标,可以捕捉价格的趋势方向,在关键点位产生买入和卖出信号,属于典型的趋势跟踪策略。

优势分析

该策略具有以下几个优势:

- 使用EMA均线判断价格趋势方向,可以有效跟踪趋势。

- 借助标准差指标构建上下轨,避免在非关键点产生误信号。

- 旗形信号直观明了,清晰判断买入卖出点位。

- 参数设置灵活,可调整均线周期和标准差倍数。

- 最大回撤控制有助于降低风险。

风险分析

该策略也存在一些风险:

- 在趋势市场效果较好,但在震荡市场中可能产生较多错误信号。

- 标准差倍数设置过大会错过买入卖出机会。

- 没有止损策略,在突破后如果出现回调可能带来较大损失。

针对以上风险,可以通过以下方法加以优化:

- 增加震荡市判断,在震荡市使用其他策略替代。

- 优化标准差参数,寻找最佳参数组合。

- 增加移动止损来控制个别单子的损失。

优化方向

该策略可以从以下几个方向进行优化:

- 增加更多指标判断,例如加上布林带,提高信号质量。

- 优化均线和标准差参数,寻找最佳参数组合。

- 增加止损策略,降低回撤风险。

- 根据不同市场设定最佳买卖信号参数。

- 增加机器学习算法判定overall market regime。

总结

该策略整体属于较为典型的趋势跟踪策略,使用EMA和标准差构建指标系统,并在关键点位产生旗形信号。策略优势在于捕捉趋势,使用标准差指标避免误信号。风险主要在于震荡市的错误信号和无止损导致的回撤风险。通过增加判断指标,优化参数以及加入止损可以进一步增强策略的稳定性和盈利能力。总体来说,该策略框架合理,有很大的优化空间。

策略源码

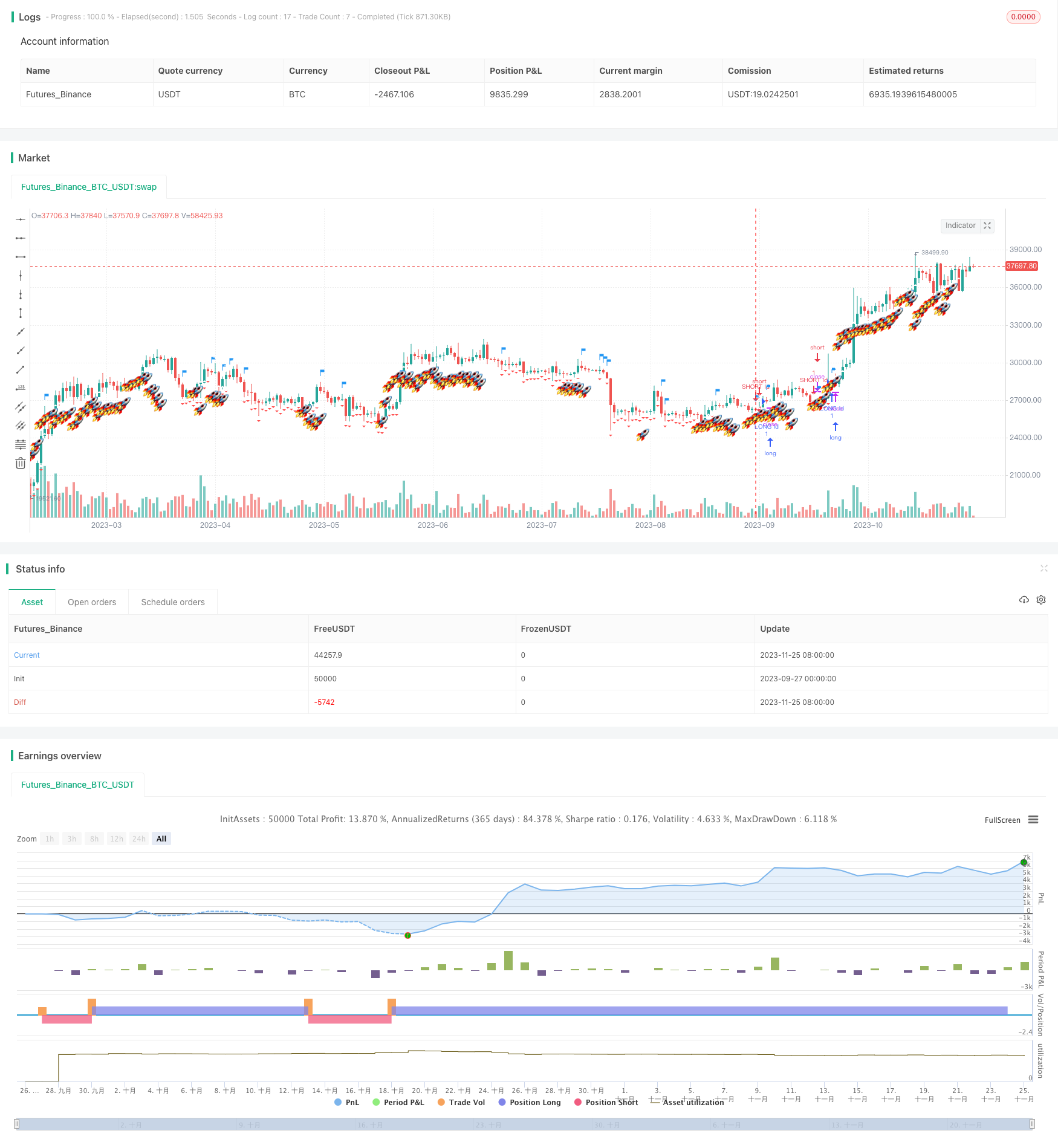

/*backtest

start: 2023-09-27 00:00:00

end: 2023-11-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ROCKET_EWO", overlay=true)

ema_range = input(5)

ema_watch = input(13)

inval_a = input(open)

inval_b = input(open)

ratio = input(0)

max = 5000

s2=ta.ema(inval_a, ema_range) - ta.ema(inval_b, ema_watch)

c_color=s2 <= ratio ? 'red' : 'lime'

s3 = s2 + (ta.stdev(open, 1)) * 5.618

plotshape(s3, color=color.white, style=shape.cross, location=location.abovebar, size=size.auto, show_last=max, transp=30, offset= 0)

cr = s2 > 0

alertcondition(cr, title='[Rocket_EWO]', message='[Rocket_EWO]')

buy = s2 > 1

sell = s2 < -1

txt = "🚀" + "\n"+ "\n"+ "\n"+ "\n"

plotshape(buy, color=color.lime, style=shape.triangleup, location=location.belowbar ,color=color.white, text=txt, size=size.normal, show_last=max, transp=1, offset= -3)

plotshape(not buy, color=color.red, style=shape.triangledown, location=location.belowbar, size=size.normal, show_last=max, transp=1, offset= 0)

signalperiod = time

s4 = ta.cross(s2, 0) ? time : na

colsig= s2 <= ratio ? color.red : color.lime

plotshape((time==s4)?7000:na,color=color.blue, style=shape.flag, location=location.abovebar, size=size.large, transp=1)

longCondition = ta.crossover(s2, 1.618)

if (longCondition)

strategy.entry("LONG Id", strategy.long)

shortCondition = ta.crossunder(s2, 1.618)

if (shortCondition)

strategy.entry("SHORT Id", strategy.short)

strategy.close("LONG Id", when = s2 < 0.218)

// strategy.risk.max_drawdown(75, strategy.percent_of_equity)