概述

该策略基于价格突破点来识别市场趋势,并结合自适应指标对大趋势进行判断,以捕捉短期价格反转机会。当价格从基准突破通道突破时产生买入/卖出信号。该策略适合于高波动率的数字货币交易。

策略原理

- 识别价格极值点作为通道边界。当价格创出新高或新低时,把该点作为通道边界。

- 计算自适应波动指标MA,判断整体趋势方向。MA值越大表示目前处于震荡阶段。

- 当价格向上突破通道上沿时,产生买入信号;当价格向下突破通道下沿时,产生卖出信号。

- 设置止损点。长仓头寸止损点设置为入场价格的1%。

优势分析

- 价格通道具有自适应性,能准确判断趋势转折点。

- 波动指标判断大趋势,避免在震荡趋势中错过大方向。

- 反转策略,适合捕捉价格短期反弹。

风险分析

- 大幅度持续下跌行情中,容易触发多个止损点,造成较大亏损。

- 震荡盘整中,频繁买入卖出交易增加交易费用。

- 需要人工确定入场时间,全自动交易有过拟合风险。

优化方向

- 优化MA的参数,使其更好地判断整体走势。

- 增加量能指标,避免量能衰竭的反转信号。

- 增加机器学习模型,实现参数的动态优化。

总结

该策略整体思路清晰,具有一定的实用价值。但仍需注意控制交易风险,防止在特定行情下造成较大损失。下一步可从整体框架、指标参数、风险控制等多个维度进行优化,使策略参数和交易信号更加可靠。

策略源码

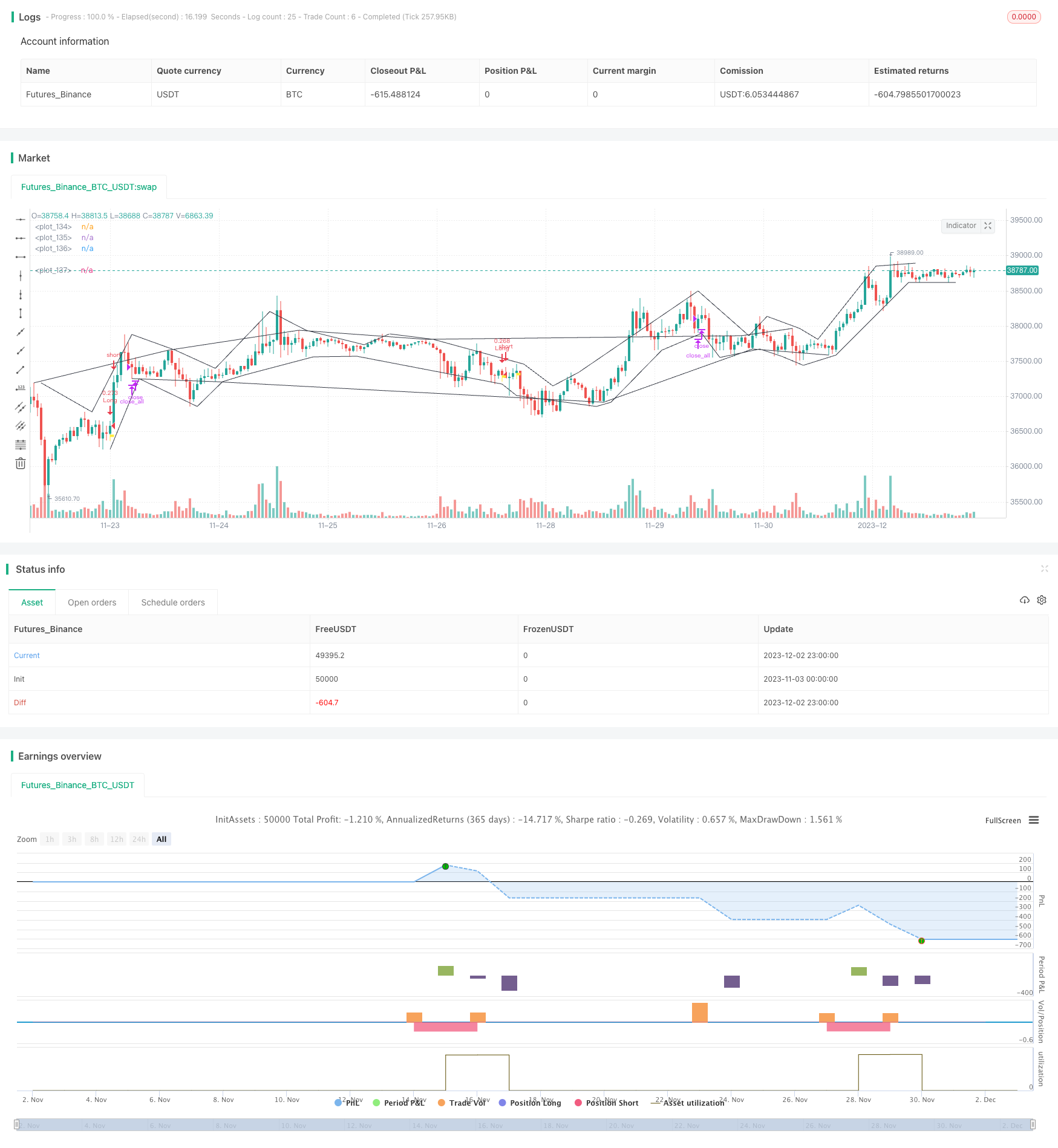

/*backtest

start: 2023-11-03 00:00:00

end: 2023-12-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version = 4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingGroundhog

// ||--- Cash & Date:

cash_amout = 10000

pyramid_val = 1

cash_given_per_lot = cash_amout/pyramid_val

startDate = input(title="Start Date",defval=13)

startMonth = input(title="Start Month",defval=9)

startYear = input(title="Start Year",defval=2021)

afterStartDate = (time >= timestamp(syminfo.timezone,startYear, startMonth, startDate, 0, 0))

// ||------------------------------------------------------------------------------------------------------

// ||--- Strategy:

strategy(title="TradingGroundhog - Strategy & Fractal V1 - Short term", overlay=true, max_bars_back = 4000, max_labels_count=500, commission_type=strategy.commission.percent, commission_value=0.00,default_qty_type=strategy.cash, default_qty_value= cash_given_per_lot, pyramiding=pyramid_val)

// ||------------------------------------------------------------------------------------------------------

// ||--- Fractal Recognition:

filterBW = input(true, title="filter Bill Williams Fractals:")

filterFractals = input(true, title="Filter fractals using extreme method:")

length = input(2, title="Extreme Window:")

regulartopfractal = high[4] < high[3] and high[3] < high[2] and high[2] > high[1] and high[1] > high[0]

regularbotfractal = low[4] > low[3] and low[3] > low[2] and low[2] < low[1] and low[1] < low[0]

billwtopfractal = filterBW ? false : (high[4] < high[2] and high[3] < high[2] and high[2] > high[1] and high[2] > high[0] ? true : false)

billwbotfractal = filterBW ? false : (low[4] > low[2] and low[3] > low[2] and low[2] < low[1] and low[2] < low[0] ? true : false)

ftop = filterBW ? regulartopfractal : regulartopfractal or billwtopfractal

fbot = filterBW ? regularbotfractal : regularbotfractal or billwbotfractal

topf = ftop ? high[2] >= highest(high, length) ? true : false : false

botf = fbot ? low[2] <= lowest(low, length) ? true : false : false

filteredtopf = filterFractals ? topf : ftop

filteredbotf = filterFractals ? botf : fbot

// ||------------------------------------------------------------------------------------------------------

// ||--- V1 : Added Swing High/Low Option

ShowSwingsHL = input(true)

highswings = filteredtopf == false ? na : valuewhen(filteredtopf == true, high[2], 2) < valuewhen(filteredtopf == true, high[2], 1) and valuewhen(filteredtopf == true, high[2], 1) > valuewhen(filteredtopf == true, high[2], 0)

lowswings = filteredbotf == false ? na : valuewhen(filteredbotf == true, low[2], 2) > valuewhen(filteredbotf == true, low[2], 1) and valuewhen(filteredbotf == true, low[2], 1) < valuewhen(filteredbotf == true, low[2], 0)

//---------------------------------------------------------------------------------------------------------

// ||--- V2 : Plot Lines based on the fractals.

showchannel = input(true)

//---------------------------------------------------------------------------------------------------------

// ||--- ZigZag:

showZigZag = input(true)

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal computation:

istop = filteredtopf ? true : false

isbot = filteredbotf ? true : false

topcount = barssince(istop)

botcount = barssince(isbot)

vamp = input(title="VolumeMA", defval=2)

vam = sma(volume, vamp)

fractalup = 0.0

fractaldown = 0.0

up = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>vam[3]

down = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>vam[3]

fractalup := up ? high[3] : fractalup[1]

fractaldown := down ? low[3] : fractaldown[1]

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal save:

fractaldown_save = array.new_float(0)

for i = 0 to 4000

if array.size(fractaldown_save) < 3

if array.size(fractaldown_save) == 0

array.push(fractaldown_save, fractaldown[i])

else

if fractaldown[i] != array.get(fractaldown_save, array.size(fractaldown_save)-1)

array.push(fractaldown_save, fractaldown[i])

if array.size(fractaldown_save) < 3

array.push(fractaldown_save, fractaldown)

array.push(fractaldown_save, fractaldown)

fractalup_save = array.new_float(0)

for i = 0 to 4000

if array.size(fractalup_save) < 3

if array.size(fractalup_save) == 0

array.push(fractalup_save, fractalup[i])

else

if fractalup[i] != array.get(fractalup_save, array.size(fractalup_save)-1)

array.push(fractalup_save, fractalup[i])

if array.size(fractalup_save) < 3

array.push(fractalup_save, fractalup)

array.push(fractalup_save, fractalup)

Bottom_1 = array.get(fractaldown_save, 0)

Bottom_2 = array.get(fractaldown_save, 1)

Bottom_3 = array.get(fractaldown_save, 2)

Top_1 = array.get(fractalup_save, 0)

Top_2 = array.get(fractalup_save, 1)

Top_3 = array.get(fractalup_save, 2)

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal Buy Sell Signal:

bool Signal_Test = false

bool Signal_Test_OUT_TEMP = false

var Signal_Test_TEMP = false

longLossPerc = input(title="Long Stop Loss (%)", minval=0.0, step=0.1, defval=0.01) * 0.01

if filteredbotf and open < Bottom_1 and (Bottom_1 - open) / Bottom_1 >= longLossPerc

Signal_Test := true

if filteredtopf and open > Top_1

Signal_Test_TEMP := true

if filteredtopf and Signal_Test_TEMP

Signal_Test_TEMP := false

Signal_Test_OUT_TEMP := true

//----------------------------------------------------------------------------------------------------------

// ||--- Plotting:

//plotshape(filteredtopf, style=shape.triangledown, location=location.abovebar, color=color.red, text="•", offset=0)

//plotshape(filteredbotf, style=shape.triangleup, location=location.belowbar, color=color.lime, text="•", offset=0)

//plotshape(ShowSwingsHL ? highswings : na, style=shape.triangledown, location=location.abovebar, color=color.maroon, text="H", offset=0)

//plotshape(ShowSwingsHL ? lowswings : na, style=shape.triangleup, location=location.belowbar, color=color.green, text="L", offset=0)

plot(showchannel ? (filteredtopf ? high[2] : na) : na, color=color.black, offset=0)

plot(showchannel ? (filteredbotf ? low[2] : na) : na, color=color.black, offset=0)

plot(showchannel ? (highswings ? high[2] : na) : na, color=color.black, offset=-2)

plot(showchannel ? (lowswings ? low[2] : na) : na, color=color.black, offset=-2)

plotshape(Signal_Test, style=shape.flag, location=location.belowbar, color=color.yellow, offset=0)

plotshape(Signal_Test_OUT_TEMP, style=shape.flag, location=location.abovebar, color=color.white, offset=0)

//----------------------------------------------------------------------------------------------------------

// ||--- Buy And Sell:

strategy.entry(id="Long", long=true, when = Signal_Test and afterStartDate)

strategy.close_all(when = Signal_Test_OUT_TEMP and afterStartDate)

//----------------------------------------------------------------------------------------------------------