概述

闭合阳线策略是一种基于K线形态的量化交易策略。该策略通过识别“闭合阳线”形态来寻找买入卖出信号。

策略原理

该策略的核心原理是:当前K线为阴线,前一K线为阳线,且当前K线的最低价高于前一K线的最低价,当前K线的最高价低于前一K线的最高价时,产生“闭合阳线”形态。这意味着价格已经形成一个封闭的上涨空间,显示多头力量即将耗尽,这是卖出信号。相反,当形成“闭合阴线”时,产生买入信号。

这里使用K线实体的平均值作为止损线。当实体大于止损线一半时止损。

优势分析

闭合阳线策略的优势主要有:

- 基于简单合理的K线形态判断,容易理解和实现。

- 可以识别换手较少的区间突破。当涨幅收窄出现“闭合阳线”时,多头力量即将耗尽,这是合适的卖点。

- 有明确的止损机制以控制风险。

风险分析

闭合阳线策略也存在一些风险:

- 监测频率较低,可能错过最佳买卖点。对较短周期的K线效果不佳。

- 假阳线、假阴线可能导致错误信号。需要结合成交量等指标进行过滤。

- 仅基于K线形态,没有考虑其他技术指标和基本面因素的综合判断,存在一定盲目性。

为降低这些风险,可以考虑加入成交量的条件判断,或与移动均线等其他指标结合使用,综合判断市场走势。 止损线也可以根据市场波动程度进行动态调整。

优化方向

闭合阳线策略还可以从以下几个方面进行优化:

- 加入成交量的条件判断。成交量急剧放大常常意味着趋势反转。

- 调整止损条件。可以根据市场波动程度及风险偏好动态调整止损线。

- 多周期结合。识别多周期上关键支持位附近的阳线闭合卖点。

- 与其他技术指标结合。例如加上均线系统判断整体走势,或引入一些预测型指标提前判断买卖点。

总结

闭合阳线策略作为一种基于K线形态的量化策略,优势在于简单易懂、容易实现,能有效识别一定的买卖信号。但也存在一些局限,如容易产生错误信号、盲目性较强等。这些问题也为该策略提供了优化的方向。通过使用成交量、多周期分析、其他技术指标等信息进行综合判断,可以进一步增强该策略的效果。

策略源码

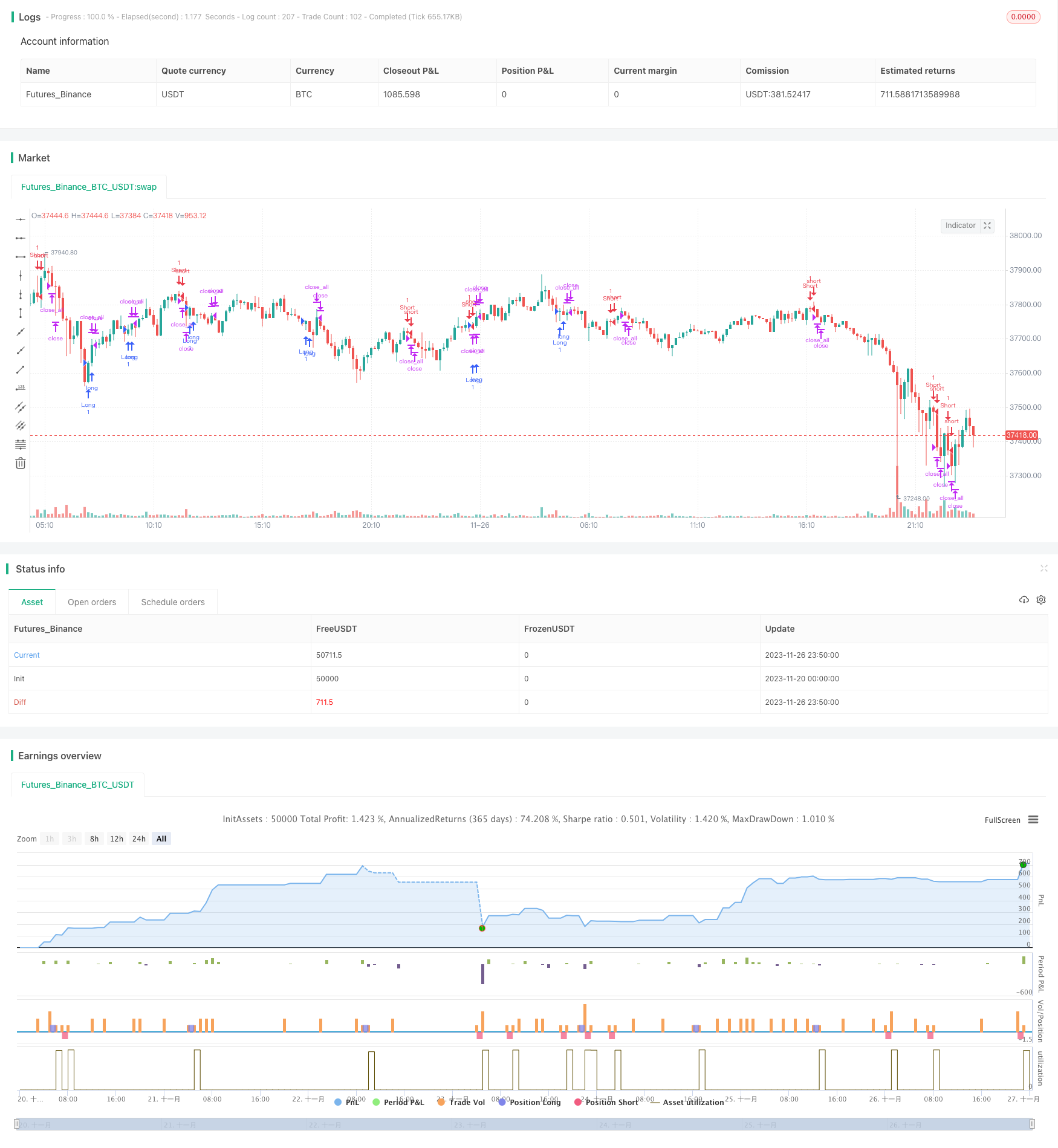

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=3

strategy(title = "Noro's Harami Strategy v1.0", shorttitle = "Harami str 1.0", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(false, defval = false, title = "Short")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Body

body = abs(close - open)

abody = sma(body, 10)

//MinMax Bars

min = min(close, open)

max = max(close, open)

bar = close > open ? 1 : close < open ? -1 : 0

//Signals

up = bar == 1 and bar[1] == -1 and min > min[1] and max < max[1]

dn = bar == -1 and bar[1] == 1 and min > min[1] and max < max[1]

exit = ((strategy.position_size > 0 and bar == 1) or (strategy.position_size < 0 and bar == -1)) and body > abody / 2

//Trading

if up

if strategy.position_size < 0

strategy.close_all()

strategy.entry("Long", strategy.long, needlong == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if dn

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if time > timestamp(toyear, tomonth, today, 23, 59) or exit

strategy.close_all()