概述

多时间框架MACD策略(Multi Timeframe MACD Strategy)是一个利用MACD指标在多个时间框架上实现趋势跟踪的量化交易策略。该策略通过在不同的时间周期(3分钟、5分钟、15分钟、30分钟)上计算MACD指标,判断不同周期之间的价格走势是否一致,来发出交易信号。

策略原理

该策略的核心逻辑是计算MACD指标在多个时间框架(3分钟、5分钟、15分钟、30分钟)上的交叉情况。首先在每个时间框架上计算MACD指标,根据MACD指标判断该时间框架下的价格走势(上升or下降)。然后将多个时间框架下的价格走势进行综合判断:

- 当所有时间框架下价格均上升时,产生买入信号;

- 当所有时间框架下价格均下降时,产生卖出信号。

通过跨时间框架判断趋势的方式,可以有效滤除短期市场噪音,使交易信号更加可靠。

策略优势

本策略具有以下优势:

- 跨时间框架检测趋势,过滤噪音,使交易信号更加可靠;

- MACD指标参数可自定义设置,适应不同市场环境;

- 可灵活配置需要综合判断的时间框架,自主定义交易规则。

策略风险及解决方案

本策略也存在以下风险:

- 在所有时间框架判断趋势一致性时,可能会错过局部反转的机会;

- MACD指标参数设置不当可能导致交易信号效果不佳。

对应解决方案:

- 可以适当放宽综合判断规则,允许个别时间框架价格出现反转,抓住更多机会;

- 需要根据不同市场调整MACD指标参数,使交易信号更契合当前行情。

优化方向

本策略可以从以下几个方面继续优化:

- 增加或减少需要综合判断的时间框架数量,寻找最佳组合;

- 测试不同的MACD指标参数设置;

- 根据实际回测情况调整具体的入场和出场规则。

总结

多时间框架MACD策略利用MACD指标的趋势判断功能,实现了跨时间框架进行价格走势检测,可有效过滤噪音,提高信号质量。该策略可以通过参数调整和规则优化,灵活适应不同品种和行情环境,具有很强的实用性。

策略源码

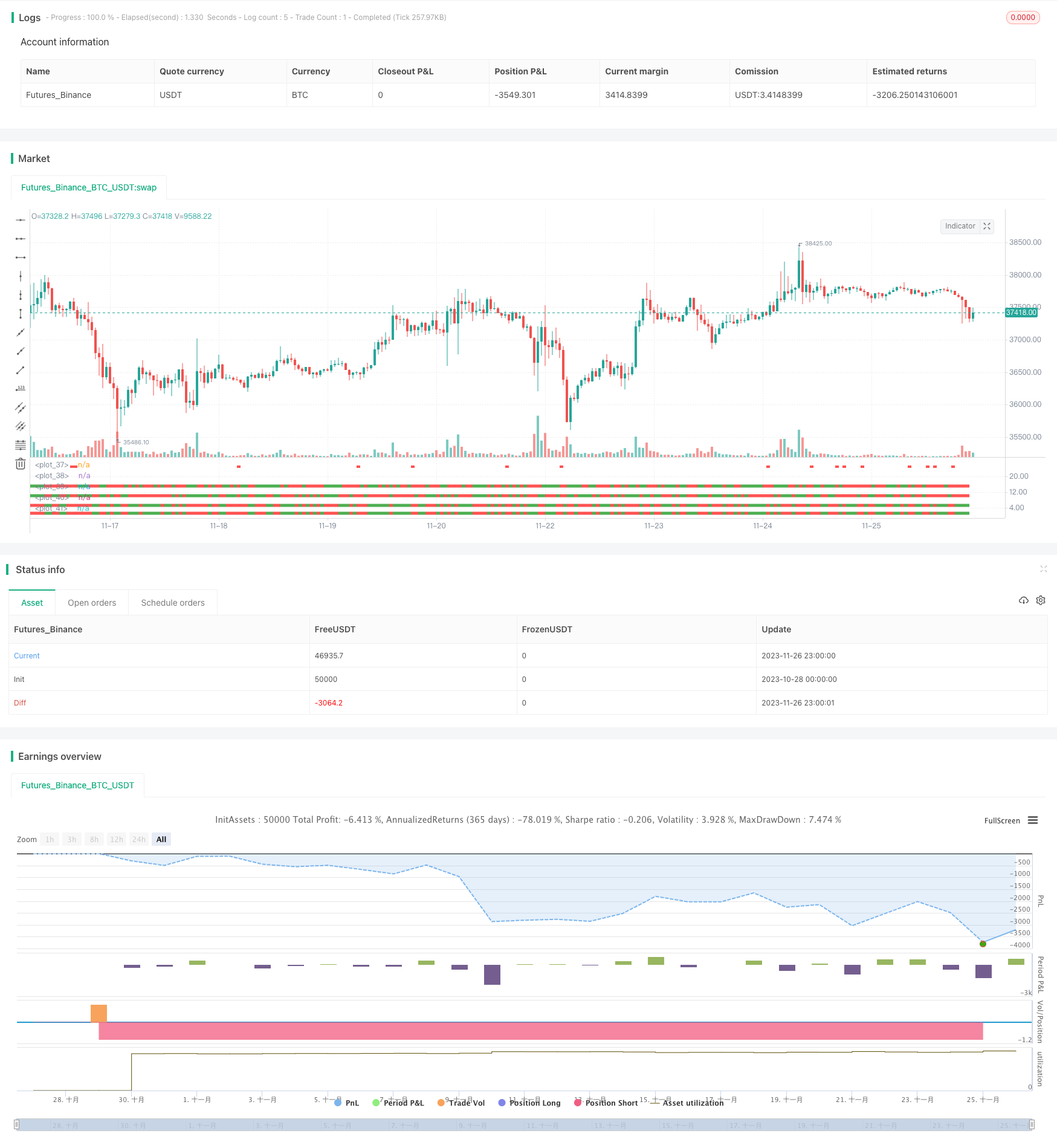

/*backtest

start: 2023-10-28 00:00:00

end: 2023-11-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("[RichG] Easy MTF Strategy", overlay=false)

TF_1_time = input("3", "Timeframe 1")

TF_2_time = input("5", "Timeframe 2")

TF_3_time = input("15", "Timeframe 3")

TF_4_time = input("30", "Timeframe 4")

fastLen = input(title="Fast Length", defval=12)

slowLen = input(title="Slow Length", defval=26)

sigLen = input(title="Signal Length", defval=9)

[macdLine, signalLine, _] = macd(close, fastLen, slowLen, sigLen)

width = 5

upcolor = green

downcolor = red

neutralcolor = blue

linestyle = line

TF_1 = request.security(syminfo.tickerid, TF_1_time, open) < request.security(syminfo.tickerid, TF_1_time, close) ? true:false

TF_1_color = TF_1 ? upcolor:downcolor

TF_2 = request.security(syminfo.tickerid, TF_2_time, open) < request.security(syminfo.tickerid, TF_2_time, close) ? true:false

TF_2_color = TF_2 ? upcolor:downcolor

TF_3 = request.security(syminfo.tickerid, TF_3_time, open) < request.security(syminfo.tickerid, TF_3_time, close) ? true:false

TF_3_color = TF_3 ? upcolor:downcolor

TF_4 = request.security(syminfo.tickerid, TF_4_time, open) < request.security(syminfo.tickerid, TF_4_time, close) ? true:false

TF_4_color = TF_4 ? upcolor:downcolor

TF_global = TF_1 and TF_2 and TF_3 and TF_4

TF_global_bear = TF_1 == false and TF_2 == false and TF_3 == false and TF_4 == false

TF_global_color = TF_global ? green : TF_global_bear ? red : white

TF_trigger_width = TF_global ? 6 : width

plot(1, style=linestyle, linewidth=width, color=TF_1_color)

plot(5, style=linestyle, linewidth=width, color=TF_2_color)

plot(10, style=linestyle, linewidth=width, color=TF_3_color)

plot(15, style=linestyle, linewidth=width, color=TF_4_color)

plot(25, style=linestyle, linewidth=4, color=TF_global_color)

exitCondition_Long = TF_global_bear

exitCondition_Short = TF_global

longCondition = TF_global

if (longCondition)

strategy.entry("MTF_Long", strategy.long)

shortCondition = TF_global_bear

if (shortCondition)

strategy.entry("MTF_Short", strategy.short)

strategy.close("MTF_Long", when=exitCondition_Long)

strategy.close("MTF_Short", when=exitCondition_Short)