概述

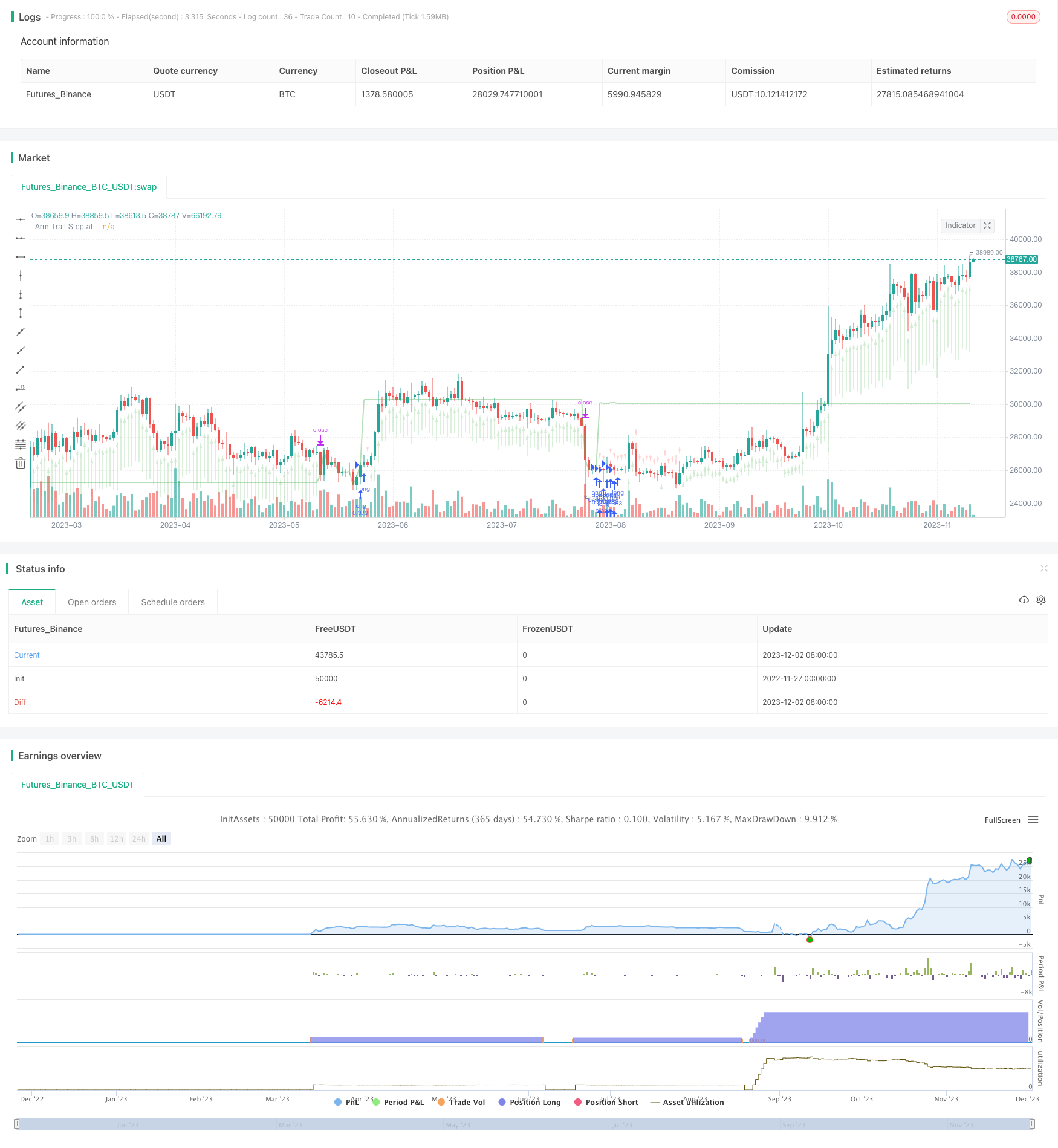

该策略是基于Dr. John Ehlers的趋势弹性振荡器(Trend Flex Oscillator,TFO)和平均真实波动范围(Average True Range,ATR)指标设计的一个趋势跟踪止损策略。它适用于多头市场,当Oversold后的价格出现反转时会打开多头仓位。它通常会在几天内平仓,除非被熊市捕获,在这种情况下它会固守仓位。该策略通过简单的回测来调整可配置的参数,但是不应该完全相信回测结果。

策略原理

该策略结合了TFO和ATR两个指标,在符合买入条件时开多仓,在符合卖出条件时平仓。

买入条件:当TFO低于某个阈值(表示过度空头),并且上一根K线的TFO值低于当前K线时(表示TFO反转上涨),同时ATR高于设定的波动门槛时(表示市场波动加大),满足这三个条件则开多仓。

平仓条件:当TFO高于某个阈值(表示过度多头)时,同时ATR高于设定门槛时,满足条件则平掉所有多仓。此外,该策略还设置了跟踪止损,当价格跌破设定的跟踪止损价位时,也会平掉所有多仓。用户可以选择让策略根据指标信号平仓,或只按照止损价位平仓。

该策略最多可同时开15个多头仓位。其参数可以调整,适用于不同时间周期。

策略优势

结合趋势和波动度判断市场方向,比较稳定。TFO能捕捉突破趋势的早期信号,ATR能把握市场波动加大的时机。

设置了可调的买卖参数和止损参数,操作灵活。用户可以根据市场调整参数,实现最优化。

内置了止损功能,可以减少极端行情的损失。止损策略是量化交易中非常重要的一环。

支持追加开仓和部分平仓,可以通过加大仓位来放大盈利。适合看多的行情。

策略风险

该策略只做多,不做空,无法在跌市中盈利。如果遇到惨烈的熊市行情,可能造成巨额损失。

参数设置不当可能导致过度交易或漏买漏卖。需要反复测试找到最佳参数组合。

在极端行情时,止损可能无效,无法阻止巨额亏损的发生。这是所有止损策略都可能面临的问题。

回测并不能完全反映实盘交易情况,实盘结果会与之存在一定偏差。

策略优化

可以考虑在卖出条件中加入移动止损线,让策略及时止损,有效控制下行风险。

可以扩展做空机制,在TFO反转下跌且ATR足够大时开空仓,使策略能适用于空头市场。

可以加入更多过滤条件,例如成交量变化,减少异常行情对策略的影响。

可以测试不同时间周期的参数设置和回测结果,寻找最佳周期及参数组合。

总结

该策略整合了趋势分析和波动度监测的优势,通过TFO和ATR的指标组合判断市场方向;设置了追加开仓、部分平仓、移动止损等机制,可以放大获利并控制风险,适合多头行情;还有可扩展的优化空间,通过加入更多指标过滤和参数调优可以进一步改进策略表现。基本实现了一个量化策略的基本功能要求,值得深入研究和应用。

/*backtest

start: 2022-11-27 00:00:00

end: 2023-12-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Chart0bserver

//

// Open Source attributions:

// portions © allanster (date window code)

// portions © Dr. John Ehlers (Trend Flex Oscillator)

//

// READ THIS CAREFULLY!!! ----------------//

// This code is provided for educational purposes only. The results of this strategy should not be considered investment advice.

// The user of this script acknolwedges that it can cause serious financial loss when used as a trading tool

// This strategy has a bias for HODL (Holds on to Losses) meaning that it provides NO STOP LOSS protection!

// Also note that the default behavior is designed for up to 15 open long orders, and executes one order to close them all at once.

// Opening a long position is predicated on The Trend Flex Oscillator (TFO) rising after being oversold, and ATR above a certain volatility threshold.

// Closing a long is handled either by TFO showing overbought while above a certain ATR level, or the Trailing Stop Loss. Pick one or both.

// If the strategy is allowed to sell before a Trailing Stop Loss is triggered, you can set a "must exceed %". Do not mistake this for a stop loss.

// Short positions are not supported in this version. Back-testing should NEVER be considered an accurate representation of actual trading results.

//@version=5

strategy('TFO + ATR Strategy with Trailing Stop Loss', 'TFO ATR Trailing Stop Loss', overlay=true, pyramiding=15, default_qty_type=strategy.cash, default_qty_value=10000, initial_capital=150000, currency='USD', commission_type=strategy.commission.percent, commission_value=0.5)

strategy.risk.allow_entry_in(strategy.direction.long) // There will be no short entries, only exits from long.

// -----------------------------------------------------------------------------------------------------------//

// Back-testing Date Range code ----------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

fromMonth = input.int(defval=9, title='From Month', minval=1, maxval=12, group='Back-Testing Start Date')

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31, group='Back-Testing Start Date')

fromYear = input.int(defval=2021, title='From Year', minval=1970, group='Back-Testing Start Date')

thruMonth = 1 //input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group="Back-Testing Date Range")

thruDay = 1 //input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group="Back-Testing Date Range")

thruYear = 2112 //input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970, group="Back-Testing Date Range")

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time

time >= start and time <= finish ? true : false

// Date range code -----//

// -----------------------------------------------------------------------------------------------------------//

// ATR Indicator Code --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

length = 18 //input(title="ATR Length", defval=18, minval=1)

Period = 18 //input(18,title="ATR EMA Period")

basicEMA = ta.ema(close, length)

ATR_Function = ta.ema(ta.tr(true), length)

EMA_ATR = ta.ema(ATR_Function, Period)

ATR = ta.ema(ta.tr(true), length)

ATR_diff = ATR - EMA_ATR

volatility = 100 * ATR_diff / EMA_ATR // measure of spread between ATR and EMA

volatilityAVG = math.round((volatility + volatility[1] + volatility[2]) / 3)

buyVolatility = input.int(3, 'Min Volatility for Buy', minval=-20, maxval=20, step=1, group='Average True Range')

sellVolatility = input.int(13, 'Min Volatility for Sell', minval=-10, maxval=20, step=1, group='Average True Range')

useAvgVolatility = input.bool(defval=false, title='Average the Volatility over 3 bars', group='Average True Range')

// End of ATR ------------/

// -----------------------------------------------------------------------------------------------------------//

// TFO Indicator code --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

trendflex(Series, PeriodSS, PeriodTrendFlex, PeriodEMA) =>

var SQRT2xPI = math.sqrt(8.0) * math.asin(1.0) // 4.44288293815 Constant

alpha = SQRT2xPI / PeriodSS

beta = math.exp(-alpha)

gamma = -beta * beta

delta = 2.0 * beta * math.cos(alpha)

float superSmooth = na

superSmooth := (1.0 - delta - gamma) * (Series + nz(Series[1])) * 0.5 + delta * nz(superSmooth[1]) + gamma * nz(superSmooth[2])

E = 0.0

for i = 1 to PeriodTrendFlex by 1

E += superSmooth - nz(superSmooth[i])

E

epsilon = E / PeriodTrendFlex

zeta = 2.0 / (PeriodEMA + 1.0)

float EMA = na

EMA := zeta * epsilon * epsilon + (1.0 - zeta) * nz(EMA[1])

return_1 = EMA == 0.0 ? 0.0 : epsilon / math.sqrt(EMA)

return_1

upperLevel = input.float(1.2, 'TFO Upper Level', minval=0.1, maxval=2.0, step=0.1, group='Trend Flex Ocillator')

lowerLevel = input.float(-0.9, 'TFO Lower Level', minval=-2.0, maxval=-0.1, step=0.1, group='Trend Flex Ocillator')

periodTrendFlex = input.int(14, 'TrendFlex Period', minval=2, group='Trend Flex Ocillator')

useSuperSmootherOveride = true //input( true, "Apply SuperSmoother Override Below*", input.bool, group="Trend Flex Ocillator")

periodSuperSmoother = 8.0 //input(8.0, "SuperSmoother Period*", input.float , minval=4.0, step=0.5, group="Trend Flex Ocillator")

postSmooth = 33 //input(33.0, "Post Smooth Period**", input.float , minval=1.0, step=0.5, group="Trend Flex Ocillator")

trendFlexOscillator = trendflex(close, periodSuperSmoother, periodTrendFlex, postSmooth)

// End of TFO -------------//

// -----------------------------------------------------------------------------------------------------------//

// HODL Don't sell if losing n% ---------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

sellOnStrategy = input.bool(defval=true, title='Allow Stategy to close positions', group='Selling Conditions')

doHoldLoss = true // input(defval = true, title = "Strategy can sell for a loss", type = input.bool, group="Selling Conditions")

holdLoss = input.int(defval=0, title='Value (%) must exceed ', minval=-25, maxval=10, step=1, group='Selling Conditions')

totalInvest = strategy.position_avg_price * strategy.position_size

openProfitPerc = strategy.openprofit / totalInvest

bool acceptableROI = openProfitPerc * 100 > holdLoss

// -----------------------//

// -----------------------------------------------------------------------------------------------------------//

// Buying and Selling conditions -------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

if useAvgVolatility

volatility := volatilityAVG

volatility

tfoBuy = trendFlexOscillator < lowerLevel and trendFlexOscillator[1] < trendFlexOscillator // Always make a purchase if TFO is in this lowest range

atrBuy = volatility > buyVolatility

tfoSell = ta.crossunder(trendFlexOscillator, upperLevel)

consensusBuy = tfoBuy and atrBuy

consensusSell = tfoSell and volatility > sellVolatility

if doHoldLoss

consensusSell := consensusSell and acceptableROI

consensusSell

// --------------------//

// -----------------------------------------------------------------------------------------------------------//

// Tracing & Debugging --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

plotchar(strategy.opentrades, 'Number of open trades', ' ', location.top)

plotarrow(100 * openProfitPerc, 'Profit on open longs', color.new(color.green, 75), color.new(color.red, 75))

// plotchar(strategy.position_size, "Shares on hand", " ", location.top)

// plotchar(totalInvest, "Total Invested", " ", location.top)

// plotarrow(strategy.openprofit, "Open profit dollar amount", color.new(color.green,100), color.new(color.red, 100))

// plotarrow(strategy.netprofit, "Net profit for session", color.new(color.green,100), color.new(color.red, 100))

// plotchar(acceptableROI, "Acceptable ROI", " ", location.top)

// plotarrow(volatility, "ATR volatility value", color.new(color.green,75), color.new(color.red, 75))

// plotchar(strategy.position_avg_price, "Avgerage price of holdings", " ", location.top)

// plotchar(volatilityAVG, "AVG volatility", " ", location.top)

// plotchar(fiveBarsVal, "change in 5bars", " ", location.top)

// plotchar(crossingUp, "crossingUp", "x", location.belowbar, textcolor=color.white)

// plotchar(crossingDown, "crossingDn", "x", location.abovebar, textcolor=color.white)

// plotchar(strategy.closedtrades, "closedtrades", " ", location.top)

// plotchar(strategy.wintrades, "wintrades", " ", location.top)

// plotchar(strategy.losstrades, "losstrades", " ", location.top)

// plotchar(close, "close", " ", location.top)

//--------------------//

// -----------------------------------------------------------------------------------------------------------//

// Trade Alert Execution ------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

strategy.entry('long', strategy.long, when=window() and consensusBuy, comment='long')

if sellOnStrategy

strategy.close('long', when=window() and consensusSell, qty_percent=100, comment='Strat')

// -----------------------------------------------------------------------------------------------------------//

// Trailing Stop Loss logic -------------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

useTrailStop = input.bool(defval=true, title='Set Trailing Stop Loss on avg positon value', group='Selling Conditions')

arm = input.float(defval=15, title='Trailing Stop Arms At (%)', minval=1, maxval=30, step=1, group='Selling Conditions') * 0.01

trail = input.float(defval=2, title='Trailing Stop Loss (%)', minval=0.25, maxval=9, step=0.25, group='Selling Conditions') * 0.1

longStopPrice = 0.0

stopLossPrice = 0.0

if strategy.position_size > 0

longStopPrice := strategy.position_avg_price * (1 + arm)

stopLossPrice := strategy.position_avg_price * ((100 - math.abs(holdLoss)) / 100) // for use with 'stop' in strategy.exit

stopLossPrice

else

longStopPrice := close

longStopPrice

// If you want to hide the Trailing Stop Loss threshold (green line), comment this out

plot(longStopPrice, 'Arm Trail Stop at', color.new(color.green, 60), linewidth=2)

if strategy.position_size > 0 and useTrailStop

strategy.exit('exit', 'long', when=window(), qty_percent=100, trail_price=longStopPrice, trail_offset=trail * close / syminfo.mintick, comment='Trail')

//-----------------------------------------------------------------------------------------------------------//