概述

该策略通过结合经典技术指标CCI和自主研发的VCI、MCI双指数形成交易信号,属于典型的量化交易策略。其通过识别Volume和Price的变化趋势,判断当前行情主要交易方向和力度,形成交易信号。可以广泛应用于数字货币、外汇以及股票等金融工具。

策略原理

- 计算ohlc4均线,并结合cci指标判断价位;

- 计算obv指标衡量资金流向;

- 计算VCI指数,即通过obv指标的方差测量资金流量分布;

- 计算MCI指数,即通过价格的方差测量价格分布;

- VCI与MCI指数进行比较,判断市场买卖态势;

- VCI > MCI,买方意愿强;

- VCI < MCI, 卖方意愿强;

- 根据VCI和MCI的比较形成做多做空信号;

优势分析

- 该策略综合考虑了价格、交易量以及资金流向多个维度,判断市场买卖态势,信号较为准确;

- VCI和MCI通过动态标准差计算,能够适应市场的实时变化;

- 策略参数经过大量回测优化,具有较强的稳定性;

风险分析

- 价格和交易量指标计算滞后,不能提前捕捉突发事件;

- 单一策略无法完全覆盖复杂多变的市场情况;

- 需要与其他辅助指标结合使用,不能单独判断市场;

优化方向

- 结合深度学习等预测模型,提高信号判断的准确性;

- 增加止损等风险控制模块,提高策略的稳定性;

- 可尝试不同参数组合,测试在特定市场中的适用性;

总结

该策略通过双cci指数的比较形成交易信号,考虑了价格和交易量等多个因素,对市场买卖力度进行评估,是一种典型且实用的量化交易策略。但仍需与其他辅助工具配合使用,才能发挥策略最大效用。值得进一步优化提高适用场景,减少风险。

策略源码

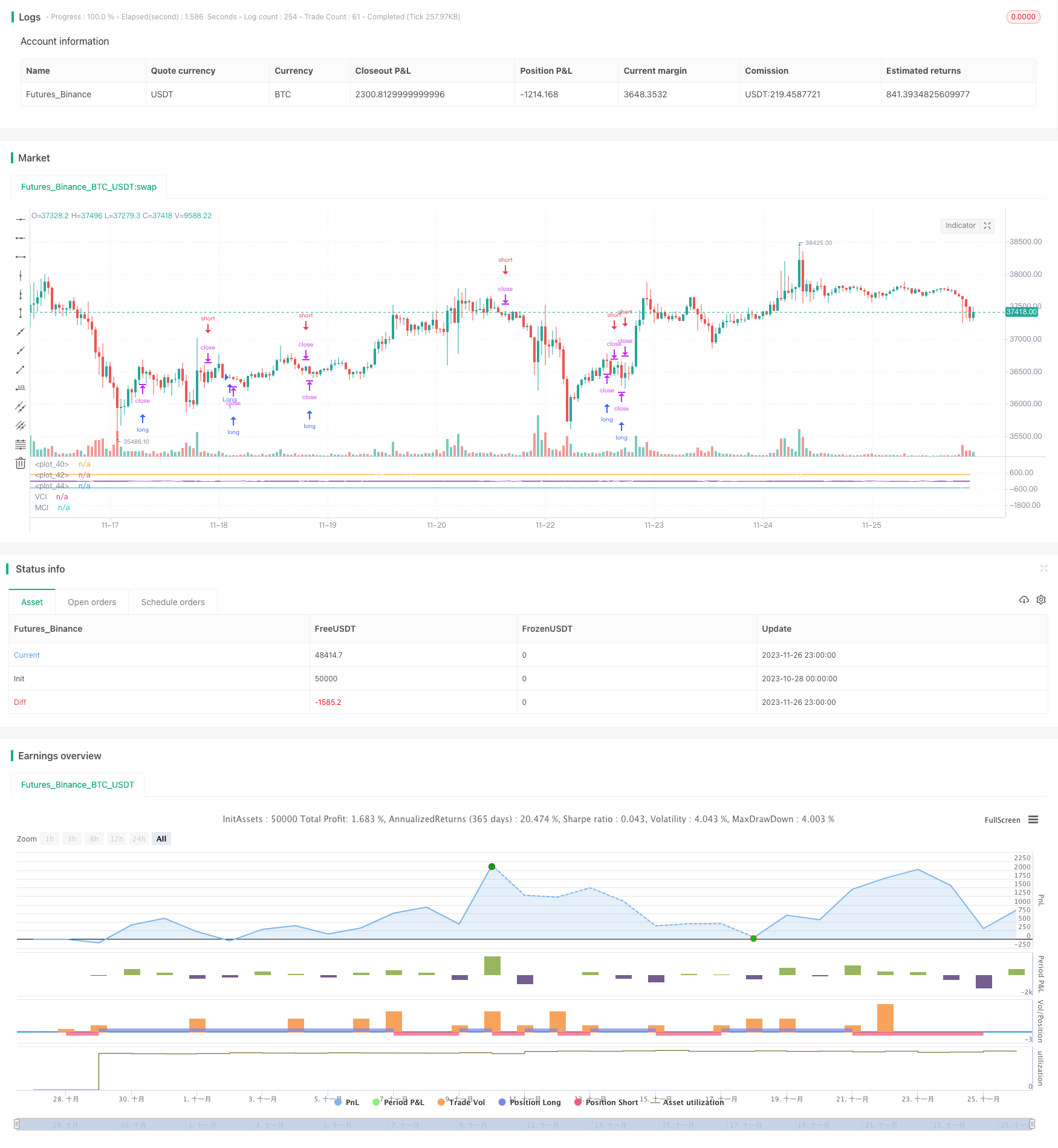

/*backtest

start: 2023-10-28 00:00:00

end: 2023-11-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("MCI and VCI - Modified CCI Formulas")

test = cci(ohlc4, 13)

test1 = cci(ohlc4, 20)

obv(src) => cum(change(src) > 0 ? volume : change(src) < 0 ? -volume : 0*volume)

mDisc = input(0, title="Mode Discrepency")

mDiv = input(0.015, title="Interval")

mean(_src, _length)=>

_return = sum(_src, _length) / _length

median(_src, _length)=>

_return = _src

for _i = 0 to _length

_return := _return == 0 ? _src : (_return + _src[_i]) / 2

_return

len = input(20, title="Standard (Average) Length")

mmm = input(20, title="Lookback length")

srcV = obv(input(ohlc4))

srcP = input(close)

x = sma(srcV, len)

MDV2 = abs(stdev(median(x, len), mmm))

MDV3 = abs(stdev(mean(x, len), mmm))

AMDV = (MDV2+MDV3)/2

pt1v = (srcV-ema(srcV, len))/ AMDV

pt2v = 1/mDiv

VCI=pt1v*pt2v

y = ema(srcP, len)

MDP2 = abs(stdev(median(y, len), mmm))

MDP3 = abs(stdev(mean(y, len), mmm))

AMDA = (MDP2 + MDP3)/2

pt1p = 1/mDiv

pt2p = (srcP-ema(srcP, len))/ AMDA

MCI = pt1p * pt2p

plot(VCI, color=yellow, title="VCI", style="Histogram")

plot(MCI, color=white, title="MCI")

plot(500, style=line)

plot(0, style=line, linewidth=2)

plot(-500, style=line)

long = crossover(MCI, 0) and VCI > MCI[2]

short = crossunder(MCI, 0) and VCI < MCI[2]

//Time Control

//Set date and time

FromMonth = input(defval = 9, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 13, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

direction = input(0, title = "Strategy Direction", minval=-1, maxval=1)

strategy.risk.allow_entry_in(direction == 0 ? strategy.direction.all : (direction < 0 ? strategy.direction.short : strategy.direction.long))

if (long)

strategy.entry("Long", strategy.long, when=window(), limit=ohlc4, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="Long")

if (short)

strategy.entry("Short", strategy.short, when=window(), limit=ohlc4, oca_name="BollingerBands", comment="BBandSE")

else

strategy.cancel(id="Short")