概述

这是一个利用均线和布林通道进行趋势判断,并结合突破过滤和止损原理的策略。它可以在趋势变化时及时捕捉信号,通过双均线过滤减少错误信号,设置止损来控制风险。

策略原理

该策略主要由以下几部分组成:

趋势判断:使用MACD判断价格趋势,区分多头和空头趋势。

范围过滤:使用布林通道判断价格波动范围,过滤掉不突破范围的信号。

双均线确认:快速EMA和慢速EMA组成的双均线,用于确认趋势信号。只有快速EMA>慢速EMA时才产生买入信号。

止损机制:设定止损点,在价格向不利方向突破止损点时平仓止损。

进入信号的判断逻辑是:

- MACD判断为向上趋势

- 价格突破布林通道上轨

- 快速EMA高于慢速EMA

当以上3个条件同时满足时产生买入信号。

平仓逻辑分两种,止盈平仓和止损平仓。止盈点为进入价乘以一定比例,止损点为进入价乘以一定比例。当价格突破其中一个点时平仓。

优势分析

这种策略具有以下优势:

- 能及时捕捉趋势变化,traceback较少。

- 通过双均线过滤错误信号,提高信号质量。

- 止损机制有效控制单笔损失。

- 参数优化空间大,可以调整至最佳状态。

风险分析

该策略也存在一些风险:

- 在震荡行情中产生的错误信号可能造成损失。

- 止损点设置不当可能造成不必要的损失。

- 参数不当可能导致策略效果不佳。

针对这些风险,可以通过优化参数,调整止损位置等方式进行优化和改进。

优化方向

该策略可以从以下几个方向进行优化:

- 调整双均线长度,寻找最佳参数组合。

- 测试不同的止损方式,如追踪止损、震荡止损等。

- 对MACD参数进行测试寻找最优参数。

- 利用机器学习对参数进行自动优化。

- 增加附加条件过滤信号。

通过测试不同的参数设置,评估收益率和夏普比率,可以找到该策略的最佳状态。

总结

这是一个利用趋势判断、范围过滤、双均线确认和止损思想的量化策略。它能够有效判断趋势方向,在利润最大化和风险控制之间找到平衡。通过参数优化和机器学习等方式,该策略还有很大的改进空间,能够得到更好的效果。

策略源码

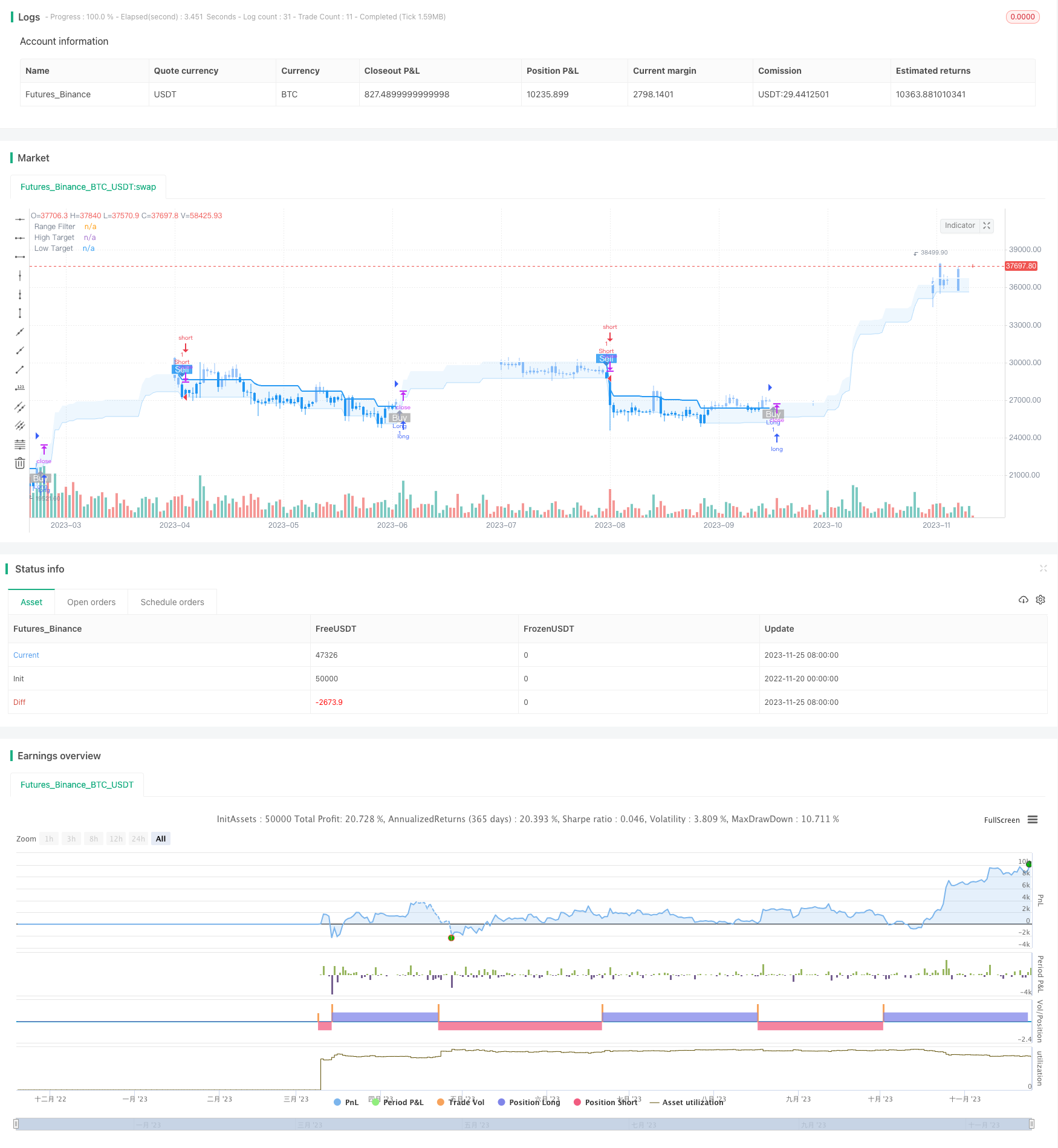

/*backtest

start: 2022-11-20 00:00:00

end: 2023-11-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Range Filter Buy and Sell Strategies", shorttitle="Range Filter Strategies", overlay=true,pyramiding = 5)

// Original Script > @DonovanWall

// Adapted Version > @guikroth

//

// Updated PineScript to version 5

// Republished by > @tvenn

// Strategizing by > @RonLeigh

//////////////////////////////////////////////////////////////////////////

// Settings for 5min chart, BTCUSDC. For Other coin, change the parameters

//////////////////////////////////////////////////////////////////////////

SS = input.bool(false,"Percentage Take Profit Stop Loss")

longProfitPerc = input.float(title='LongProfit(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

shortProfitPerc = input.float(title='ShortProfit(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

longLossPerc = input.float(title='LongStop(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

shortLossPerc = input.float(title='ShortStop(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

// Color variables

upColor = color.white

midColor = #90bff9

downColor = color.blue

// Source

src = input(defval=close, title="Source")

// Sampling Period

// Settings for 5min chart, BTCUSDC. For Other coin, change the paremeters

per = input.int(defval=100, minval=1, title="Sampling Period")

// Range Multiplier

mult = input.float(defval=3.0, minval=0.1, title="Range Multiplier")

// Smooth Average Range

smoothrng(x, t, m) =>

wper = t * 2 - 1

avrng = ta.ema(math.abs(x - x[1]), t)

smoothrng = ta.ema(avrng, wper) * m

smoothrng

smrng = smoothrng(src, per, mult)

// Range Filter

rngfilt(x, r) =>

rngfilt = x

rngfilt := x > nz(rngfilt[1]) ? x - r < nz(rngfilt[1]) ? nz(rngfilt[1]) : x - r :

x + r > nz(rngfilt[1]) ? nz(rngfilt[1]) : x + r

rngfilt

filt = rngfilt(src, smrng)

// Filter Direction

upward = 0.0

upward := filt > filt[1] ? nz(upward[1]) + 1 : filt < filt[1] ? 0 : nz(upward[1])

downward = 0.0

downward := filt < filt[1] ? nz(downward[1]) + 1 : filt > filt[1] ? 0 : nz(downward[1])

// Target Bands

hband = filt + smrng

lband = filt - smrng

// Colors

filtcolor = upward > 0 ? upColor : downward > 0 ? downColor : midColor

barcolor = src > filt and src > src[1] and upward > 0 ? upColor :

src > filt and src < src[1] and upward > 0 ? upColor :

src < filt and src < src[1] and downward > 0 ? downColor :

src < filt and src > src[1] and downward > 0 ? downColor : midColor

filtplot = plot(filt, color=filtcolor, linewidth=2, title="Range Filter")

// Target

hbandplot = plot(hband, color=color.new(upColor, 70), title="High Target")

lbandplot = plot(lband, color=color.new(downColor, 70), title="Low Target")

// Fills

fill(hbandplot, filtplot, color=color.new(upColor, 90), title="High Target Range")

fill(lbandplot, filtplot, color=color.new(downColor, 90), title="Low Target Range")

// Bar Color

barcolor(barcolor)

// Break Outs

longCond = bool(na)

shortCond = bool(na)

longCond := src > filt and src > src[1] and upward > 0 or

src > filt and src < src[1] and upward > 0

shortCond := src < filt and src < src[1] and downward > 0 or

src < filt and src > src[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

// alertcondition(longCondition, title="Buy alert on Range Filter", message="Buy alert on Range Filter")

// alertcondition(shortCondition, title="Sell alert on Range Filter", message="Sell alert on Range Filter")

// alertcondition(longCondition or shortCondition, title="Buy and Sell alert on Range Filter", message="Buy and Sell alert on Range Filter")

////////////// 副

sensitivity = input(150, title='Sensitivity')

fastLength = input(20, title='FastEMA Length')

slowLength = input(40, title='SlowEMA Length')

channelLength = input(20, title='BB Channel Length')

multt = input(2.0, title='BB Stdev Multiplier')

DEAD_ZONE = nz(ta.rma(ta.tr(true), 100)) * 3.7

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, multt) =>

basis = ta.sma(source, length)

dev = multt * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, multt) =>

basis = ta.sma(source, length)

dev = multt * ta.stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) - calc_macd(close[1], fastLength, slowLength)) * sensitivity

e1 = calc_BBUpper(close, channelLength, multt) - calc_BBLower(close, channelLength, multt)

trendUp = t1 >= 0 ? t1 : 0

trendDown = t1 < 0 ? -1 * t1 : 0

duoad = trendUp > 0 and trendUp > e1

kongad = trendDown > 0 and trendDown > e1

duo = longCondition and duoad

kong = shortCondition and kongad

//Alerts

plotshape(longCondition and trendUp > e1 and trendUp > 0 , title="Buy Signal", text="Buy", textcolor=color.white, style=shape.labelup, size=size.small, location=location.belowbar, color=color.new(#aaaaaa, 20))

plotshape(shortCondition and trendDown > e1 and trendDown > 0 , title="Sell Signal", text="Sell", textcolor=color.white, style=shape.labeldown, size=size.small, location=location.abovebar, color=color.new(downColor, 20))

if longCondition and trendUp > e1 and trendUp > 0

strategy.entry('Long',strategy.long, comment = "buy" )

if shortCondition and trendDown > e1 and trendDown > 0

strategy.entry('Short',strategy.short, comment = "sell" )

longlimtPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortlimtPrice = strategy.position_avg_price * (1 - shortProfitPerc)

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

if (strategy.position_size > 0) and SS == true

strategy.exit(id="Long",comment_profit = "Profit",comment_loss = "StopLoss", stop=longStopPrice,limit = longlimtPrice)

if (strategy.position_size < 0) and SS == true

strategy.exit(id="Short",comment_profit = "Profit",comment_loss = "StopLoss", stop=shortStopPrice,limit = shortlimtPrice)