概述

大悦多因子量化策略是一种同时结合均线、MACD、Ichimoku云图多种技术指标的长线追涨策略。它主要利用200日简单移动均线判断总体行情方向,再结合20日指数移动均线、MACD指标和Ichimoku云图提供更多细节信号,从而决定具体的止盈止损点。

该策略同时考量长短期趋势以及多因子验证,可以有效过滤假突破带来的噪音交易。它追求优质机会的同时控制风险,适合有经验的投资者用于中长线持仓。

策略原理

当价格处于200日移动均线之上时,策略认为是牛市,此时只要20日均线和MACD指标同时发出买入信号,并且价格高于云图的最高价格或位于云图当中,则产生买入信号。

当价格跌破200日移动均线时,策略认为步入熊市,此时要求信号更为严格:必须20日均线和MACD指标同时发出买入信号,并且Ichimoku云图必须同向发出买入信号(绿云或者价格高于云图最高价格),才会产生买入信号。

卖出信号的判断逻辑与买入信号类似,但是方向相反:在牛市中价格只要跌破云图底部或云图反转;在熊市中只要价格进入红色云图或20日均线和MACD指标发出卖出信号则产生卖出。

优势分析

这套策略最大的优势在于同时结合长短期多种指标判断市场结构,可以有效滤除假信号。具体来说,主要有以下几点:

- 200日移动均线判断总体行情趋势,避免逆势操作。

- 20日均线关注近期动态,捕捉转折机会。

- MACD指标验证趋势是否改变。

- Ichimoku云图再次验证,防止产生错误信号。

通过多层指标验证,可以大大提高盈利概率。此外长短期指标的配合也使策略同时适合短线和中长线操作。

风险分析

该策略主要风险在于多个指标同时发出错误信号的概率。尽管山穷水尽疑无路的时候,这种概率极低,但长期操作中依然难免发生。主要应对方法是:

适当调整参数,例如采用均线期数,寻找最佳参数组合。

严格止损,错误信号后及时止损切换方向。策略本身没有设置止损,可以在实盘中补充。

采用期货套期保值等方法锁定利润。

根据大周期级别的支持位适当调整仓位。

优化方向

该策略可以从以下几个方面进行优化:

测试不同参数的效果:可以尝试改变均线周期、云图参数等,找到最佳参数组合。

增加止损模块:适当的移动止损可以更好控制风险。

结合相关性指标:例如涨跌速率,可以避免追高杀跌。

引入机器学习:使用神经网络等方法训练指标权重。

多市场验证:在不同市场中验证策略健壮性。

总结

大悦多因子量化策略通过科学的指标组合过滤噪音信号,在控制风险的前提下持续盈利。它既考量大周期趋势又关注短期机会,可广泛使用在中长线投资中。通过参数优化、止损优化以及机器学习引入等方法,该策略有望产生更加优异的效果。

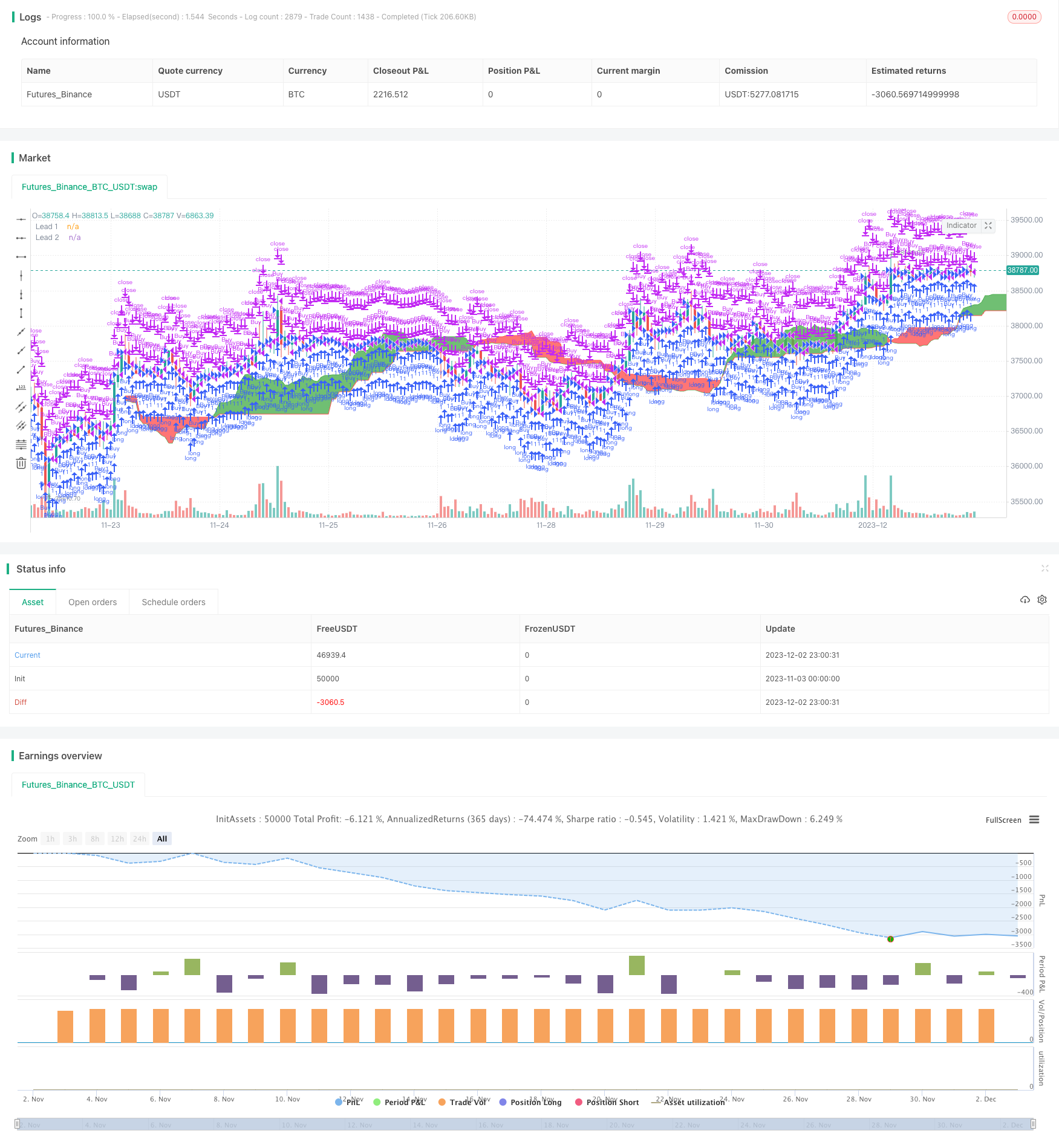

/*backtest

start: 2023-11-03 00:00:00

end: 2023-12-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="MACD/EMA/SMA/Ichimoku Long Strategy",overlay=true)

// Ichimoku

conversionPeriods = input(9, minval=1, title="Conversion Line Periods"),

basePeriods = input(26, minval=1, title="Base Line Periods")

laggingSpan2Periods = input(52, minval=1, title="Lagging Span 2 Periods"),

displacement = input(26, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(laggingSpan2Periods)

p1 = plot(leadLine1, offset = displacement, color=green,

title="Lead 1")

p2 = plot(leadLine2, offset = displacement, color=red,

title="Lead 2")

fill(p1, p2, color = leadLine1 > leadLine2 ? color(green,50) : color(red,50))

bottomcloud=leadLine2[displacement-1]

uppercloud=leadLine1[displacement-1]

// SMA Indicator - Are we in a Bull or Bear market according to 200 SMA?

SMA200 = sma(close, input(200))

EMA = ema(close,input(20))

//MACD Indicator - Is the MACD bullish or bearish?

fastLength = input(12)

slowlength = input(26)

MACDLength = input(9)

MACD = ema(close, fastLength) - ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

// Set Buy/Sell conditions

[main,signal,histo]=macd(close,fastLength,slowlength,MACDLength)

buy_entry = if ((uppercloud>bottomcloud or close>max(uppercloud,bottomcloud)) and close>EMA and (delta>0 and close>min(uppercloud,bottomcloud))) or (close<SMA200 and delta>0 and close>EMA and (uppercloud>bottomcloud or close>max(uppercloud,bottomcloud)))

true

if close<EMA and ((delta<0 and close<min(uppercloud,bottomcloud)) or (uppercloud<bottomcloud and close>max(uppercloud,bottomcloud)))

buy_entry = false

strategy.entry("Buy",true , when=buy_entry)

alertcondition(buy_entry, title='Long', message='Chart Bullish')

sell_entry = if ((uppercloud<bottomcloud or close<min(uppercloud,bottomcloud)) and close<EMA and (delta<0 and close<max(uppercloud,bottomcloud))) or (close>SMA200 and delta<0 and close<EMA and (uppercloud<bottomcloud or close<min(uppercloud,bottomcloud)))

true

if close>EMA and ((delta>0 and close>max(uppercloud,bottomcloud)) or (uppercloud>bottomcloud and close<min(uppercloud,bottomcloud)))

sell_entry = false

strategy.close("Buy",when= sell_entry)

alertcondition(sell_entry, title='Short', message='Chart Bearish')

//plot(delta, title="Delta", style=cross, color=delta>=0 ? green : red )