概述

RSI均线交叉趋势策略(RSI Moving Average Crossover Trend Strategy)是一个利用RSI指标的均线交叉信号来判断趋势和发出交易信号的策略。该策略同时结合价格的EMA,只有当价格高于EMA的时候,才会发出买入信号。

策略原理

该策略的核心指标是RSI,同时计算RSI的EMA和SMA两条均线。只有当RSI的EMA线高于SMA线而价格高于EMA时,才会发出买入信号;当RSI的EMA线低于SMA线时,会发出卖出信号,实施趋势跟踪。

RSI指标能够有效反映市场的超买超卖现象。RSI指标上突破70视为市场超买,而下破30则被视为超卖。该策略运用EMA和SMA两条移动平均线来发现RSI指标的趋势和转折点。EMA线对最新价格变化更为敏感,而SMA线对老数据的依赖更高,二者能够形成配合。

当RSI的EMA开始上扬,说明市场出现盘整企稳迹象,此时用SMA来验证其方向;当SMA也开始上扬,说明RSI明确进入上升趋势,这时策略会在价格高于EMA的前提下发出买入信号,跟踪趋势。

优势分析

这是一个跟踪趋势的策略,能够有效抓住中长线的方向性机会。相比单一指标,该策略运用RSI的EMA和SMA形成交叉验证,可以减少错误信号和增强稳定性。

该策略还结合价格的EMA以确保只在价格上升趋势中买入,避免震荡行情的风险,从而提高盈利概率。

风险分析

该策略主要基于RSI指标,当RSI产生错误信号时,该策略也会跟随发出错误信号。此外,RSI指标更适用于判断超买超卖现象,对判断中长线趋势有一定的滞后性。

该策略也存在一定的时间滞后,特别是当RSI的EMA和SMA均值偏平盘整时,会导致信号推迟。这段期间亦存在一定亏损的风险。

优化方向

可以考虑对RSI进行优化,选取更加合适的参数,增强其判断效果。

可以考虑加入止损逻辑,在亏损达到一定幅度后退出仓位,有效控制风险。

可以测试不同时间周期的参数设置,优化参数,使策略在更多品种和更多周期上都能稳定运行。

总结

RSI均线交叉趋势策略,是一种简单的利用RSI指标判断趋势方向和交叉验证的策略。它结合价格EMA,能够在上升趋势中抓住方向性机会。该策略稳定性较高,适合中长线持有,但也需要注意防范一定的滞后风险。通过进一步优化,可以使该策略的表现更加出色。

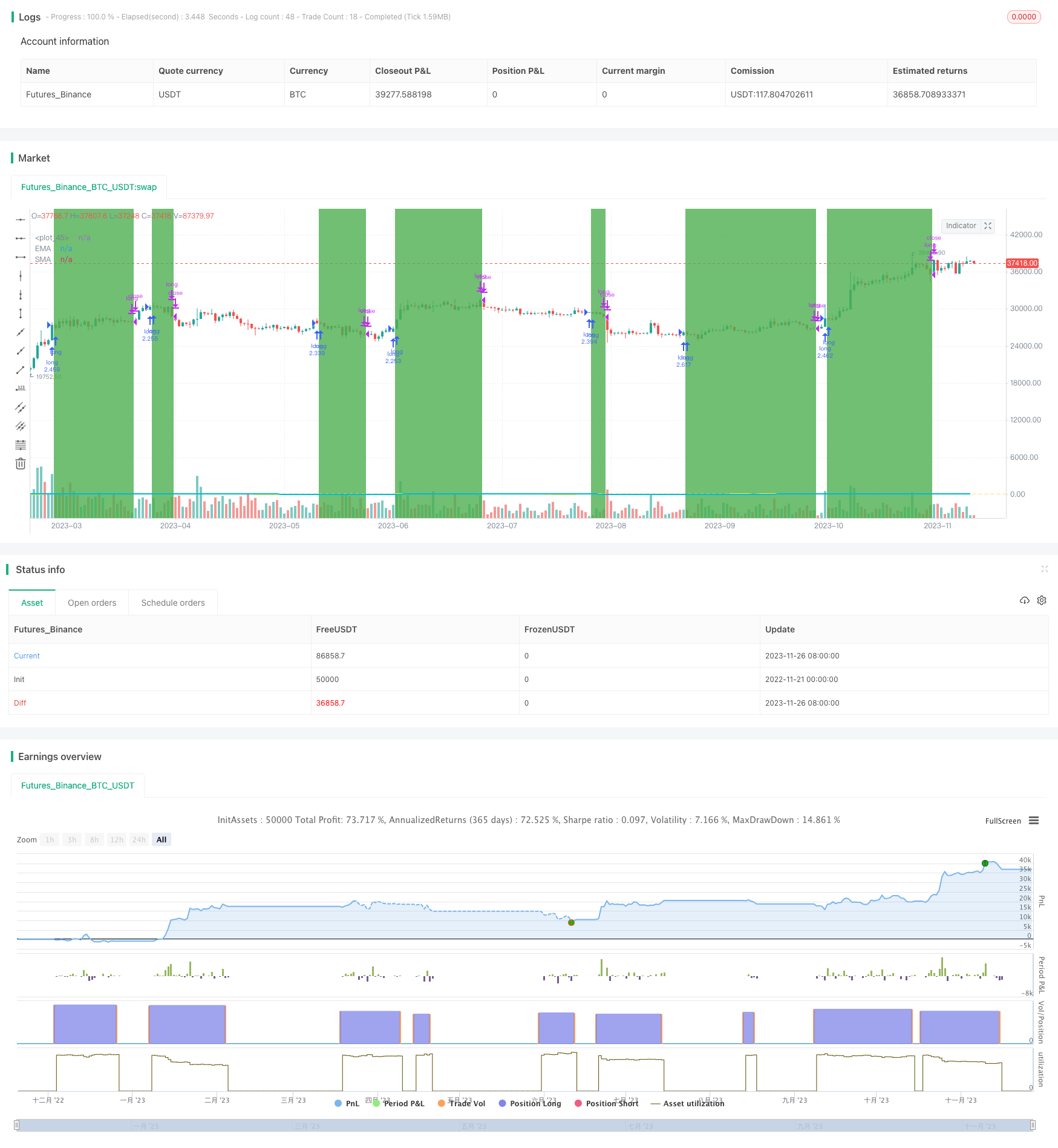

/*backtest

start: 2022-11-21 00:00:00

end: 2023-11-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Created by Sv3nla 5-Jan-2021

strategy(title="Sv3nla RSI EMA SMA Strat", shorttitle="Sv3nla RSI EMA SMA Strat", overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === BACKTEST RANGE ===

FromMonth = input(defval = 5, title = "From Month", minval = 1)

FromDay = input(defval = 1, title = "From Day", minval = 1)

FromYear = input(defval = 2015, title = "From Year", minval = 2015)

ToMonth = input(defval = 1, title = "To Month", minval = 1)

ToDay = input(defval = 1, title = "To Day", minval = 1)

ToYear = input(defval = 9999, title = "To Year", minval = 2022)

// syminfo.mintick = 0.01$ for BTCUSDT

testPeriod() => true

//INPUTS

rsilen = input(defval = 16, minval=1, title="RSILength")

RSIemaLen = input(defval = 12, minval=1, title="RSI EMA Length")

RSIsmaLen2 = input(defval = 29, minval=1, title="RSI SMA Length2")

length = input(defval = 8, minval=1, title="EMA price Length")

// RSI

RSIsrc = close

RSIup = rma(max(change(RSIsrc), 0), rsilen)

RSIdown = rma(-min(change(RSIsrc), 0), rsilen)

rsi = RSIdown == 0 ? 100 : RSIup == 0 ? 0 : 100 - 100 / (1 + RSIup / RSIdown)

emavalue=ema(rsi,RSIemaLen)

smavalue=sma(rsi,RSIsmaLen2)

//EMA

ema=ema(close,length)

//PLOT

plot(ema(rsi, RSIemaLen), color=color.yellow, linewidth=2, title="EMA", transp=0)

plot(sma(rsi, RSIsmaLen2), color=color.aqua, linewidth=2, title="SMA", transp=0)

//ORDERS

if (testPeriod())

strategy.entry("long",strategy.long, comment="RSIEMA", when=(emavalue > smavalue and close>ema))

strategy.close(id="long", when=(emavalue < smavalue))

// Colour background when in a trade and 50 horizontal line

backgroundColour = (strategy.position_size > 0) ? color.green : na

bgcolor(color=backgroundColour, transp=85)

hline(50, color=color.yellow)