概述

该策略是一个基于布林带的动量波动追踪策略。它结合布林带指标判断市场趋势和反转点,通过设置多空仓位追踪市场波动。

策略原理

该策略的核心指标是布林带。布林带由中轨、上轨和下轨组成。中轨是n天的移动平均线,上下轨分别是中轨加减标准差的偏移。当价格接近上下轨时视为超买超卖的信号。策略加入趋势偏离作为建仓的依据,即当价格反向突破中轨时开仓。为防止假突破造成亏损,策略要求开仓突破幅度大于均值。平仓条件是突破中轨后价格再次回折。

该策略同时加入了趋势性建仓和反转型建仓,分别对应不同的交易机会。趋势性建仓要求中轨作为支撑阻力参考,形成突破偏离的效果。反转型建仓则直接在布林带上下轨附近反转形成。策略通过组合这两种启示,能够兼顾趋势追踪和反转操作。

优势分析

该策略结合布林带的超买超卖特征,加入反转点判断。这使得其能够同时适用于趋势市和震荡市,捕捉不同类型的交易机会。策略的止损 Exit 设置防止了亏损扩大。多空双向交易的特点也增强了策略的适用性。

相比简单布林带策略,该策略加入的趋势逻辑判断使得建仓更稳定,同时也抓住了反转机会。这让信噪比得到提升。其次,多空双向交易也比较全面的利用了不同市场的交易机会。

风险分析

该策略主要依赖布林带的超买超卖特征。所以当价格出现剧烈波动时,布林带区间会不断增加,容易导致多次亏损建仓。这是潜在的风险点。此外,反转判断依然有一定的不确定性和误差,会造成失败的建仓和停损。

针对布林带失效的情况,可以缩短n天参数,使布林带更灵敏。或者减小它的幅度范围,降低造成亏损的可能。对于反转曲线判断,则可通过优化突破的参数来减少错误。

优化方向

该策略可优化的方向主要有以下几个: 1. 布林带的参数可根据不同市场调整,找到最佳的参数组合。 2. 趋势偏离的幅度和均值的计算方式可以测试其他选项。 3. 加入更多过滤器判断建仓信号,减少误判概率。 4. 可测试止损方式,如trail停损等其他模式。 5. 可以针对特定品种、周期进行参数调优。

总结

该策略对布林带标准策略进行了有效的扩展与优化。加入的趋势偏离判断提高了稳定性,利用好了反转机会。多空双向交易和止损设置也让策略更加健壮。通过参数优化和加入更多过滤器,可进一步提高效果

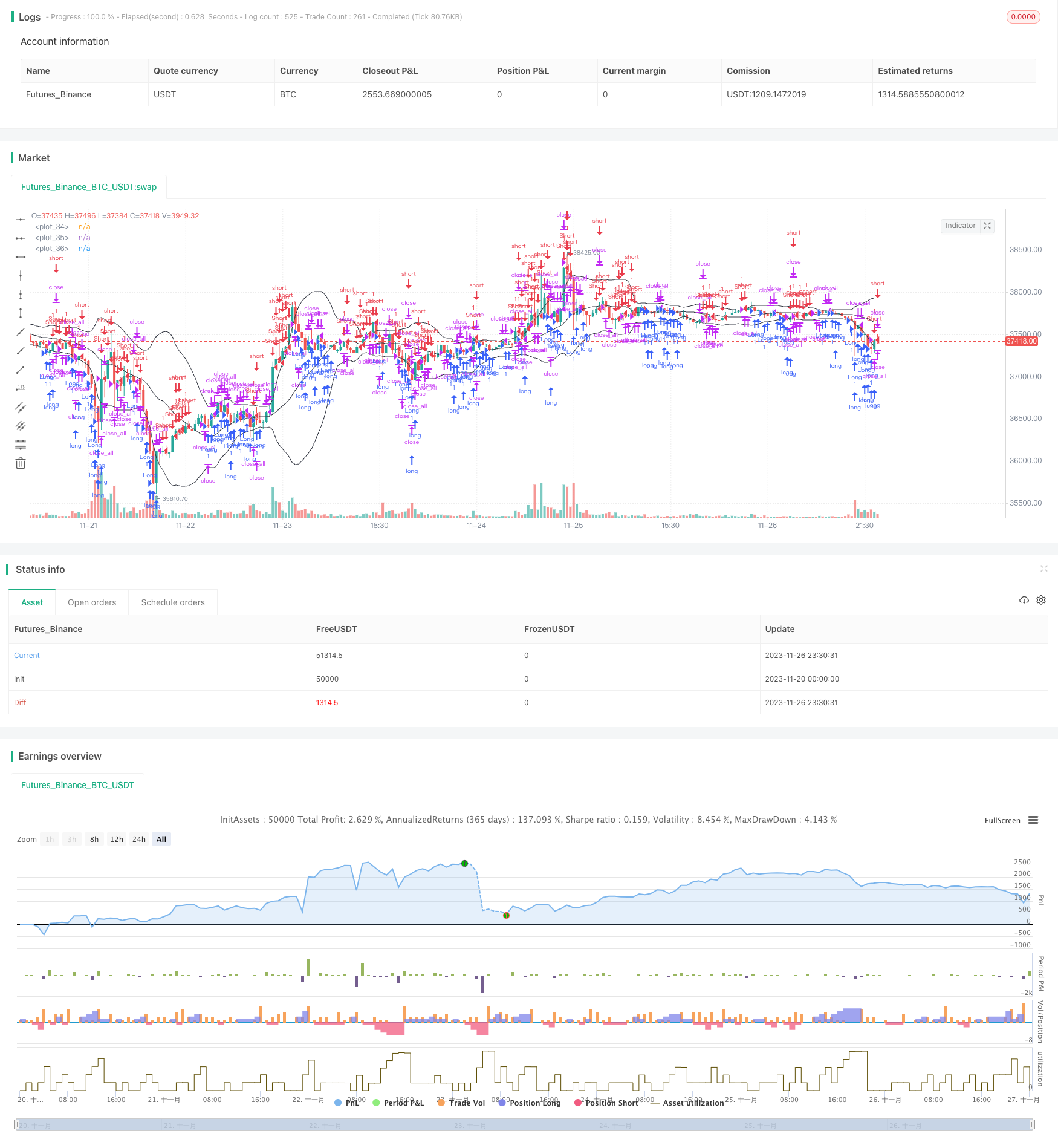

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=3

strategy("Noro's Bollinger Strategy v1.3", shorttitle = "Bollinger str 1.3", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100.0, pyramiding = 5)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

length = input(20, defval = 20, minval = 1, maxval = 1000, title = "Bollinger Length")

mult = input(2.0, defval = 2.0, minval = 0.001, maxval = 50, title = "Bollinger Mult")

source = input(ohlc4, defval = ohlc4, title = "Bollinger Source")

uset = input(true, defval = true, title = "Use trend entry")

usect = input(true, defval = true, title = "Use counter-trend entry")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

showbands = input(true, defval = true, title = "Show Bollinger Bands")

//Bollinger Bands

basis = sma(source, length)

dev = mult * stdev(source, length)

upper = basis + dev

lower = basis - dev

//Lines

col = showbands ? black : na

plot(upper, linewidth = 1, color = col)

plot(basis, linewidth = 1, color = col)

plot(lower, linewidth = 1, color = col)

//Body

body = abs(close - open)

abody = ema(body, 30)

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up1 = bar == -1 and ohlc4 >= basis and ohlc4 < upper and (close < strategy.position_avg_price or strategy.position_size == 0) and uset

dn1 = bar == 1 and ohlc4 <= basis and ohlc4 > lower and (close > strategy.position_avg_price or strategy.position_size == 0) and uset

up2 = close <= lower and usect

dn2 = close >= upper and usect

exit = ((strategy.position_size > 0 and close > open) or (strategy.position_size < 0 and close < open)) and body > abody / 2

//Trading

if up1 or up2

strategy.entry("Long", strategy.long, needlong == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if dn1 or dn2

strategy.entry("Short", strategy.short, needshort == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if time > timestamp(toyear, tomonth, today, 23, 59) or exit

strategy.close_all()