概述

唐奇安渠道突破策略是一种基于价格行为和趋势的突破交易策略。它利用唐奇安通道上下轨来识别潜在的突破点,在价格突破通道时打开多头或空头头寸。

策略原理

该策略的核心逻辑是:

使用 Ta.highest 和 Ta.lowest 函数计算一定周期(如60根K线)的最高价和最低价,构建唐奇安通道的上轨和下轨。

当价格突破上轨时,认为行情可能进入多头趋势,所以在上轨突破下一根K线开盘时做多;当价格突破下轨时,认为行情可能进入空头趋势,所以在下轨突破下一根K线开盘时做空。

一旦价格重新跌破上轨或重新涨破下轨,则认为趋势发生转折,此时平掉当前的多头或空头头寸。

为控制风险,做多做空后的止损点设定为开仓价格减去或加上一个最小跳价。

这种基于通道突破的策略简单而直接,既考虑了价格行为又结合了趋势特征,容易操作而稳定。

优势分析

该策略具有以下几个优势:

策略逻辑清晰简洁,容易理解和实施,实操性强。

利用唐奇安通道判断趋势方向,可以有效过滤噪音,识别可靠的突破信号。

做多做空后的止损设置合理,可以很好控制单笔损失。

无论行情处于何种状态,只要价格发生有效突破,该策略都可以顺势而为,抓住潜在趋势。

策略参数较少,不易过拟合,参数优化空间大,可塑性强。

风险分析

该策略也存在一些风险:

趋势following策略,无法抓住反转行情。

停损点过近可能会被价格短线波动止损。

通道长度设置不当会增加假突破的概率。

针对上述风险,可以采取以下应对措施:

结合其他指标识别潜在反转信号,避免强行following。

设置合理的尾随止损以锁定盈利,而不是死撑初始止损。

测试不同参数取值,找出最佳参数组合。

优化方向

该策略还具有进一步优化的空间:

尝试双通道突破策略,一个通道用于确定入场点,另一个通道用于确定止损或止盈点。

在价格突破通道一定ticks后再开仓,以过滤部分假突破。

添加交易量或波动率指标过滤,避免在价格剧烈波动时出现失误交易。

尝试不同持仓策略,如趋势following策略或反转策略,多种组合可能获得更好结果。

添加风险管理模块,控制单日最大损失、最大回撤等等。

总结

唐奇安渠道突破策略整体来说是一种非常实用的短期跟随趋势策略。它通过价格行为判断,识别潜在趋势的变化,利用通道突破打开仓位。策略逻辑简洁,容易操作,在多种市场中都可能获得不错的效果。通过进一步优化参数设定、止损机制、反转识别等等,该策略的表现还具有很大的提升空间。它可以作为量化交易的一个很好的起点策略。

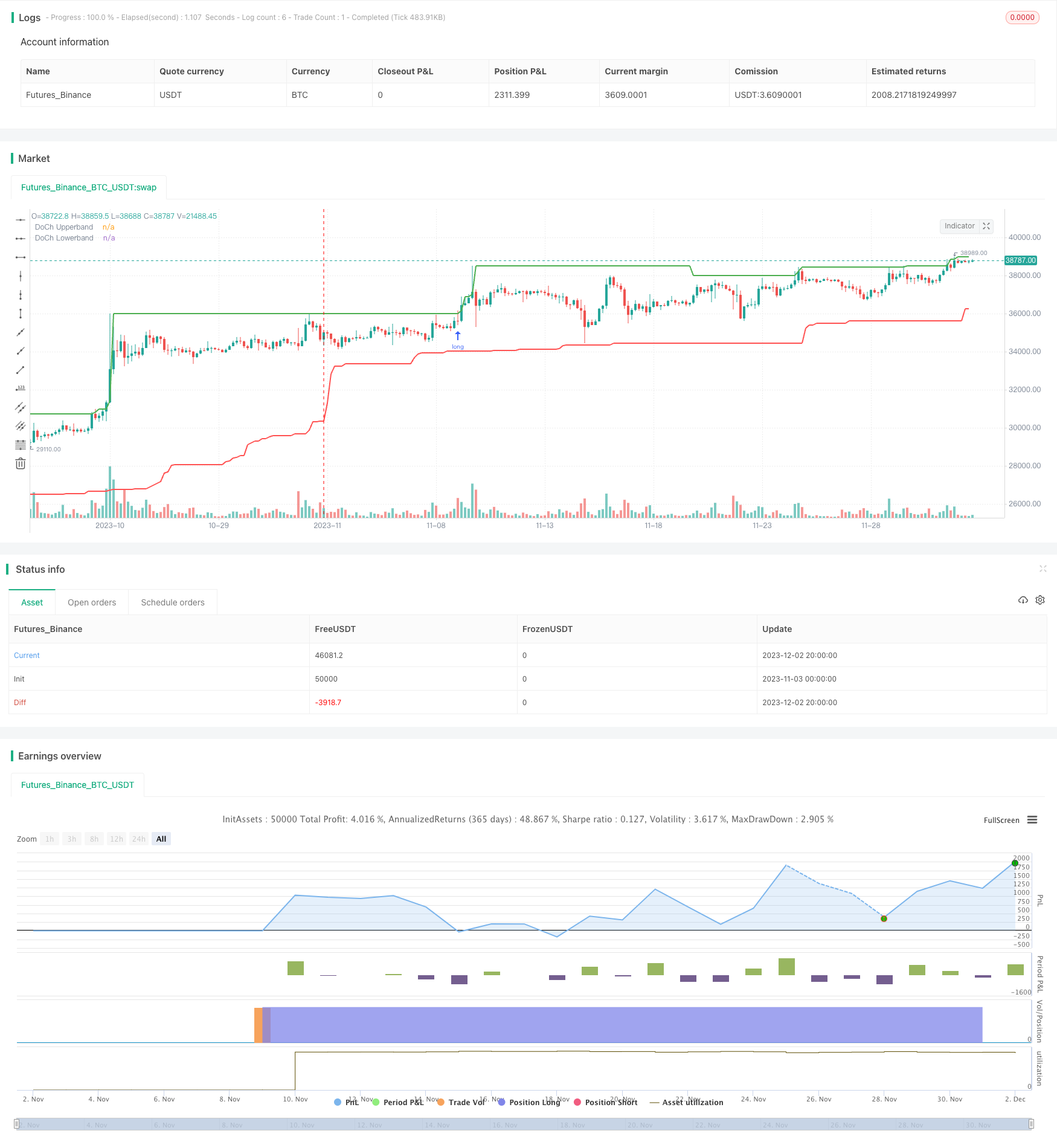

/*backtest

start: 2023-11-03 00:00:00

end: 2023-12-03 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Step 1. Define strategy settings

strategy(title="Price action and breakout Channel Forexrn", overlay=true,

pyramiding=0, initial_capital=100000,

commission_type=strategy.commission.cash_per_order,

commission_value=4, slippage=2)

dochLen = input.int(60, title="Price action and breackout Channel Forexrn")

// Position sizing inputs

usePosSize = input.bool(true, title="Use Position Sizing?")

atrLen = input.int(10, title="ATR Length")

atrRiskOffset = input.float(4, title="ATR Risk Offset Multiple", step=0.25)

maxRisk = input.float(2, title="Max Position Risk %", step=.25,

minval=0.25, maxval=15)

maxExposure = input.float(10, title="Max Position Exposure %", step=1,

minval=1, maxval=100)

marginPerc = input.int(10, title="Margin %", minval=1, maxval=100)

// Step 2. Calculate strategy values

upperband = ta.highest(high, dochLen)[1]

lowerband = ta.lowest(low, dochLen)[1]

// Calculate position size

riskEquity = (maxRisk * 0.01) * strategy.equity

riskTrade = (ta.atr(atrLen) * atrRiskOffset) * syminfo.pointvalue

maxPos = ((maxExposure * 0.01) * strategy.equity) /

((marginPerc * 0.01) * (close * syminfo.pointvalue))

posSize = usePosSize ? math.min(math.floor(riskEquity / riskTrade), maxPos) : 1

// Step 3. Output strategy data

plot(upperband, color=color.green, linewidth=2, title="DoCh Upperband")

plot(lowerband, color=color.red, linewidth=2, title="DoCh Lowerband")

// Step 4. Determine trading conditions

tradeWindow = true

tradeAllowed = tradeWindow and bar_index > dochLen

// Step 5. Submit entry orders

if tradeAllowed

if strategy.position_size < 1

strategy.entry("EL", strategy.long, qty=posSize,

stop=upperband + syminfo.mintick)

if strategy.position_size > -1

strategy.entry("ES", strategy.short, qty=posSize,

stop=lowerband - syminfo.mintick)

// Step 6. Submit exit orders

if not tradeWindow

strategy.close_all()