概述

该策略是基于双重均线交叉的趋势跟踪策略。它结合了快速简单移动平均线(SMA)和缓慢加权移动平均线(VWMA),利用两条平均线的交叉形成买入和卖出信号。

当快速SMA向上穿过缓慢VWMA时,产生买入信号;当快速SMA向下穿过缓慢VWMA时,产生卖出信号。策略采用止损机制控制风险。

策略原理

该策略的核心逻辑基于双重均线交叉系统。具体来说,它同时运用了以下技术指标:

- 简单移动平均线(SMA):对最近n天的收盘价取算术平均值,能反映最近期间的平均价格。

- 加权移动平均线(VWMA):对最近n天的收盘价进行加权平均,赋予近期价格更大权重,能更快速地响应价格变动。

双重均线中的快速SMA参数设置较短,能快速响应价格变化;缓慢VWMA参数较长,具有滤波作用。当短期和长期趋势向同一方向发展时,快速SMA向上穿越缓慢VWMA产生买入信号;向下穿越时产生卖出信号。

该策略同时设置止损机制。当价格向不利方向运行时,及时止损以控制风险。

优势分析

- 响应迅速,跟踪市场趋势的变化

- 回撤控制好,止损机制有效控制风险

- 简单直观,容易理解实现

- 可以通过调整参数进行优化,适应不同市场环境

风险分析

- 双重均线策略容易产生多头市场的假信号

- 需要选择合适的参数,不当设置可能导致亏损

- 偶尔可能会头疼 Markt 的突发事件而造成损失

风险控制的方法:

- 采用趋势过滤指标进行确认

- 优化参数设置

- 采取止损策略,合理控制单笔损失

优化方向

该策略可以从以下几个方面进行优化:

- 结合其他技术指标进行确认,例如RSI,布林线等,提高信号的准确性

- 优化均线参数的长度,根据不同周期调整参数

- 结合交易量指标,在大量能量进出的点位进行交易

- 根据回测结果进行参数调整,选择最优参数

- 采用动态止损,根据市场波动程度来调整止损点

总结

该策略整体来说是一个非常实用的趋势跟踪策略。它采用简单直观的双重均线交叉来产生交易信号,通过快速均线和缓慢均线的配合,能够有效捕捉市场趋势的变化。止损机制也使其具有良好的风险控制。通过配合其他指标和参数优化,可以进一步提高策略的交易效果。

策略源码

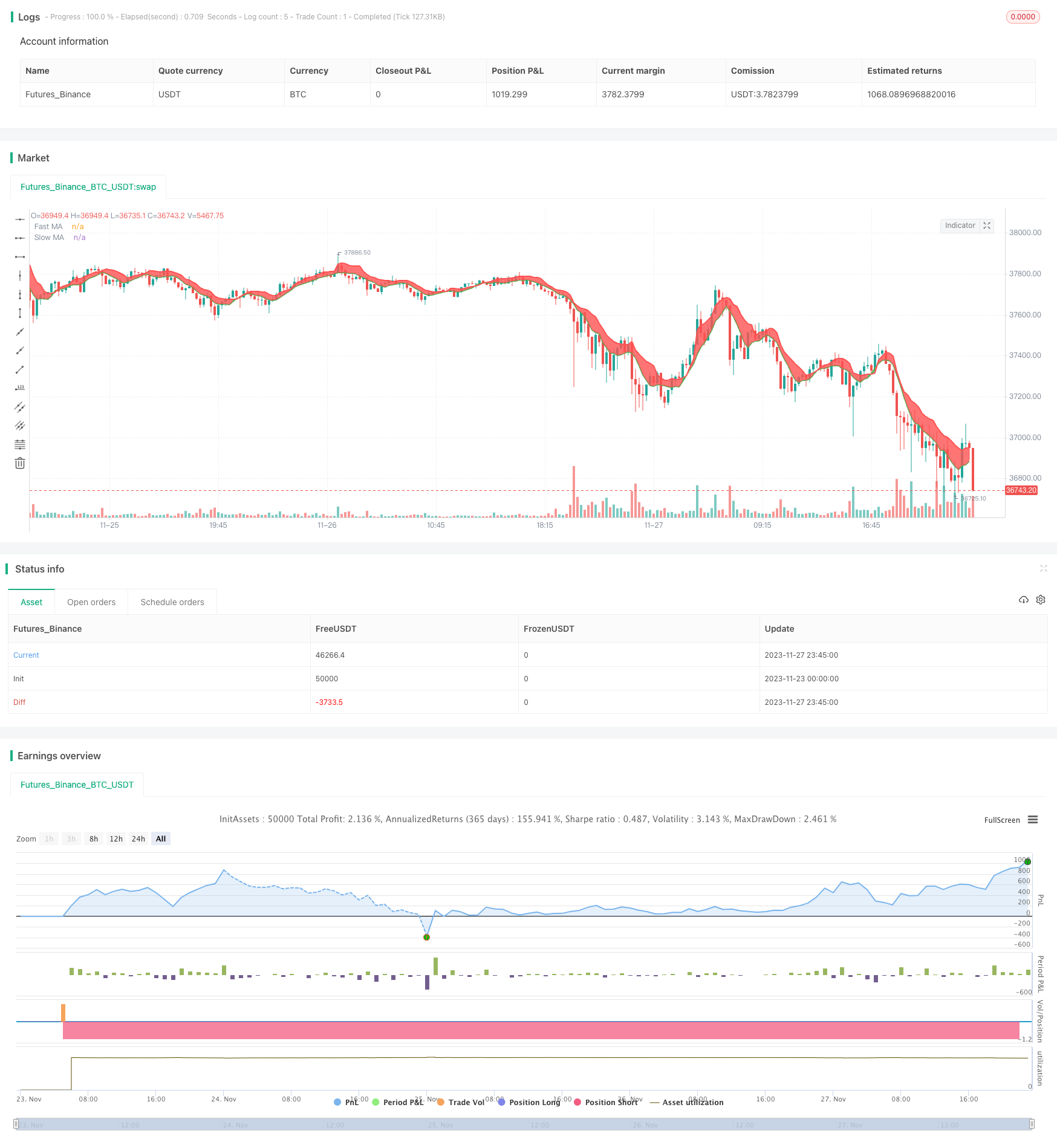

/*backtest

start: 2023-11-23 00:00:00

end: 2023-11-28 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//strategy(title="Bitlinc Entry v0.1 VWMA / SMA / MRSI SQQQ 94M", overlay=true, initial_capital=10000, currency='USD')

strategy(title="Bitlinc Entry v0.1 VWMA / SMA / MRSI SQQQ 94M", overlay=true)

// Credit goes to this developer for the "Date Range Code"

// https://www.tradingview.com/script/62hUcP6O-How-To-Set-Backtest-Date-Range/

// === GENERAL INPUTS ===

// short ma

maFastSource = input(defval = close, title = "Simple MA Source")

maFastLength = input(defval = 6, title = "Simple MA Length", minval = 1)

// long ma

maSlowSource = input(defval = high, title = "VW MA Source")

maSlowLength = input(defval = 7, title = "VW MA Period", minval = 1)

// === SERIES SETUP ===

// a couple of ma's...

maFast = sma(maFastSource, maFastLength)

maSlow = vwma(maSlowSource, maSlowLength)

// === PLOTTING ===

fast = plot(maFast, title = "Fast MA", color = color.green, linewidth = 2, style = plot.style_line, transp = 30)

slow = plot(maSlow, title = "Slow MA", color = color.red, linewidth = 2, style = plot.style_line, transp = 30)

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

// === LOGIC ===

enterLong = crossover(maFast, maSlow)

exitLong = crossover(maSlow, maFast)

//enterLong = crossover(maSlow, maFast)

//exitLong = crossover(maFast, maSlow)

// Entry //

strategy.entry(id="Long Entry", long=true, when=window() and enterLong)

strategy.entry(id="Short Entry", long=false, when=window() and exitLong)

// === FILL ====

fill(fast, slow, color = maFast > maSlow ? color.green : color.red)

// === MRSI ===

//

//

basis = rsi(close, input(50))

ma1 = ema(basis, input(2))

ma2 = ema(basis, input(27))

oversold = input(32.6)

overbought = input(63)

//plot(ma1, title="RSI EMA1", color=blue)

//plot(ma2, title="RSI EMA2", color=yellow)

obhist = ma1 >= overbought ? ma1 : overbought

oshist = ma1 <= oversold ? ma1 : oversold

//plot(obhist, title="Overbought Highligth", style=columns, color=color.maroon, histbase=overbought)

//plot(oshist, title="Oversold Highligth", style=columns, color=color.yellow, histbase=oversold)

//i1 = hline(oversold, title="Oversold Level", color=white)

//i2 = hline(overbought, title="Overbought Level", color=white)

//fill(i1, i2, color=olive, transp=100)

// === LOGIC ===

enterLongMrsi = crossover(ma1, oversold)

exitLongMrsi = crossover(ma1, overbought)

// Entry //

strategy.entry(id="MRSI Long Entry", long=true, when=window() and enterLongMrsi)

strategy.entry(id="MRSI Short Entry", long=false, when=window() and exitLongMrsi)

//hline(50, title="50 Level", color=white)