概述

本策略是一个基于技术指标MACD和RSI的伦敦交易时段比特币交易策略。它只在伦敦交易时段开仓,使用MACD判断趋势方向进入场内,使用RSI判断超买超卖离场。该策略适合中短线交易比特币。

策略原理

伦敦交易时段

伦敦交易时段在外汇市场非常活跃,大部分机构都会参与其中。本策略设置伦敦时段为早上7点到下午4点之间,只有在这个时段才会开仓。

MACD判断趋势

MACD一般可以判断趋势方向。当快线上穿慢线时为金叉,表示涨势来临,做多;当快线下穿慢线时为死叉,表示跌势来临,做空。本策略就是利用这个原理判断趋势方向。

RSI判断超买超卖

RSI可以判断市场是否超买或者超卖。当RSI大于70时表示超买,当RSI小于30时表示超卖。本策略就是利用这个原理来设置止损退出点。

优势分析

本策略最大的优势在于结合了趋势交易和超买超卖的节奏交易。在趋势不明显的情况下,它可以利用MACD判断 possívelwk的趋势;而利用RSI来控制风险,从而避免在没有明确趋势的情况下盲目追涨杀跌。此外,本策略只在机构主导的伦敦交易时段开仓,可以减少非理性的价格波动对策略的影响。

风险分析

本策略的主要风险在于MACD作为盘整市的技术指标,在明确的趋势下效果并不是很好。如果遇到长期单边行情,MACD的金叉死叉信号可能会频繁失效。此外,RSI在高位徘徊或低位徘徊的情况下也可能失效。为了降低这些风险,我们可以适当调整参数,或增加其他滤波条件来确保只在高概率的信号下开仓。

优化方向

本策略可以从以下几个方面进行优化:

增加其他技术指标过滤,例如布林线、KDJ等,避免假突破。

增加止盈策略,例如移动止损或价格跳空止盈,以锁定更多利润。

优化参数,调整MACD和RSI的参数,适应不同行情类型。

增加机器学习元素,使用lstm等深度学习模型判断趋势策略。

总结

本策略总体来说是一个可靠的伦敦交易时段比特币交易策略。它结合趋势与节奏,在有效过滤无效信号的同时确保了较高的盈利概率。通过持续优化参数与增加其他技术指标判断,本策略可以进一步增强稳定性与收益性。它适合对伦敦时段及MACD和RSI等技术指标有一定了解的投资者使用。

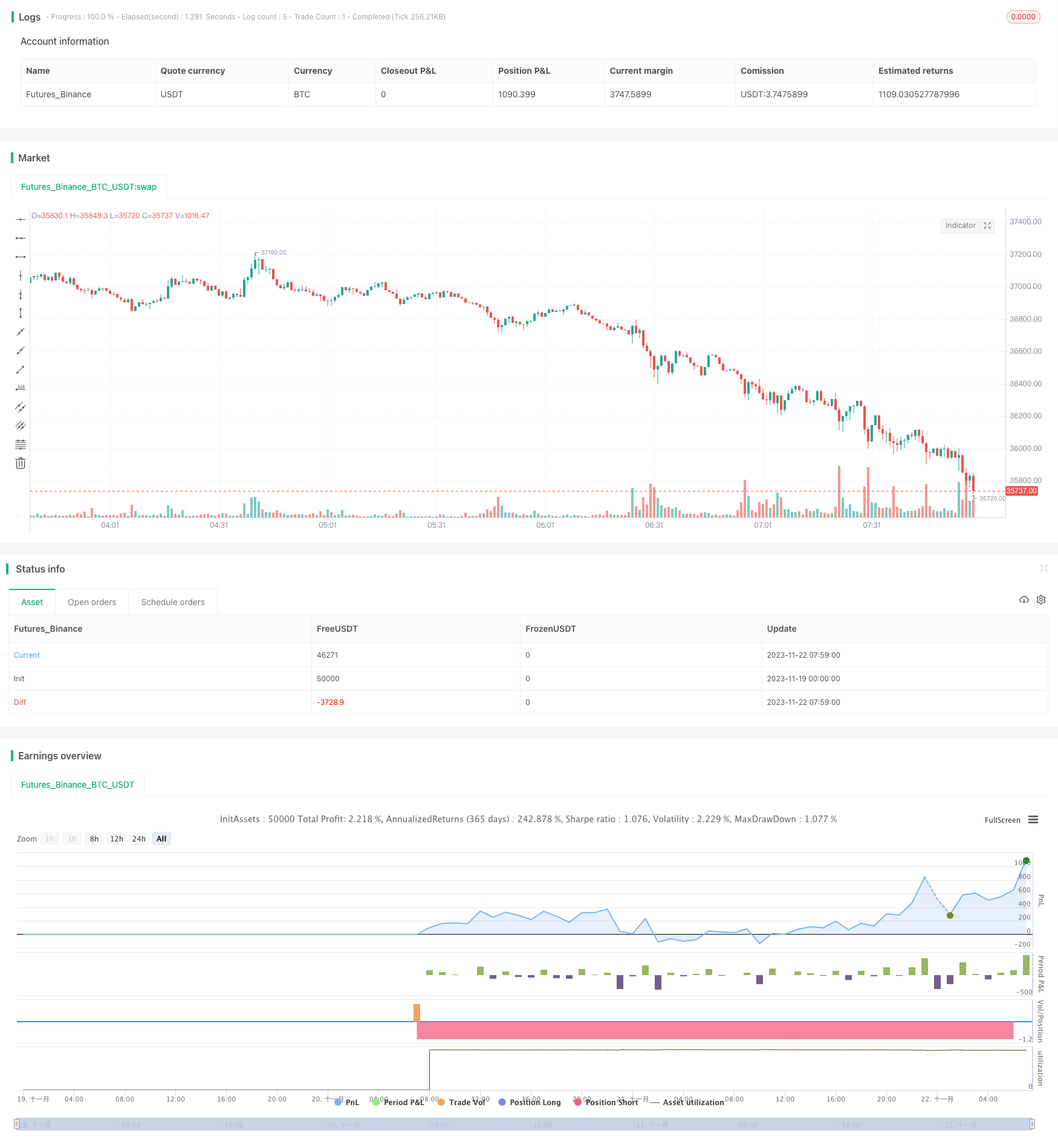

/*backtest

start: 2023-11-19 00:00:00

end: 2023-11-22 08:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("London MACD RSI Strategy -1H BTC", overlay=true)

// Define London session times

london_session_start_hour = input(6, title="London Session Start Hour")

london_session_start_minute = input(59, title="London Session Start Minute")

london_session_end_hour = input(15, title="London Session End Hour")

london_session_end_minute = input(59, title="London Session End Minute")

// Define MACD settings

fastLength = input(12, title="Fast Length")

slowLength = input(26, title="Slow Length")

signalSMA = input(9, title="Signal SMA")

// RSI settings

rsiLength = input(14, title="RSI Length")

rsiOverbought = input(65, title="RSI Overbought")

rsiOversold = input(35, title="RSI Oversold")

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalSMA)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Convert input values to timestamps

london_session_start_timestamp = timestamp(year, month, dayofmonth, london_session_start_hour, london_session_start_minute)

london_session_end_timestamp = timestamp(year, month, dayofmonth, london_session_end_hour, london_session_end_minute)

// Filter for London session

in_london_session = time >= london_session_start_timestamp and time <= london_session_end_timestamp

// Long and Short Conditions

longCondition = ta.crossover(macdLine, signalLine) and rsi < rsiOversold and in_london_session

shortCondition = ta.crossunder(macdLine, signalLine) and rsi > rsiOverbought and in_london_session

// Strategy entries and exits

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)