概述

ADX智能趋势跟踪策略利用平均趋向指数(ADX)来判断趋势的力量,在趋势较弱的时候进行趋势捕捉,在强势趋势中进行跟踪获利。该策略判断趋势力量的同时结合价格突破来产生交易信号,属于趋势跟踪策略的一种。

策略原理

该策略主要基于平均趋向指数(ADX)来判断目前的趋势力量。ADX通过计算一定周期内价格波动的 DIRECTIONAL INDICATOR 的平均值来表示趋势的力量。当ADX值低于设定阈值时,我们认为行情正在整理,这时进行方框范围判定,如果价格突破方框上下轨,产生交易信号。

具体来说,策略首先计算14周期的ADX值,低于18时认为趋势较弱。然后计算过去20根K线的最高价和最低价形成的方框范围。当价格突破该方框时,产生买入和卖出信号。止损距离为方框大小的50%,止盈距离为方框大小的100%。

该策略同时结合了趋势力量判断和突破信号,能够在趋势较弱而进入整理的情况下进行捕捉,避免在无序行情中频繁交易。而当出现强势趋势时,止盈范围较大,能够获得更多利润。

策略优势

- 结合趋势力量判断,能够避免在无序行情中频繁交易。

- 方框突破增加了一定的过滤,避免在震荡行情中被套。

- 在趋势行情中,能够获得更大的止盈空间。

- 可自定义ADX参数、方框参数、止损止盈系数等,适应不同品种。

策略风险

- ADX参数设置不当可能错过趋势或判断错误。

- 方框范围过大过小都可能影响效果。

- 止损止盈系数不当可能造成过小止损或止盈太早。

可以通过调整ADX参数、方框参数、止损止盈系数等来优化,使之更适合不同的品种和行情环境。同时严格的资金管理也很重要,控制单笔止损比例,避免单笔大损失。

策略优化方向

- ADX参数可以测试不同周期效果。

- 方框参数可以测试不同长度,判断最佳范围大小。

- 止损止盈系数可以微调,优化风险收益比。

- 可以测试仅做多、仅做空的单边交易效果。

- 可以加入其他指标进行组合,如增加量能指标等。

总结

ADX智能趋势跟踪策略总体来说是一种较为稳定的趋势策略。它同时结合了趋势力量判断和价格突破信号,在一定程度上避免了常见趋势跟踪策略中追高杀跌的问题。通过参数优化和严格的资金管理,可以使该策略稳定获利。

策略源码

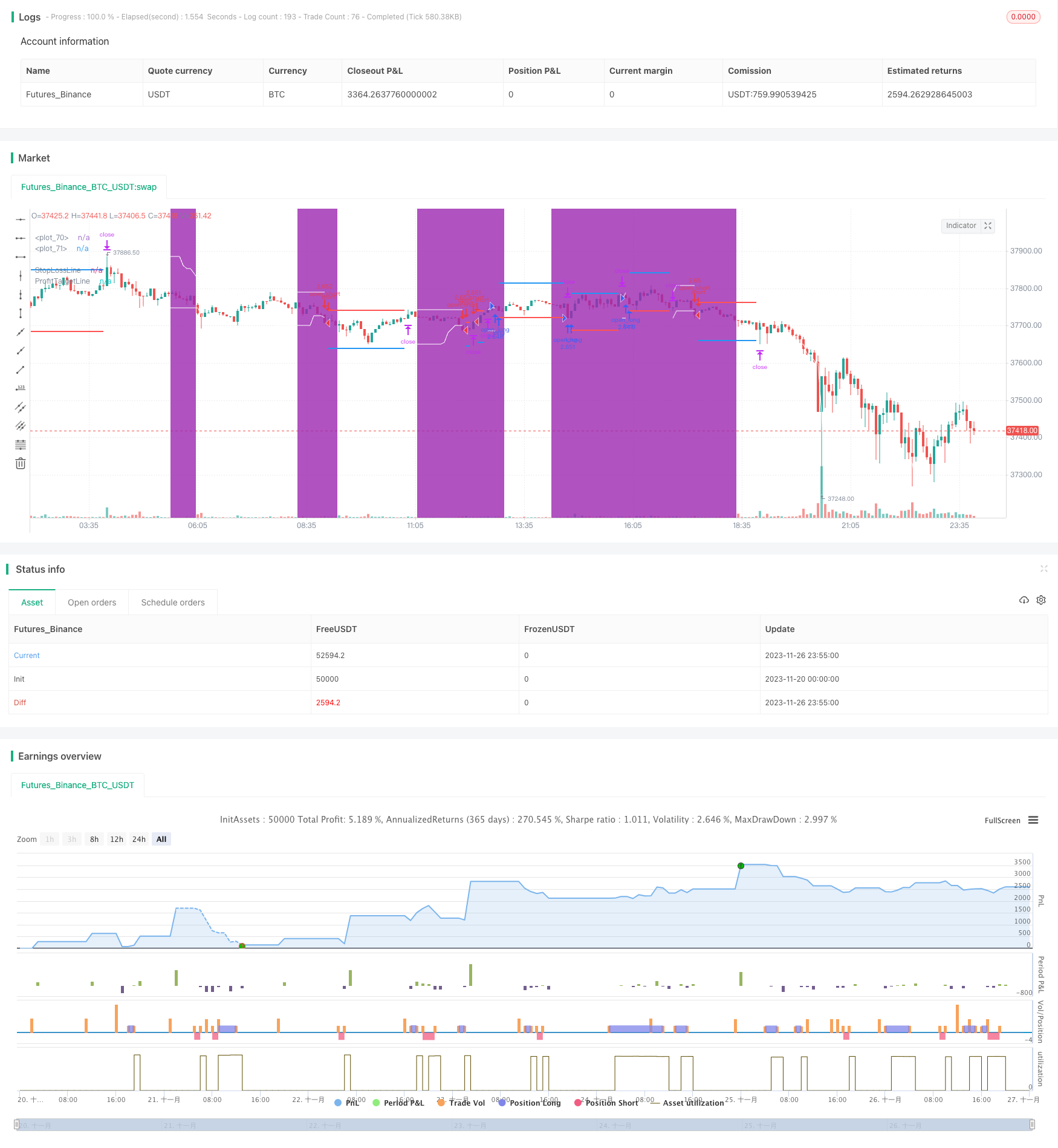

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Developer: Andrew Palladino.

//Creator: Rob Booker.

//Date: 9/29/2017

//@version=5

//Date: 08/10/2022

//Updated to V5 from V1, default cash settings added and indicators made more easily visible by:

// @ Powerscooter

strategy("Rob Booker - ADX Breakout", shorttitle="ADX Breakout V5", overlay=true, default_qty_type = strategy.cash, default_qty_value = 100000, initial_capital = 100000)

adxSmoothPeriod = input(14, title="ADX Smoothing Period", group = "ADX Settings")

adxPeriod = input(14, title="ADX Period", group = "ADX Settings")

adxLowerLevel = input(18, title="ADX Lower Level", group = "ADX Settings")

boxLookBack = input(20, title="BreakoutBox Lookback Period", group = "BreakoutBox")

profitTargetMultiple = input(1.0, title="Profit Target Box Width Multiple", group = "Take Profit and Stop Loss")

stopLossMultiple = input(0.5, title="Stop Loss Box Width Multiple", group = "Take Profit and Stop Loss")

enableDirection = input(0, title="Both(0), Long(1), Short(-1)", group = "Trade Direction")

// When the ADX drops below threshold limit, then we consider the pair in consolidation.

// Set Box around highs and lows of the last 20 candles. with upper and lower boundaries.

// When price breaks outside of box, a trade is taken. (on close or on touch?)

// Stop is placed, default 50%, of the size of the box. So if box is 200 pips, stop is at 100 pips.

// Profit target is 100% of the size of the box. Default. User can set a profit target of 0.5, 1 full size, 2 or 3.

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(up > down and up > 0 ? up : 0, len) / truerange)

minus = fixnan(100 * ta.rma(down > up and down > 0 ? down : 0, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

adxHigh(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

plus

adxLow(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

minus

sig = adx(adxSmoothPeriod, adxPeriod)

//sigHigh = adxHigh(dilen, adxlen)

//sigLow = adxLow(dilen, adxlen)

isADXLow = sig < adxLowerLevel

//boxUpperLevel = ta.highest(high, boxLookBack)[1]

//boxLowerLevel = ta.lowest(low, boxLookBack)[1]

var float boxUpperLevelCarry = 0

var float boxLowerLevelCarry = 0

boxUpperLevel = strategy.position_size == 0 ? ta.highest(high, boxLookBack)[1] : boxUpperLevelCarry

boxUpperLevelCarry := boxUpperLevel

boxLowerLevel = strategy.position_size == 0 ? ta.lowest(low, boxLookBack)[1] : boxLowerLevelCarry

boxLowerLevelCarry := boxLowerLevel

boxWidth = boxUpperLevel - boxLowerLevel

profitTarget = strategy.position_size > 0 ? strategy.position_avg_price + profitTargetMultiple*boxWidth : strategy.position_size < 0 ? strategy.position_avg_price - profitTargetMultiple*boxWidth : na

stopLoss = strategy.position_size > 0 ? strategy.position_avg_price - stopLossMultiple*boxWidth : strategy.position_size < 0 ? strategy.position_avg_price + stopLossMultiple*boxWidth : na

plot(strategy.position_size == 0 ? boxUpperLevel : na, color=color.white, style = plot.style_linebr)

plot(strategy.position_size == 0 ? boxLowerLevel : na, color=color.white, style = plot.style_linebr)

bgcolor(isADXLow ? color.purple : na, transp=72, title = "ADX limit")

plot(stopLoss, color=color.red, linewidth=2, style = plot.style_linebr, title="StopLossLine")

plot(profitTarget, color=color.blue, linewidth=2, style = plot.style_linebr, title="ProfitTargetLine")

isBuyValid = strategy.position_size == 0 and ta.cross(close, boxUpperLevel) and isADXLow

//Long Entry Condition

strategy.exit("close_long", from_entry="open_long", limit = profitTarget, stop = stopLoss)

if isBuyValid and strategy.opentrades == 0 and (enableDirection == -1 or enableDirection == 0)

strategy.entry("open_long", strategy.long)

isSellValid = strategy.position_size == 0 and ta.cross(close, boxLowerLevel) and isADXLow

//Short Entry condition

strategy.exit(id="close_short", from_entry="open_short", limit = profitTarget, stop = stopLoss)

if isSellValid and strategy.opentrades == 0 and (enableDirection == 1 or enableDirection == 0)

strategy.entry("open_short", strategy.short)