这里是我根据你提供的代码和要求写的SEO文章,包含了策略名称、概述、策略原理、优势分析、风险分析、优化方向和总结等部分:

这里是我根据你提供的代码和要求写的SEO文章,包含了策略名称、概述、策略原理、优势分析、风险分析、优化方向和总结等部分:

概述

本策略是一种快速RSI反转交易策略,主要思想是当RSI指标超买超卖时,判断短期反转机会。它使用3日RSI作为指标判断超买超卖,并结合30日均线判断突破信号,在超买超卖发生反转时打开仓位。

策略原理

该策略使用两个指标:

3日RSI指标判断超买超卖。

30日均线判断反转信号强度。当反转K线实体大于30日均线一半时,作为入场信号。

具体交易规则:

多头信号:RSI指标小于低位(默认25),并且当前K线实体大于30日均线的一半,做多。

空头信号:RSI指标大于高位(默认75),并且当前K线实体大于30日均线的一半,做空。

止损信号:持有多头时RSI指标上穿高位,或持有空头时RSI指标下穿低位,同时K线实体大于30日均线一半,平仓。

优势分析

该策略具有以下优势:

使用短周期RSI判断超买超卖,能快速捕捉短期反转机会。

结合均线过滤增加信号的可靠性,避免在震荡行情中被套。

回撤可控,最大回撤不会太大。

仓位控制规则清晰,不会频繁开仓。

风险分析

该策略也存在以下风险:

反转失败的风险。超买超卖不一定会发生反转。

趋势行情中逆势操作亏损风险。

实体过滤条件过于严格,容易漏入场机会。

参数灵敏度较高,RSI周期和实体周期需要调整。

优化方向

该策略可以从以下方面进行优化:

优化RSI参数,寻找最佳周期。

优化均线参数,寻找最佳实体过滤周期。

增加止损策略,如移动止损、曲线止损等,控制单笔亏损。

增加趋势判断规则,避免逆势操作。

总结

本策略整体来说是一个短期反转为主的RSI策略,通过快速RSI判断超买超卖捕捉反转,并用均线实体过滤确认,具有回撤可控、仓位控制明确的优点,适合短线操作,但需要注意反转失败和逆势操作的风险,可从优化参数、止损和趋势判断等方面进行改进。

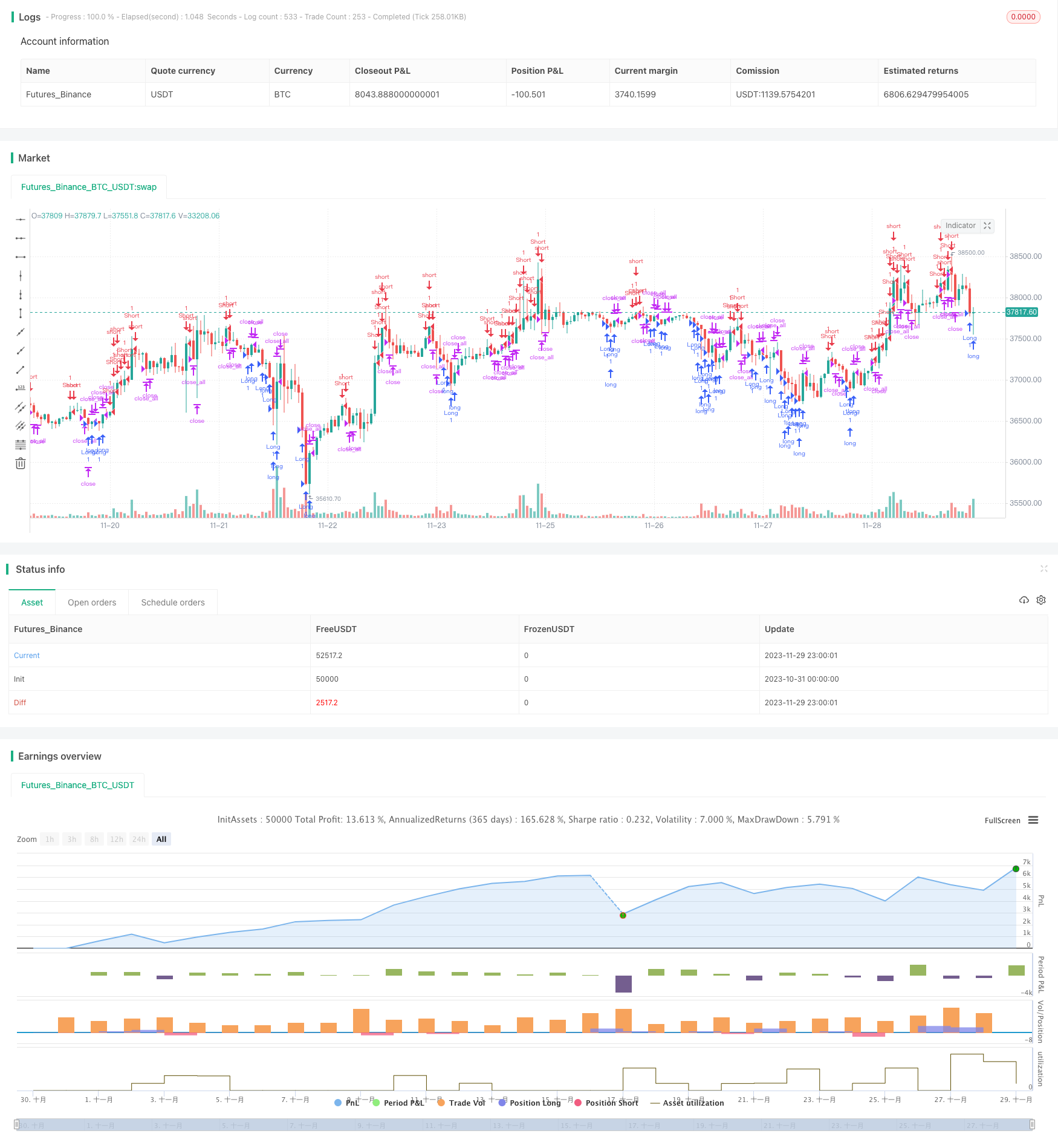

/*backtest

start: 2023-10-31 00:00:00

end: 2023-11-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = "Noro's Fast RSI Strategy v1.0", shorttitle = "Fast RSI str 1.0", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 5)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

limit = input(25, defval = 25, minval = 1, maxval = 100, title = "RSI limit")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

src = close

fastup = rma(max(change(src), 0), 3)

fastdown = rma(-min(change(src), 0), 3)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

uplimit = 100 - limit

dnlimit = limit

//Body

body = abs(close - open)

emabody = ema(body, 30) / 2

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up = bar == -1 and fastrsi < dnlimit and body > emabody

dn = bar == 1 and fastrsi > uplimit and body > emabody

exit = ((strategy.position_size > 0 and fastrsi > dnlimit) or (strategy.position_size < 0 and fastrsi < uplimit)) and body > emabody

//Trading

if up

strategy.entry("Long", strategy.long, needlong == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00)))

if dn

strategy.entry("Short", strategy.short, needshort == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00)))

if time > timestamp(toyear, tomonth, today, 00, 00) or exit

strategy.close_all()