概述

该策略通过计算股票的快速30日简单移动平均线和慢速33日简单移动平均线,在它们发生金叉或死叉时进行 LONG 或 SHORT 入场。在相反信号出现时立即止损。这可以有效捕捉趋势的变化。

策略原理

该策略的核心在于计算快速30日均线和慢速33日均线。快速线能更快响应价格变化而慢速线则有更好的滤波效果。当快速线从下方突破慢速线而上时产生买入信号。这表示价格开始上涨而快速线已响应但慢速线仍落后。当快速线从上方跌破慢速线而下时产生卖出信号。这表示价格开始下跌而快速线已响应但慢速线仍落后。

通过这样的快慢均线交叉设计,可以在趋势开始的时候产生交易信号,在相反信号出现时止损,有效捕捉了中长线的价格趋势。同时也避免被过多的市场波动所迷惑。

优势分析

该策略具有以下几点优势:

- 使用简单移动平均线,易于理解和实现

- 快速线和慢速线结合,既能快速响应价格变化,也具有滤波效果

- 金叉和死叉信号简单明确,容易操作

- 可以有效捕捉中长线趋势

- 在反向信号出现时快速止损,可控制风险

风险分析

该策略也存在一些风险:

- 当价格处于震荡状态时,可能出现多次虚假信号导致过频交易

- 无法很好地应对突发事件造成的剧烈价格变动

- 选取的参数例如均线周期等可能需要优化,不当设置会影响策略表现

- 交易费用会对盈利造成一定影响

可以通过参数优化、止损点设置、仅在趋势明确时交易等方法来控制和减少这些风险。

优化方向

该策略可从以下几个方面进行优化:

- 对均线周期和交叉类型进行优化,找到最优参数组合

- 增加其他技术指标过滤,例如trading volume, MACD等,减少虚假信号

- 添加adaptive 止损机制,而不是简单的反向信号止损

- 针对不同商品设计参数组合和止损规则

- 结合机器学习等方法动态调整参数

通过测试和优化,可以持续改进策略规则,在不同市场环境下获得更可靠的交易信号。

总结

该双均线交叉突破策略整体来说较为简单实用,通过快速均线和慢速均线的结合,可以有效识别中长线趋势的开始,生成较为可靠的交易信号。同时其止损规则也易于实现。通过进一步优化,该策略可以成为一个值得长期持有的量化系统。

策略源码

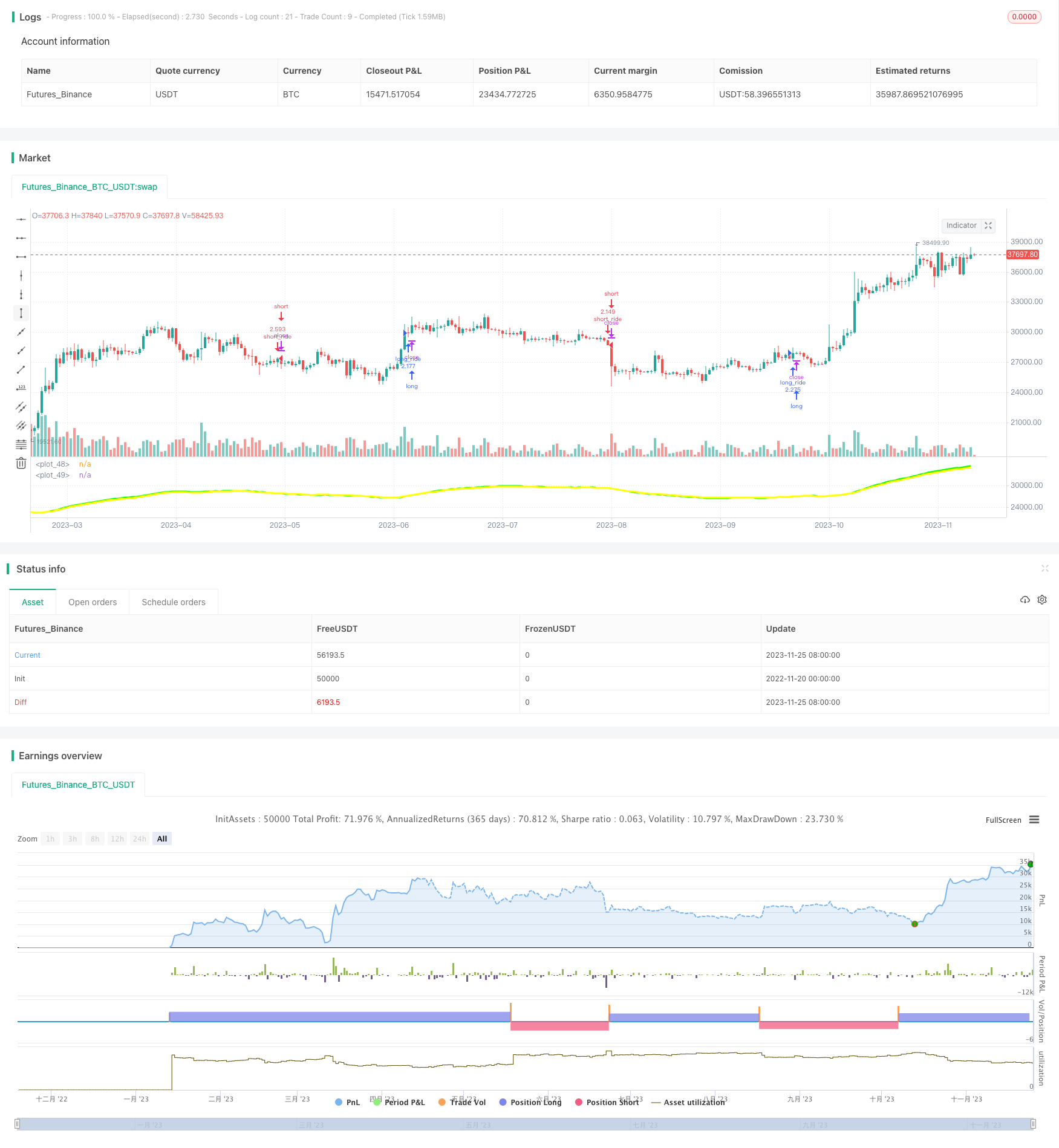

/*backtest

start: 2022-11-20 00:00:00

end: 2023-11-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//future strategy

//strategy(title = "es1!_1minute_hull", default_qty_type = strategy.fixed, initial_capital=250000, overlay = true, commission_type=strategy.commission.cash_per_contract,commission_value=2, calc_on_order_fills=false, calc_on_every_tick=false,pyramiding=0)

//strategy.risk.max_position_size(2)

//stock strategy

strategy(title = "stub", default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=1000000, overlay = false)//, calc_on_order_fills=true, calc_on_every_tick=true)

//forex strategy

//strategy(title = "stub", default_qty_type = strategy.percent_of_equity, default_qty_value = 100, overlay = true,initial_capital=250000, default_qty_type = strategy.percent_of_equity)

//crypto strategy

//strategy(title = "stub", default_qty_type = strategy.percent_of_equity, default_qty_value = 100, overlay = true, commission_type=strategy.commission.percent,commission_value=.005,default_qty_value=10000)

//strategy.risk.allow_entry_in(strategy.direction.long) // There will be no short entries, only exits from long.

testStartYear = 2010

testStartMonth = 1

testStartDay = 1

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testEndYear = 2039

testEndMonth = 1

testEndDay = 1

testPeriodEnd = timestamp(testEndYear,testEndMonth,testEndDay,0,0)

testPeriod() =>

//true

time >= testPeriodStart and time <= testPeriodEnd ? true : false

fast_length = 30

slow_length = 33

ema1 = 0.0

ema2 = 0.0

volumeSum1 = sum(volume, fast_length)

volumeSum2 = sum(volume, slow_length)

//ema1 := (((volumeSum1 - volume) * nz(ema1[1]) + volume * close) / volumeSum1)

ema1 := ema(close,fast_length)

//ema2 := (((volumeSum2 - volume) * nz(ema2[1]) + volume * close) / volumeSum2)

ema2 := ema(close,slow_length)

plot(ema1,color=#00ff00, linewidth=3)

plot(ema2, color=#ffff00, linewidth=3)

go_long = crossover(ema1,ema2)

go_short = crossunder(ema1,ema2)

if testPeriod()

strategy.entry("long_ride", strategy.long, when=go_long)

strategy.entry("short_ride", strategy.short,when=go_short)

strategy.close("long_ride",when=go_short)

strategy.close("short_ride",when=go_long)